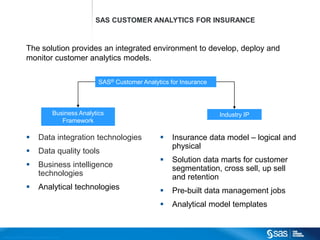

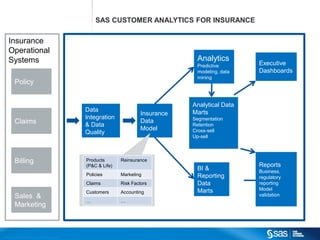

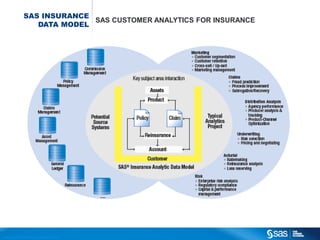

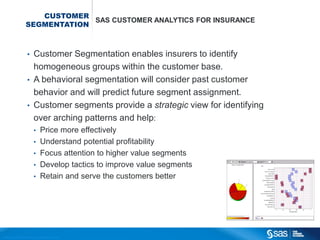

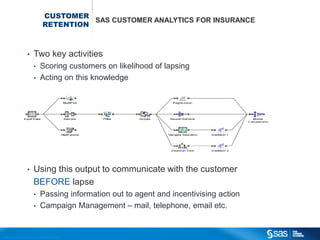

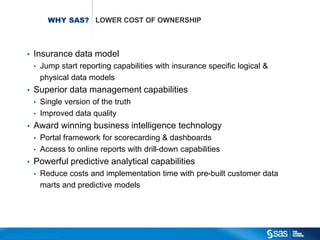

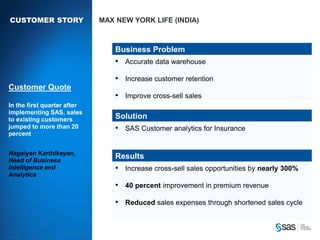

SAS Customer Analytics for Insurance offers a comprehensive solution for enhancing customer segmentation, retention, and sales in the insurance sector by providing integrated analytics, data management, and reporting tools. It focuses on creating a singular view of customer data to improve decision-making and operational efficiency, ultimately leading to increased retention rates and profitability. The platform includes capabilities for predictive modeling, customer scoring, and effective cross-sell and up-sell strategies.