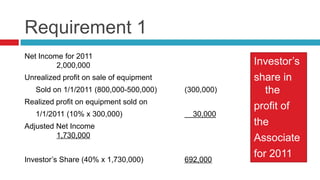

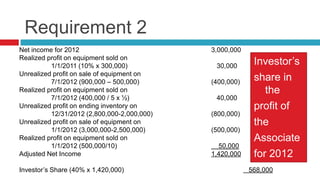

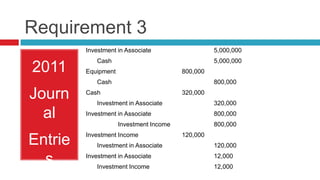

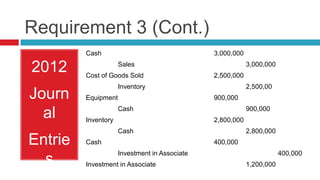

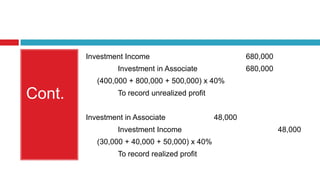

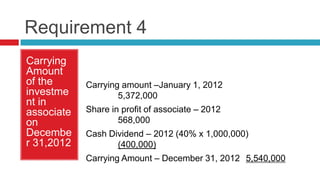

The document details the financial analysis of investments in associates for the years 2011 and 2012, including calculations of net income, unrealized profits, and investment adjustments. It outlines the investor's share of profits and adjustments to carrying amounts based on provided financial data. The summary includes specific figures related to net income calculations, equipment sales, and investment income for both years.