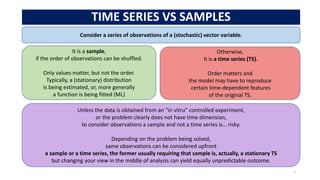

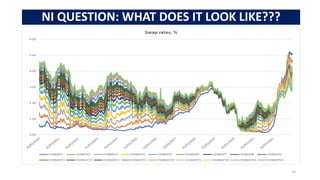

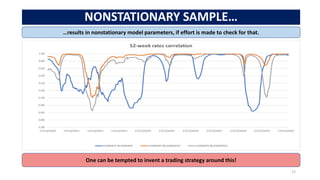

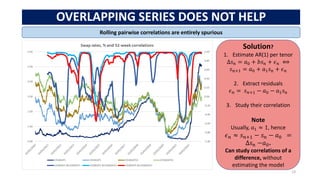

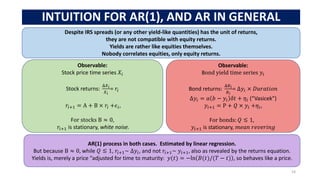

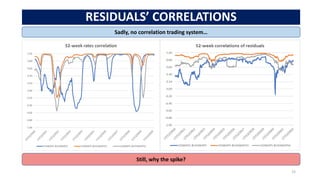

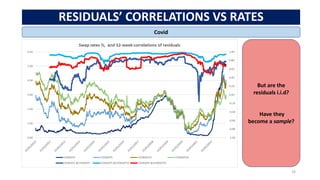

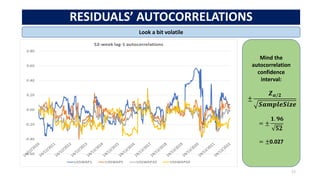

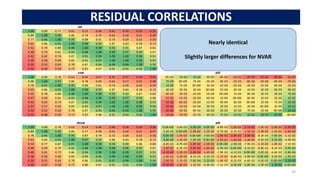

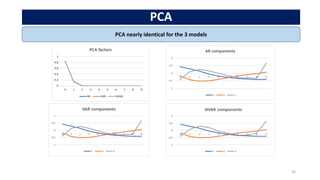

The document explores the use of autoencoders for nonlinear modeling of financial time series, particularly interest rate curves, with an emphasis on dimensionality reduction. It presents a methodology to enhance traditional VAR models by integrating autoencoders and discusses the challenges related to distinguishing between sample and time series data. The analysis includes comparisons of various model types and their effectiveness, revealing insights into residual behaviors and correlations in the context of interest rate swaps from 2010 to 2023.

![THE MODELS

22

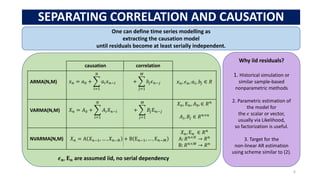

3 types of lag-1 models were estimated

Model Dynamics Method

AR(1)

Per tenor

𝑥𝑛 = 𝑎0 + 𝑎1𝑥𝑛−1 + 𝜖𝑛 tsa.ar_model.AutoReg

VAR(1) 𝑋𝑛 = 𝐴0 + 𝐴1𝑋𝑛−1 + Ε𝑛 tsa.VAR

NVAR(1) 𝑋𝑛 = Α(𝑋𝑛−1) + Ε𝑛 sklearn.neural_network

.MLPRegressor

Different topologies for operator Α in NVAR(1,1) were tried,

and the one with the lowest loss chosen: [20], which was superior to [10,2,10] AEN.

RELU activation and LBGFS yield best results, probably due to the relatively small sample size,

To find a NVAR “equivalent” matrix to the VAR’s 𝑨𝟏, the identity matrix was predicted with fitted NVAR.](https://image.slidesharecdn.com/aen-var-aen-231021112321-b5fd5a3d/85/AEN-VAR-AEN-pdf-22-320.jpg)

![ACT 3

28

The residuals: PCA vs AEN

1. Fit a [10,2,10] autoencoder

…for residuals of estimated AR, VAR and NVAR models.

2. Predict residuals.

3. Compare their correlation matrices to the original ones.

4. Test closeness of the predicted residuals to the original residuals

… using Kolmogorov-Smirnov test

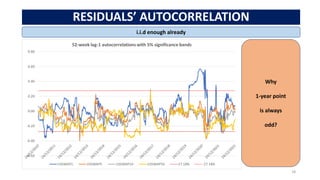

(which is justified, if residuals are not autocorrelated,

hence samples).](https://image.slidesharecdn.com/aen-var-aen-231021112321-b5fd5a3d/85/AEN-VAR-AEN-pdf-28-320.jpg)