The document summarizes the 3Q12 results of a company. Key points include:

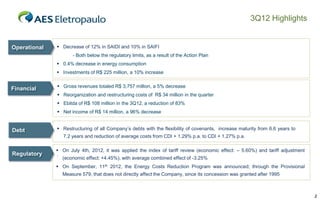

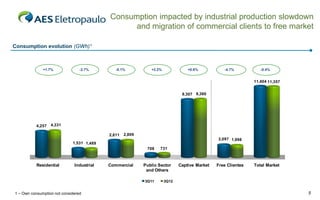

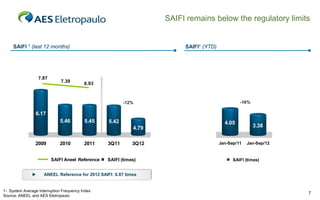

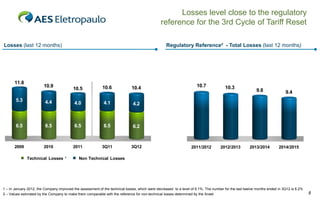

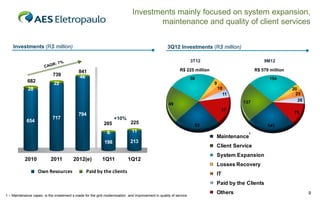

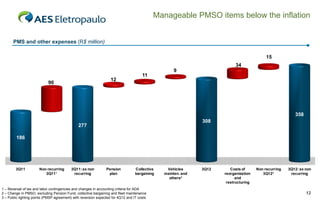

- Operational improvements with decreases in SAIDI and SAIFI indices. Investments increased 10% to R$225 million.

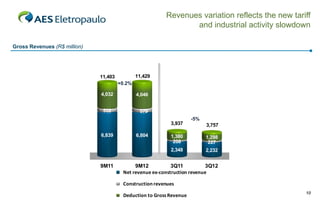

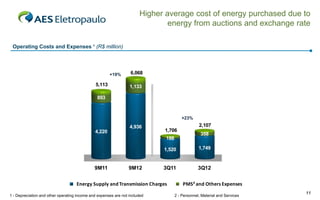

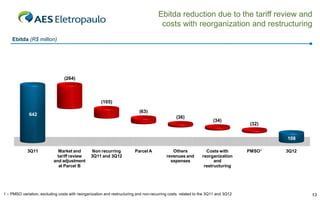

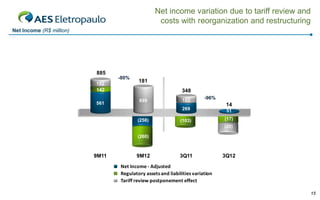

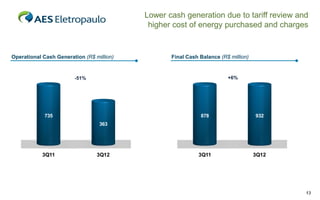

- Financial results declined due to a 5% decrease in revenues from tariff adjustments, and higher energy costs. EBITDA decreased 83% to R$108 million and net income declined 96% to R$14 million.

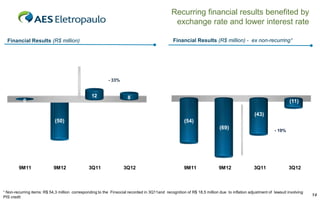

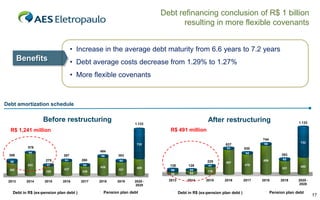

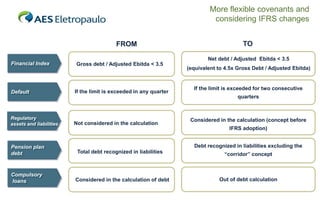

- The company restructured debts, increasing average maturity to 7.2 years and reducing average costs. Covenants were also made more flexible considering regulatory assets/liabilities and IFRS changes.