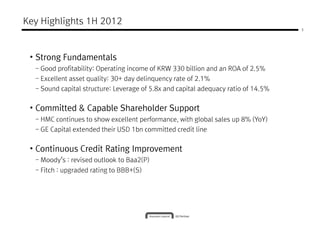

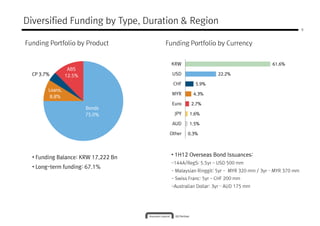

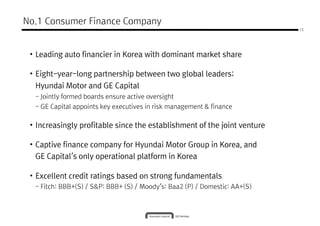

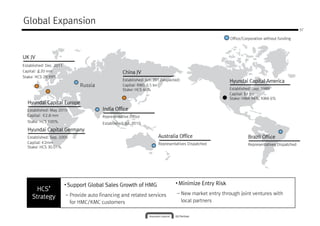

Hyundai Capital provides a mid-year investor presentation highlighting its strong fundamentals and performance in the first half of 2012. Key points include:

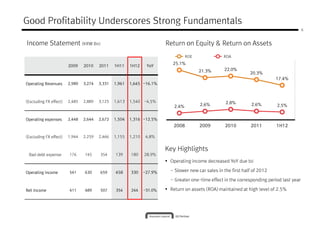

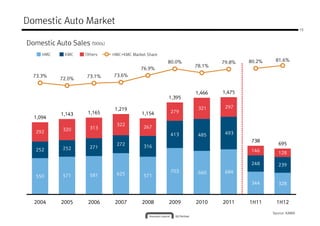

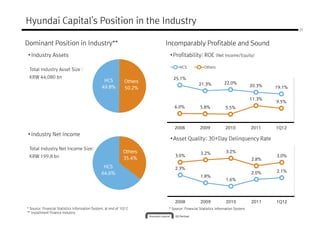

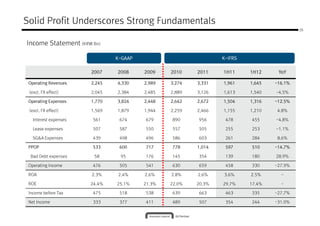

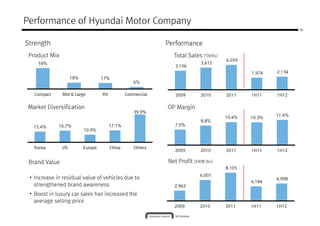

- Good profitability with an operating income of KRW 330 billion and ROA of 2.5%, despite slower new car sales.

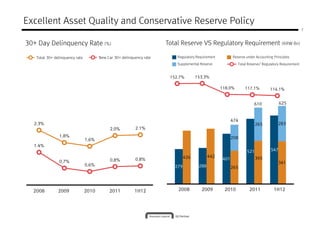

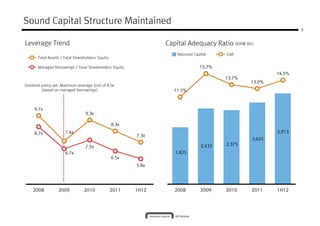

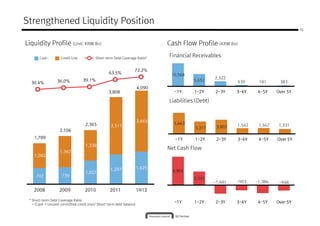

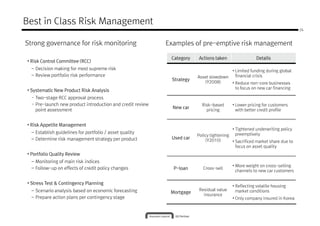

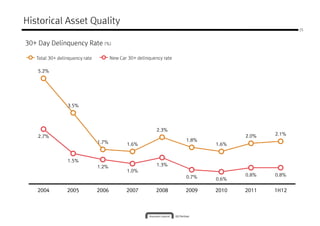

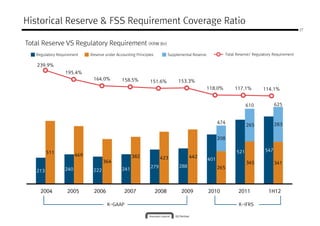

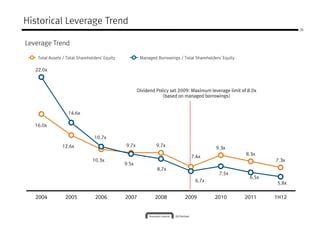

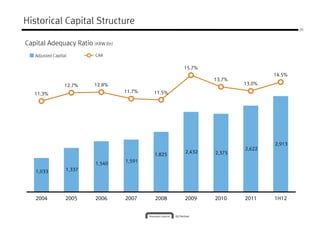

- Excellent asset quality shown by a low 30+ day delinquency rate of 2.1% and sound capital structure with leverage of 5.8x.

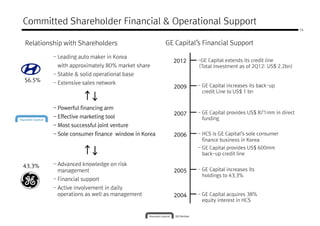

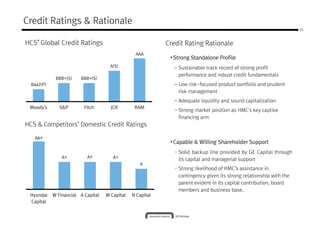

- Committed shareholder support from Hyundai Motor Company and an extended credit line from GE Capital.

- Continuous improvement in credit ratings from rating agencies despite challenges from weaker new car sales.