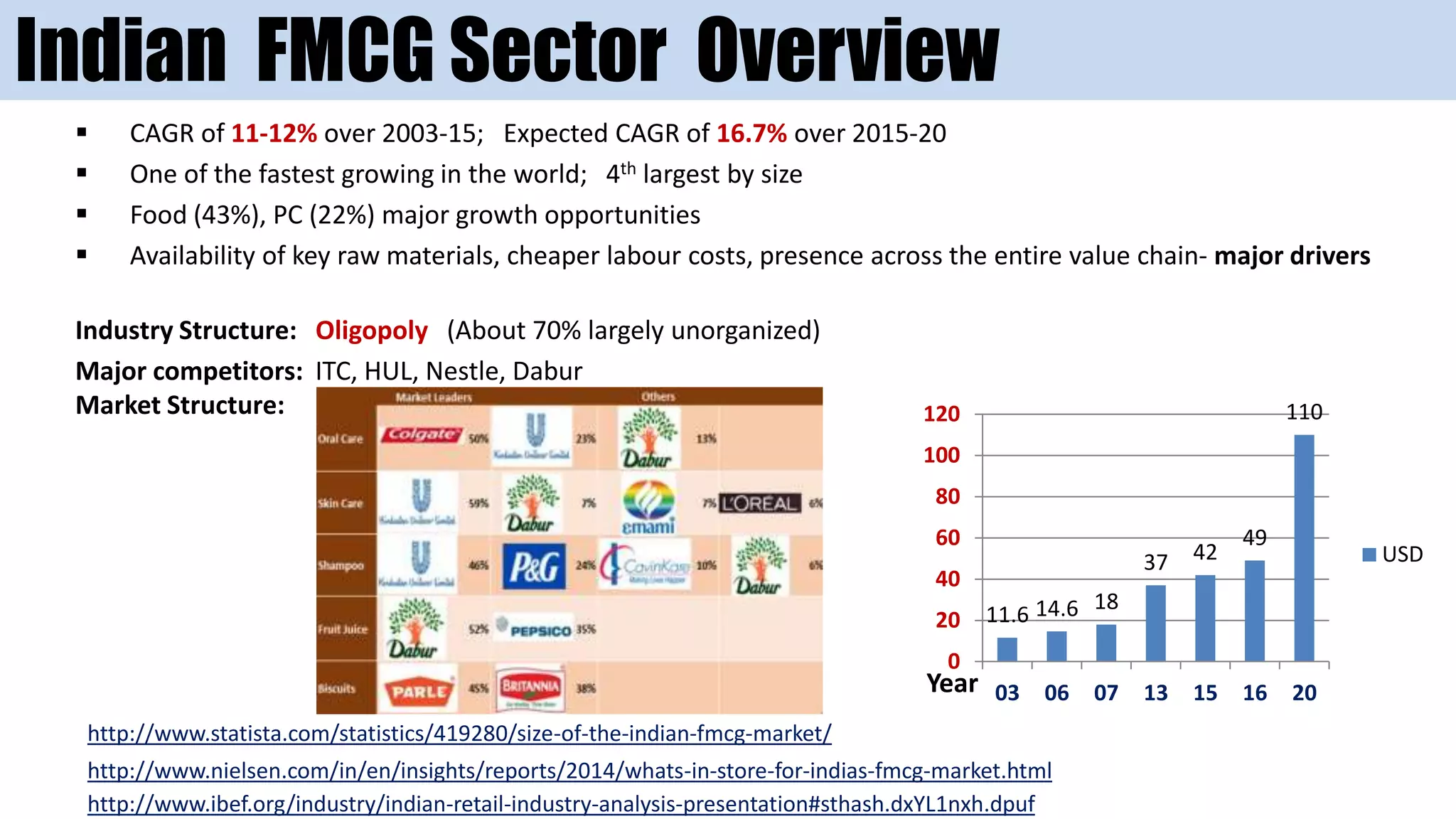

- The document provides an overview of the Indian FMCG sector and Patanjali Ayurved Ltd. It notes that the Indian FMCG sector grew at a CAGR of 11-12% from 2003-2015 and is one of the fastest growing in the world. Food and personal care are major growth opportunities.

