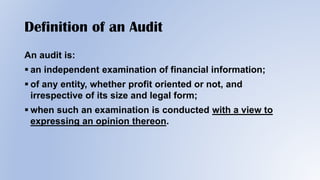

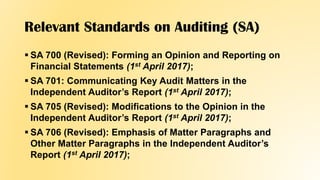

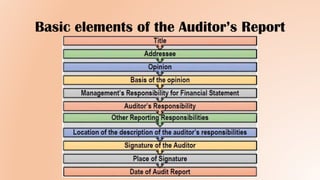

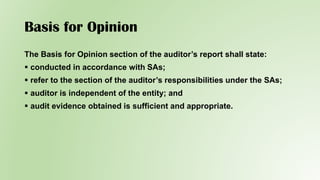

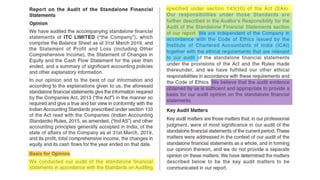

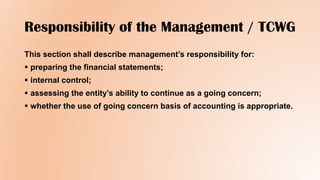

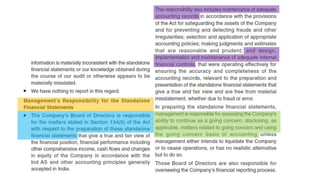

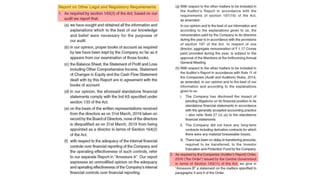

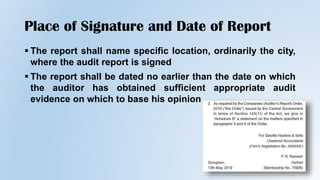

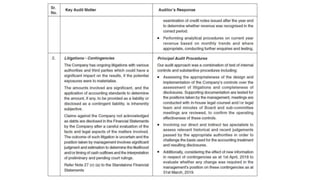

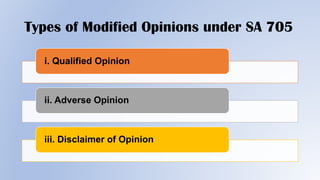

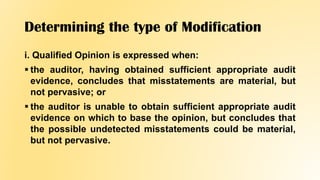

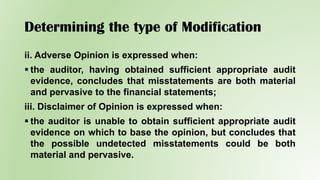

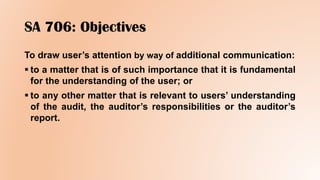

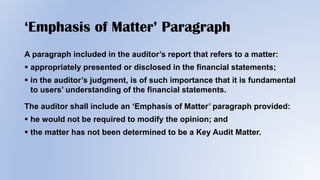

The document presents an overview of audit reports, including the definition and purpose of an audit, relevant auditing standards, and key responsibilities of both auditors and management. It outlines specific standards such as SA 700, SA 701, SA 705, and SA 706, detailing the requirements for auditors' opinions, communication of key audit matters, and modifications to opinions. The document emphasizes the importance of clear communication in auditors' reports to enhance user understanding and transparency.