FRAUD - AUDITING STUDY NOTES

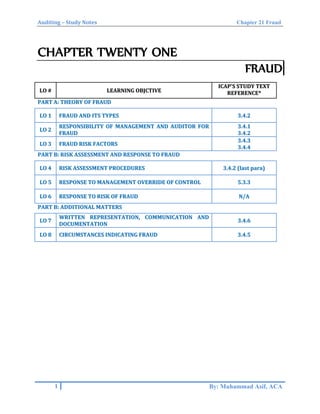

- 1. Auditing – Study Notes Chapter 21 Fraud CHAPTER TWENTY ONE FRAUD LLOO ## LLEEAARRNNIINNGG OOBBJJCCTTIIVVEE IICCAAPP''SS SSTTUUDDYY TTEEXXTT RREEFFEERREENNCCEE** PPAARRTT AA:: TTHHEEOORRYY OOFF FFRRAAUUDD LLOO 11 FFRRAAUUDD AANNDD IITTSS TTYYPPEESS 33..44..22 LLOO 22 RREESSPPOONNSSIIBBIILLIITTYY OOFF MMAANNAAGGEEMMEENNTT AANNDD AAUUDDIITTOORR FFOORR FFRRAAUUDD 33..44..11 33..44..22 LLOO 33 FFRRAAUUDD RRIISSKK FFAACCTTOORRSS 33..44..33 33..44..44 PPAARRTT BB:: RRIISSKK AASSSSEESSSSMMEENNTT AANNDD RREESSPPOONNSSEE TTOO FFRRAAUUDD LLOO 44 RRIISSKK AASSSSEESSSSMMEENNTT PPRROOCCEEDDUURREESS 33..44..22 ((llaasstt ppaarraa)) LLOO 55 RREESSPPOONNSSEE TTOO MMAANNAAGGEEMMEENNTT OOVVEERRRRIIDDEE OOFF CCOONNTTRROOLL 55..33..33 LLOO 66 RREESSPPOONNSSEE TTOO RRIISSKK OOFF FFRRAAUUDD NN//AA PPAARRTT BB:: AADDDDIITTIIOONNAALL MMAATTTTEERRSS LLOO 77 WWRRIITTTTEENN RREEPPRREESSEENNTTAATTIIOONN,, CCOOMMMMUUNNIICCAATTIIOONN AANNDD DDOOCCUUMMEENNTTAATTIIOONN 33..44..66 LLOO 88 CCIIRRCCUUMMSSTTAANNCCEESS IINNDDIICCAATTIINNGG FFRRAAUUDD 33..44..55 1 By: Muhammad Asif, ACA

- 2. Auditing – Study Notes Chapter 21 Fraud PART A – THEORY OF FRAUD LLOO 11:: FFRRAAUUDD AANNDD IITTSS TTYYPPEESS:: Distinction between Error and Fraud: Misstatements in the financial statements can arise from either fraud or error. Fraud: An intentional act by one or more individuals (among management, those charged with governance, employees, or third parties) involving the use of deception to obtain an unjust or illegal advantage. Error: an unintentional misstatement in financial statements. Fraudulent Financial Reporting: Fraudulent financial reporting involves intentional misstatements including omissions of amounts or disclosures in financial statements to deceive financial statement users. Fraudulent financial reporting may be accomplished by the following: Manipulation, falsification (including forgery), or alteration of accounting records or supporting documentation from which the financial statements are prepared. Misrepresentation in, or intentional omission from, the financial statements of events, transactions or other significant information. Intentional misapplication of accounting principles relating to amounts, classification, manner of presentation, or disclosure. Misappropriation of Assets: Misappropriation of assets involves the theft of an entity’s assets and is often perpetrated by employees Misappropriation of assets can be accomplished in a variety of ways including: Embezzling receipts (for example, misappropriating collections on accounts receivable or diverting receipts in respect of written-off accounts to personal bank accounts). Fraudulent financial reporting can be committed by management overriding controls using such techniques as: Recording fictitious journal entries, particularly close to the end of an accounting period, to manipulate operating results or achieve other objectives. Inappropriately adjusting assumptions and changing judgments used to estimate account balances. Omitting, advancing or delaying recognition in the financial statements of events and transactions that have occurred during the reporting period. Concealing, or not disclosing, facts that could affect the amounts recorded in the financial statements. Engaging in complex transactions that are structured to misrepresent the financial position or financial performance of the entity. Altering records and terms related to significant and unusual transactions. 2 By: Muhammad Asif, ACA

