This document contains sample accounting documents and questions including:

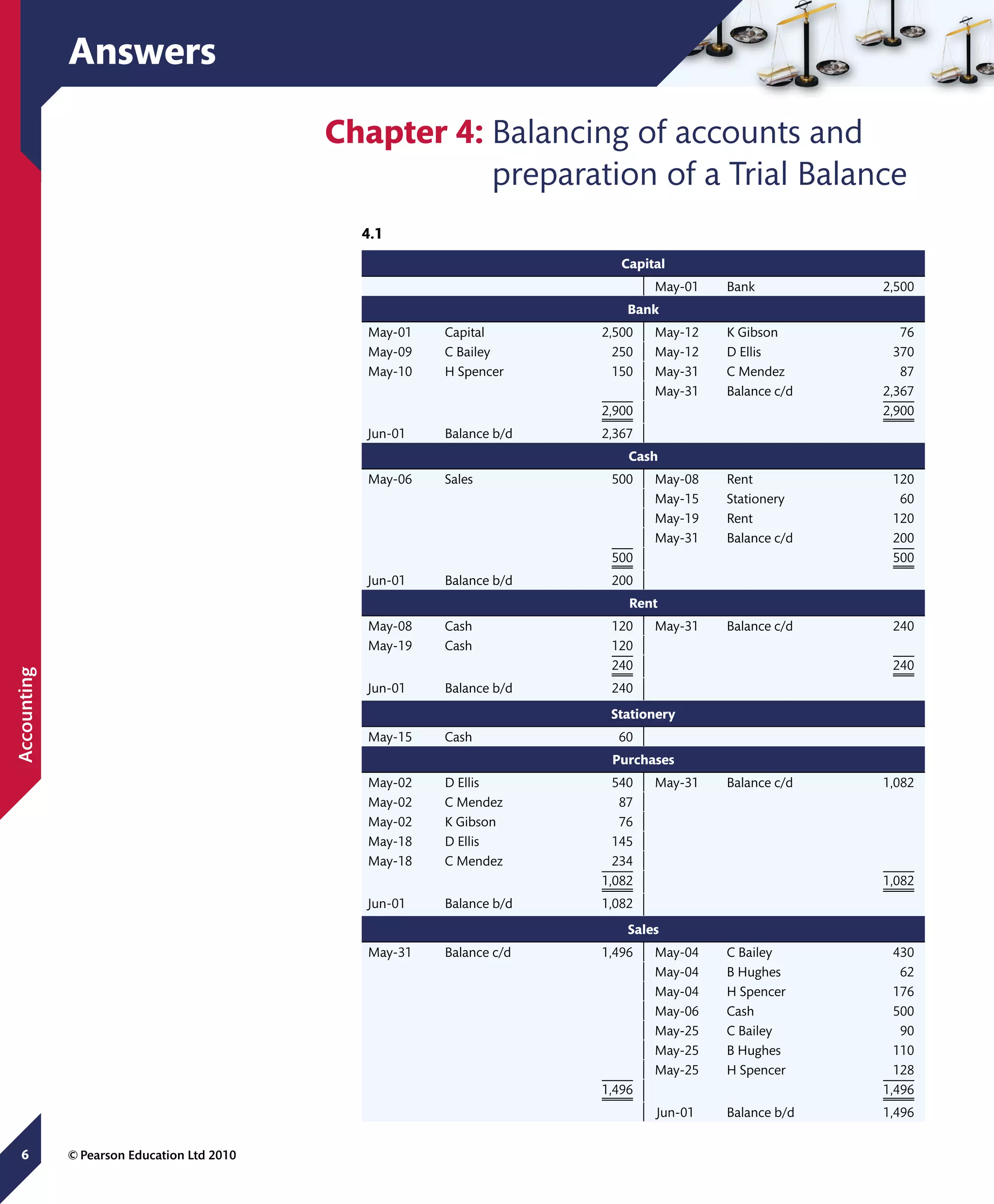

