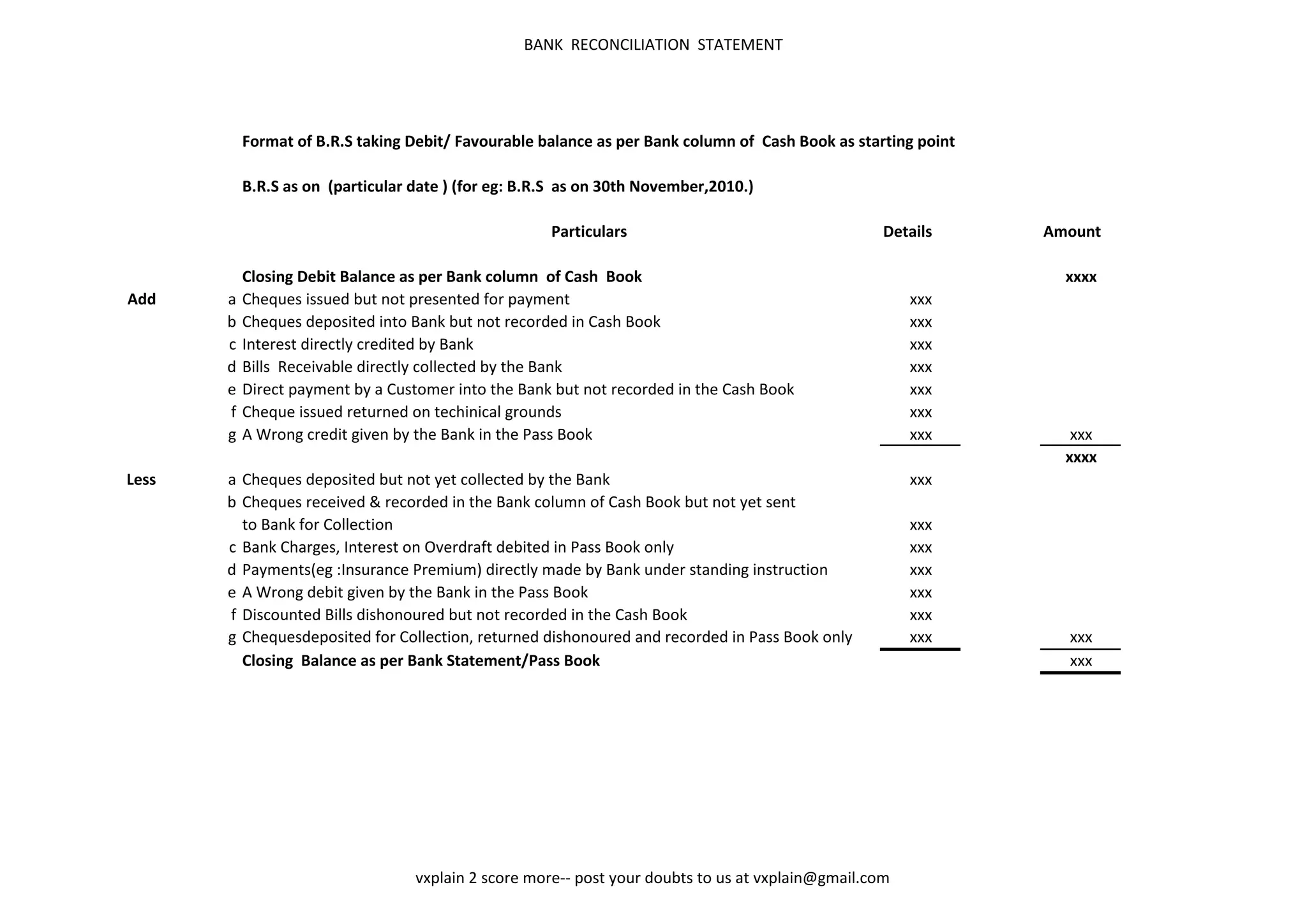

The document discusses bank reconciliation statements. It explains that a bank reconciliation statement analyzes the reasons for differences between the balance in a company's cash book and its bank statement on a given date. Common reasons for differences include checks that have been written but not cleared yet and deposits made that have not appeared in the bank statement yet. The document provides a detailed format for preparing a bank reconciliation statement, including items that should be added or subtracted to reconcile the two balances.