- 3. Auditing – Study Notes Chapter 21 Fraud Stealing physical assets or intellectual property (for example, stealing inventory for personal use or for sale, stealing scrap for resale, colluding with a competitor by disclosing technological data in return for payment). Causing an entity to pay for goods and services not received (for example, payments to fictitious vendors, kickbacks paid by vendors to the entity’s purchasing agents in return for inflating prices, payments to fictitious employees). Using an entity’s assets for personal use (for example, using the entity’s assets as collateral for a personal loan or a loan to a related party). CONCEPT REVIEW QUESTION Because of its ability to exert influence, management is in a position to perpetrate fraud and prepare fraudulent financial statements. Identify six different ways in which fraud may be committed by management through overriding of controls. (06 marks) (CA Inter – Spring 2016) Recent worldwide events of fraud have raised several questions over the role of external auditors in relation to identification of fraud. Required: Define the term .fraud. and describe any two major categories of fraud. (08 marks) (ICMAP – February 2014) Explain the term ‘fraudulent financial reporting’, illustrating your explanation with examples. (04 marks) (ACCA P7 – June 2009) LLOO 22:: RREESSPPOONNSSIIBBIILLIITTYY OOFF MMAANNAAGGEEMMEENNTT AANNDD AAUUDDIITTOORR FFOORR FFRRAAUUDD:: Responsibility of Management regarding Fraud: The primary responsibility for the prevention and detection of fraud rests with both those charged with governance of the entity and management. Management should create a culture of honesty and ethical behaviour with oversight of TCWG to prevent fraud. Oversight by TCWG should also include consideration for potential for management override of control. Responsibility of Auditor regarding Fraud: Overall responsibility for error and fraud: An auditor conducting an audit in accordance with ISAs is responsible for obtaining reasonable assurance that the financial statements taken as a whole are free from material misstatement, whether caused by fraud or error. Owing to the inherent limitations of an audit, there is an unavoidable risk that some material misstatements of the financial statements may not be detected, even though the audit is properly planned and performed in accordance with the ISAs. Specific responsibility for fraud: In relation to fraud, it is auditor’s responsibility to: Assess risk of material misstatement due to fraud. Perform substantive procedures to address risk of fraud. Maintain professional skepticism throughout the audit recognizing the possibility that a material misstatement due to fraud may exist. However, risk of not detecting a material misstatement resulting from fraud is higher than the risk of not detecting one resulting from error. This is because: fraud may involve sophisticated and carefully organized schemes. there may be collusion. 3 By: Muhammad Asif, ACA

- 4. Auditing – Study Notes Chapter 21 Fraud Management fraud is more difficult to detect than other frauds because of management override of control The auditor’s ability to detect a fraud depends on factors such as the skillfulness of the perpetrator, the frequency and extent of manipulation, the degree of collusion involved, the relative size of individual amounts manipulated, and the seniority of those individuals involved. CONCEPT REVIEW QUESTION What are the responsibilities of an auditor and those charged with governance with respect to fraudulent financial reporting? (06 marks) (CA Final – Winter 2003) State external auditor’s responsibilities in relation to the prevention and detection of fraud and error. (04 marks) (ACCA F8 – June 2015) LLOO 33:: FFRRAAUUDD RRIISSKK FFAACCTTOORRSS:: Misappropriation of Assets Fraudulent Financial Reporting Incentives /Pressures 1. Personal Financial Obligations. 2. Adverse Relationships between entity and employee. 1. Intended sale of shares or business. 2. Management holds majority shareholding. 3. Bonuses based on financial performance. 4. Pressure on management to meet financial targets e.g. debt-covenant or investor’s expectations. 5. Personal guarantee of management for repayments of loans. 6. Going Concern Issues e.g. increased competition, product failures, operating losses Opportunity 1. Excessive cash in hand. 2. Portable and precious inventory or fixed assets. 3. Deficiencies in internal control over assets e.g. a. Inadequate segregation of duties for assets (e.g. cash, inventory). b. Inadequate record keeping and reconciliations for assets. c. Inadequate physical safeguards over tangible assets. 1. Domination of management by a single person or small group without audit committee or internal audit function. 2. Ineffective oversight by audit committee or internal audit function (due to lack of independence from management). 3. Significant transactions outside the normal course of business with related parties. 4. Deficiencies in internal control over financial reporting. 5. High turnover of senior management. 6. Nature of entity’s operations e.g. operations in diversified jurisdictions and use of business intermediaries. Attitudes/ Rationalizations 1.Disregard for monitoring of control. 2.Tolerance on petty theft. 3.Disregard for internal control by overriding. 4.Dissatisfied or unhappy employees 5.Change in lifestyle. 1. Lack of integrity in management. 2. Ineffective communication of code of conduct. 3. Non-financial management’s excessive participation in accounting policies and estimates. 4. Management failing to correct material weakness in internal controls. 4 By: Muhammad Asif, ACA

