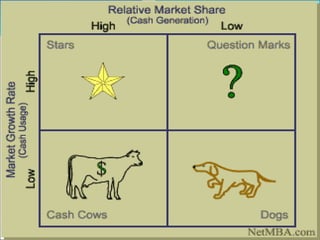

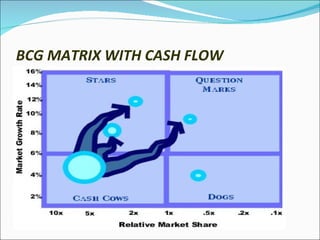

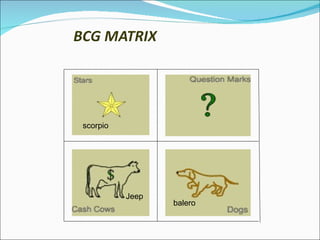

The document summarizes the Boston Consulting Group (BCG) Matrix, a portfolio planning model developed in the 1970s. The BCG Matrix classifies a company's business units into four categories - Stars, Cash Cows, Question Marks, and Dogs - based on their relative market share and the market growth rate. Stars have high market share in a high growth market and require heavy investment. Cash Cows have high market share in a low growth market and generate cash. Question Marks have low market share but are in a high growth market, requiring investment. Dogs have low market share and are in a low growth market, acting as cash traps. The matrix is used to assess products/businesses and allocate resources effectively.