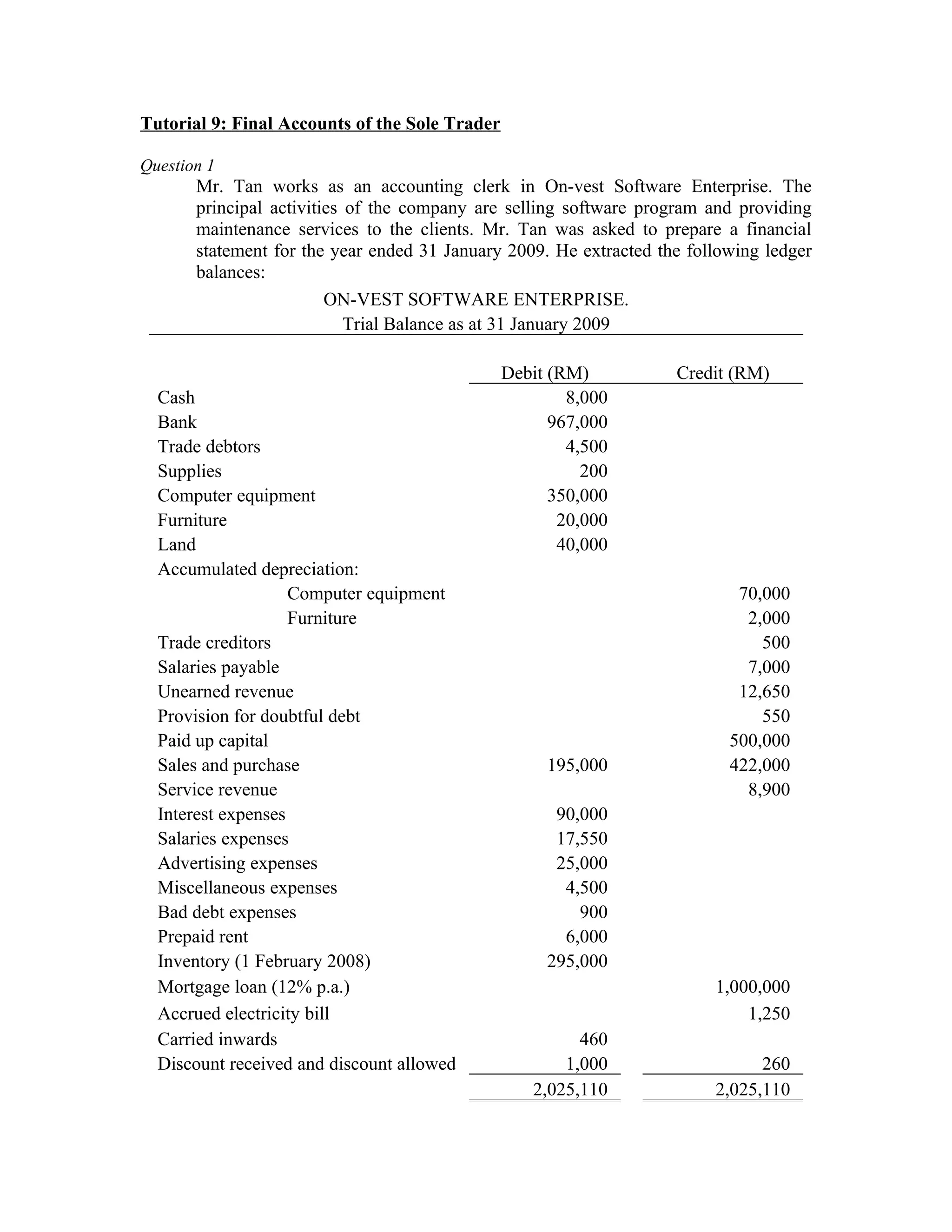

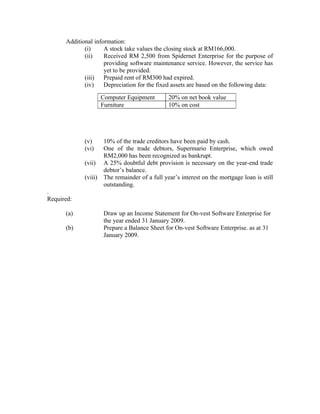

The document provides the trial balance and additional financial information for On-vest Software Enterprise as of January 31, 2009. It asks to prepare an income statement and balance sheet based on the information given. The income statement will show the company's revenues, expenses and net income for the year. The balance sheet will report the company's assets, liabilities and equity as of the specified date.