- 5. Auditing – Study Notes Chapter 21 Fraud CONCEPT REVIEW QUESTION (a) Identify the two categories in which fraud risk factors relating to misstatements resulting from misappropriation of assets may be grouped. (02 marks) (b) For each of the above two categories, identified in (a) above, list examples of fraud risk factors which relate to misstatements that results from misappropriation of assets. (08 marks) (CA Final – Winter 2002) PART B – RISK ASSESSMENT AND RESPONSE TO FRAUD LLOO 44:: RRIISSKK AASSSSEESSSSMMEENNTT PPRROOCCEEDDUURREESS:: ISAs require the auditor to perform the following procedures to identify the risks of material misstatement due to fraud: 1. Make enquiries of management in respect of: a) their assessment of the risk of fraud b) their process in place for identifying and responding to the risks of fraud c) any specific risks of fraud identified or likely to exist d) any communications within the entity in respect of fraud (e.g. code of conduct). 2. Make inquiries of management and others within the entity as to whether they have any knowledge of any actual, suspected or alleged frauds. 3. Evaluate any unusual or unexpected relationships identified in performing analytical procedures which may indicate a risk of material fraud. 4. Evaluate whether any fraud risk factors are present. CONCEPT REVIEW QUESTION Briefly state the audit procedures which may be performed to identify the risks of material misstatement due to fraud. (05 marks) (CA Inter – Spring 2016) LLOO 55:: RREESSPPOONNSSEE TTOO MMAANNAAGGEEMMEENNTT OOVVEERRRRIIDDEE OOFF CCOONNTTRROOLL:: Auditor shall perform following audit procedures to respond to the risk of management override of controls: 1. Test the appropriateness of journal entries (for fake entries) 2. Review accounting estimates (for biases) 3. Obtain an understanding of the business rationale for significant transactions outside the normal course of business Test the appropriateness of journal entries: In designing and performing audit procedures for such tests, auditor shall: i. Inquire of individuals involved in the financial reporting process about inappropriate or unusual activity relating to the processing of journal entries and other adjustments; ii. Select (judgementally) and Test the journal entries and other adjustments made at the end of a reporting period; and iii. Select (judgementally) and Test the journal entries and other adjustments throughout the reporting period. (if considered necessary) 5 By: Muhammad Asif, ACA

- 6. Auditing – Study Notes Chapter 21 Fraud Review accounting estimates: In performing this review, auditor shall: i. Perform comparative review with other estimates for indication of possible biases. ii. Perform a retrospective review of significant accounting estimates reflected in the financial statements of the prior periods. iii. Use an expert to develop an independent estimate for comparison to management’s estimate. iv. Extend inquiries to individuals outside of management and the accounting department to corroborate management’s ability and intent to carry out plans that are relevant to developing the estimate. Understand business rationale of significant transactions outside the normal course of business: Following characteristics of significant transactions outside the normal course of business suggests/indicates fraud: Transaction: Lacks an apparent logical business reason for its occurrence. Has unusual terms of trade. Is processed in an unusual manner. Is overly complex (for example, it may involve multiple related parties within a consolidated group). Management has not discussed such transaction with TCWG. Management is placing more emphasis on a particular accounting treatment instead of underlying substance of the transaction. Transaction involves parties which do not have financial strength to support the transaction. CONCEPT REVIEW QUESTION Management is in a unique position to perpetrate fraud because of its ability to manipulate accounting records and prepare fraudulent financial statements by overriding controls that otherwise appears to be operating effectively. Required: Determine the audit procedures that may be performed by the auditor to address the risks related to override of controls. (08 marks) (CA Inter - Spring 2014) During the course of audit an auditor is expected to be vigilant enough to develop understanding about the propriety of important transactions and to determine whether or not such transactions have appropriate business rationale. Required: Briefly describe the situations in which a transaction is indicative of fraud or an attempt to conceal fraud or fraudulent reporting. (07 marks) (CA Inter -Autumn 2009) Characteristics of Journal entries that auditor should select to test for fraud: (a) made to unrelated, unusual, or seldom-used accounts, (b) made by individuals who typically do not make journal entries, (c) recorded at the end of the period or as post-closing entries that have little or no explanation or description, (d) made either before or during the preparation of the financial statements that do not have account numbers, or (e) containing round numbers or consistent ending numbers. 6 By: Muhammad Asif, ACA

- 7. Auditing – Study Notes Chapter 21 Fraud LLOO 66:: RREESSPPOONNSSEE TTOO RRIISSKK OOFF FFRRAAUUDD:: Overall response to risk at financial statement level has been covered in chapter 10. CONCEPT REVIEW QUESTION Describe what actions are to be taken by an auditor on identifying a fraud risk factor. (04 marks) (CA Inter - Spring 2015) PART C – ADDITIONAL MATTERS LLOO 77:: WWRRIITTTTEENN RREEPPRREESSEENNTTAATTIIOONN,, CCOOMMMMUUNNIICCAATTIIOONN TTOO TTCCWWGG:: Written Representation: (already covered in chapter of written representation). Communication to TCWG: 1. If the auditor has identified or suspects fraud, the auditor shall communicate these matters on a timely basis to the appropriate level of management (regardless of size of fraud). 2. Auditor shall also communicate identified/suspected fraud to TCWG if fraud involves management or is significant. 3. If management is involved in a fraud, integrity of management becomes doubtful and auditor may consider appropriate action (e.g. withdrawal) based on advice of his legal advisor. CONCEPT REVIEW QUESTION Is an auditor responsible for detection of frauds in the financial statements? What an auditor should do when he becomes aware about existence of fraud in the financial statements? (06 marks) (CA Final - Winter 2001) LLOO 88:: CCIIRRCCUUMMSSTTAANNCCEESS IINNDDIICCAATTIINNGG FFRRAAUUDD:: Circumstances indicating Misstatement in Financial Statements due to Fraud: Following are examples of circumstances which indicate possibility of fraud in financial statements. Discrepancies in accounting records − Transactions not recorded/completed in timely manner or improperly recorded as to amount, period, or classification. − Supporting documents are not available for transactions/balances. − Last minute adjustments that significantly affect financial statements − Tips or complaints to the auditor about the alleged fraud. Conflicting or missing evidence − Missing accounting records − Altered accounting records − Unavailability of original documents when they are expected to exist − Significant unexplained items on reconciliations − Unusual discrepancies between the entity’s record and confirmation replies − Large amount of credit entries and other adjustments at year end. Problematic or unusual relationships between the auditor and management − Denial of access to records, employees or other evidence − Undue time pressure by management to resolve complex or contentious issues − Management intimidation − Unusual delays by entity in providing requested information Others − Accounting policies at variance with industry norms − Frequent changes in accounting estimates 7 By: Muhammad Asif, ACA

