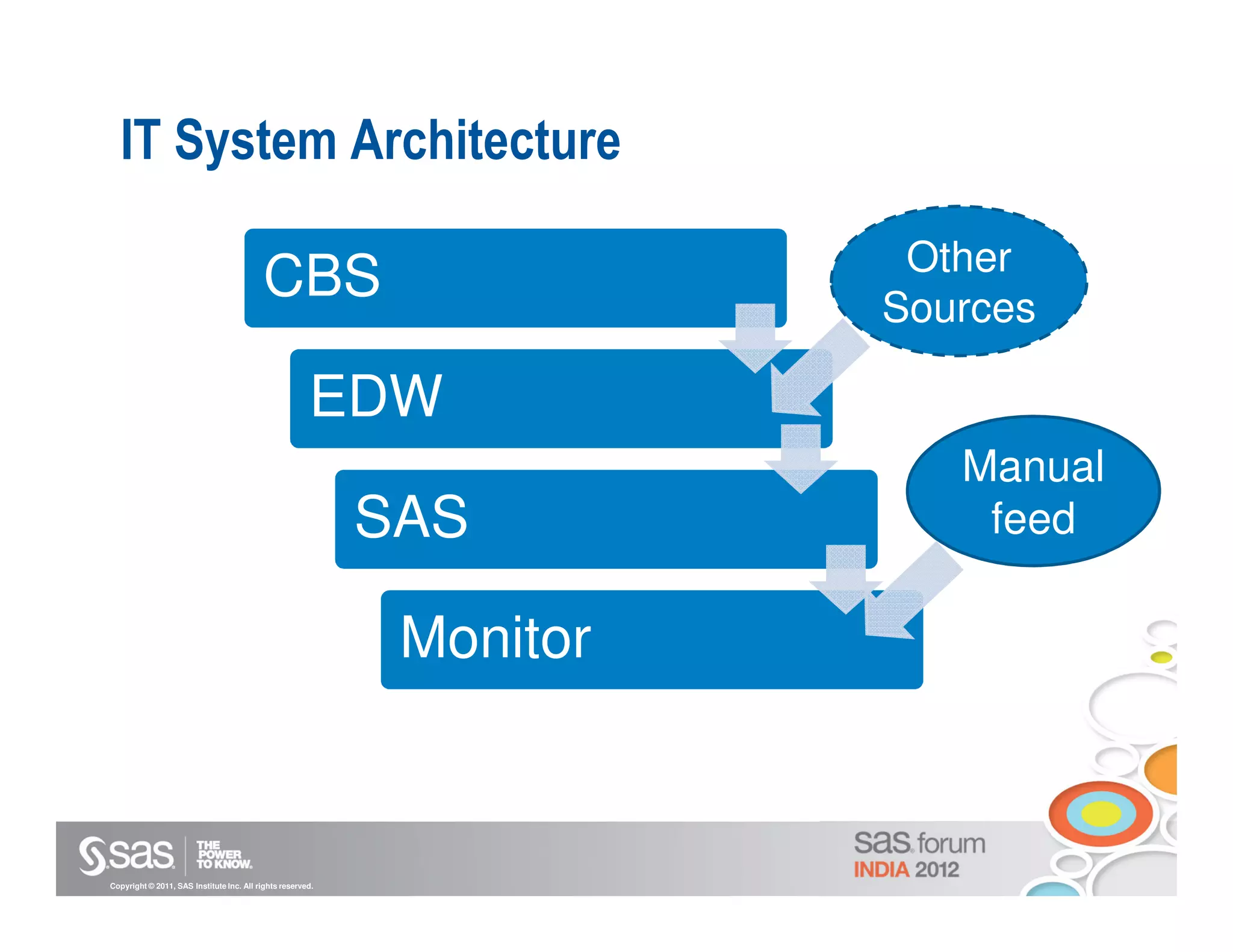

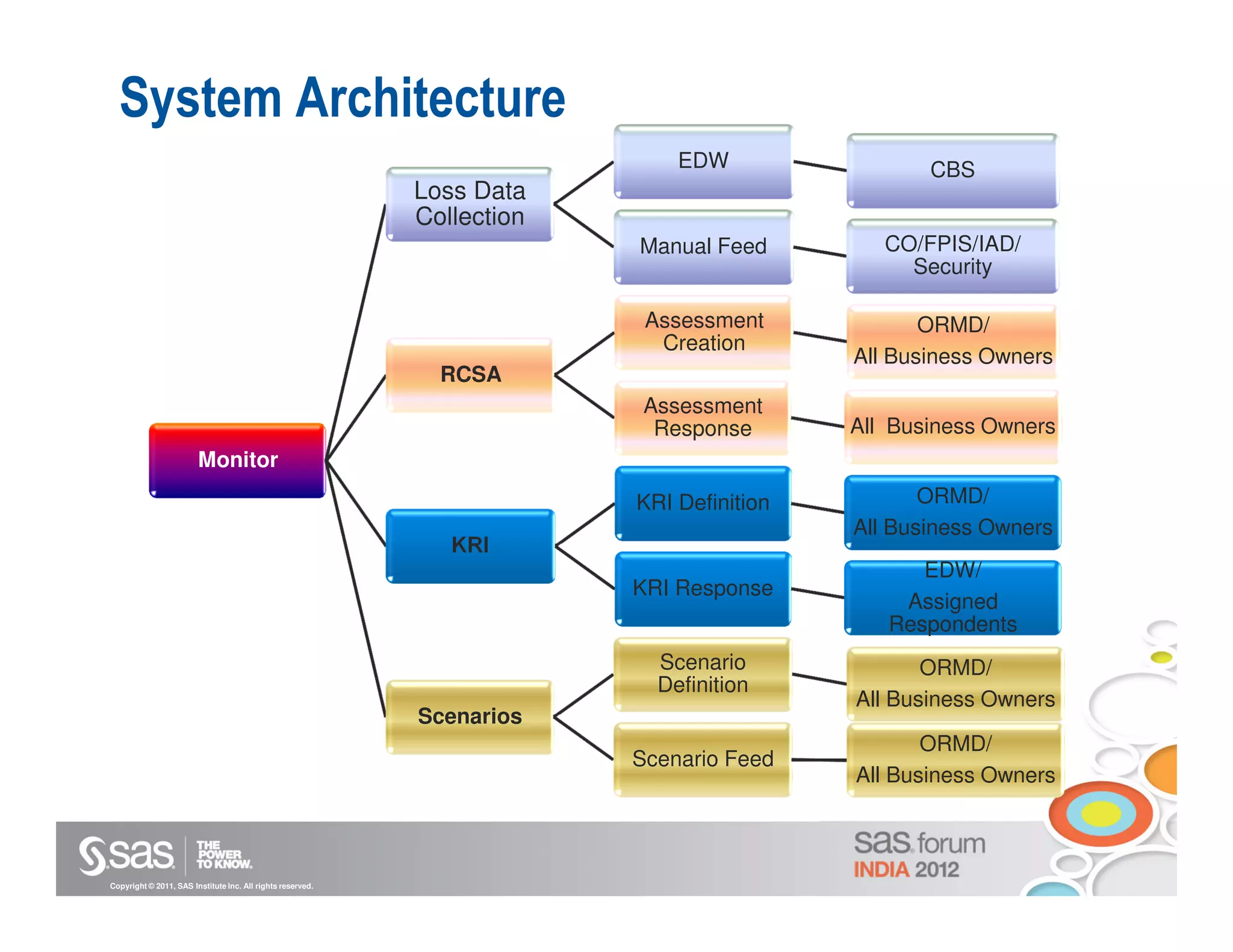

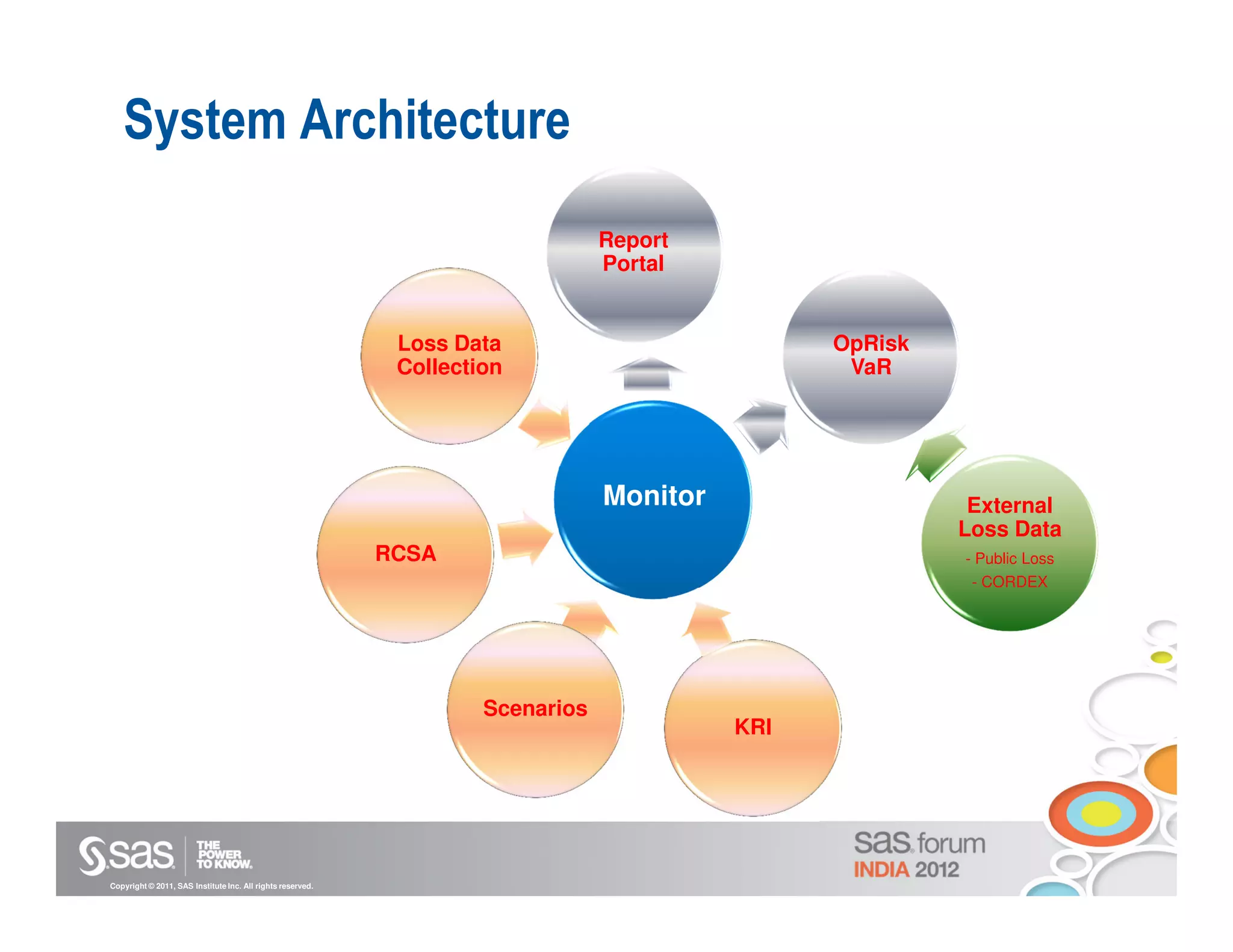