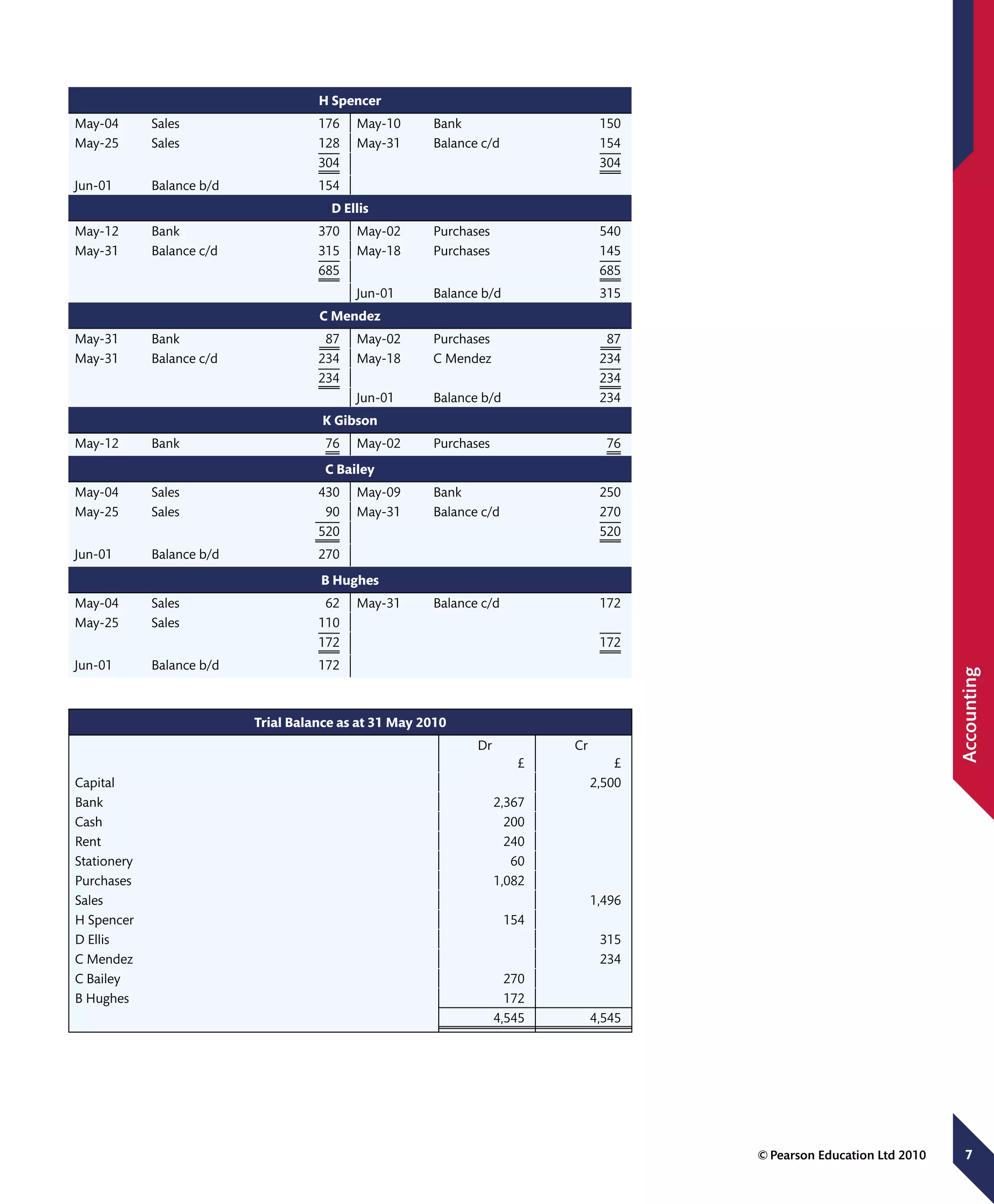

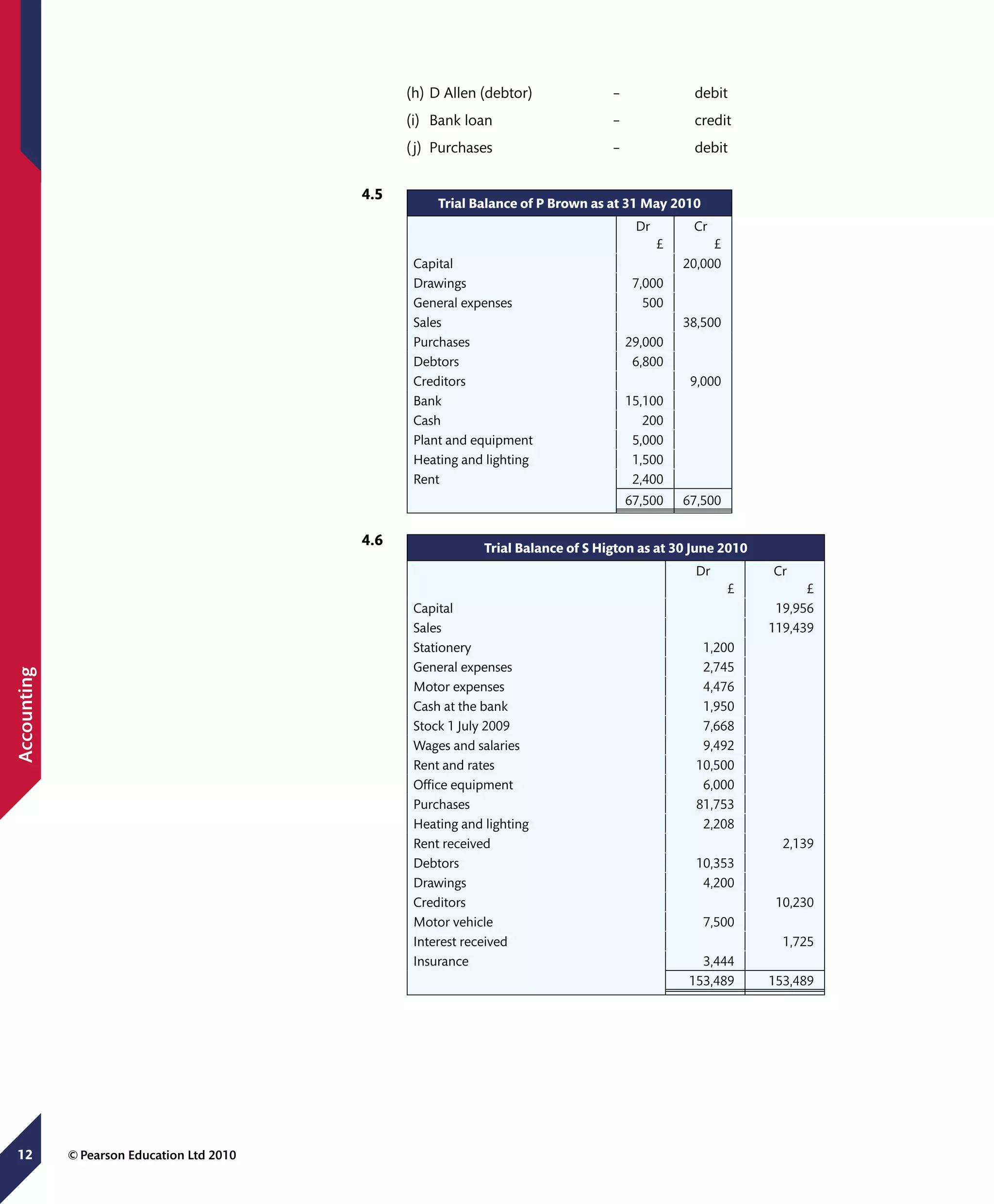

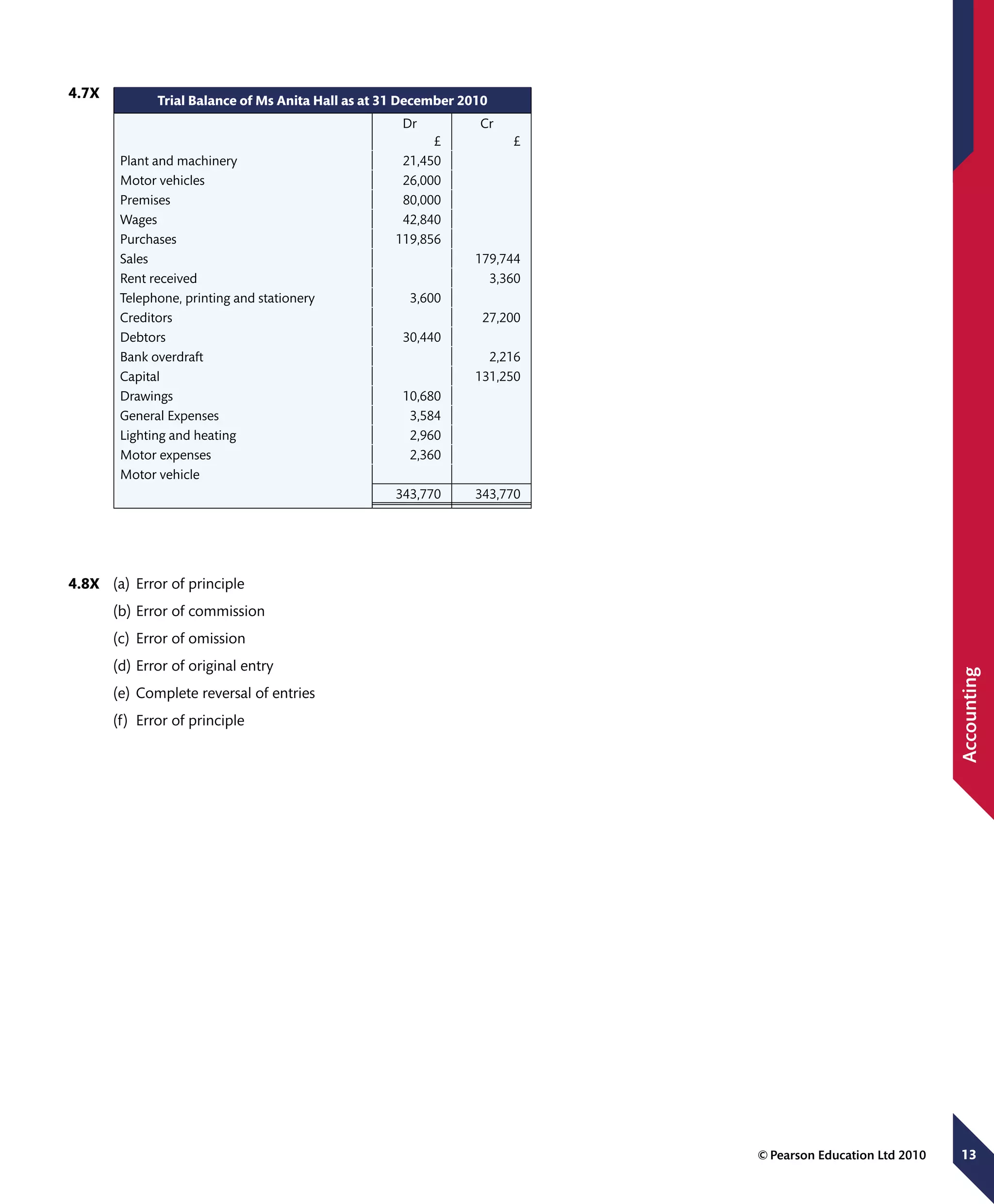

