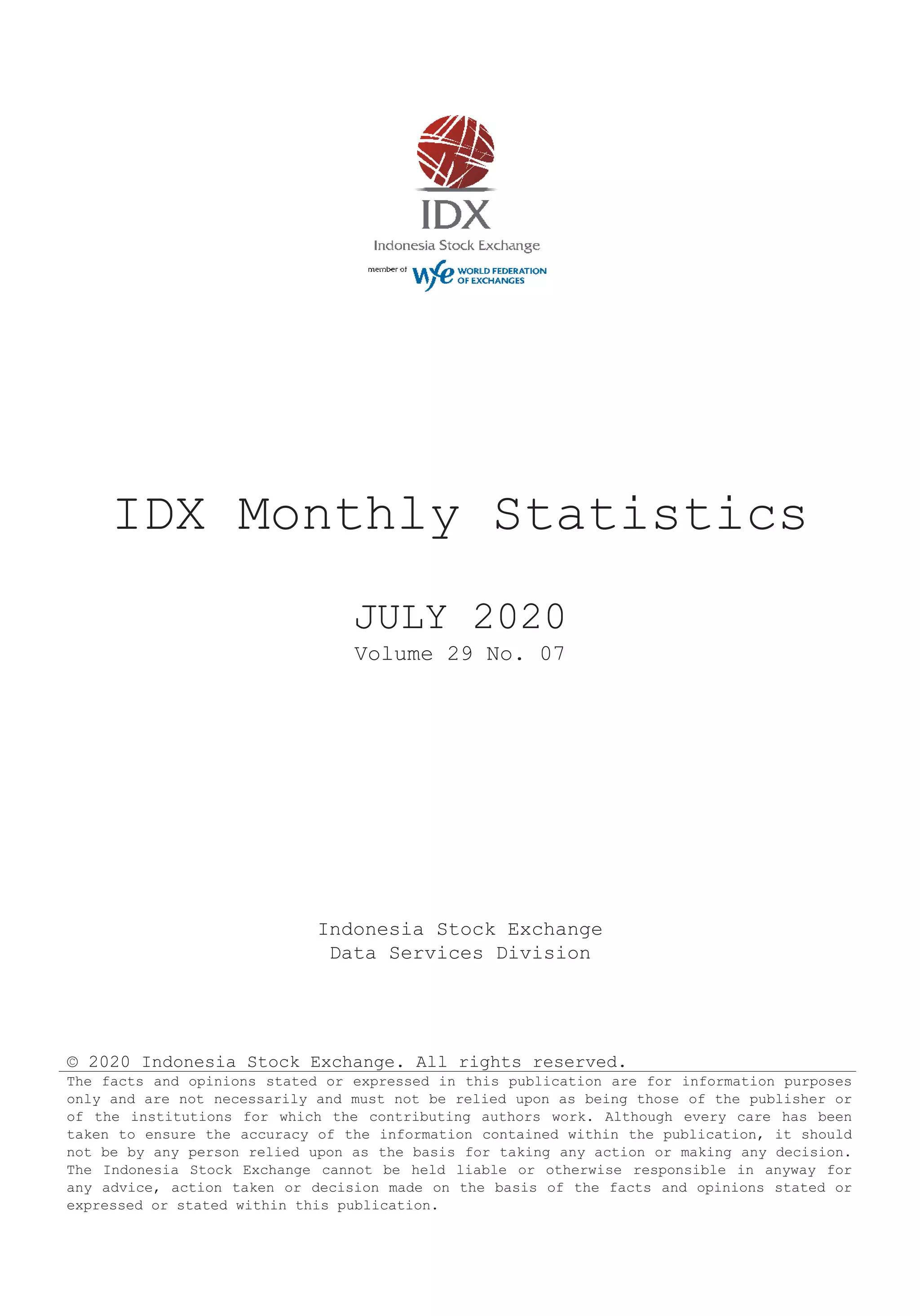

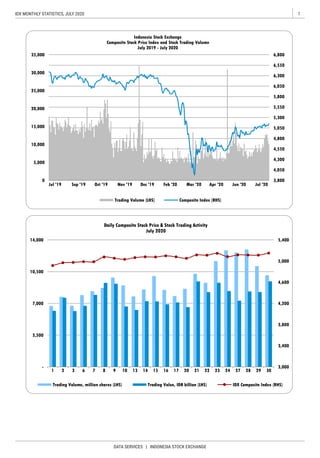

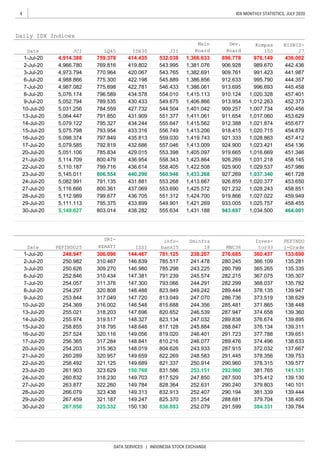

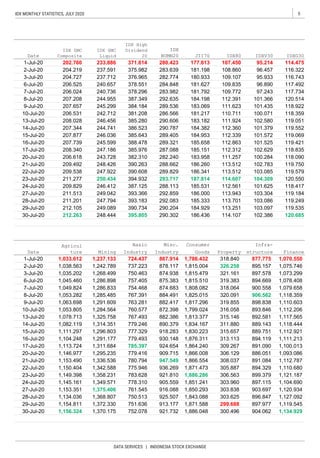

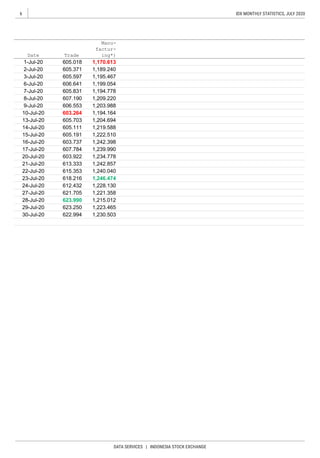

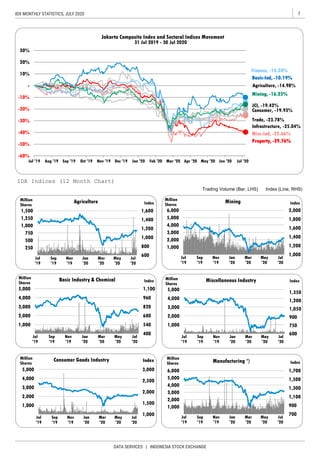

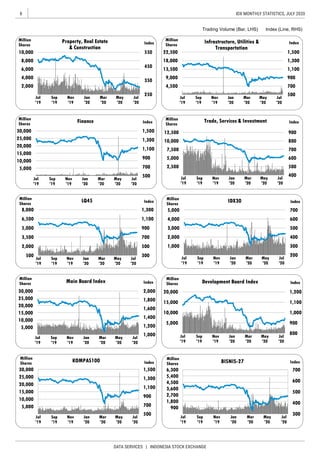