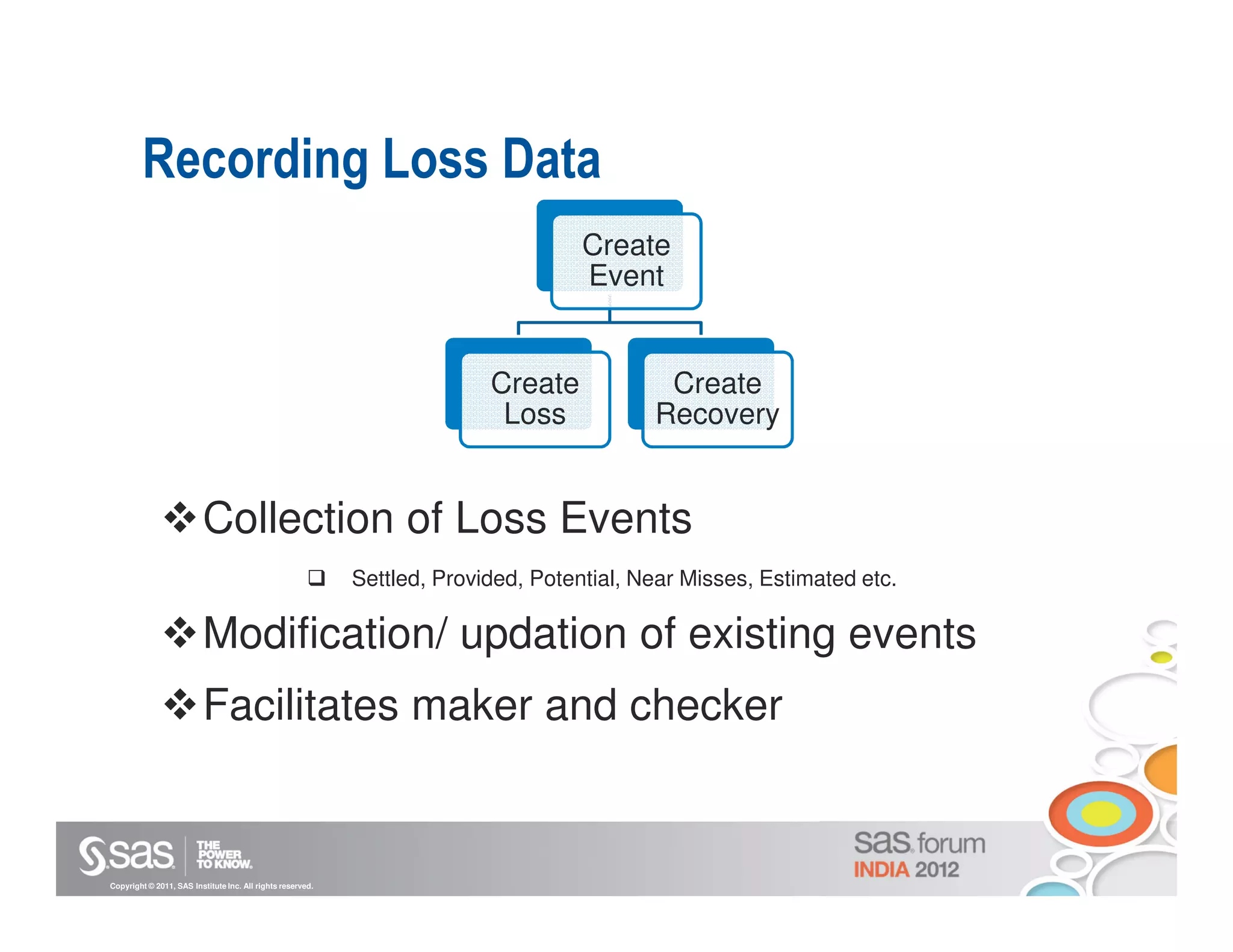

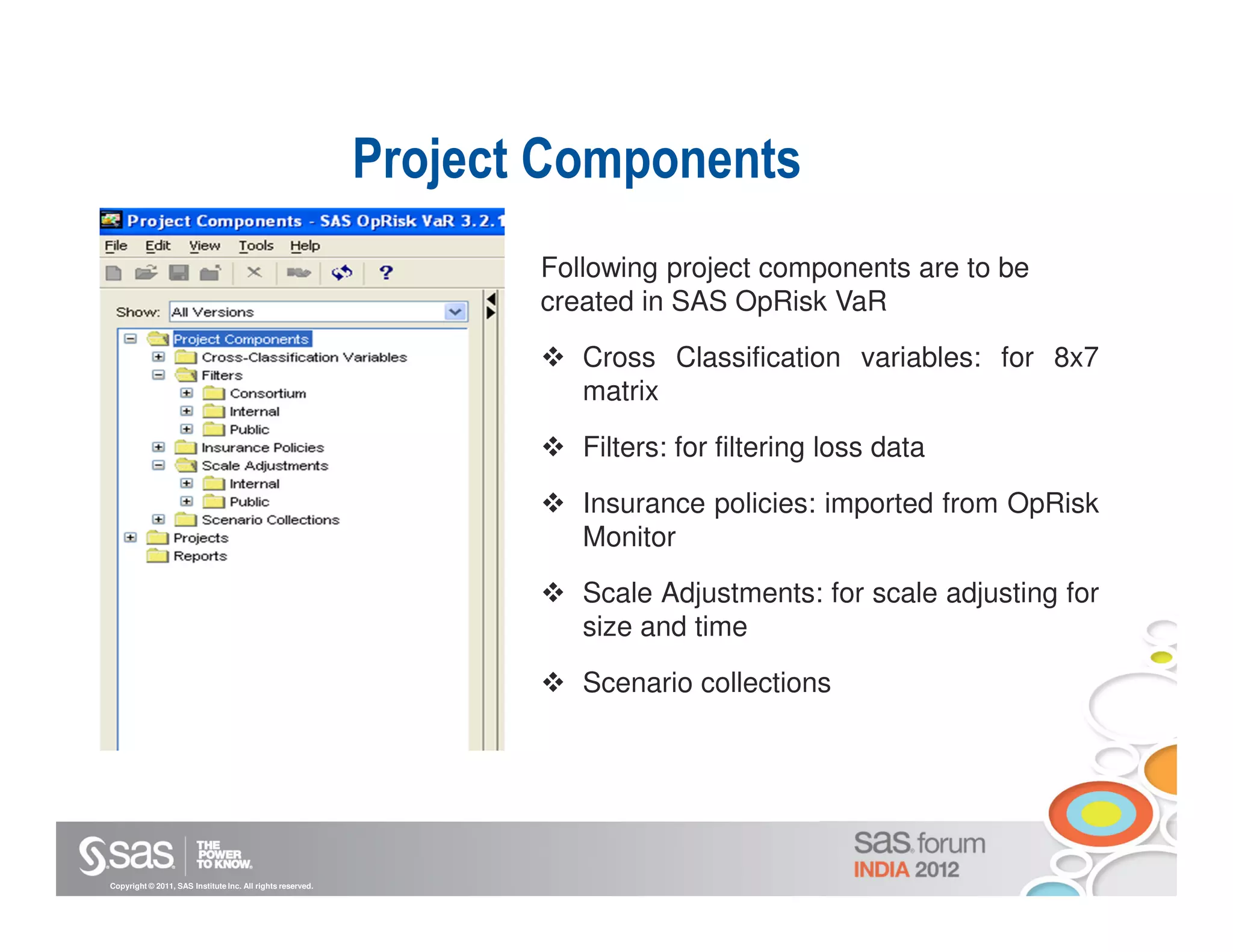

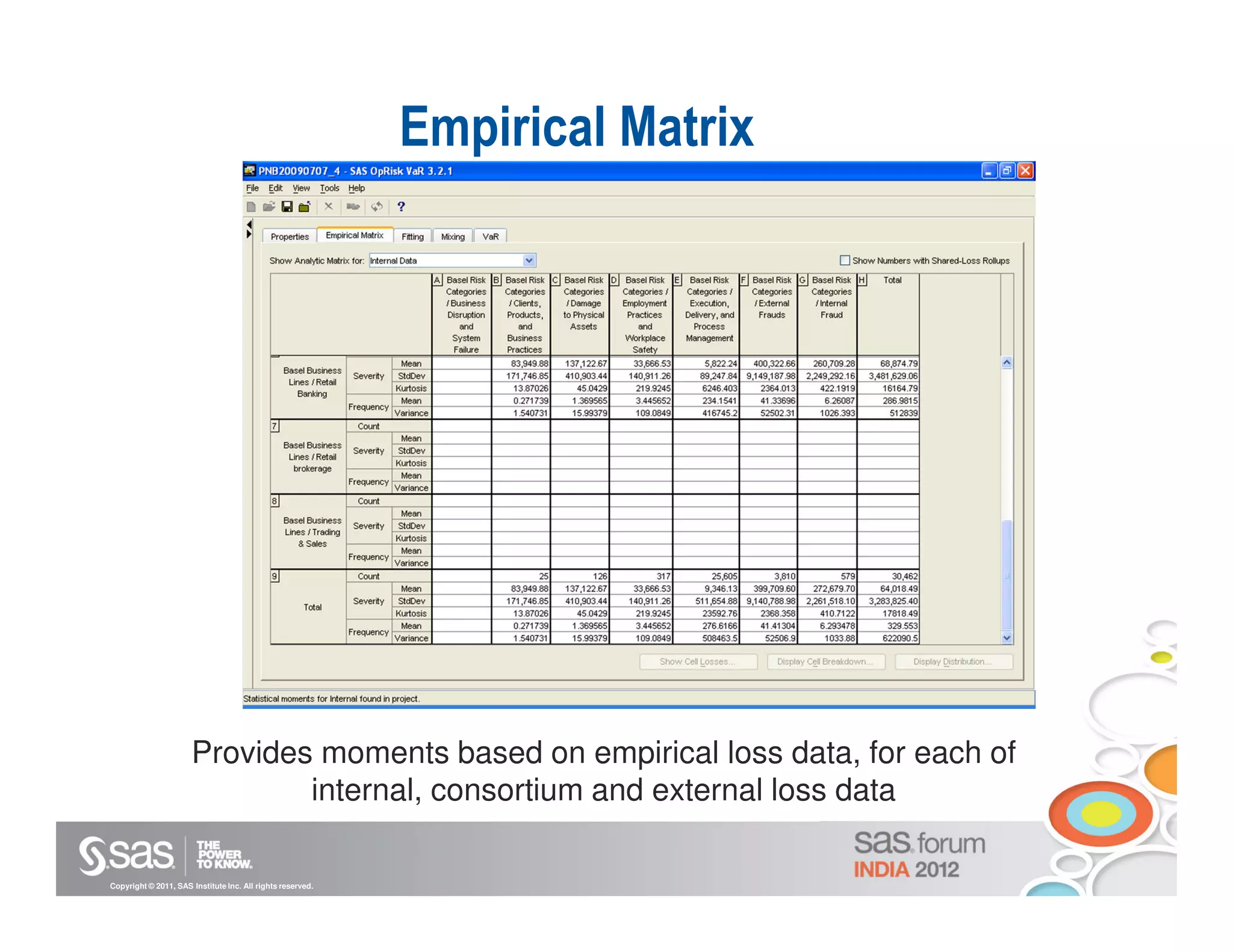