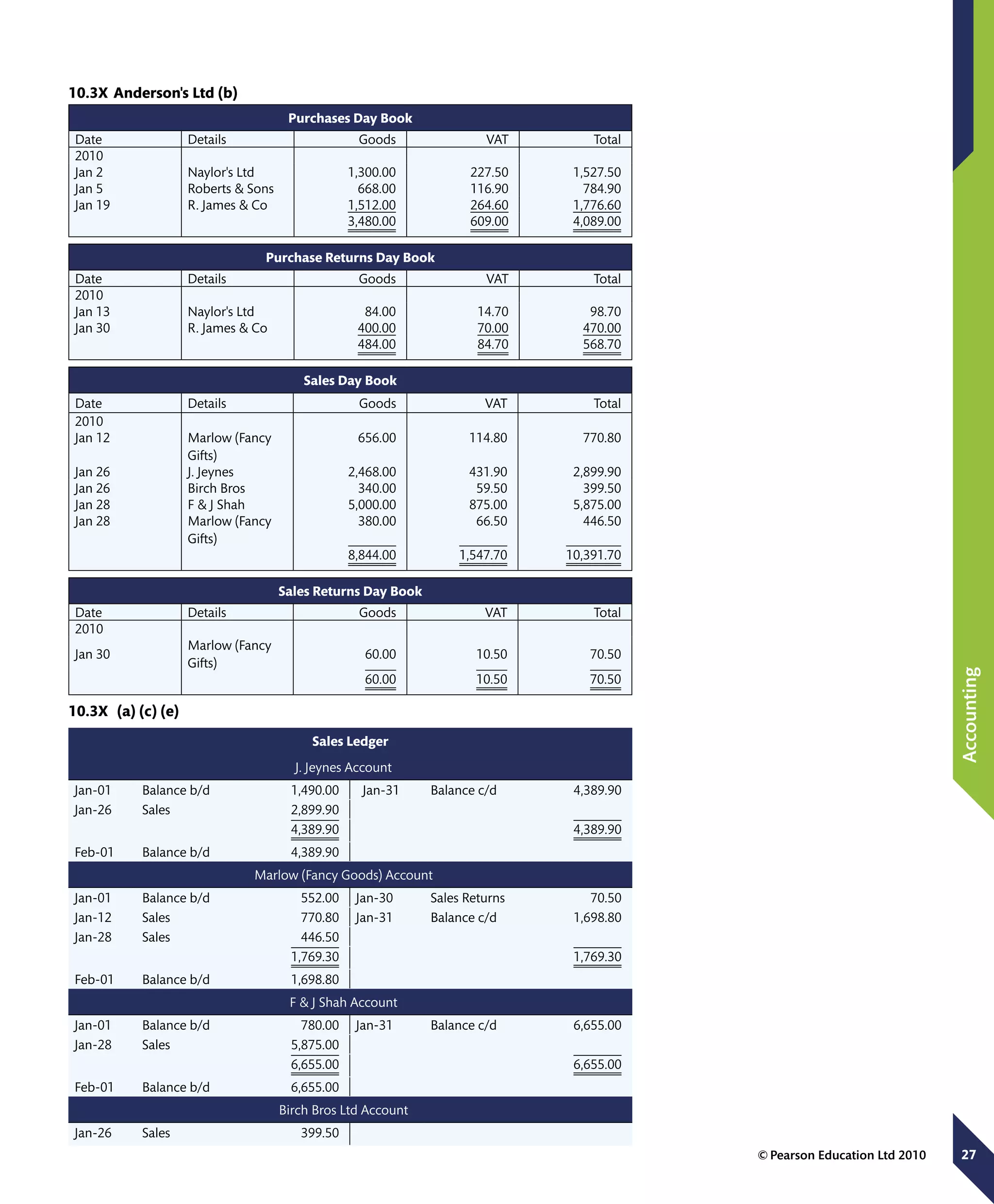

- Trial balances for businesses showing debit and credit balances of accounts

