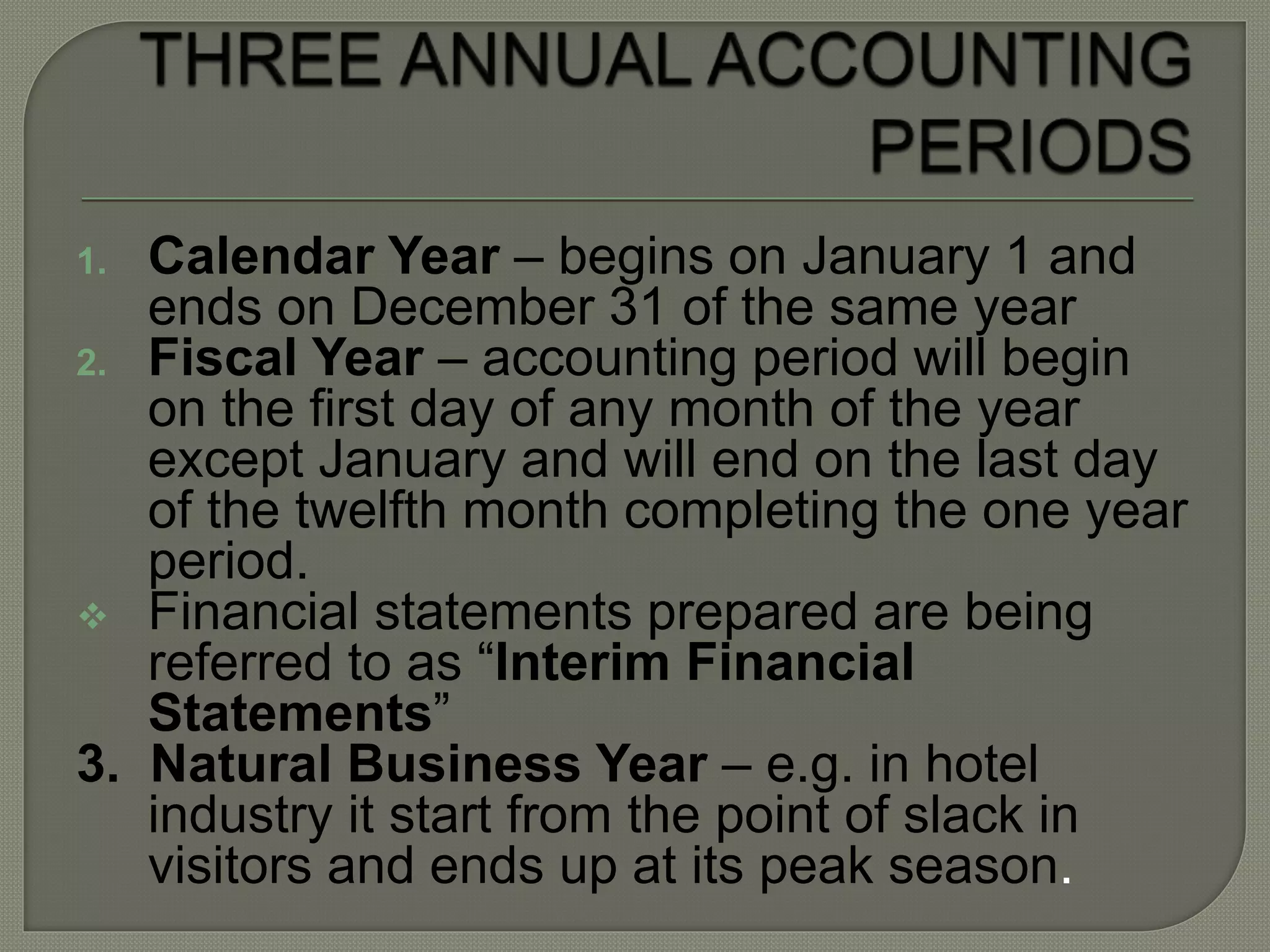

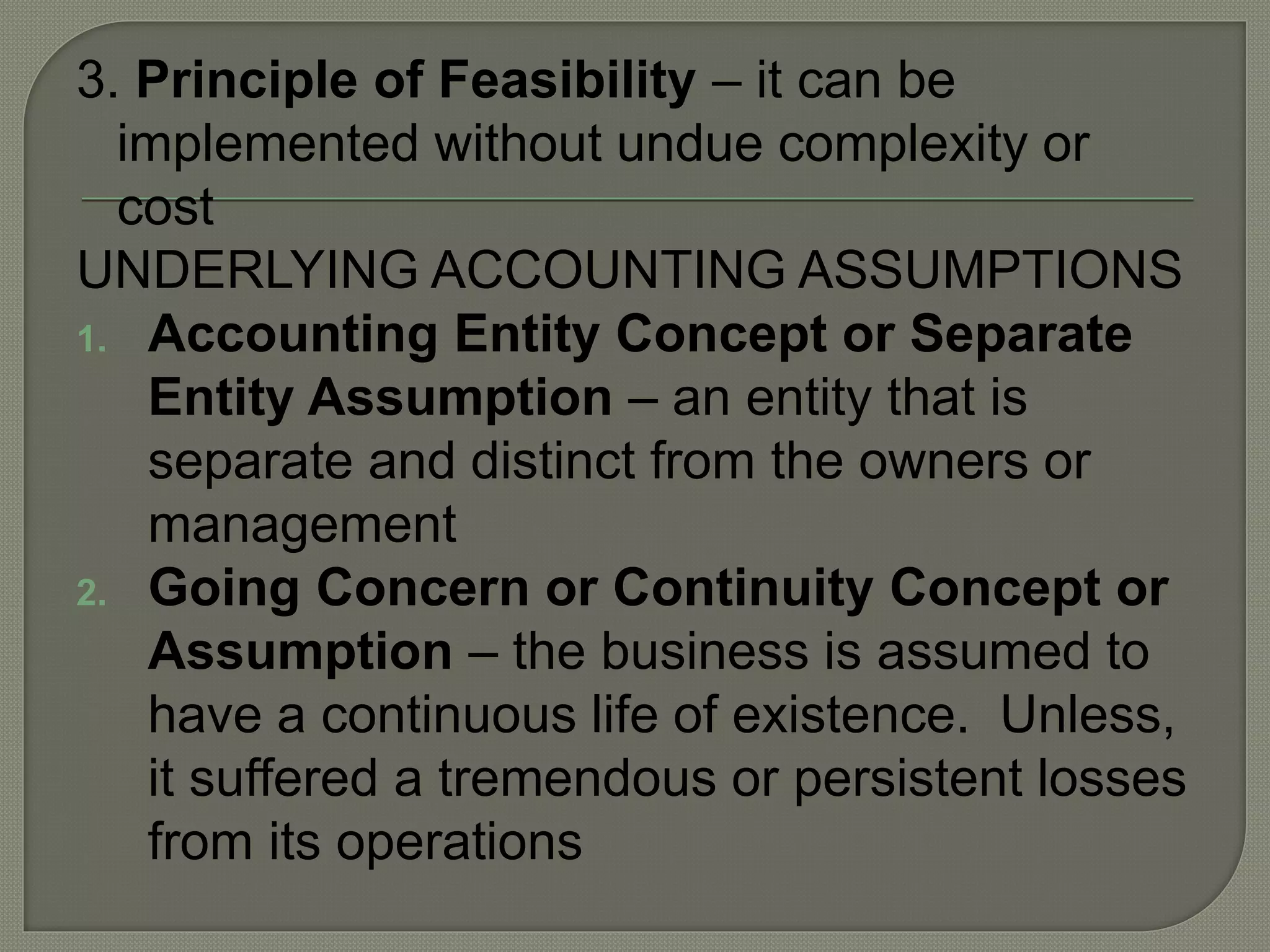

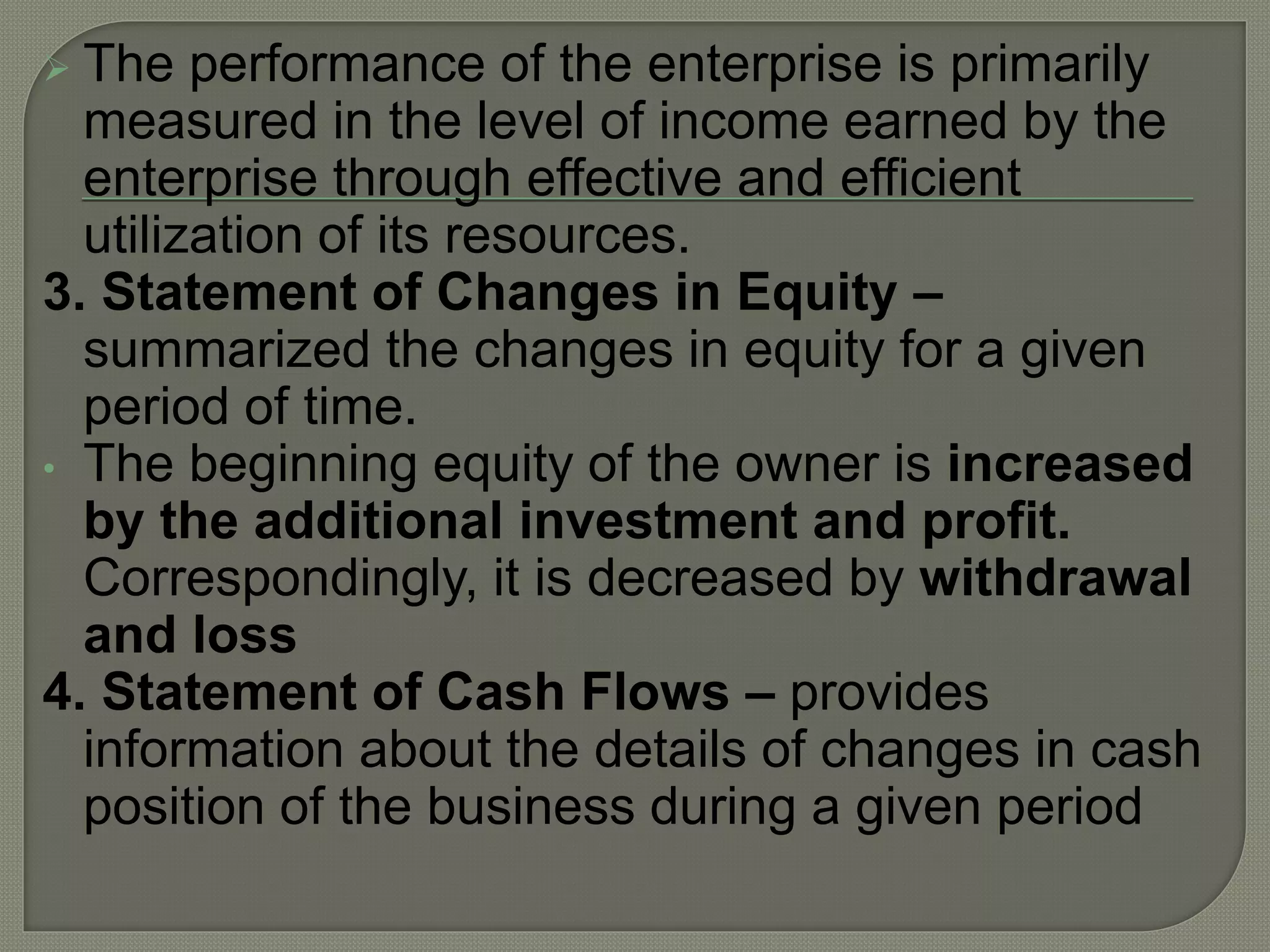

The document defines accounting and summarizes key accounting concepts. It defines accounting as the process of identifying, measuring, recording, classifying, summarizing, communicating, and interpreting economic information. The key functions of accounting include recording transactions, preparing financial statements, and interpreting results to help users make informed decisions. Financial statements like the balance sheet, income statement, and statement of cash flows are the main output of the accounting process.