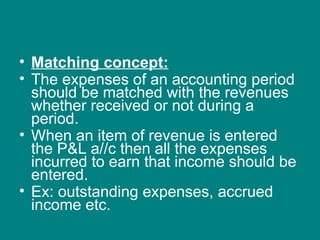

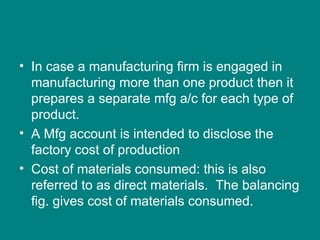

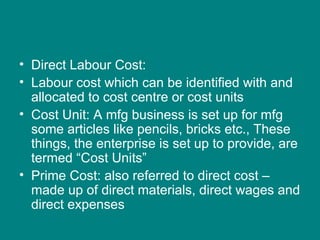

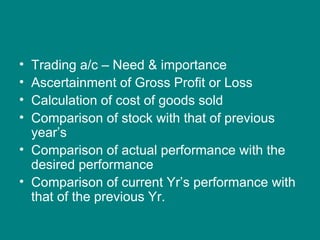

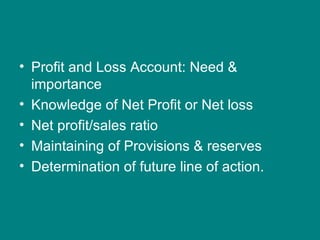

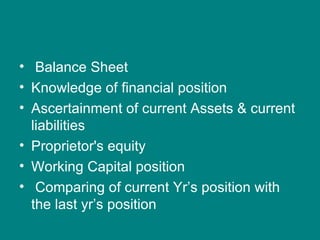

The document discusses the basic concepts of book keeping and accounting. It explains that book keeping involves systematically recording business transactions, while accounting builds on book keeping by analyzing records to prepare financial statements and interpret financial results. The key principles of accounting include the money measurement concept, business entity concept, going concern concept, and matching concept. Financial statements like the manufacturing account, trading account, profit and loss account, and balance sheet are prepared according to accounting principles and concepts.