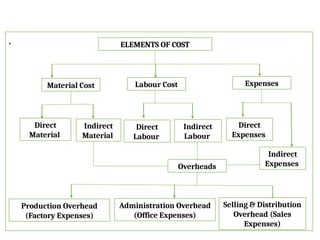

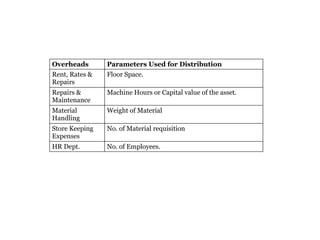

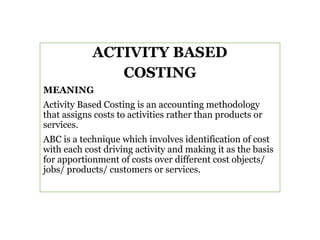

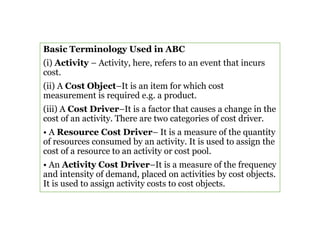

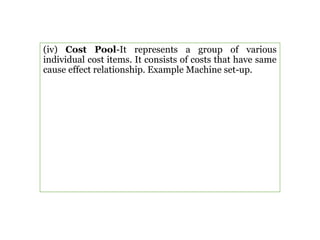

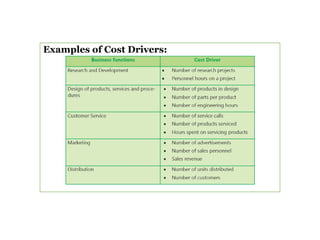

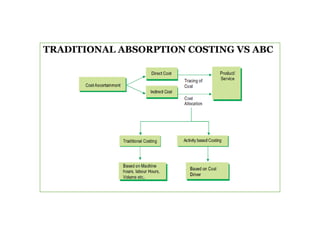

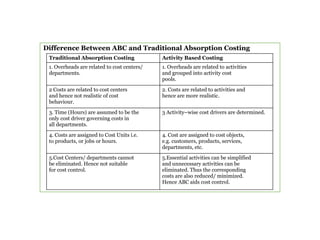

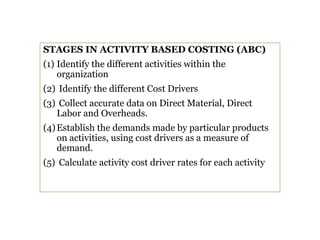

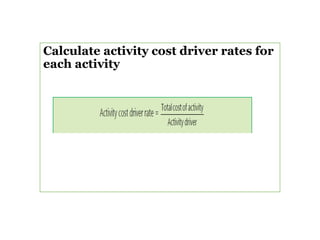

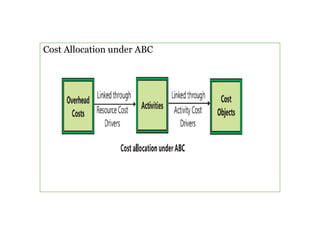

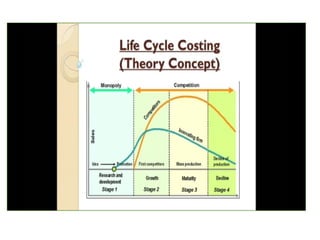

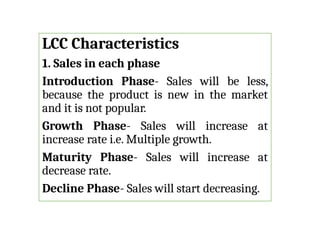

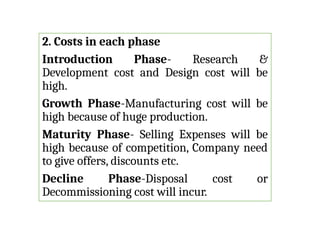

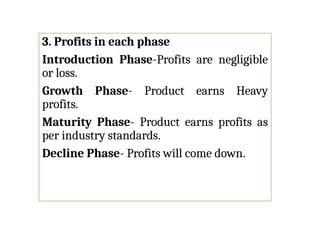

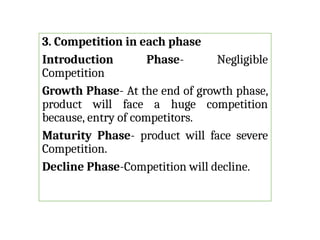

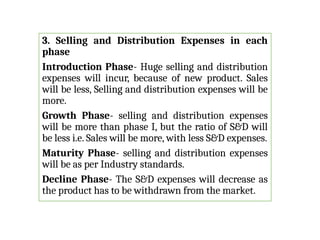

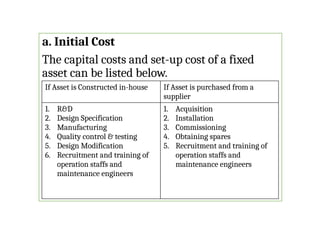

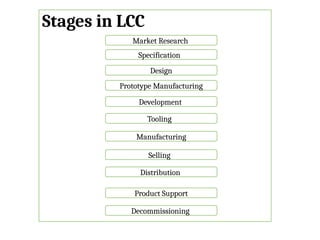

The document outlines various costing strategies, including elements of cost such as material, labor, and expenses. It explains direct and indirect costs and introduces the concepts of Activity Based Costing (ABC) and Life Cycle Costing (LCC), highlighting the differences between traditional costing methods and ABC. Additionally, it discusses the phases of a product's life cycle and the associated costs at each stage.