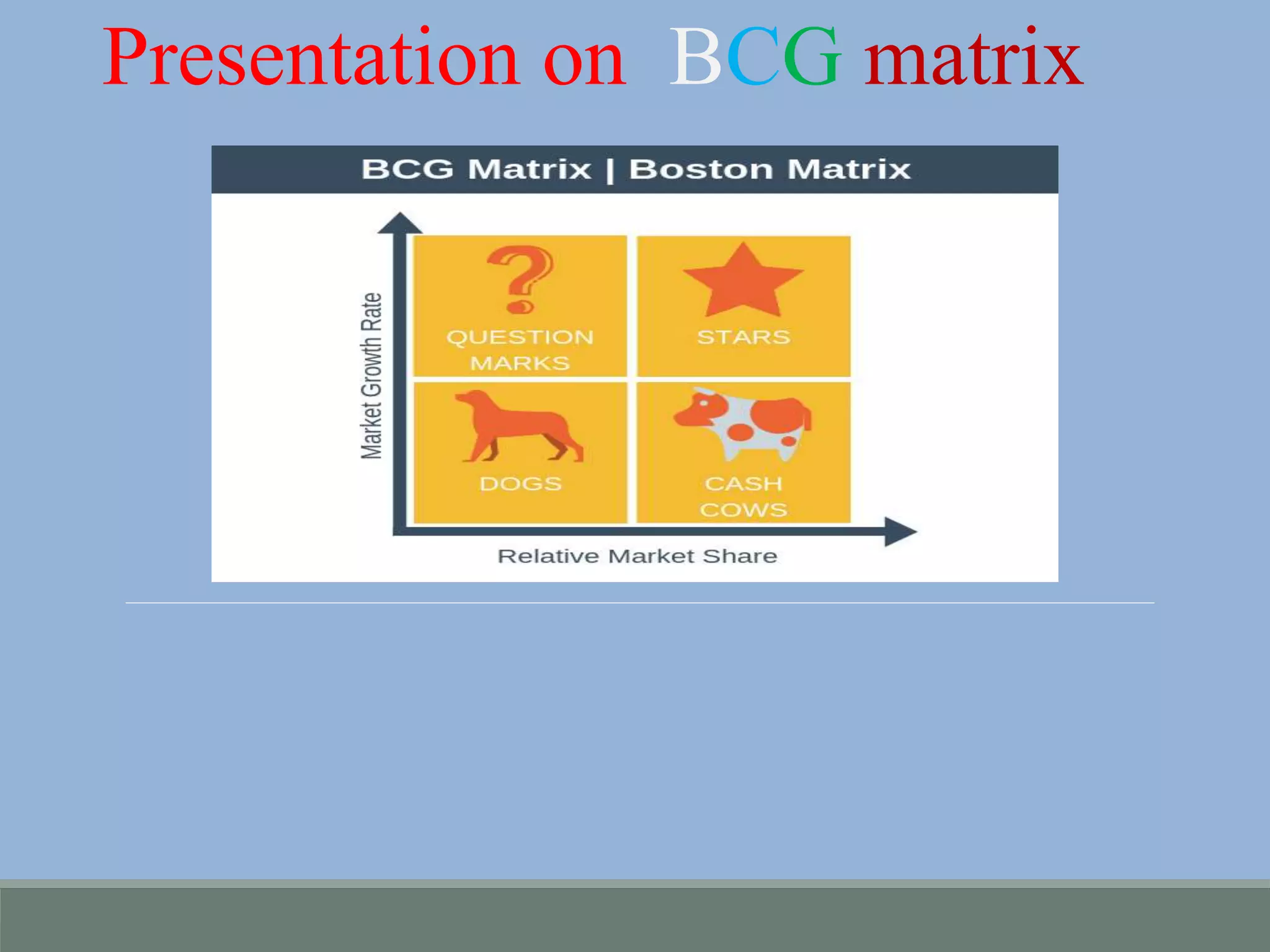

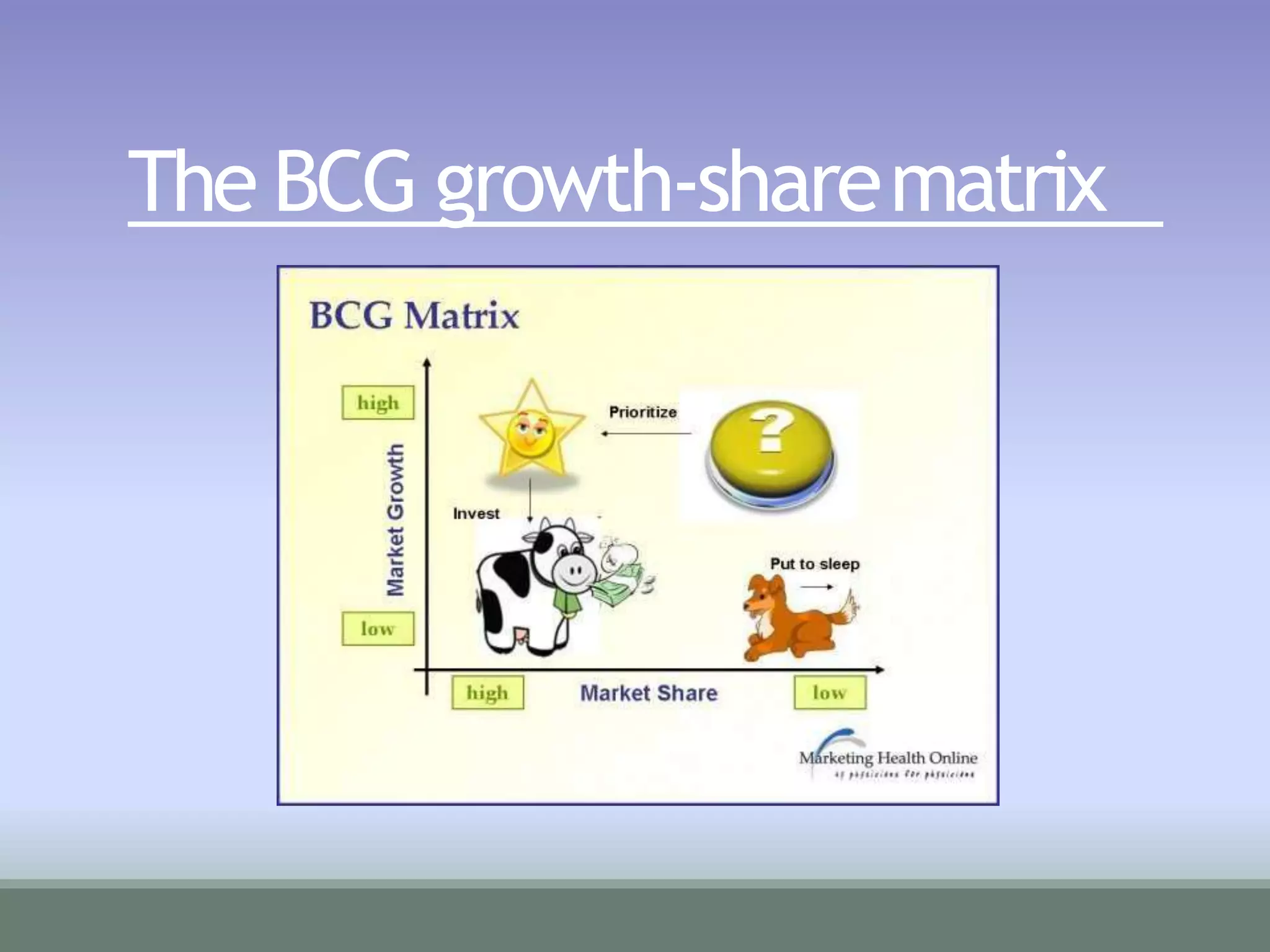

The BCG matrix classifies products into four categories based on their relative market share and market growth rate: Stars (high share, high growth), Cash Cows (high share, low growth), Question Marks (low share, high growth), and Dogs (low share, low growth). Stars generate cash from their market share while requiring investment for growth. Cash Cows generate stable cash flow. Question Marks have potential but require investment to gain share. Dogs provide little value and should be avoided or divested. While simple, the BCG matrix provides a framework for portfolio planning and resource allocation across a company's products.