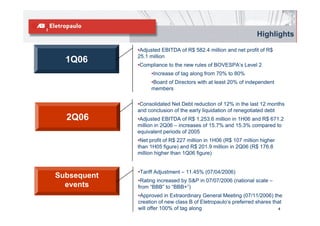

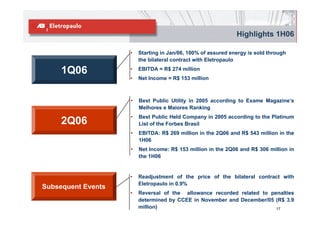

1) The document reports on the 2nd quarter 2006 results of an unnamed company. It highlights an adjusted EBITDA of R$671.2 million for 2Q06 and R$1,253.6 million for the first half of 2006.

2) Net profit was R$201.9 million for 2Q06, a significant increase from R$25.1 million for the same period last year.

3) The company reduced its consolidated net debt by 12% over the last 12 months through debt repayment and renegotiation.