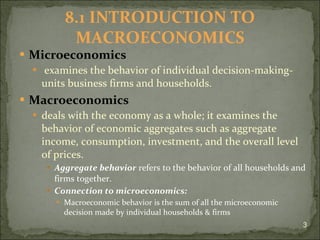

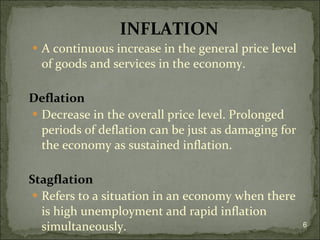

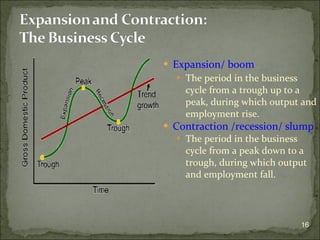

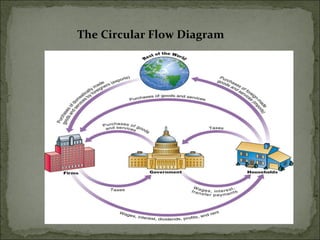

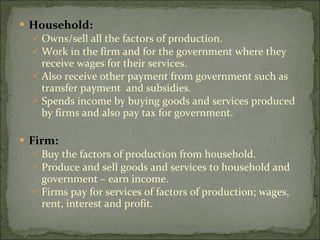

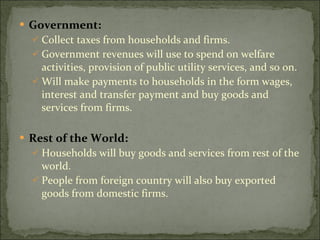

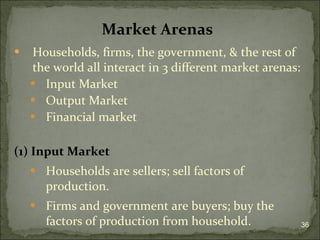

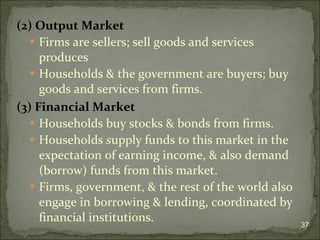

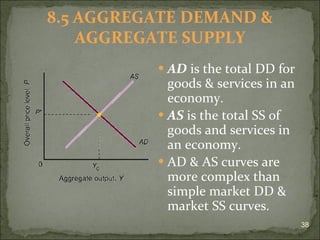

This document provides an introduction to macroeconomics. It discusses the key components and concerns of macroeconomics including inflation, output growth, unemployment, and income distribution. It also covers aggregate demand and supply, the circular flow model, and the roles of households, firms, government and the international sector in the macroeconomy. Government policies aim to achieve price stability, economic growth, full employment, and an equitable distribution of income.