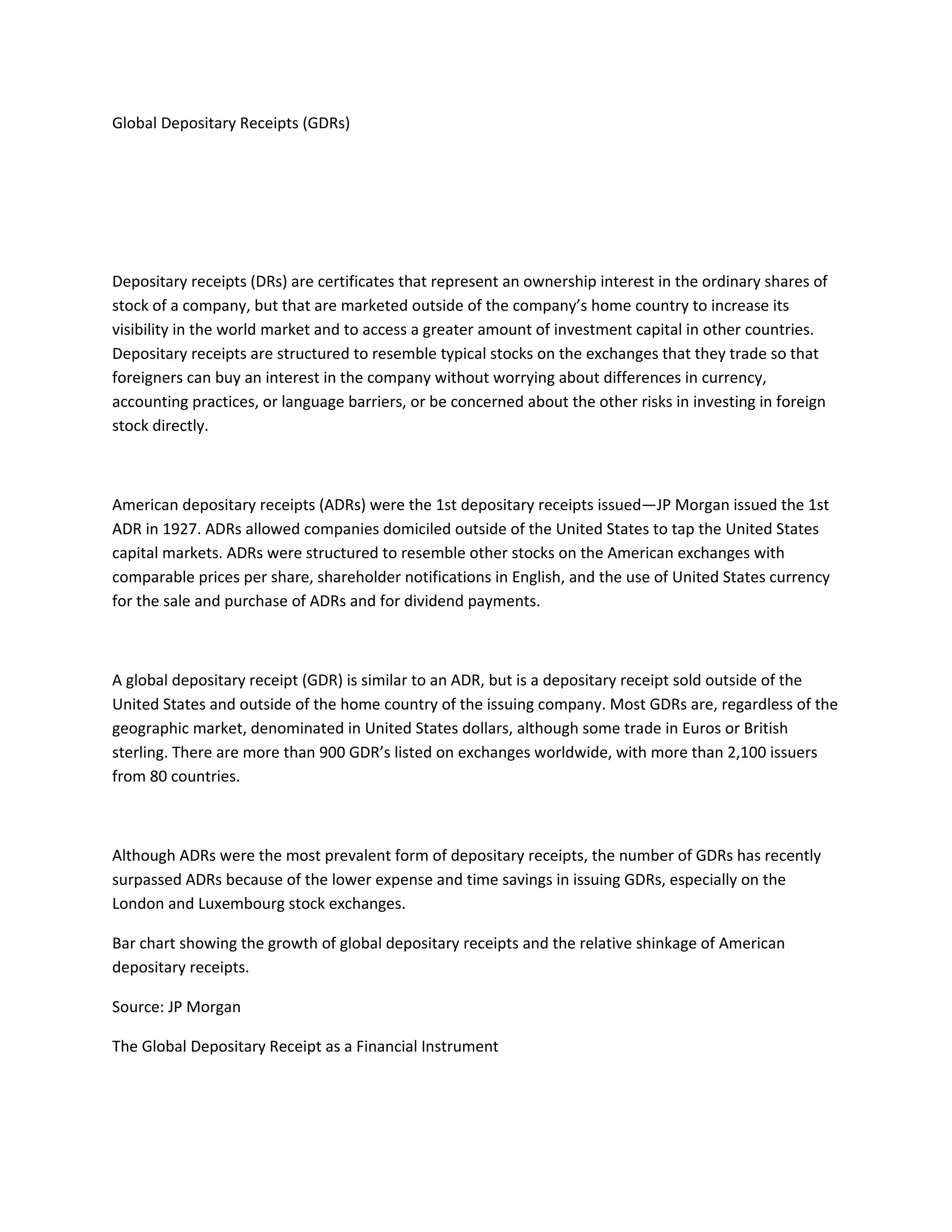

Global depositary receipts (GDRs) allow foreign companies to access international capital markets. A GDR represents an ownership in shares of a foreign company that are held in trust by a depositary bank. The depositary bank issues the GDRs and ensures the shares are traded similarly to local stocks. Benefits of GDRs include easier trading, dividends in US dollars, and English documents. GDR prices depend on demand and the depositary ratio to the underlying shares. Investors purchase GDRs through brokers who coordinate with depositary and custodian banks to issue or cancel shares.