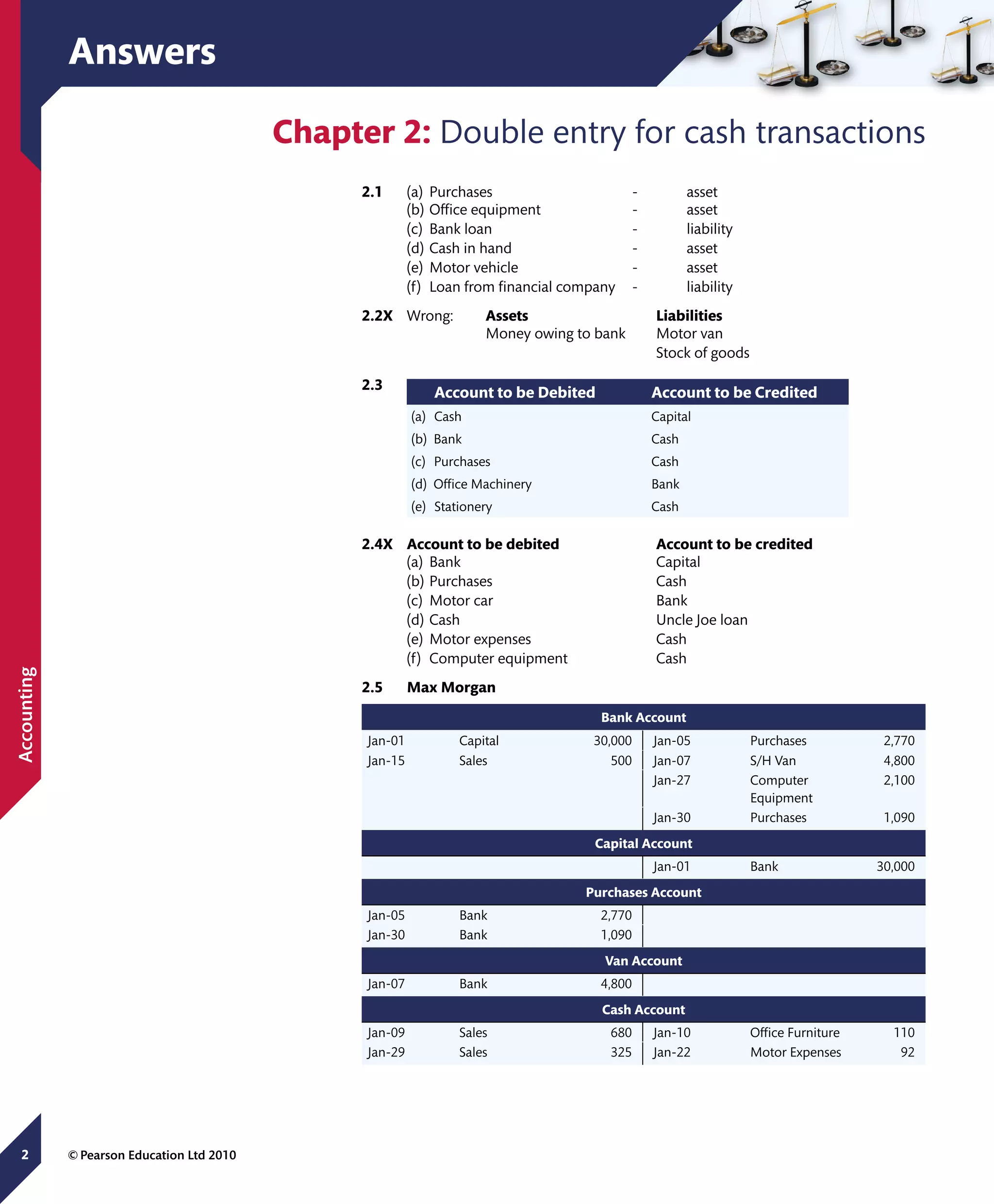

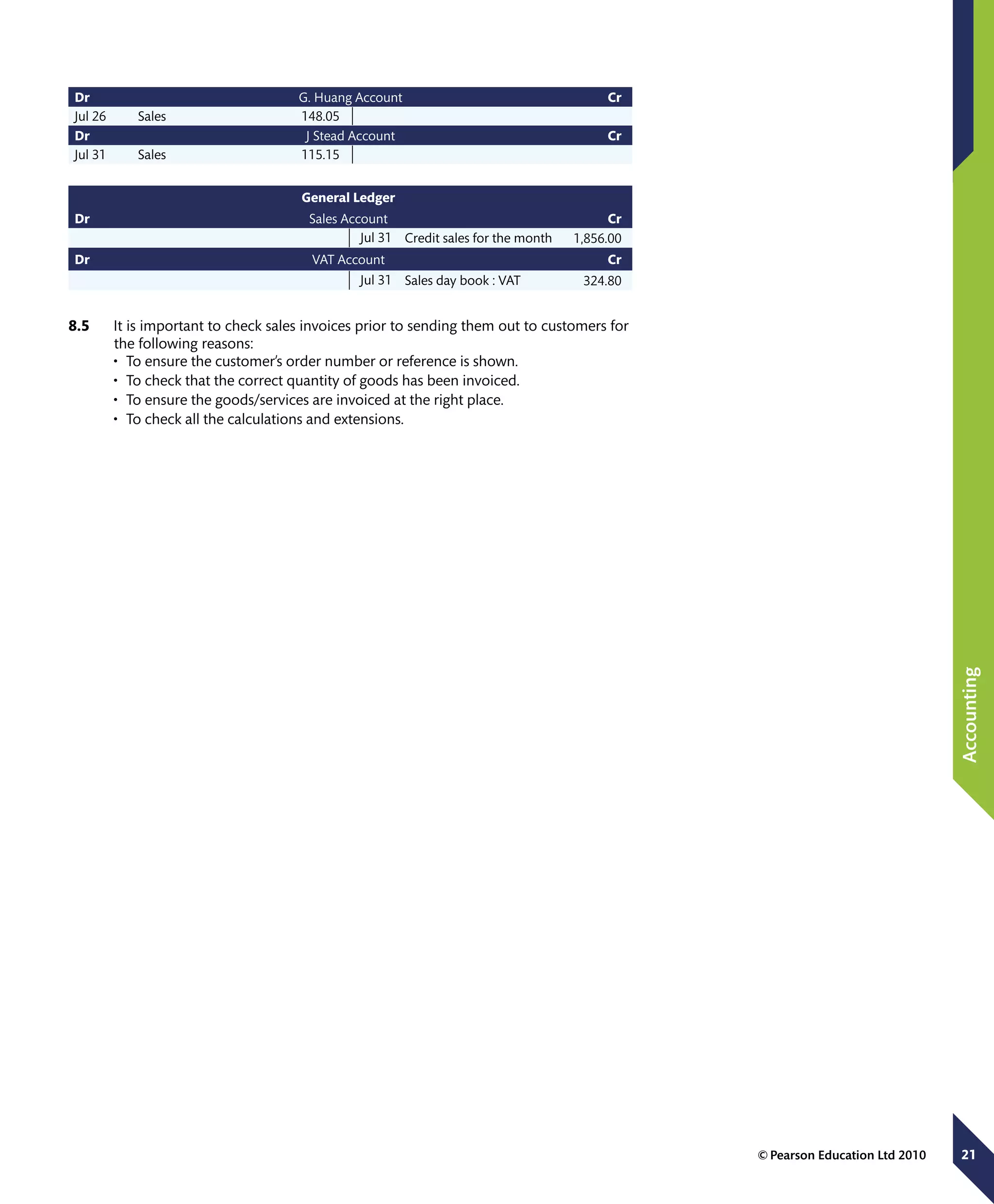

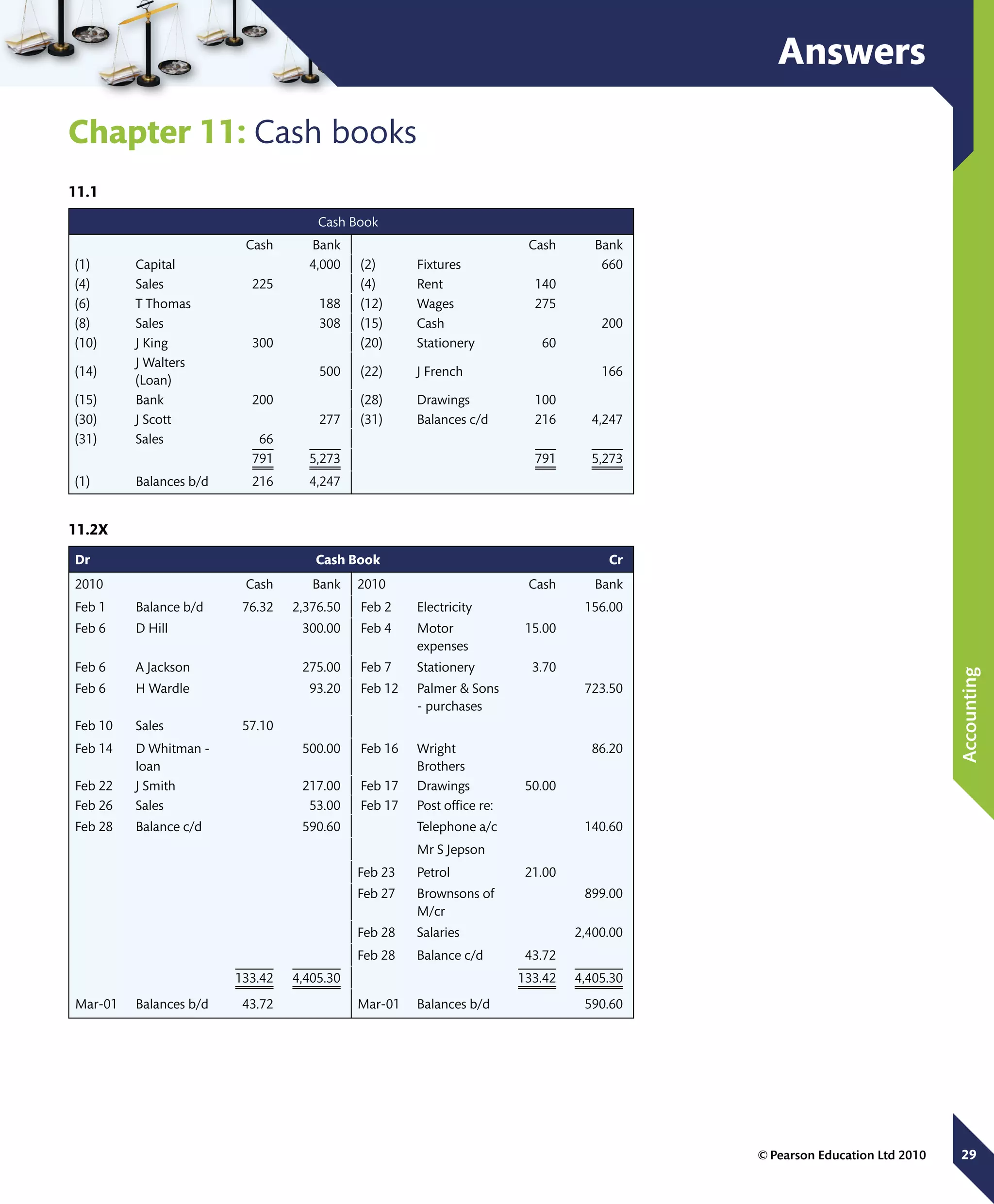