- 8. Auditing – Case Studies Chapter 21 Fraud CHAPTER TWENTY ONE (CASE STUDIES) FRAUD AAPPPPEENNDDIIXX 11:: CCAASSEE SSTTUUDDIIEESS OONN IIDDEENNTTIIFFYYIINNGG WWHHIICCHH OOFF TTHHEE SSIITTUUAATTIIOONNSS RREEPPRREESSEENNTTSS RRIISSKK OOFF FFRRAAUUDD:: Model Case Study From Examination Questions: Case Study 1: During the planning of an audit, auditor has come to know about following situations. Indicate whether each of the situations given below indicates risk of fraud. If so, also identify type of fraud risk factor involved. 1. Management wants to minimize profit to save tax. 2. Company' board of directors include non-executive, independent directors. 3. Significant judgments, estimates are uncertainties are involved in financial statements. 4. Manager accounts has applied for a loan. Application was rejected by CFO. 5. The company has to meet stock exchange listing requirements and debt-covenant requirements. 6. The company has experienced low turnover in management and its internal audit function. 7. Purchase Manager was found involved in a petty theft. Although amount involved was immaterial, he was issued a warning. 8. Significant operations of business in different jurisdictions with different environments. 9. Company deals in imported watches, which have high demand in market. 10. There is high competition and market saturation. Solution: 1. Risk of fraud is increased. Type of fraud is fraudulent financial reporting. 2. There is no risk involved in this situation. 3. There is risk of material misstatement, but no risk of fraud. 4. Risk of fraud is increased. Type of fraud is misappropriation of asset. 5. Risk of fraud is increased. Type of fraud is fraudulent financial reporting. 6. There is no risk involved in this situation. 7. Risk of fraud is increased. Type of fraud is misappropriation of asset. 8. Risk of fraud is increased. Type of fraud is fraudulent financial reporting. 9. Risk of fraud is increased. Type of fraud is misappropriation of asset. 10. Risk of fraud is increased. Type of fraud is fraudulent financial reporting. Case Study 2: Standard Commercial Bank (SCB) is an audit client of your firm. Given below are some factors which you came to know during risk assessment procedures. For each of the factor mentioned below Indicate whether it increases, decreases or has no effect on audit risk, and whether it affects risk of fraud. 1. SCB is a continuing audit client. 2. SCB has remained profitable over the years. 3. SCB's board of directors is controlled by Saqib, the majority stockholder, who also acts as the chief executive officer. 4. Management at the bank's branch offices has authority for directing and controlling SCB's operations and is compensated based on branch profitability. 5. The internal auditor reports directly to Haris, a minority shareholder, who also acts as chairman of the board's audit committee. 6. During 20X1, SCB increased the efficiency of its accounting operations by installing a new, sophisticated computer system. 7. SCB’s formula has consistently underestimated the allowance for loan losses in current years. 8. Management has been receptive to auditor’s suggestions relating to accounting adjustments. Solution: 1. It decreases audit risk. No effect on risk of fraud. 2. It decreases audit risk. No effect on risk of fraud. 1 By Muhammad Asif, ACA

