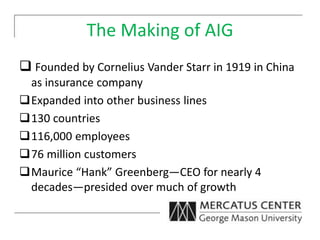

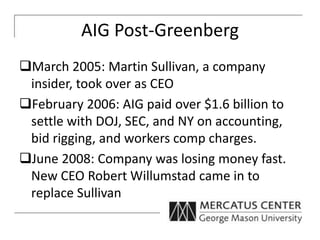

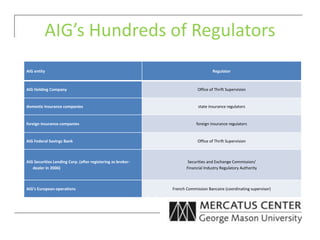

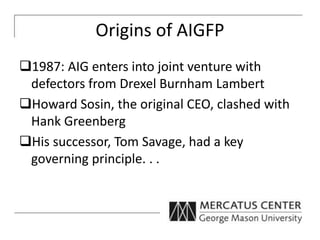

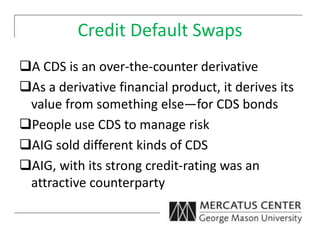

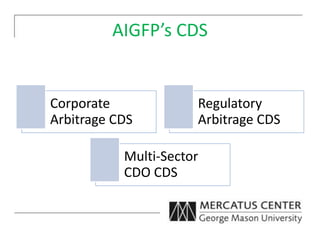

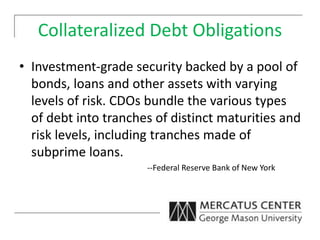

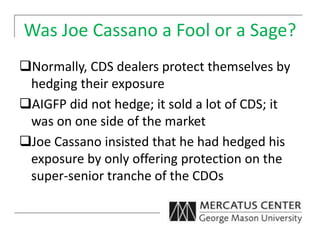

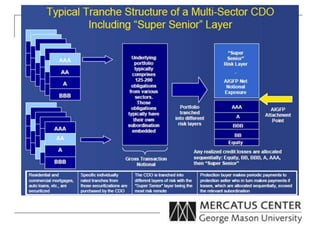

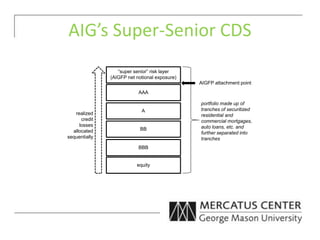

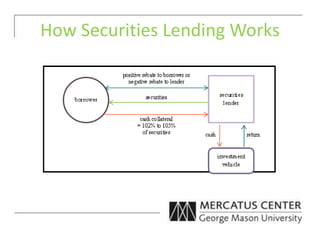

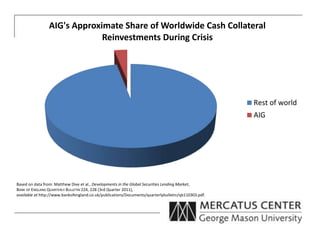

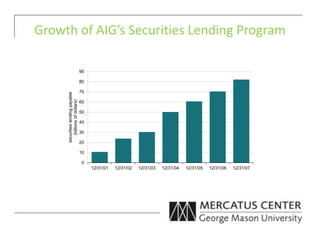

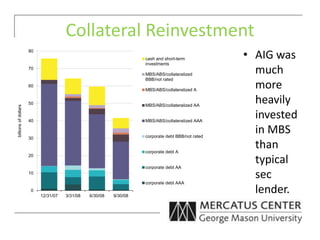

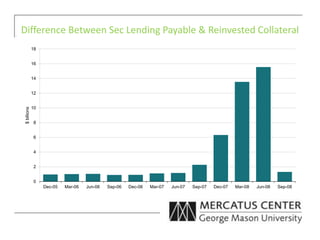

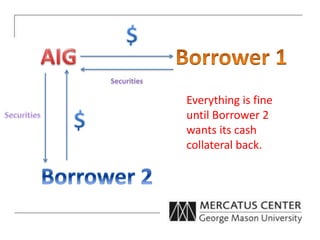

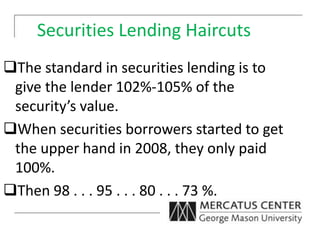

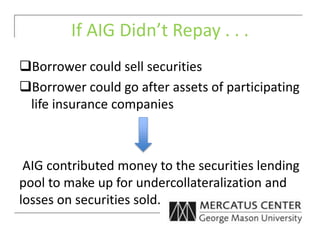

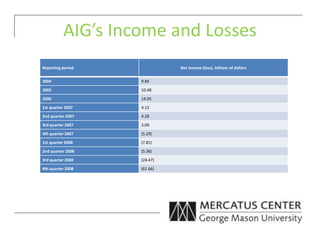

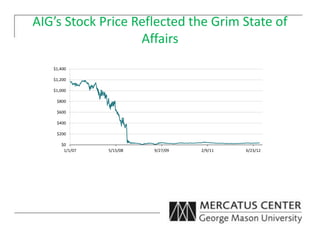

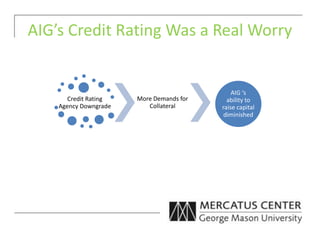

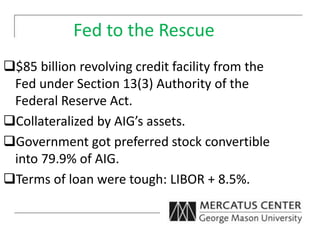

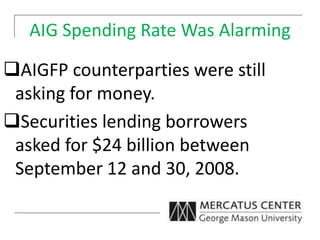

