The document summarizes the 2006 results of an energy company. Some key highlights include:

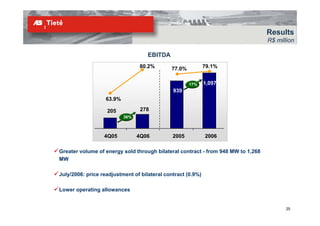

1) Adjusted EBITDA was R$2.49 billion in 2006, 16.7% higher than 2005. Net profit was R$373.4 million compared to a loss in 2005.

2) Debt was reduced by 19.8% and credit ratings were increased.

3) The captive electricity market grew 5.1% excluding free consumers. Total market increased 4.6% to 38,183 GWh.

4) Technical and commercial losses decreased while collection rates remained steady at over 99%. Fraud detection and clandestine connections were reduced.