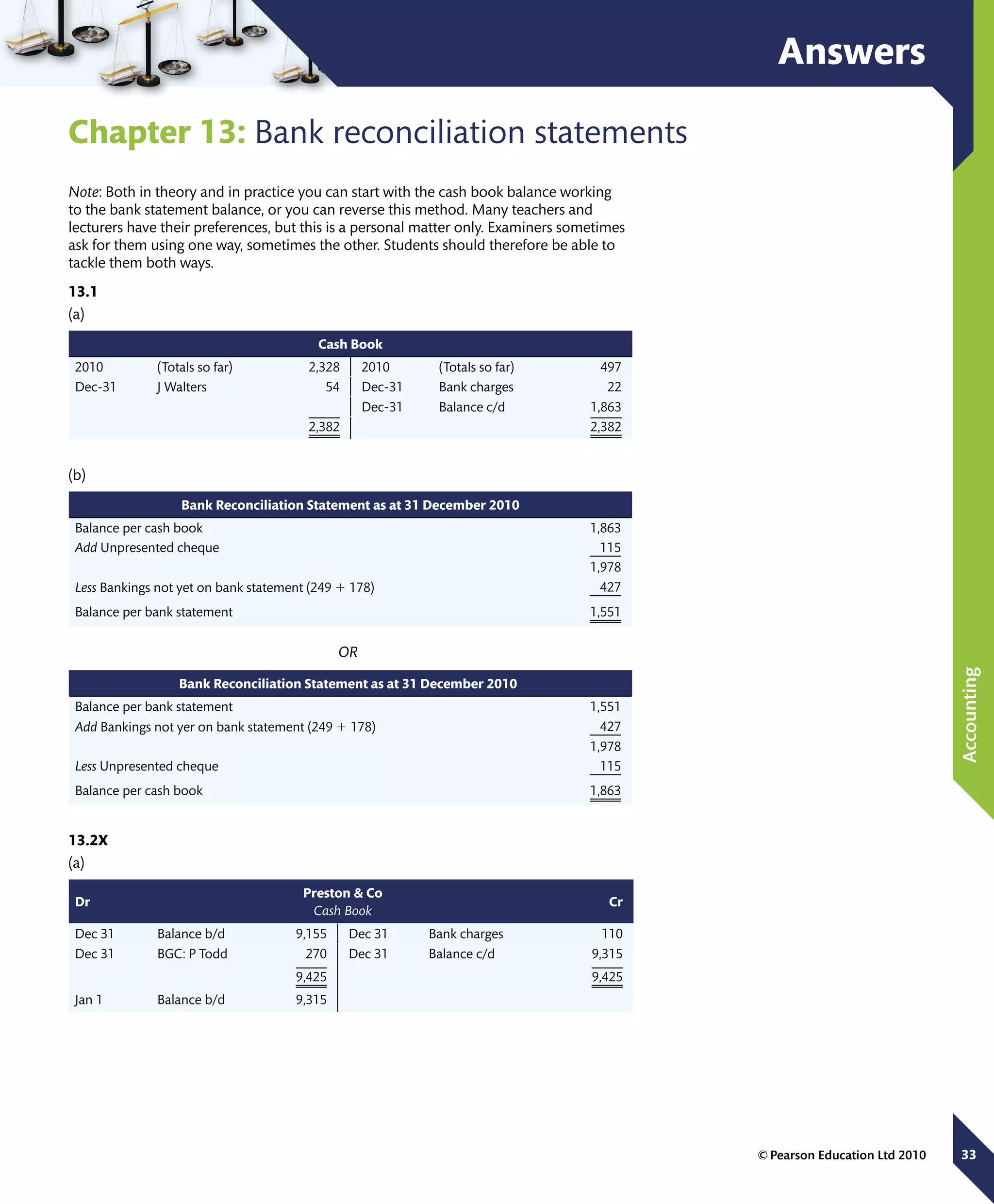

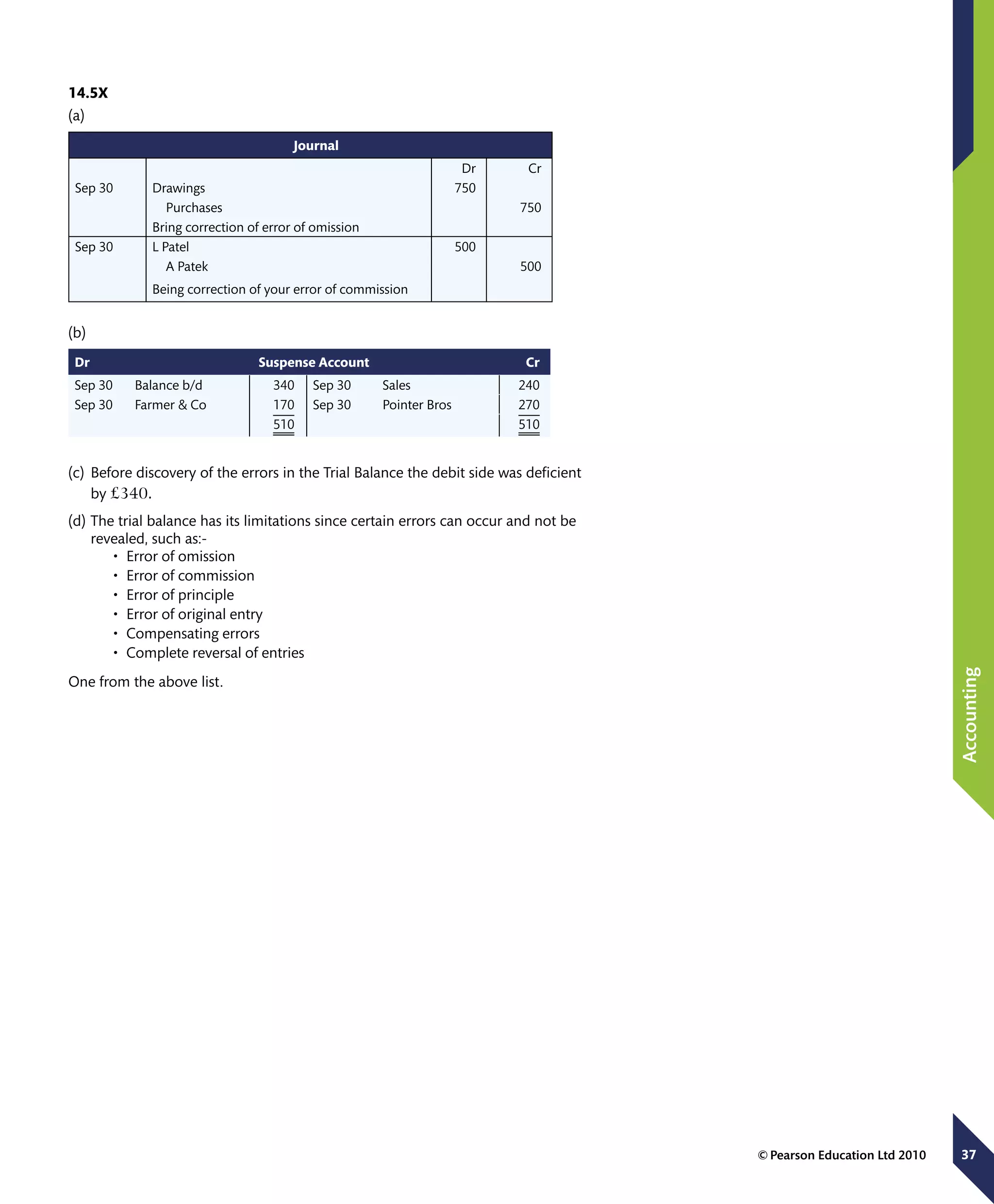

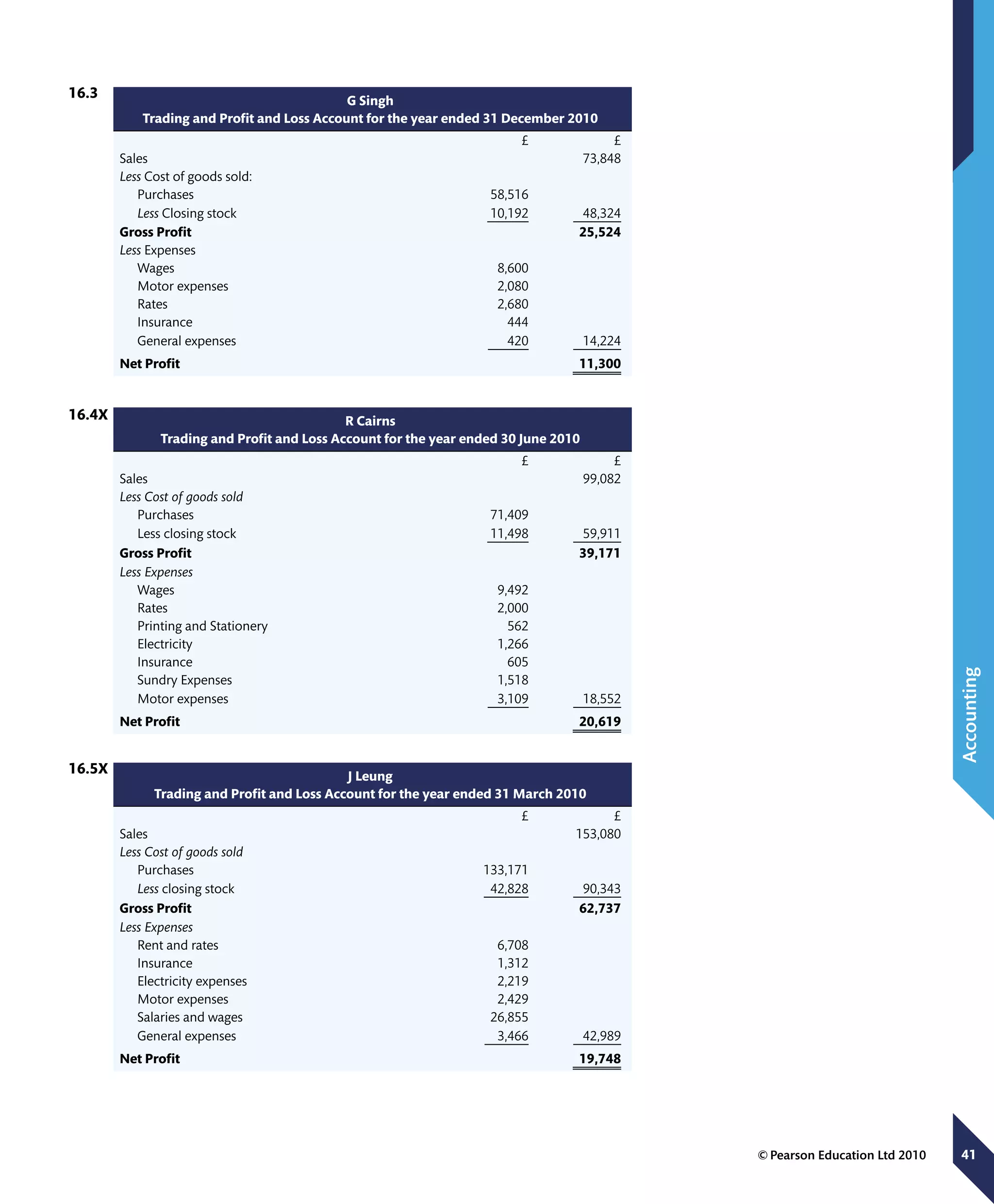