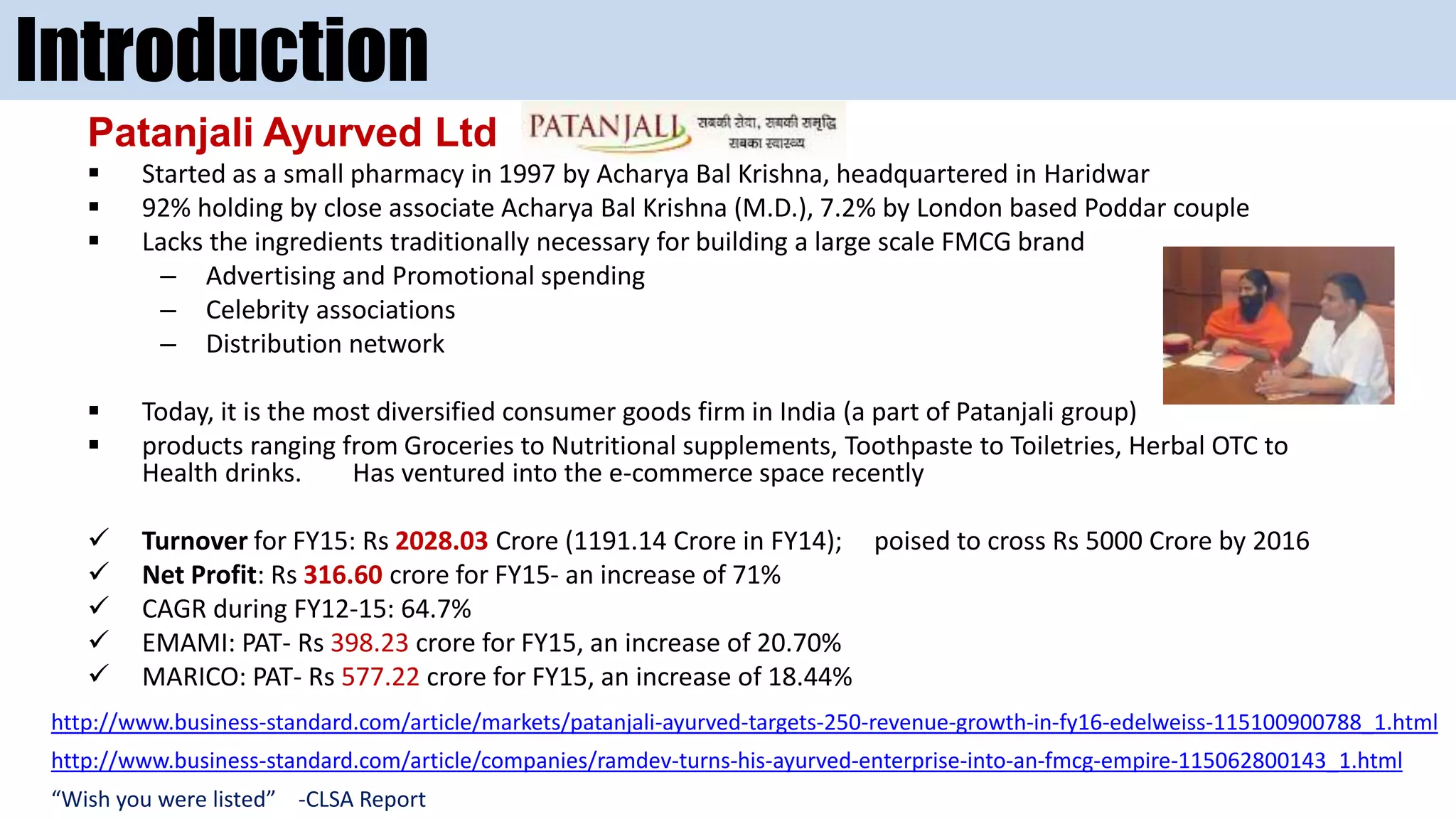

- Patanjali Ayurved Ltd started as a small pharmacy in 1997 and today produces over 800 products across categories. It has seen strong growth with revenues increasing from Rs. 1185 crore in FY2014 to Rs. 2028 crore in FY2015.