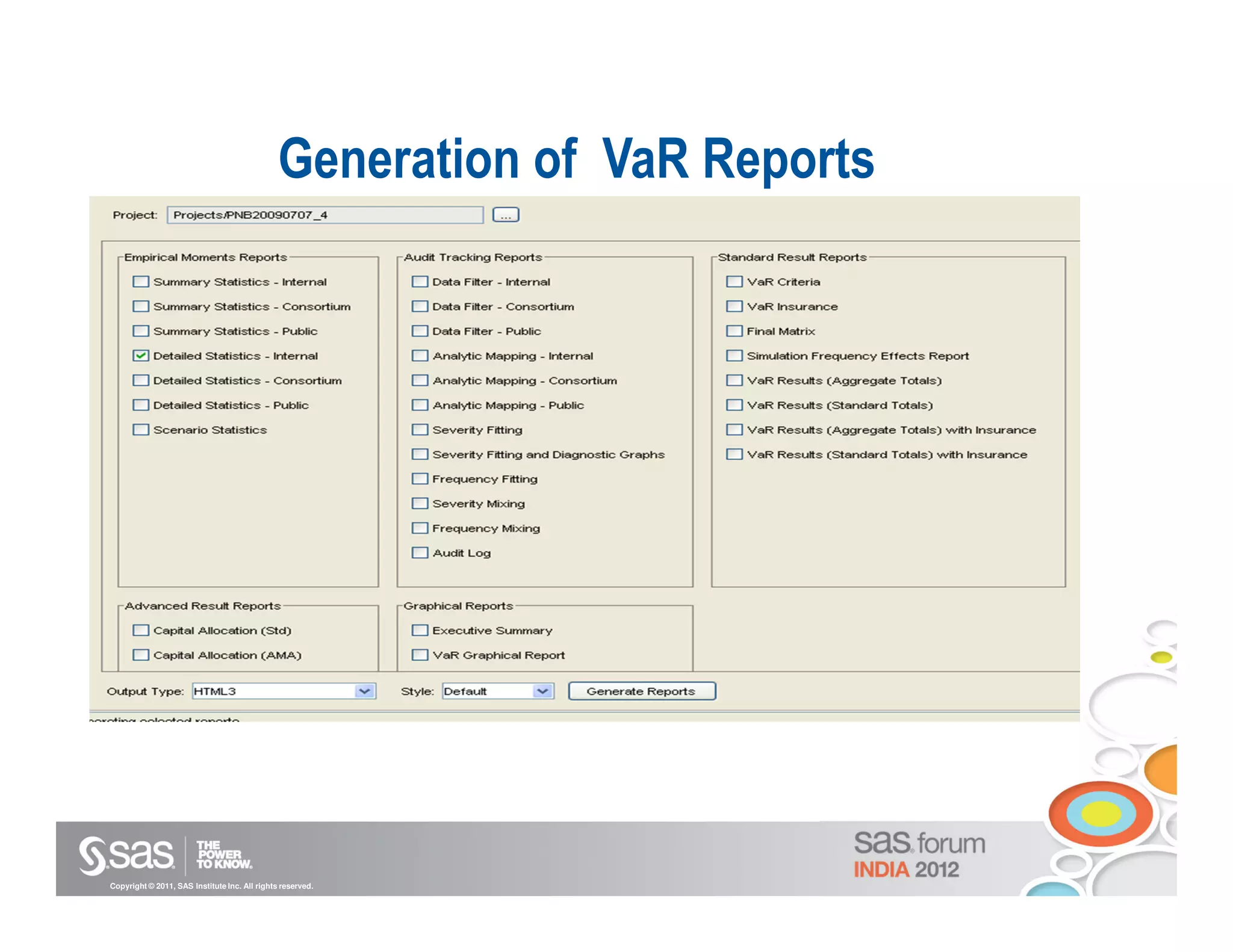

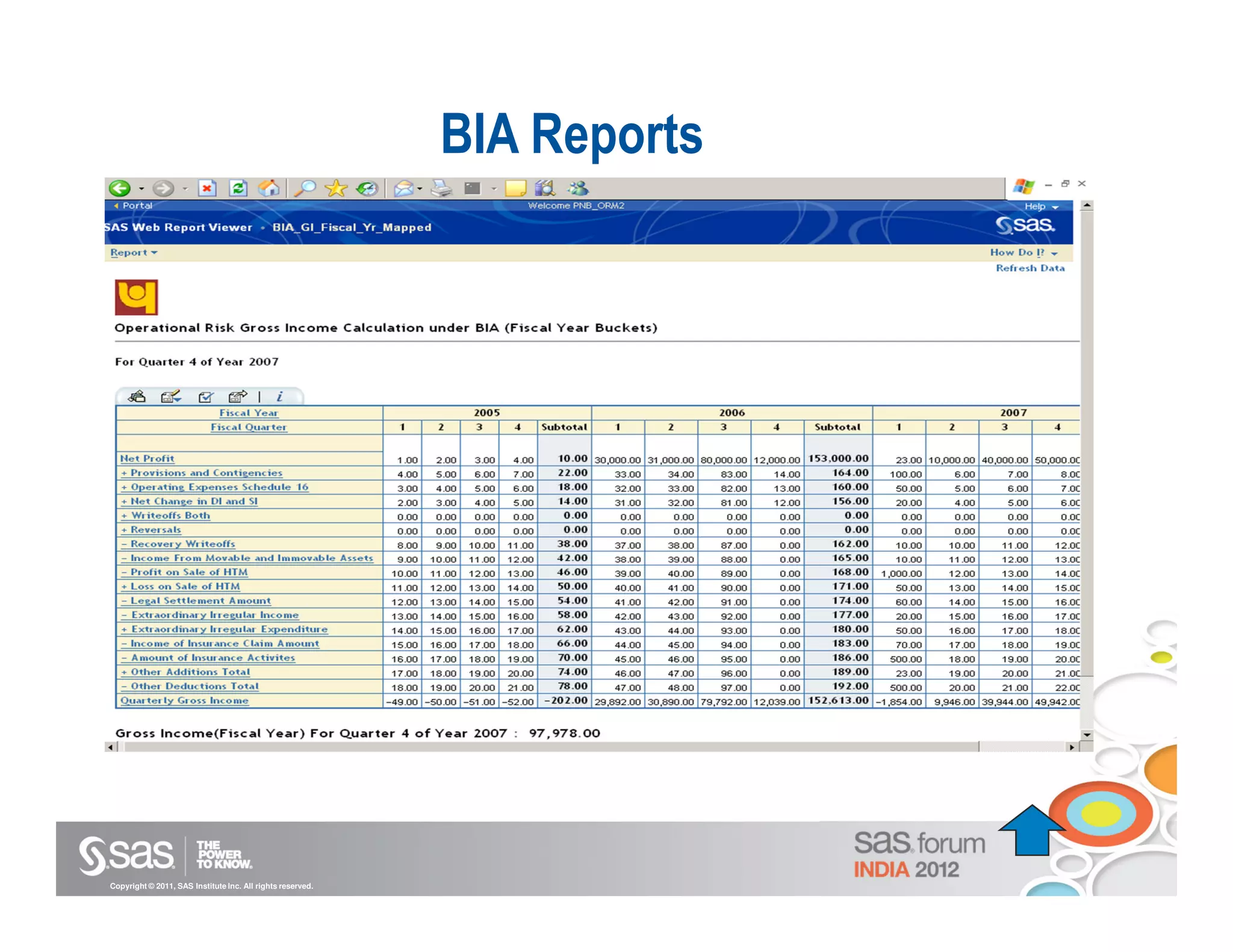

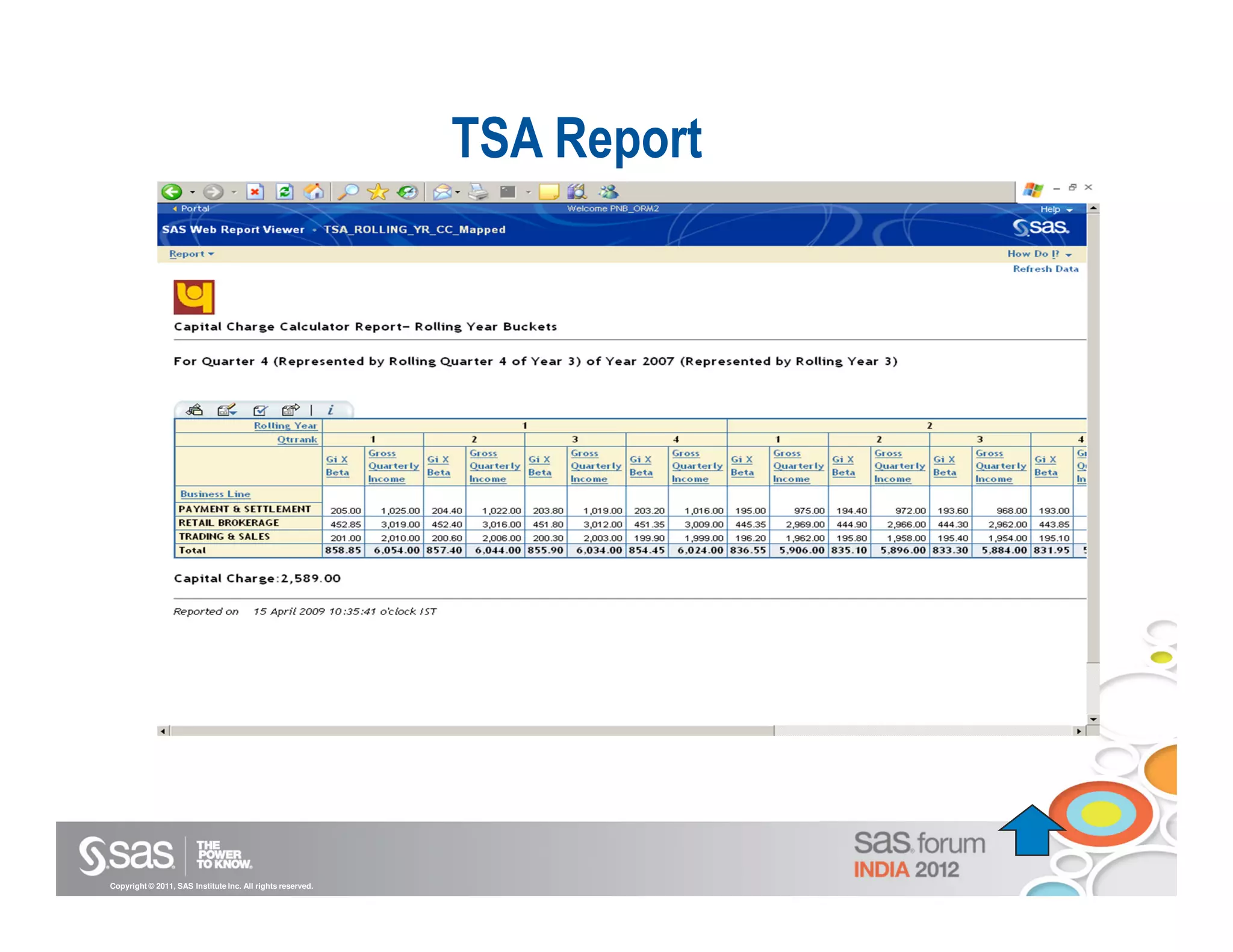

