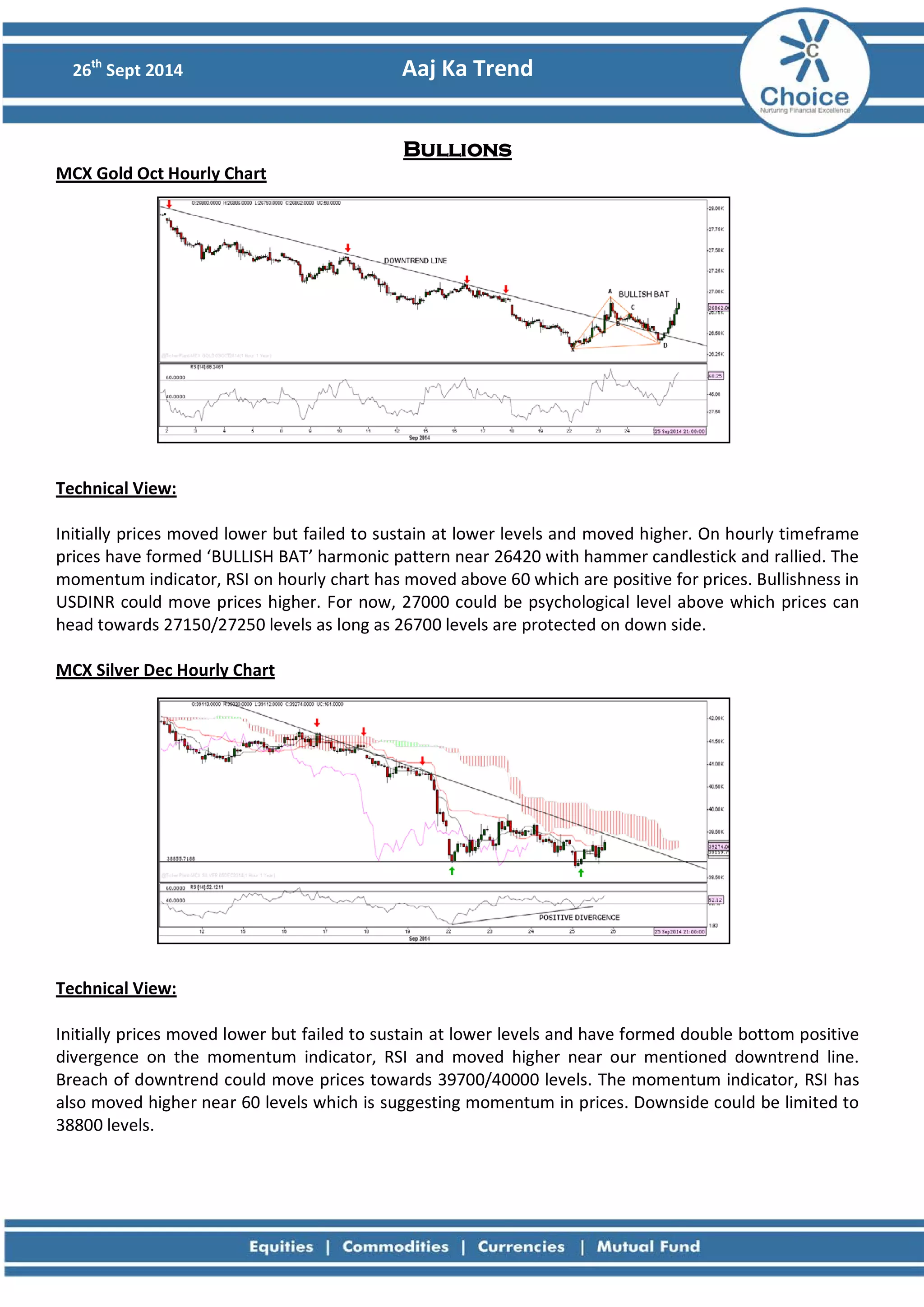

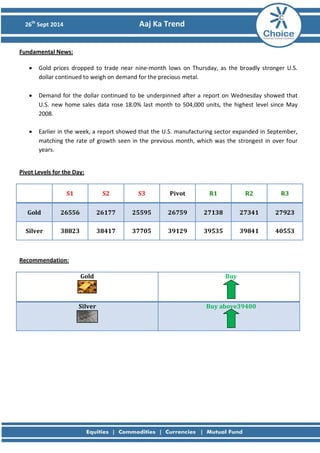

- Gold and silver prices initially dropped but failed to sustain lower levels and rose, with gold forming a bullish pattern and silver a double bottom positive divergence, suggesting further upside.

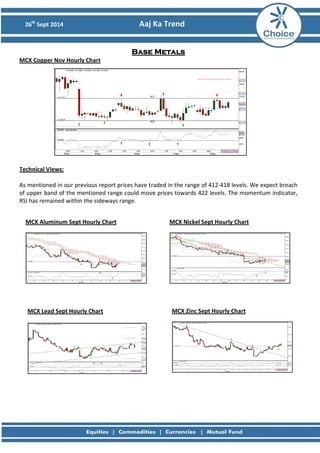

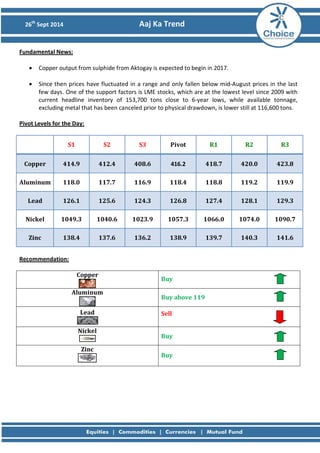

- Most base metals also saw prices rise within defined ranges, with recommendations to buy copper, aluminum, nickel and zinc, and sell lead.

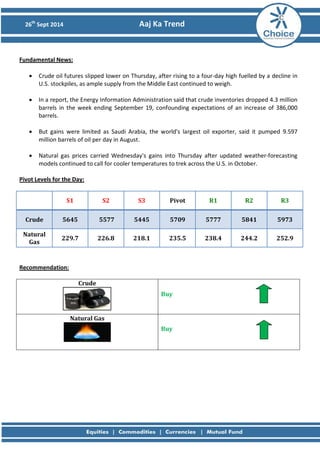

- Crude oil and natural gas rose but gains were capped by ample supply, with forecasts for further rises supported by declining inventories and expected cooler weather.