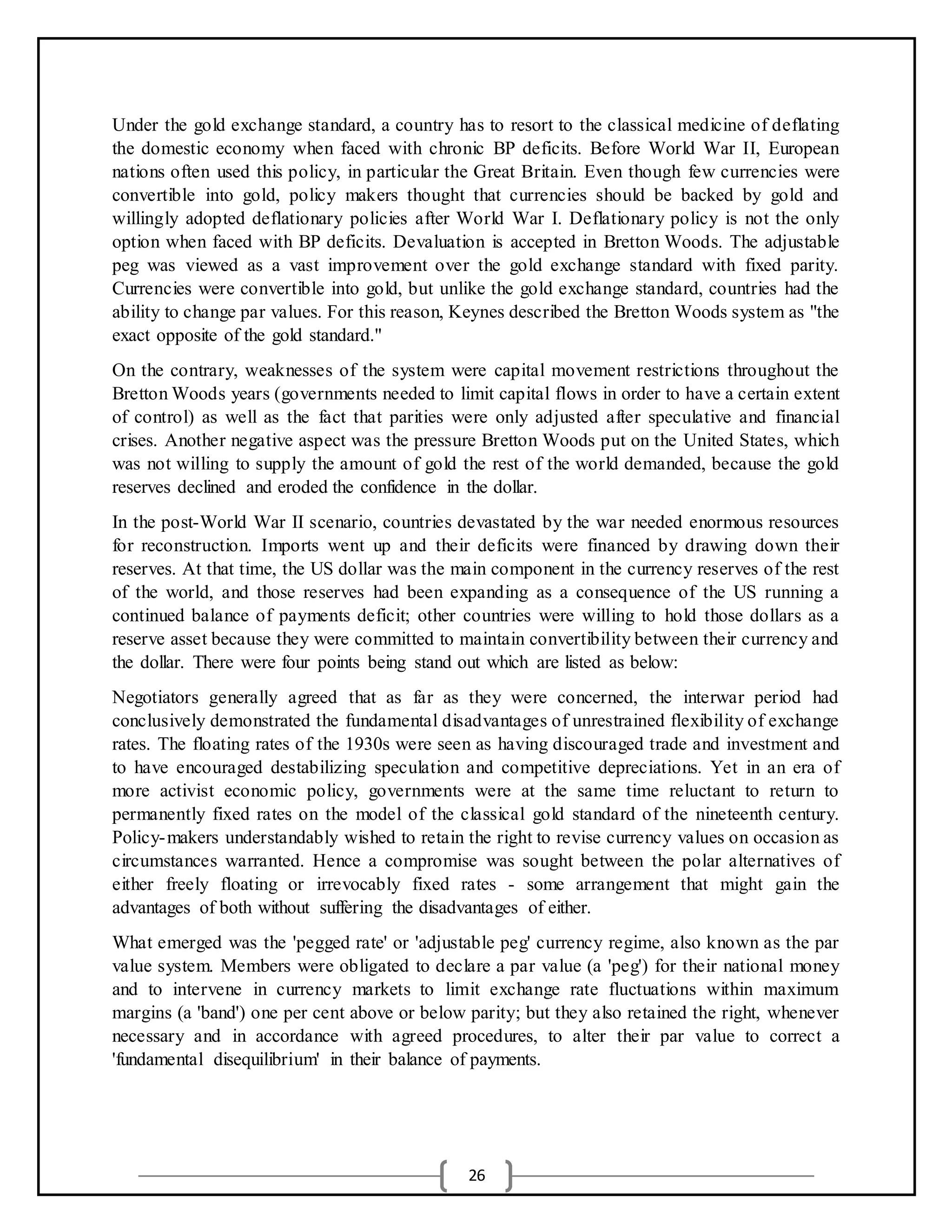

1. The Bretton Woods system established rules for international monetary management among major industrial states in the mid-20th century, including fixed exchange rates tied to the US dollar and gold.

2. The Bretton Woods conference in 1944 aimed to rebuild the international economic system and prevent competitive currency devaluations that exacerbated the Great Depression. It established the IMF and World Bank.

3. The collapse of Bretton Woods in 1971 ended convertibility of the US dollar to gold, making it a fiat currency and others like the pound floating currencies.

![5

According to economic historian Brad Delong, on almost every point where he was overruled by

the Americans, Keynes was later proved correct by events. Today these key 1930s events look

different to scholars of the era in particular, devaluations today are viewed with more

nuance. Ben Bernanke's opinion on the subject follows:

"... [T]he proximate cause of the world depression was a structurally flawed and poorly managed

international gold standard. ... For a variety of reasons, including a desire of the Federal

Reserve to curb the US stock market boom, monetary policy in several major countries turned

contractionary in the late 1920s—a contraction that was transmitted worldwide by the gold

standard. What was initially a mild deflationary process began to snowball when the banking and

currency crises of 1931 instigated an international "scramble for gold." Sterilization of gold

inflows by surplus countries [the USA and France], substitution of gold for foreign exchange

reserves, and runs on commercial banks all led to increases in the gold backing of money, and

consequently to sharp unintended declines in national money supplies. Monetary contractions in

turn were strongly associated with falling prices, output and employment. Effective international

cooperation could in principle have permitted a worldwide monetary expansion despite gold

standard constraints, but disputes over World War I reparations and war debts, and the insularity

and inexperience of the Federal Reserve, among other factors, prevented this outcome. As a

result, individual countries were able to escape the deflationary vortex only by unilaterally

abandoning the gold standard and re-establishing domestic monetary stability, a process that

dragged on in a halting and uncoordinated manner until France and the other Gold Bloc countries

finally left gold in 1936." —Great Depression, B. Bernanke

In 1944 at Bretton Woods, as a result of the collective conventional wisdom of the time,

representatives from all the leading allied nations collectively favored a regulated system of

fixed exchange rates, indirectly disciplined by a US dollar tied to gold—a system that relied on a

regulated market economy with tight controls on the values of currencies.

Flows of speculative international finance were curtailed by shunting them through and limiting

them via central banks. This meant that international flows of investment went into foreign direct

investment (FDI)—i.e., construction of factories overseas, rather than international currency

manipulation or bond markets. Although the national experts disagreed to some degree on the

specific implementation of this system, all agreed on the need for tight controls.](https://image.slidesharecdn.com/economics-150312113615-conversion-gate01/75/Bretton-Woods-system-of-monetary-management-5-2048.jpg)