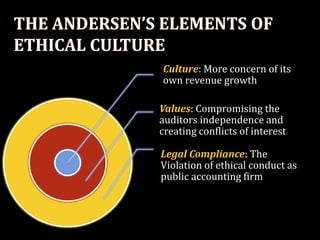

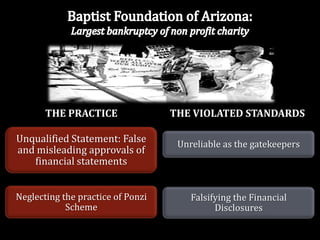

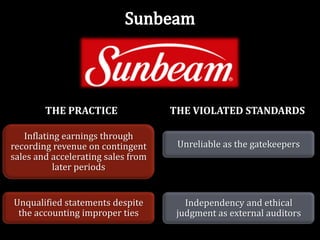

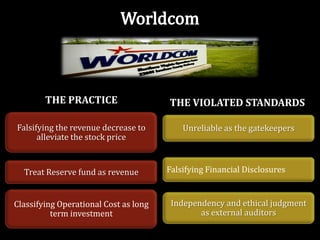

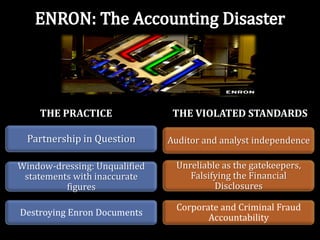

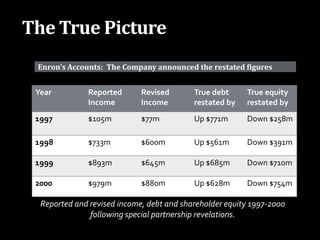

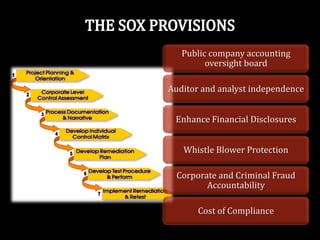

Arthur Andersen was once a leading accounting firm that set standards for the profession but faced scandals due to questionable accounting practices that compromised its independence and integrity. Its culture prioritized revenue growth over ethics. It provided both auditing and consulting to Enron, violating standards by issuing unqualified statements despite improper accounting that falsified financial disclosures. After Enron's fraud was revealed and documents destroyed, Arthur Andersen was found guilty of obstruction of justice and ceased operations. The scandals led to new regulations like the Sarbanes-Oxley Act to strengthen financial disclosures and auditor independence but critics argue it does not prevent all excessive risk taking.