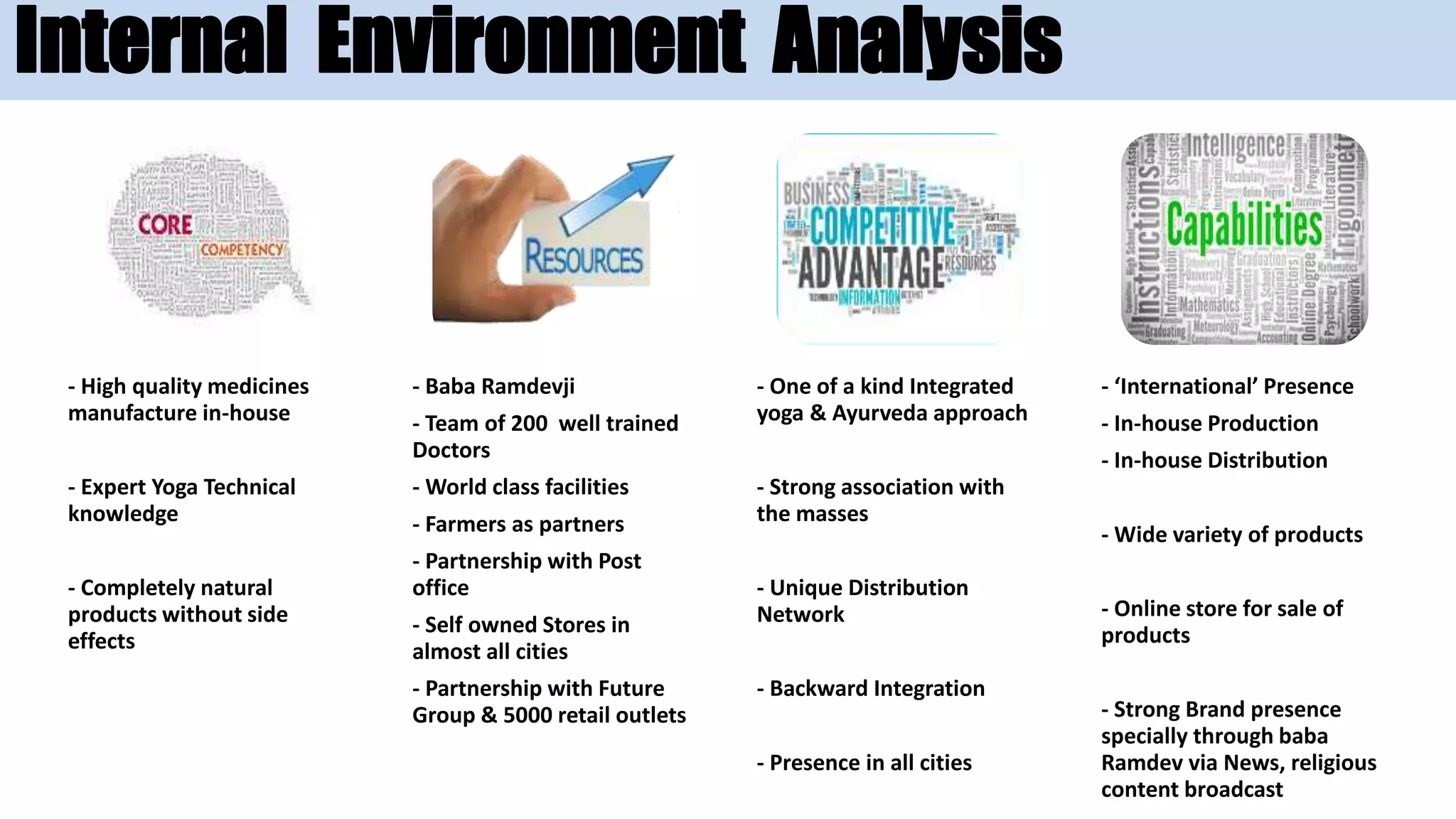

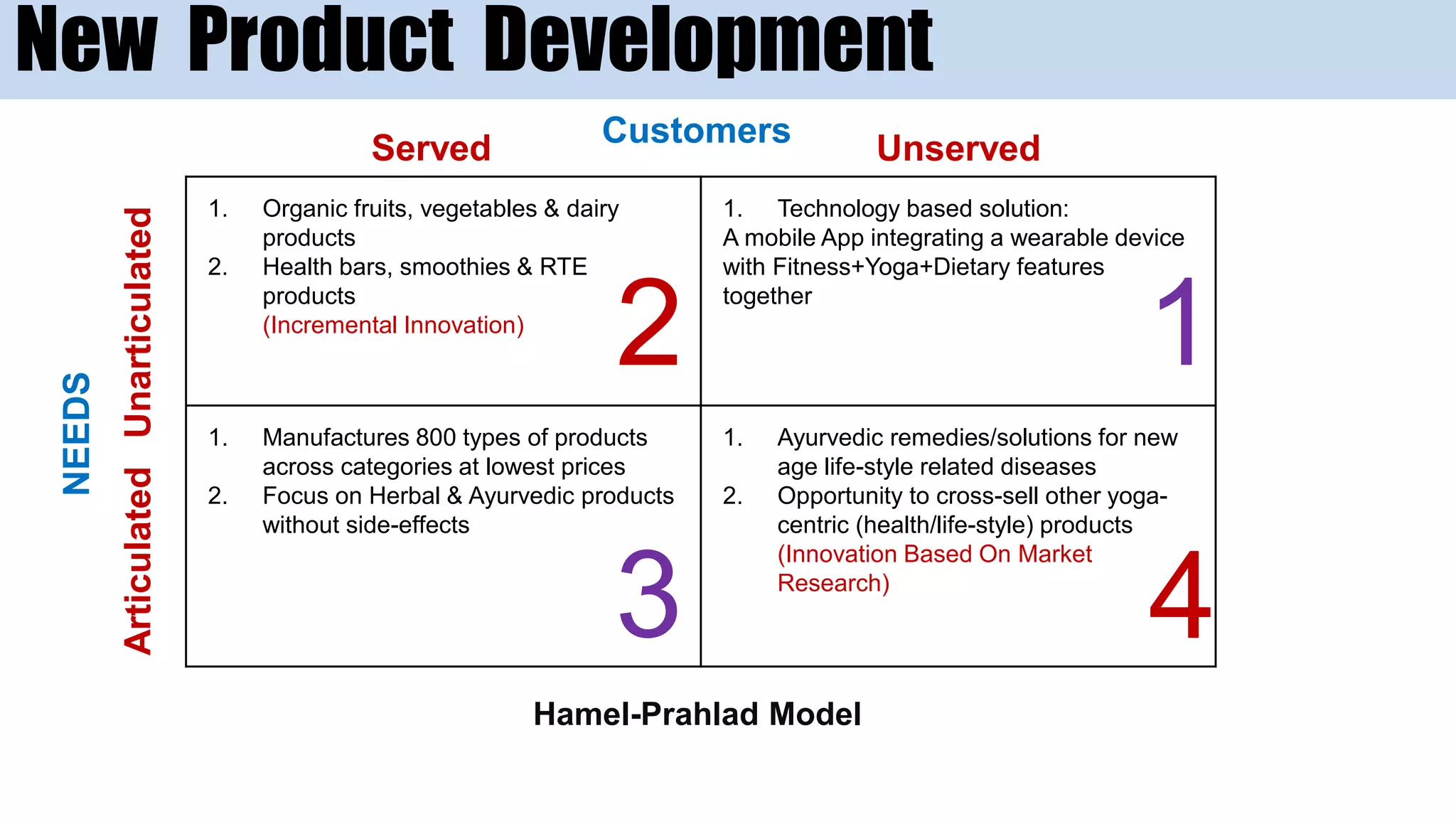

