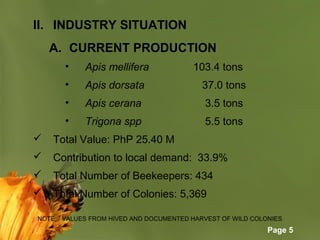

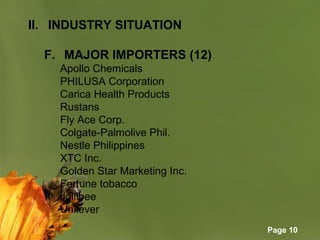

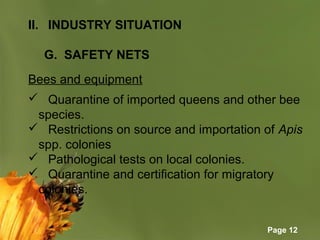

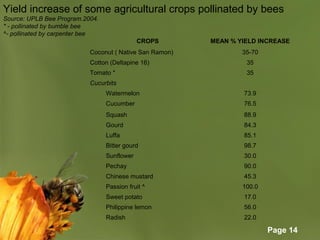

The document provides a draft roadmap for the Philippine bee industry from 2011-2015. It summarizes the current state of the bee industry including annual honey production, major producers, research institutions, importers and opportunities. The roadmap's vision is for a profitable bee industry that supports agriculture and biodiversity. Its goals include strengthening research programs, supporting enterprise development, and conserving bee species. Targets include increasing production, establishing quarantine measures, and developing human resources for the industry. The roadmap outlines strategies such as enhancing research funding, improving inputs, developing partnerships, and establishing quality standards.