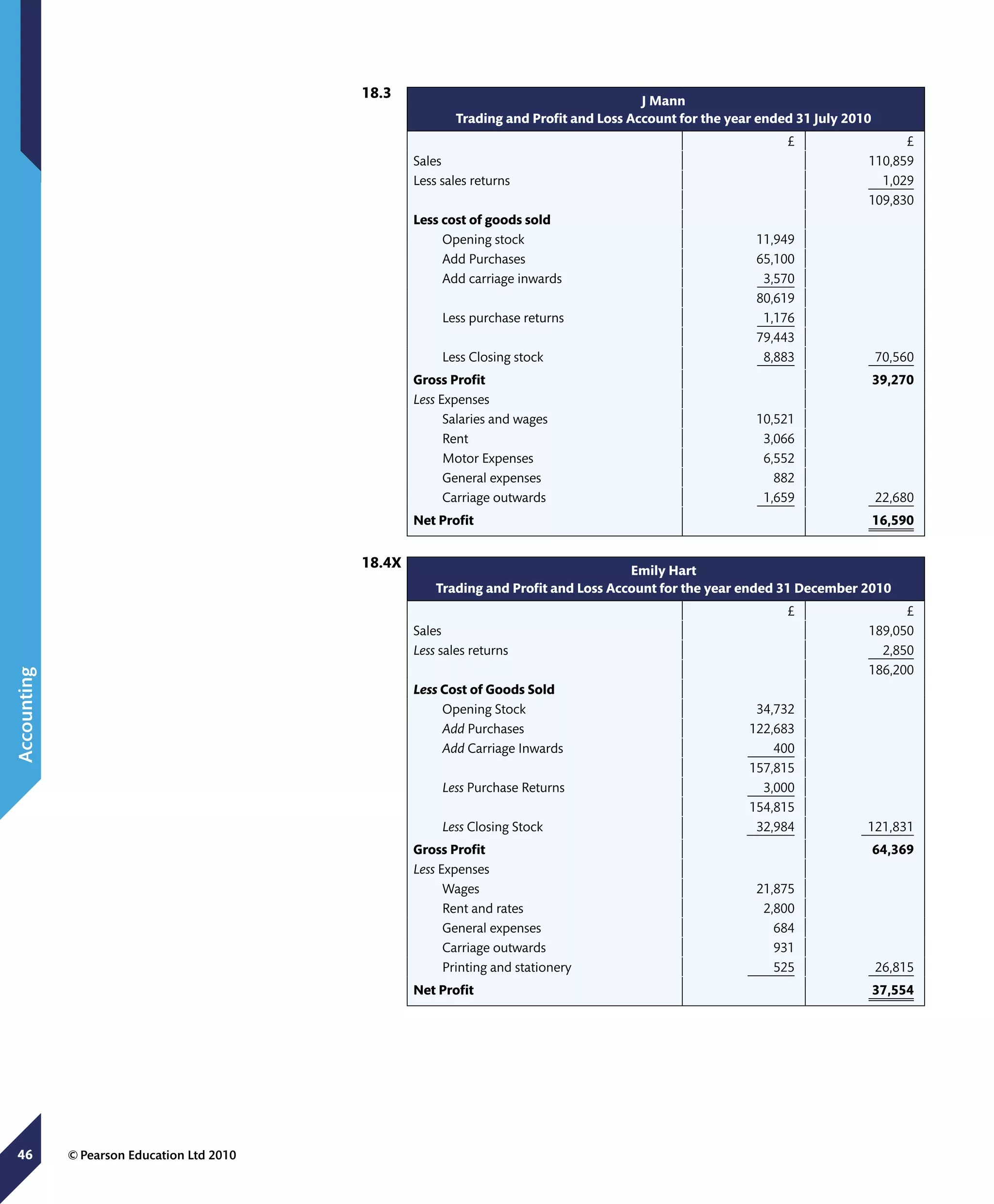

- Double entry bookkeeping examples for transactions involving cash, credit, purchases, sales, expenses and assets

- Questions testing understanding of concepts like debits and credits, balancing accounts, and preparing trial balances

The goal is to introduce basic accounting principles and bookkeeping practices.