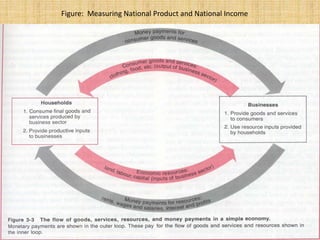

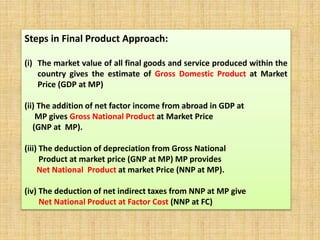

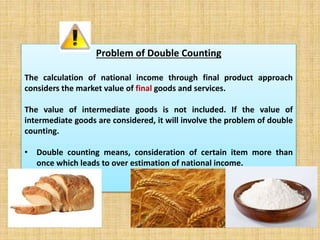

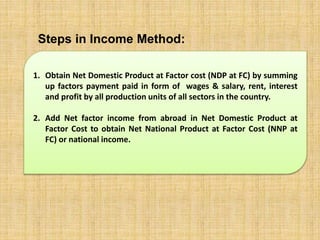

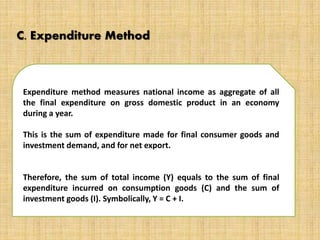

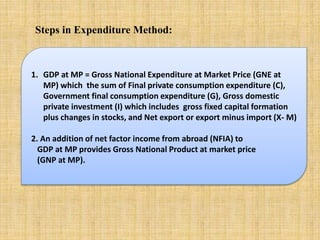

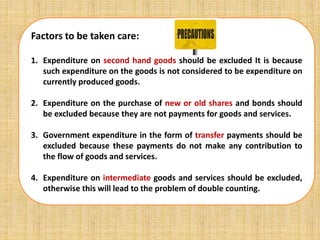

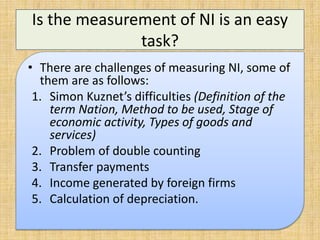

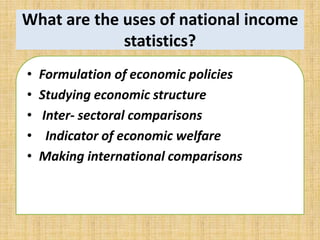

National income measures the total value of goods and services produced in an economy over a period of time. It is important for economists to measure national income to analyze economic growth, living standards, and income inequality. There are several concepts for calculating national income, including gross domestic product (GDP), gross national product (GNP), personal income, and per capita income. National income can be measured using the product, income, and expenditure methods, each with their own steps and considerations to account for issues like double counting. Calculating national income precisely poses challenges but the statistics are useful for economic planning, analysis, and international comparisons.