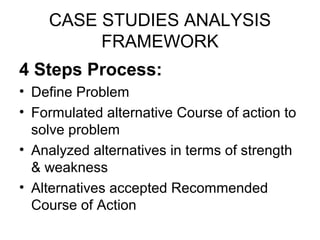

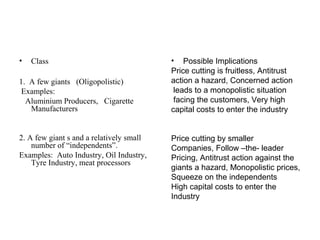

The document outlines a case study analysis framework. It discusses how Harvard Business School developed case studies in 1920 to provide in-depth analysis of business problems and decision making processes. The 4 step framework involves: 1) defining the problem, 2) formulating alternative courses of action, 3) analyzing alternatives in terms of strengths and weaknesses, and 4) recommending an accepted course of action. The document also provides details on analyzing a firm's environment, industry, technology, political/social influences, and financials as part of a case study.