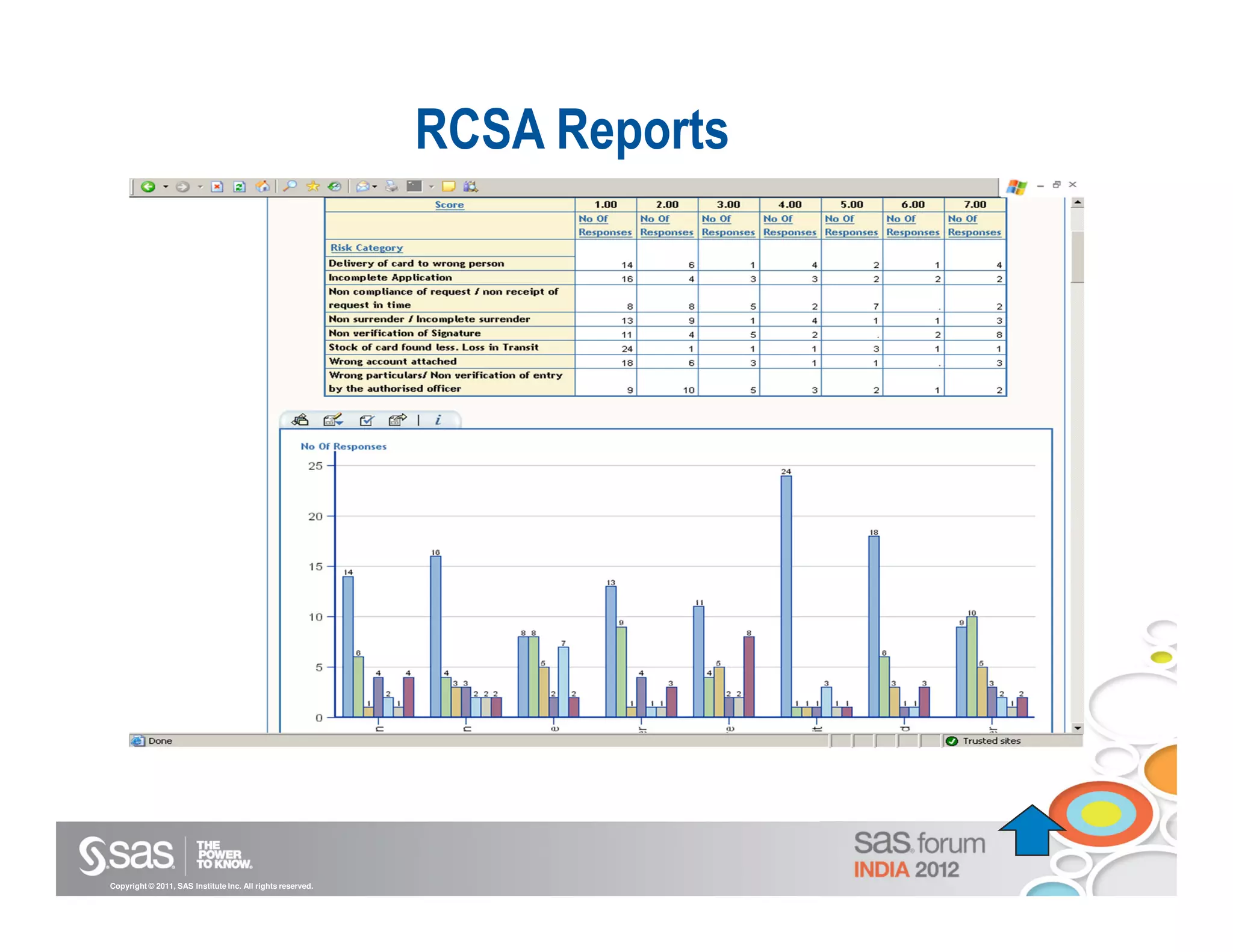

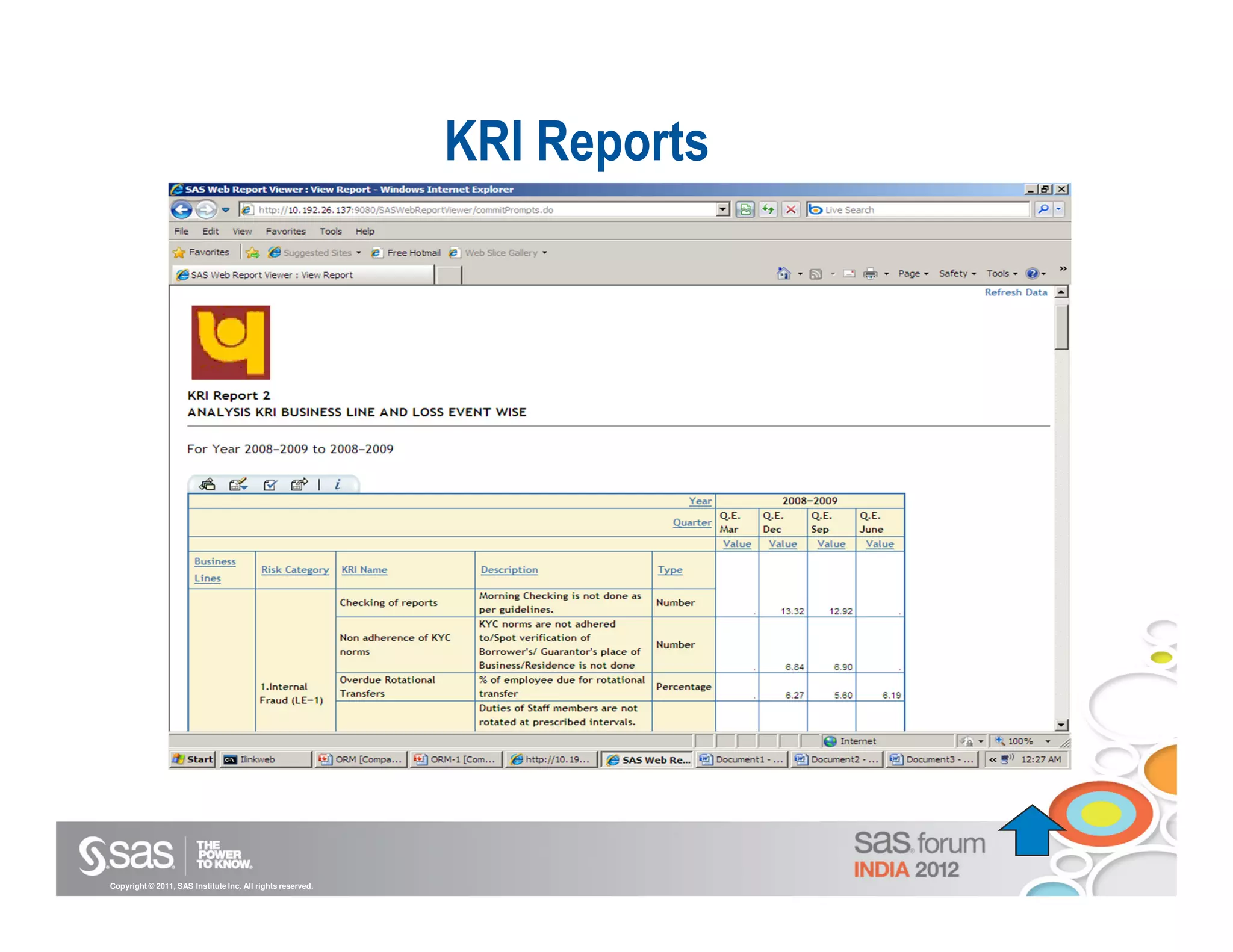

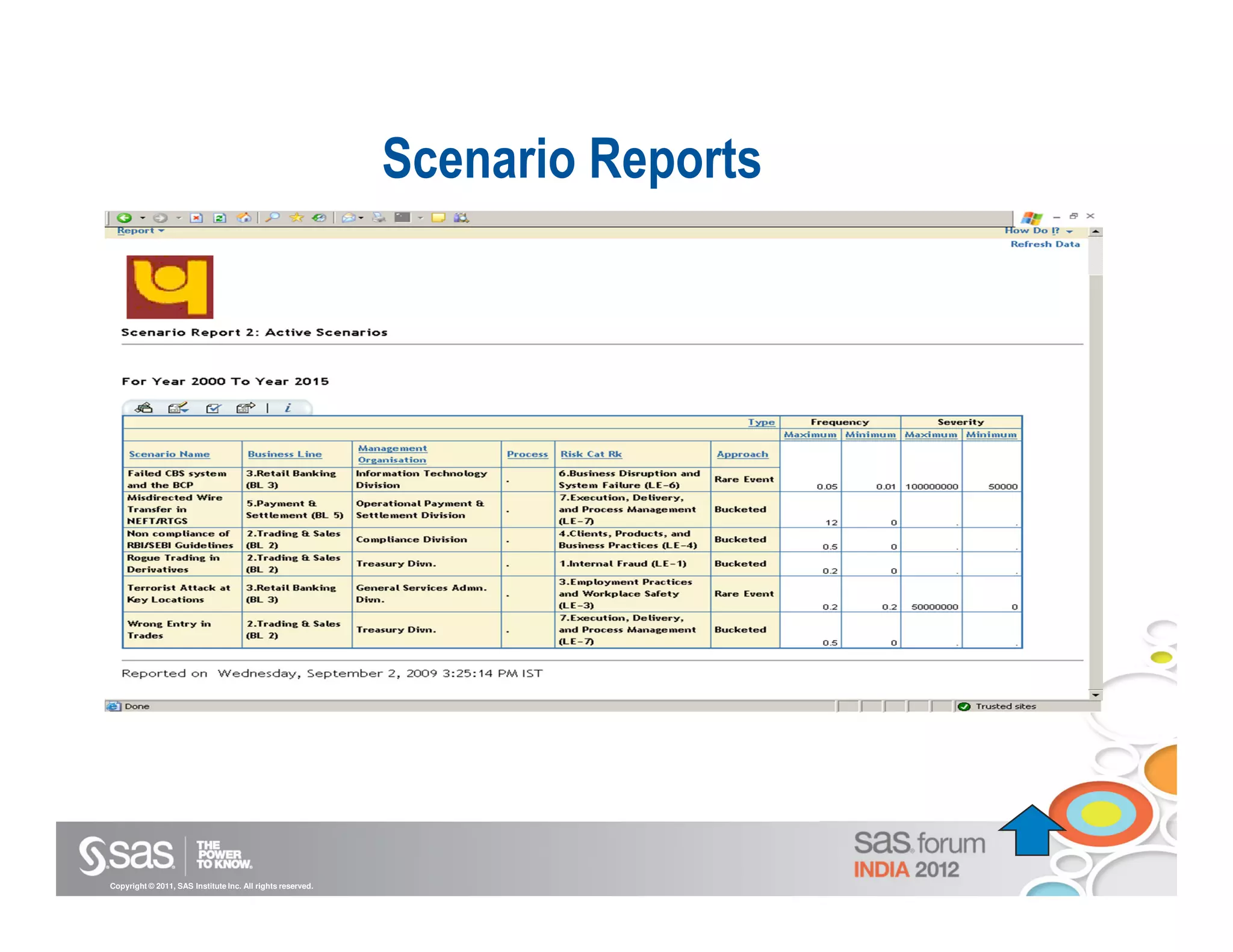

The document presents a case study on the SAS Operational Risk (OPrisk) solution implemented by Punjab National Bank, aimed at enhancing the bank's operational risk management framework and ensuring Basel compliance. It discusses the objectives, components, and system architecture of the solution, as well as future enhancements planned to improve data collection and analysis. The case study highlights the challenges faced during implementation and provides an overview of reporting capabilities related to internal and external loss data.