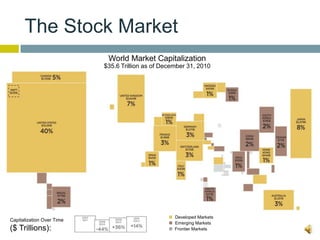

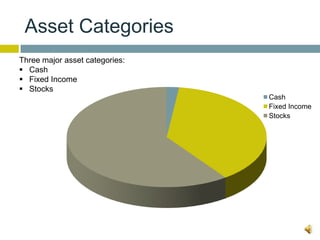

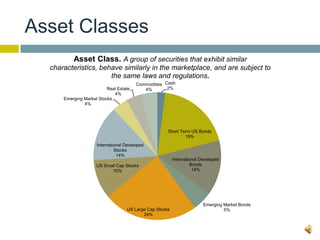

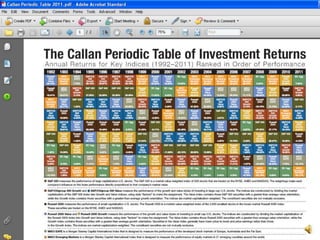

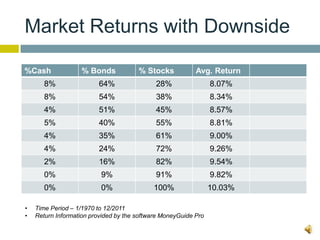

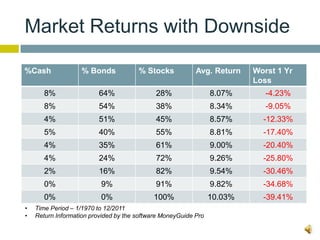

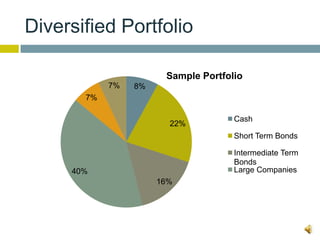

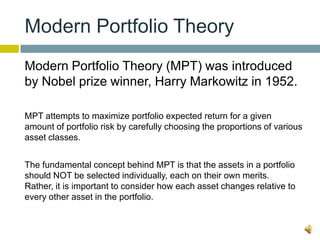

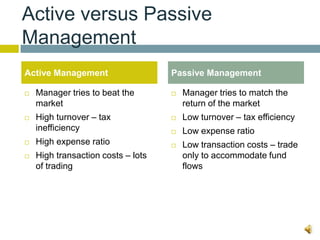

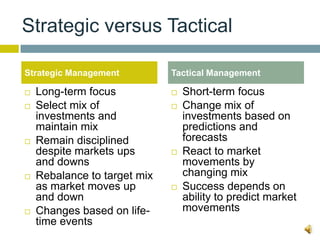

This document provides an overview of capital markets and portfolio construction from Ferro Financial. It discusses the objectives of understanding capital markets, portfolio construction, diversification, and Ferro's investment philosophy. It defines the stock and bond markets, describing their sizes and complexities. It emphasizes the importance of diversifying among asset classes and within sectors to reduce risk and enhance returns. Modern portfolio theory aims to maximize returns for a given risk level by carefully selecting asset proportions. Successful long-term investing requires a disciplined strategy of diversification and maintaining a long-term view.