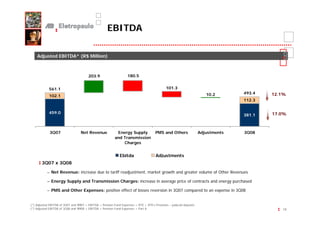

Eletropaulo reported financial results for 3Q08. Total consumption increased 4.9% compared to 3Q07. Adjusted EBITDA decreased 12.1% to R$493.4 million. Net income decreased 24.9% to R$148.3 million. Gross revenue increased 11.3% due to an 8.01% tariff increase and market growth. Costs increased due to higher energy prices and provisions. The company maintained a strong financial position with net debt decreasing 14.8% and cash availability of R$1.373 billion.