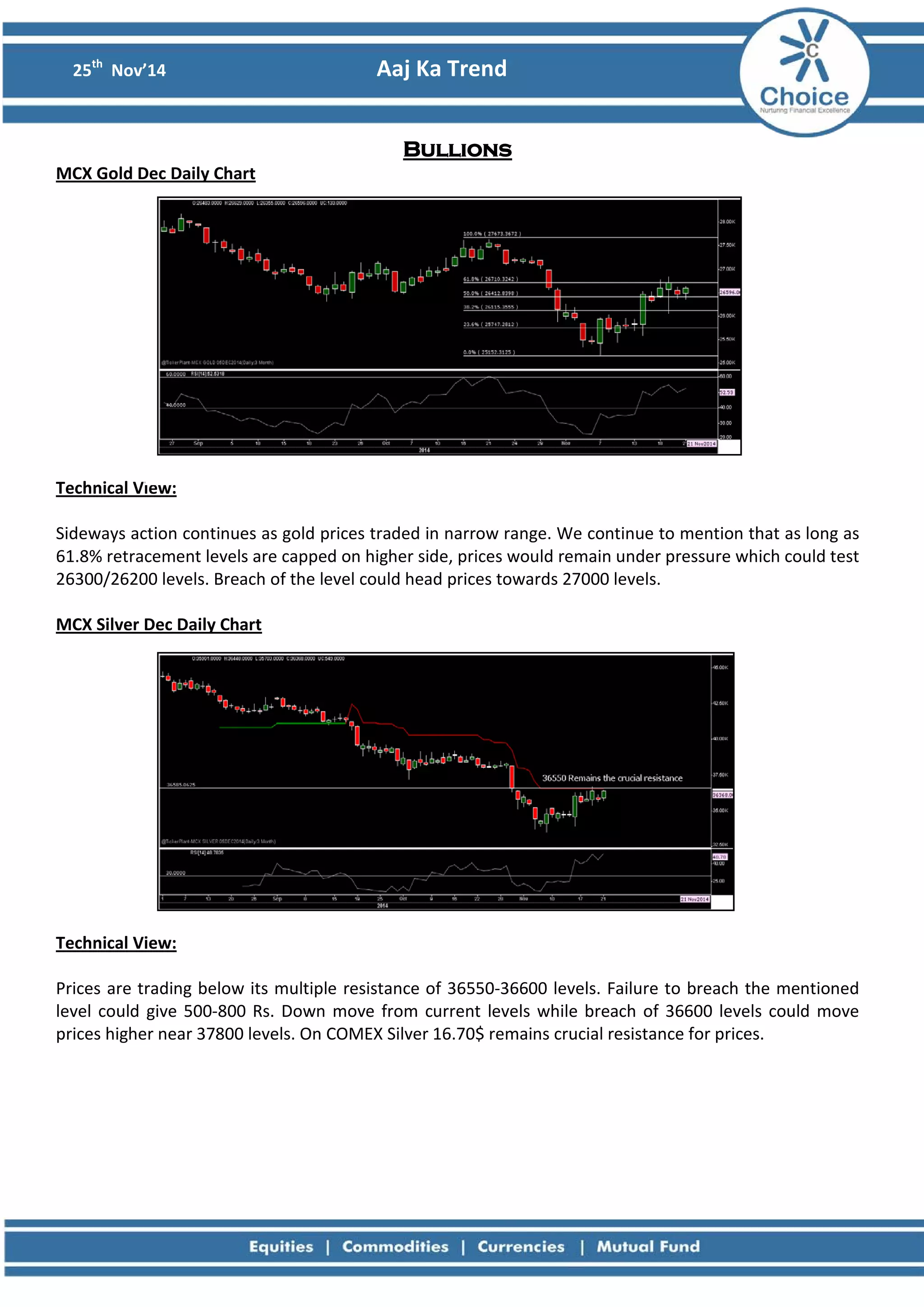

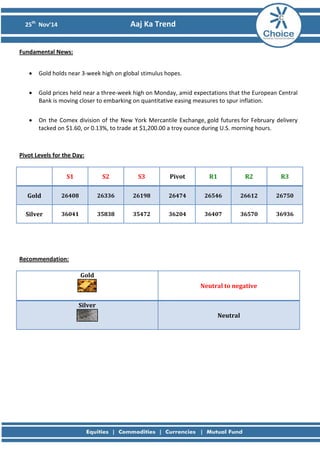

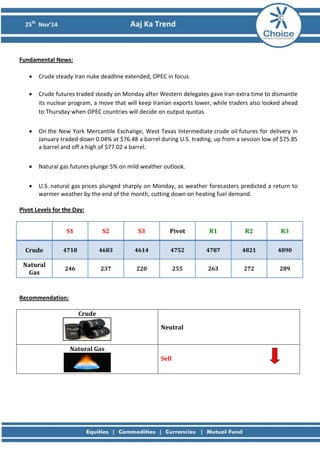

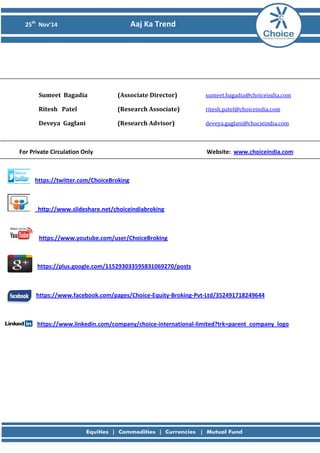

The document provides a daily technical analysis of trends in bullion and base metal commodities markets. It notes that gold and silver prices remained rangebound and below key resistance levels. Base metals like copper are expected to decline further, while aluminum and zinc are recommended for purchase. Crude oil remained stable ahead of an OPEC meeting, while natural gas prices plunged on a forecast for warmer weather reducing heating demand.