- 9. Auditing – Case Studies Chapter 21 Fraud 3. It increases audit risk. It also increases fraud risk factor relating to fraudulent financial reporting. 4. It increases audit risk. It also increases fraud risk factor relating to fraudulent financial reporting. 5. It decreases audit risk. No effect on risk of fraud. 6. It increasers audit risk. No effect on risk of fraud. 7. It increases audit risk. It also increases fraud risk factor relating to fraudulent financial reporting. 8. It decreases audit risk. No effect on risk of fraud. Case Study 3: Greater Engineering Designs (GED) is a private eight-partner firm that provides engineering services to the commercial building industry. You are planning the audit for GED for the year ended 30 June 2015 and are assessing the risk of fraud occurring. You note the following characteristics of the business: GED was established over 40 years ago and has maintained a good reputation in the marketplace. As well as its partners, all of GED’s senior engineers also have shares in the business. They are paid a lower- than-market salary, but in return receive a profit share via dividends. Many of GED’s projects are complex and long term (for example, infrastructure development). The company is in a sound financial position and has solid cash reserves. Management is reasonably vigilant in overseeing the accounting staff, although it is having trouble understanding the reports produced by the new accounting system. The credit controller, about whom there have been many complaints in relation to poor job performance, is the brother-in-law of one of the directors. The chair of the board and the finance director have worked together for around 15 years and both have domineering personalities. In the past, management has refused to sign a management representation letter on the grounds that you would not need one if the auditor was doing their job properly. Required Referring to the information above, explain whether there is a significant risk of fraud at GED. Source: This question was adapted from the Chartered Accountants Program of The Institute of Chartered Accountants in Australia—2008 (1) Audit & Assurance Module. Solution: Fraud Risk factors include following: 1. Management is having trouble in understanding reports produced by new accounting system. This will cause ineffective controls over the system. 2. Complains about credit controllers are also a fraud risk factor, which is further increased by the fact that this managerial role has close association with those charged with governance. 3. There is domination of management by finance director which creates risk of fraud. Further, close association between finance director and chairman of board of director also increases risk of fraud as audit committee lacks independence and may not oversee management effectively. 4. Management’s refusal to sign written representation letter also raises concerns about integrity of management and increases risk of fraud. Additional Concepts: Factors which reduces risk of fraud are: The company is in a sound financial position and has solid cash reserves. Management is reasonably vigilant in overseeing the accounting staff. “Many of GED’s projects are complex” increases risk of material misstatement, but not necessarily risk of fraud. Engineers having shares does not increases risk because engineers have no influence over financial statements. Case Study 4: While reviewing the audit files of four different clients you confronted the following situations: (i) Due to tough competition in the market, the company has been unable to increase the prices of its products since last 5 years. (ii) Addition to intangible assets, amounting to Rs. 500 million include research cost of Rs. 10 million which is duly supported by invoices from suppliers. (iii) During the last three years, the Chief Executive and higher management has been earning handsome bonuses, based on the profitability of the company. (iv) Physical stock take on 31 December 2014 included goods sold but not despatched amounting to Rs. 52 million. The delivering of goods was stopped on the request of a distributor. Upto 20 January 2015, the distributor has taken delivery of goods amounting to Rs. 2 million. 2 By Muhammad Asif, ACA

- 10. Auditing – Case Studies Chapter 21 Fraud Required: In each of the above situations, identify with justification whether it represents a risk of fraud. (06 marks) (CA Inter – Spring 2015) Solution: (i) This situation represents risk of fraud relating to fraudulent financial reporting, because company there is increased competition in the market and company is unable to increases its price of product since last 5 years. Due to decreasing profitability, company may face going concerns problems and may attempt to hide it in financial statements. (ii) This appears to be an error as there is inherent risk in research and development costs for misclassification. Further, supporting evidence is also available. (iii) This represents risk of fraud relating to fraudulent financial reporting, because chief executive and higher management may attempt to overstate profits to earn high bonuses. (iv) This appears to be a risk of fraud relating to fraudulent financial reporting, because significant sales has been made on the last day of the accounting year which have not been dispatched within reasonable time. However, there should be further investigations to confirm whether a related party is involved and whether terms of the transactions are normal. Case Study 5: You are the Audit Manager on the audit of Al-Salam Pakistan Limited (ASPL) for the year ended June 30, 2010. ASPL is engaged in the manufacture of a wide range of plastic products. While reviewing the initial work performed by the audit team, the following matters have come to your notice: (i) The quantity of material scrapped during the year is materially different from the quantity of scrap sold. The company’s records show nil balance both at the beginning and at the close of the year. No reconciliation for the difference has been provided by the company. (ii) Sales for the year have increased by 7% over the previous year. However, it has been noted that sales in the last two weeks of June 2010 have been exceptionally high and represent 15% of the annual sales. The audit working papers carry the following observations in respect of the above: 70% of the sales in the last two weeks of June were made to two new customers whose credit assessment has not been formally documented; a significant portion of the goods sold to the above referred customers were returned in the first week of July 2010; and management bonuses are linked to the operating performance of the company. (iii) During the year, ASPL purchased a machine for Rs. 25 million. The payment voucher is duly supported by the invoice from the supplier. However, the fixed assets schedule provided by the client shows the amount capitalized as Rs. 2.5 million. Depreciation has been charged on this amount. The difference of Rs. 22.5 million is appearing in the Bank Reconciliation Statement. Required: Analyze each of the above situations and assess whether it represents a fraud or an error. (06 marks) (CA Inter – Autumn 2010) Solution: (i) This situation represents risk of fraud relating to misappropriation of assets as scrap inventory of company is missing, and no reconciliation has been performed which shows deficiencies in internal control over assets. (ii) This situation represents risk of fraud relating to fraudulent financial reporting on following grounds: there have been unusually high sales in the last two weeks of the year. there have been week internal controls over financial reporting i.e. credit assessment is not made for new customers. Significant portion of sales has been returned soon after the year. Management may intentionally overstate profits to get its bonuses based on profits of the company. (iii) This appears to be an error of transposition as supporting documents are available (neither missing or altered). Although there is a difference in bank reconciliation but it has been duly explained by management. 3 By Muhammad Asif, ACA

