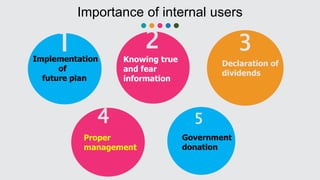

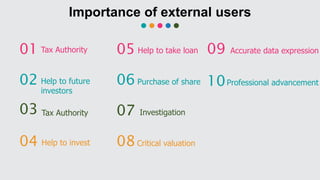

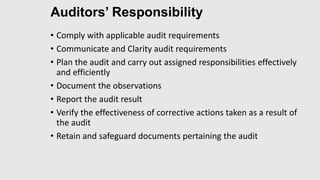

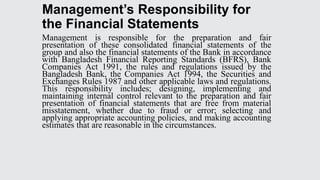

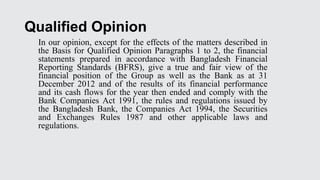

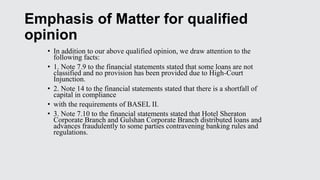

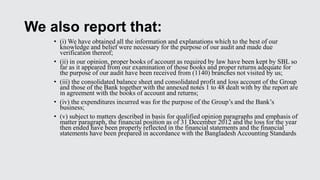

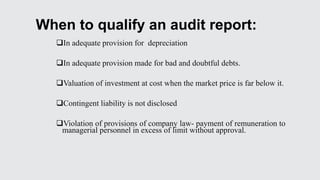

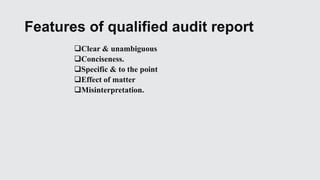

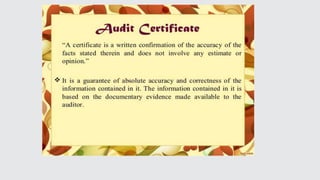

The presentation by group 4 outlines the definition and importance of an auditor's report, detailing its role in ensuring accountability and reliability for both internal and external users. It discusses key elements of an audit report, the responsibilities of auditors and management, and the classification of audit opinions, including unqualified, qualified, adverse, and disclaimer reports. Moreover, it highlights specific issues leading to qualified opinions and the requirements of audit reporting under relevant regulations.