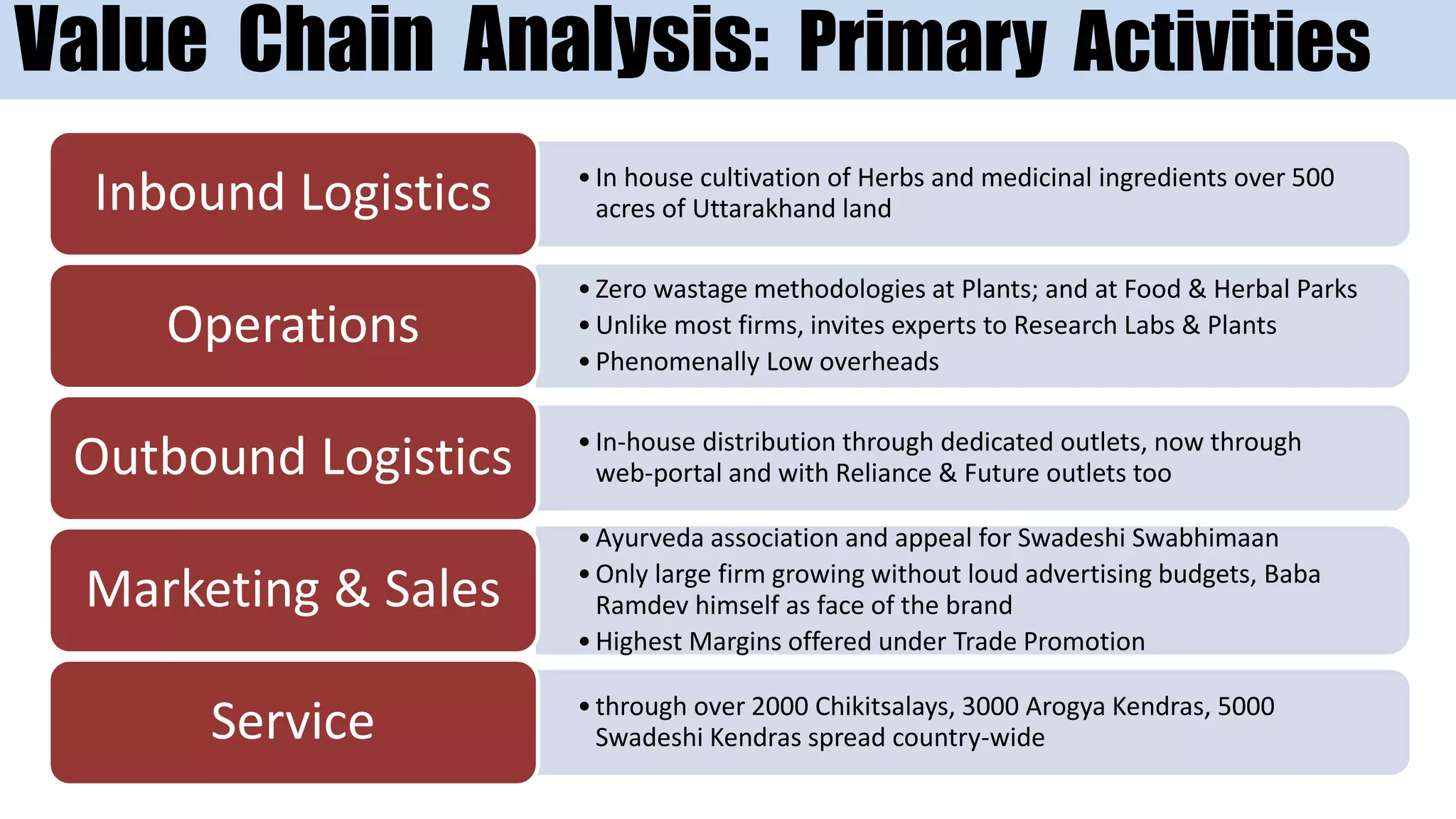

- The document analyzes Patanjali's business model, value chain, strategies and competitive position versus