- 11. Auditing – Case Studies Chapter 21 Fraud Case Study 6: You are the audit senior at Clifton & Associates and are in the process of planning the 30 June 2015 audit of Sweet Pty Ltd (Sweet), a large confectionery manufacturer. You have the following information about Sweet’s acquisition of 100 per cent of White Magic Pty Ltd on 3 April 2015: White Magic operates a small liquorice operation based in Queensland. White Magic was owned by Sam Quick (CEO) and Joelene Walters (CFO). Sam and Joelene were motivated to sell the business because of restricted cash flows that prevented them from investing in new technology to improve production efficiency. Sam and Joelene started White Magic immediately on finishing university and this has been their only employment. They have similar philosophies and together they have kept close control of the operations of White Magic, being involved in all day-to-day aspects of the entity’s operations. Given the size of White Magic, there is no separate audit committee or internal audit function. The accounting function of White Magic consisted of Joelene and one part-time and two full-time employees. White Magic’s sales staff have been with the business since its incorporation. They are paid a relatively low retainer, with generous bonuses if sales targets are met. White Magic’s external borrowings at the time of acquisition were related to the construction of a new liquorice- packaging plant. These borrowings contained net asset and interest coverage loan covenants. In order to obtain the funding, the lender required that Sam provide a personal guarantee that the loan would be repaid. The quarterly management accounts for White Magic contained an actual versus budget comparison of revenues and expenses. For the four quarters prior to acquisition, actual revenue was consistently in excess of budget by 5 to 10 per cent. This is a very good result given current tough conditions in the confectionary industry. White Magic’s sales and receipts systems are well controlled. The terms of sale are well defined, with approximately 75 per cent on 30-day account and the remainder on a cash on delivery basis. Required Based on the information provided above, identify five fraud risk factors in relation to Sweet’s acquisition of White Magic. Source: This question was adapted from the Chartered Accountants Program of The Institute of Chartered Accountants in Australia—2012 (3) Audit & Assurance Module. Solution: Following factors represent risk of fraud: 1. Management is the majority shareholders. They may ‘window-dress’ financial statements to increase personal wealth. 2. Business is facing liquidity problems and shareholders are intending to sale the business. 3. There is domination of management by just 2 persons without audit committee or internal audit function. 4. Bonuses of sales staff are based on sales target of the company. This gives them incentive to inflate or falsify sales. 5. There is pressure on management to meet debt-covenant requirements relating to net assets and interest coverage. 6. Management has given personal guarantee of loans. 7. Financial results of the company are significantly different from industry. 8. There is excessive dealing in cash, which may be misappropriated by dishonest employees. AAPPPPEENNDDIIXX 22:: CCAASSEE SSTTUUDDIIEESS OONN IIDDEENNTTIIFFYYIINNGG DDIIFFFFEERREENNTT FFRRAAUUDD RRIISSKK FFAACCTTOORRSS IINN AA GGIIVVEENN SSIITTUUAATTIIOONN:: Model Case Study From Examination Questions: Case Study 1: You are part of the Houston & Associates (Houston) audit team working on the audit for Shiny Shoes Ltd (Shiny Shoes) for the year ending 30 June 2015. Shiny Shoes is a national fashion footwear retail chain with stores located throughout Australia. Shiny Shoes specialises in women’s designer footwear. Shiny Shoes designs its footwear in Australia and manufactures them in China from Italian-sourced materials. The only exception is the leather for Shiny Shoes’ designer boots, which is purchased from an Australian company, Luxury Leather Pty Ltd (Luxury). On 1 August 2011, Shiny Shoes obtained additional financing from Big Bank (BB). This financing was subject to strict loan covenants. During the 2015 audit, Shiny Shoes’ chief financial officer (CFO) confided that he suspected Shiny Shoes was in 4 By Muhammad Asif, ACA

