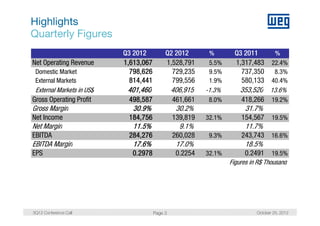

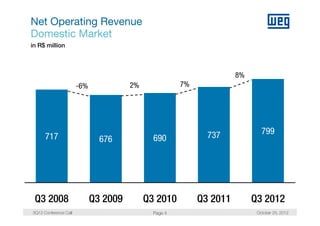

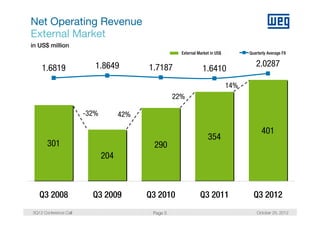

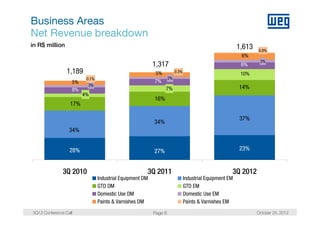

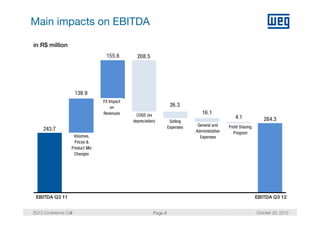

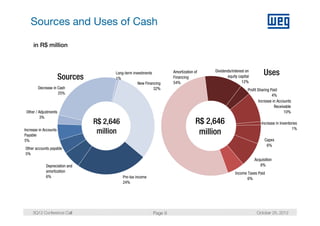

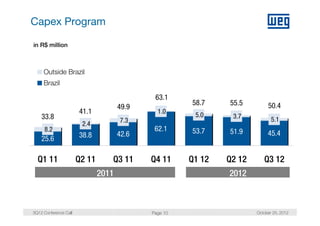

WEG reported financial results for the third quarter of 2012 with increases in key metrics compared to the same period in 2011. Net operating revenue grew 22.4% to R$1.61 billion with domestic market revenue up 8.3% and external markets revenue increasing 40.4%. Gross operating profit rose 19.2% to R$498.6 million and net income increased 19.5% to R$184.8 million. EBITDA grew 16.6% to R$284.3 million. The results demonstrated continued strong growth in both domestic and external markets. Management also provided details on capital expenditures and cash flow.