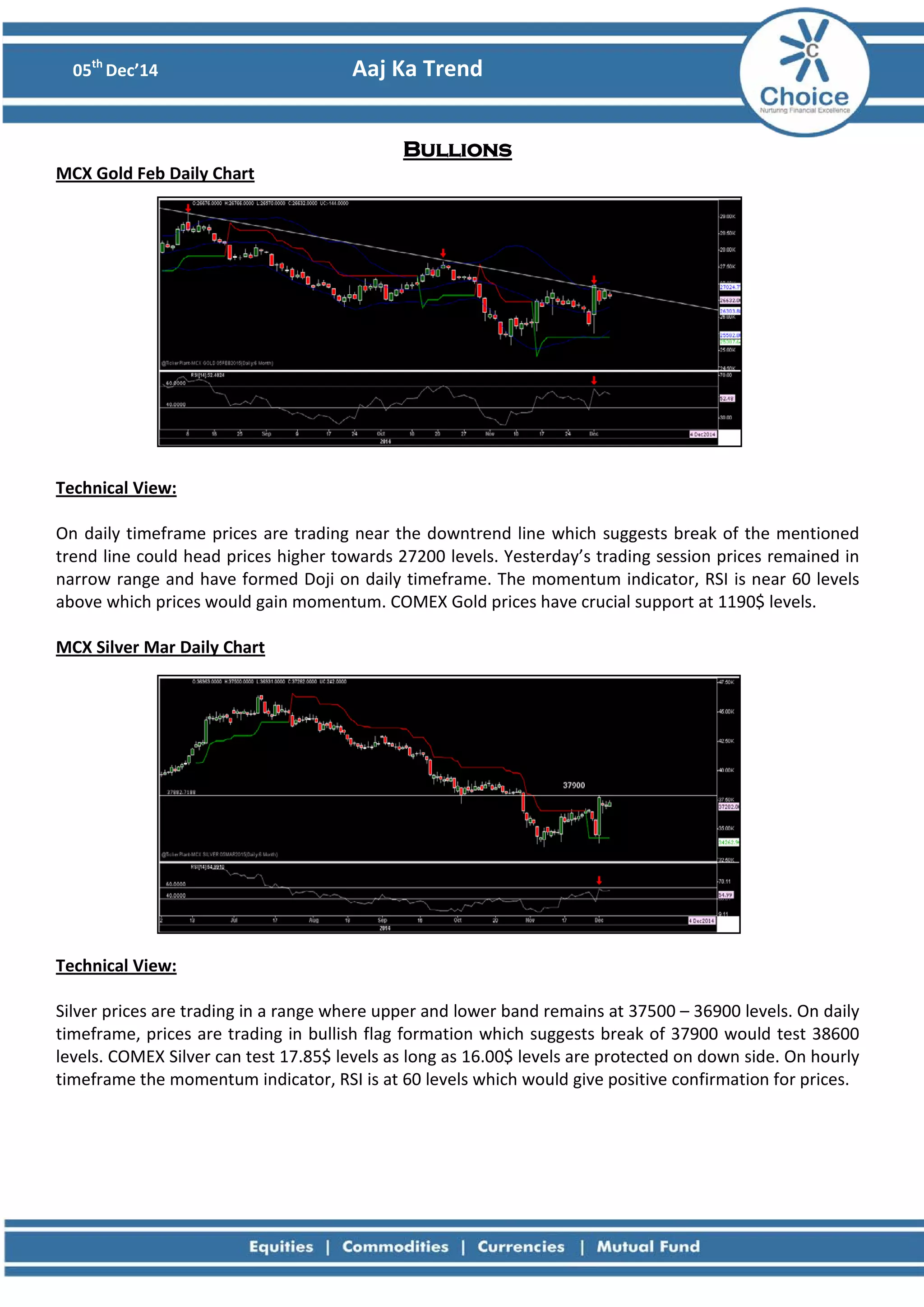

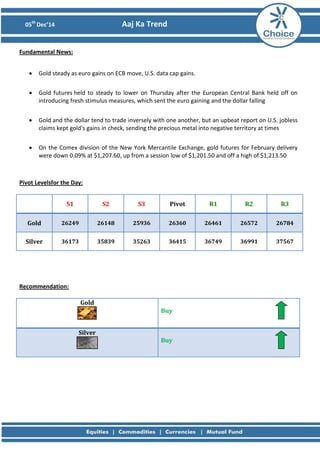

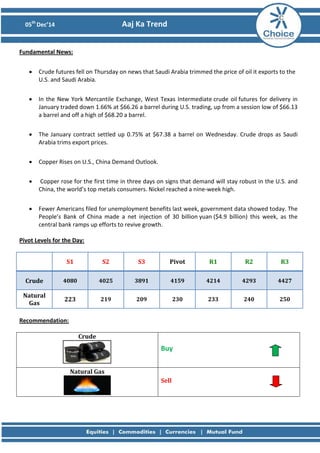

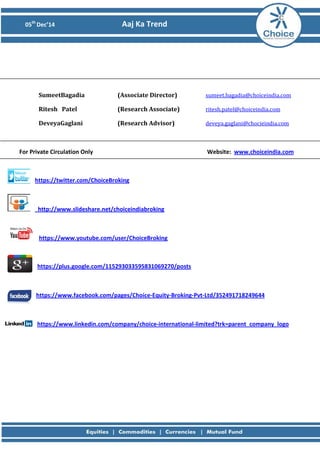

The document provides a technical analysis of gold, silver, and various base metals markets. It summarizes daily charts and technical indicators to identify key support and resistance levels. For gold and silver, it notes prices are near downtrend lines and momentum indicators suggest potential for higher prices. For copper, it finds prices have broken above resistance and may test higher levels. It also provides commentary on fundamental news affecting commodity prices and gives buy or neutral recommendations for various metals.