- 12. Auditing – Case Studies Chapter 21 Fraud breach of its loan covenants during the course of the 2015 financial year. This would put his bonus in jeopardy, as maintaining loan covenants is one of his KPIs. A refinancing with BB was due to occur on 31 July 2015. No refinancing documents had been provided by BB as at 30 June 2015 and Shiny Shoes had not attempted to secure financing from other financial institutions. Since Houston started auditing Shiny Shoes five years ago, Shiny Shoes has been plagued by poor internal controls over accounts payable operations. In past audits, Houston has brought the poor internal controls to management’s attention. One example of Shiny Shoes’ poor internal control is that Bruce Franklin, one of the accounts payable clerks, is able to approve and pay transactions of up to $3000 per transaction. You have learned that Bruce is currently having trouble paying his mortgage. Despite Houston bringing these weaknesses to management’s attention, processes at Shiny Shoes remained unchanged. Kylie Fine was in charge of purchases during 2015 and renegotiated Shiny Shoes’ contract with Luxury so that Shiny Shoes pays cash on delivery for all Luxury materials, instead of the industry standard 30 days. No one outside of the purchasing department is aware of the renegotiation. Required State three potential fraud risk factors that indicate fraud could be an issue at Shiny Shoes and provide explanations for your answer. Source: This question was adapted from the Chartered Accountants Program of The Institute of Chartered Accountants in Australia—2011 (2) Audit & Assurance Module. Solution: Fraud Risk Factor: CFO bonus linked to the achievement of KPIs, including the maintenance of loan covenants: Incentive to manipulate the accounts to ensure this occurs Fraud Risk Factor: Bruce Franklin can approve and pay invoices of up to $3000, and is under personal financial obligation: Bruce could misappropriate company funds by, for example, paying dummy invoices. Fraud Risk Factor: Shiny Shoes pays Luxury cash on delivery, contrary to normal terms. There is a risk that the cash is misappropriated Case Study 2: You are the audit senior at Quality Chartered Accountants working on the financial audit for Cruise Ship Maintenance Ltd (CSML) for the year ended 30 June 2015. CSML is a large commercial cruise ship maintenance business that supports various shipping routes in and around Australian and New Zealand ports. CSML has 10 maintenance workshops throughout the region, with its head office based in Brisbane. Parts for cruise ships are often expensive, as they are precision-engineered from high-grade materials in order to withstand the harsh conditions in which the vessels operate. CSML holds a stock of standard parts that are most frequently required for repairs. Specialist parts are ordered from overseas as and when required. No formal inventory record of parts is maintained at the CSML workshops. When parts arrive, they are simply stored in the workshop without any reconciliation back to the packing slip or the invoice. The parts are charged to clients as disbursements when invoicing for the finished job. The spare parts and consumables line in the statement of financial position is not updated year to year. Instead, the balance carries forward from one year to the next. Management at head office is not concerned, and advise that as the balance won’t have changed much, it is not worth the effort to conduct a stocktake. CSML’s accounts receivable function is managed by an employee who prepares invoices and credit notes, and receipts and bank payments. They also have signing authority on the bank account and perform bank reconciliations. CSML’s division managers receive a bonus of 15 per cent of their base remuneration if profit targets are reached. These profit targets are set by head office without input from the managers and are based on aggressive growth assumptions. Required List three fraud risk factors indicated by the information above and explain why they are a fraud risk. Source: This question was adapted from the Chartered Accountants Program of The Institute of Chartered Accountants in Australia—2013 (2) Audit & Assurance Module. 5 By Muhammad Asif, ACA

- 13. Auditing – Case Studies Chapter 21 Fraud Solution: Fraud Risk Factor: Inadequate record keeping over the spare parts and consumables asset. Risk of misappropriation of the spare parts and consumables asset due to a lack of supervision over assets at CSML’s many different locations. Fraud Risk Factor: Inadequate segregation of duties between management of accounts receivable and cash at bank. The accounts receivable staff member has the opportunity to misappropriate assets, by, for example, crediting invoices and diverting cash to their own account. Fraud Risk Factor: Management remuneration is contingent upon achieving aggressive forecasts. Management may attempt to overstate profit by recording fictitious revenue or incorrectly recording revenue in the current period. Similarly, expenses may be incorrectly recorded in a subsequent period or expenditure may be incorrectly capitalised. Case Study 3: Your firm is the auditor of Cell Phones (Private) Limited (CPPL), which operates a chain of mobile phone retail outlets. About 25% of shareholding in CPPL is owned by Anwar and his wife. Anwar is the Chief Executive of CPPL and also looks after the finance and operations of the company. There are five other directors and each of them holds 15% shares in CPPL. The Internal Audit Function comprises of three senior officers who are graduates. Their duties include checking of accounting records, physical stock taking, preparation of bank reconciliations, reviewing payments and verification of fixed and current assets. During the planning phase, Anwar stressed the need for early completion of audit, in order to be able to submit the audited financial statements for seeking a long term finance. He was of the view that internal audit working papers would be of enormous help in performing and early completion of the audit. Required: Identify and briefly describe the fraud risk factors in the above scenario. (06 marks) (CA Inter – Autumn 2014) Solution: Fraud Risk Factor: Portable and precious inventory: Mobiles can be easily misappropriated by dishonest employees or customers. Fraud Risk Factor: Management is the majority shareholder: They may ‘window-dress’ financial statements to increase personal wealth. Fraud Risk Factor: Internal audit function is given conflicting responsibilities: There is ineffective oversight by internal audit function as they are given managerial responsibilities like stocktaking and preparation of bank reconciliations. Fraud Risk Factor: Undue time pressure from management: This makes auditors suspicious because, because not given appropriate time to auditor may be an attempt to hide some misstatements. Fraud Risk Factor: Seeking long term finance on the basis of financial statements: Management may manipulate the figures to show better financial performance and position to the bank. Case Study 4: At the planning phase of the audit of Prudent Limited, a listed company, senior auditor of your team submitted the following information; − The Board of Directors of the company has recently appointed Mr. Smart as new chief executive whose remuneration is mostly based on efficiency bonus and stock options. − Mr. Smart is reputed as a seasoned business executive and has been a very good friend of the Chairman of the audit committee. − Since his joining he has proved to be the main decision maker and the Board appears to be relying considerably on Mr. Smart and less interested in day to day operations of the company. − Board’s main concern is now the growth in net earnings estimated for the next year, which Mr. Smart strongly 6 By Muhammad Asif, ACA