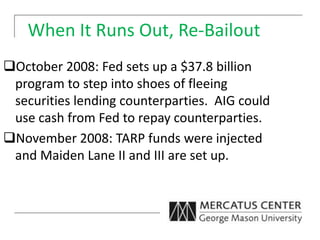

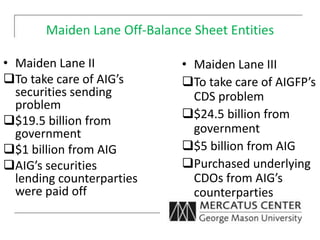

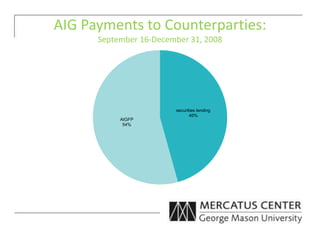

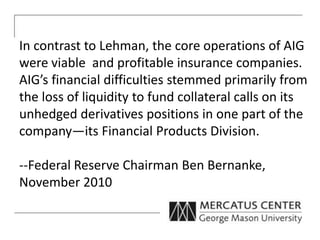

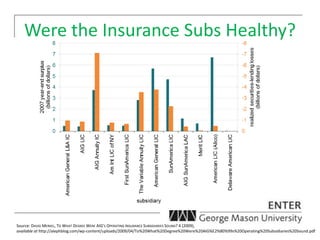

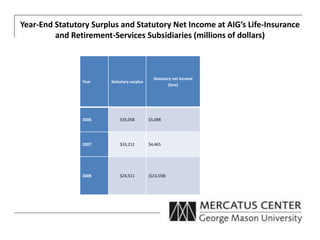

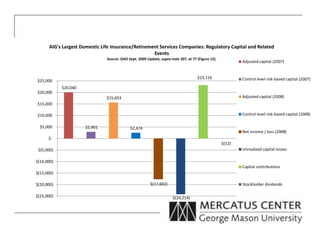

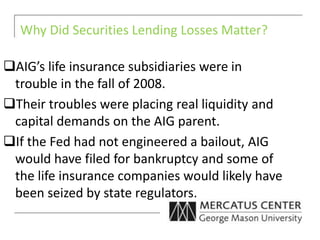

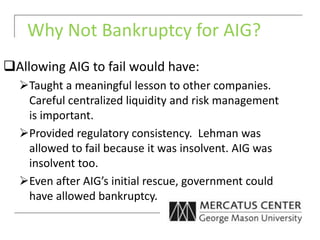

The document explores the collapse of AIG, a major financial institution that received a $182.3 billion bailout during the 2008 financial crisis, focusing on the factors leading to its downfall, including risky financial products and a problematic securities lending program. It argues that AIG's troubles stemmed from liquidity issues caused by unhedged derivatives and that regulatory oversight was inadequate. The analysis concludes with recommendations to improve risk management and consider alternative solutions to bailouts for large financial companies.