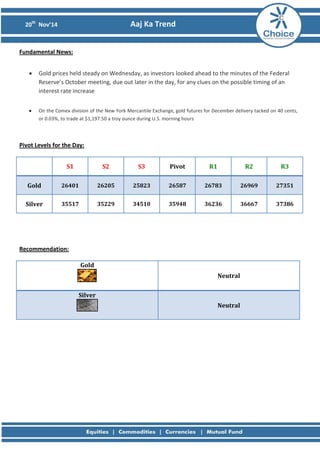

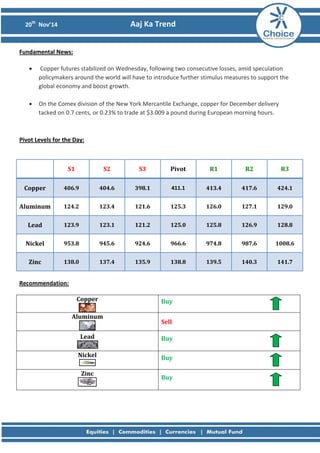

The document provides a technical analysis of gold, silver, and various base metals markets. It notes that gold and silver prices moved higher but failed to sustain gains, while copper prices rebounded after losses. The analysis includes charts showing price movements and resistance/support levels, along with recommendations to buy or sell various commodities. Fundamental news is also provided on factors influencing prices such as US economic data, supply levels, and weather conditions affecting energy demand.