- 14. Auditing – Case Studies Chapter 21 Fraud believes, will be 30% at the minimum. − There are a number of instances of lack of segregation of duties and Mr. Smart being cost conscious, has allowed the situation to continue. − There is a big lay off plan in place and employees are expecting such plan although it has been kept as top secret. This lay off will help the company to achieve higher growth in earnings. − Mr. Smart has introduced an employees’ skill development scheme only for top management personnels. Describe the fraud risk factors, if any, that are indicated in the above information. (07 marks) (CA Final – Winter 2006) Solution: Fraud Risk Factors: Chief Executive’s remuneration linked with operating results This may create Incentive for fraudulent financial reporting. Fraud Risk Factors: Close relation of higher management with audit committee Such a close relation impairs independence of audit committee and renders control environment as weak. This provides opportunity of fraud. Fraud Risk Factors: Undue reliance of board on management Ineffective oversight of board on activities of management provides opportunity of fraud. Fraud Risk Factors: Focus of board on growth Excessive pressure on management to meet the requirements or expectations of board creates pressure to commit fraud. Fraud Risk Factors: Lack of segregation of duties Ineffective monitoring of management over financial reporting process and internal control creates opportunities for lower management to commit fraud. Fraud Risk Factors: Layoff of employees Adverse Relationships between entity and employee having access over assets provides employees Incentive for fraud. Fraud Risk Factors: Skills development schemes only for top management Dissatisfaction among employees provides them rationalization for fraud. Case Study 5: During the external audit of Tuna Ltd for the year ended 31 March 2010, the following matters were discovered: (i) cheques received from customers, listed as outstanding lodgements in the bank reconciliation at the year end, were cleared through the bank on 21 April 2010; and (ii) a sales credit note, relating to a pre-year-end delivery of inventory, was issued to a major customer on 20 April 2010. Explain why these matters should be investigated further. (04 marks) (ICAEW – June 2010) Solution: (i) There is an undue delay in cash clearing. This may be because of poor controls over cash. This is also an indication of fraud of teeming and lading. (ii) A return of goods after the year end indicates that goods may be faulty, which require provision for closing stock. It also indicates fraudulent transaction to window-dress financial statements by inflating sales. 7 By Muhammad Asif, ACA

- 15. Auditing – Case Studies Chapter 21 Fraud AAPPPPEENNDDIIXX 33:: CCAASSEE SSTTUUDDIIEESS OONN IIDDEENNTTIIFFYY WWHHEETTHHEERR AAUUDDIITTOORR IISS LLIIAABBLLEE IINN AA GGIIVVEENN SSIITTUUAATTIIOONN OOFF FFRRAAUUDD:: Model Case Study From Examination Questions: Case Study 1: The following issues were highlighted in a meeting of the audit committee of XYZ Limited with regard to financial statements of one of its subsidiaries on which auditors had issued an unmodified audit report: (i) The audit procedures were unable to detect a material error in inventory valuation, because it occurred under exceptional circumstances and the internal controls established by the management could not prevent and detect the same. (ii) The provision for bad debt was insufficient and the impact was material. It was also evident from the subsequent events, which came into the knowledge of the auditors before they issued their report. You are one of the independent members of the audit committee and are considered an expert on financial reporting issues. The chairman of the audit committee has asked your comments with regard to the responsibilities of management and auditors of the above mentioned subsidiary. Give your comments on each of the above matters. (06 marks) (CA Inter – Autumn 2005) Solution: (i) In this case, although financial statements contained a material misstatement but auditor was justified in issuing unmodified audit report because error occurred in exceptional circumstances. However as the matter has come to attention now, auditor should take necessary steps to ensure that financial statements are revised and should issue new audit report on them because subsequent discovery of errors or frauds is an adjusting event. (ii) In this case, auditor can be held responsible for this because matter had come into his knowledge before issuance of auditor’s report. He should have proposed adjustment for the misstatement and if uncorrected, he should have issued Qualified Opinion or Adverse Opinion. Case Study 2: You have received a letter from the managing director of one of your audit clients, informing you that he has recently dismissed his payables ledger clerk. It was discovered that the clerk had set up a number of fictitious supplier accounts as a means of paying company funds into his own bank account. The total amounts defrauded have been estimated at £50,000 over the last two years. The managing director is unhappy that the fraud was not detected earlier by your firm, and has requested an immediate explanation. The company’s revenue last year was £5,000,000 and its profit was £750,000. Briefly set out the points to include in your response to the managing director. (02 marks) (ICAEW – March 2007) Solution: Primary responsibility to prevent and detect fraud rests with management and those charged with governance. Auditor is required to obtain reasonable assurance. In this case auditor has not detected this fraud because it may have involve sophisticated techniques. Further, amounts involved are immaterial (if divided in two years) for which auditor does not provide reasonable assurance. 8 By Muhammad Asif, ACA