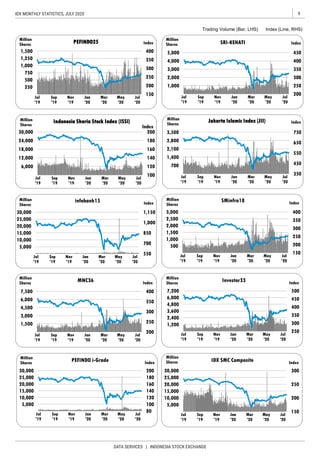

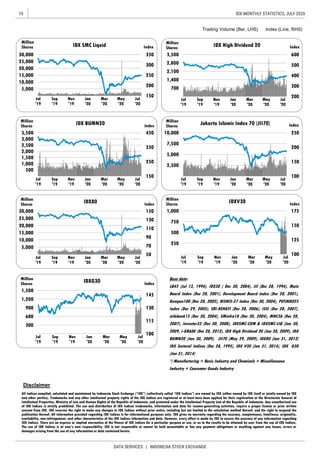

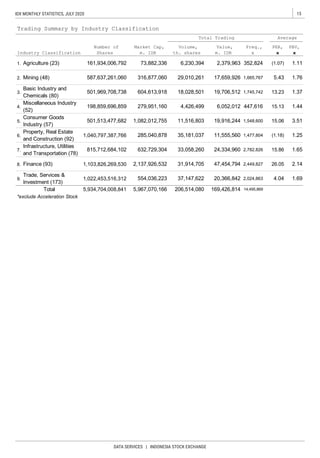

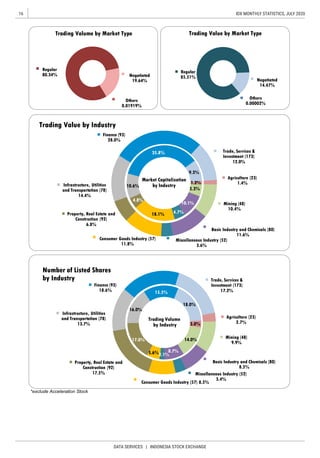

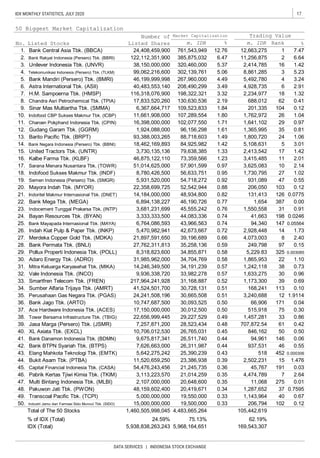

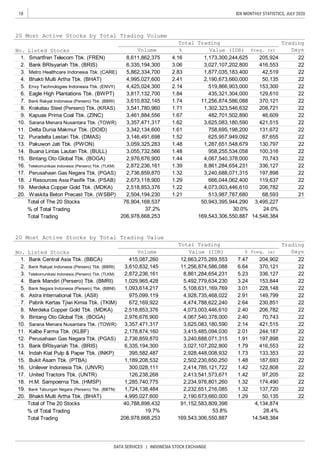

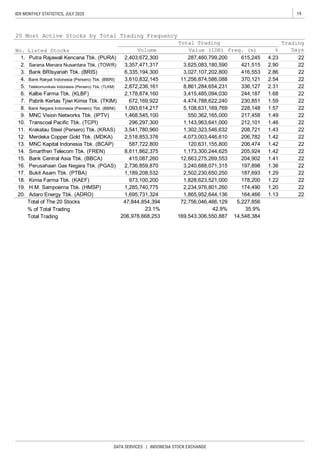

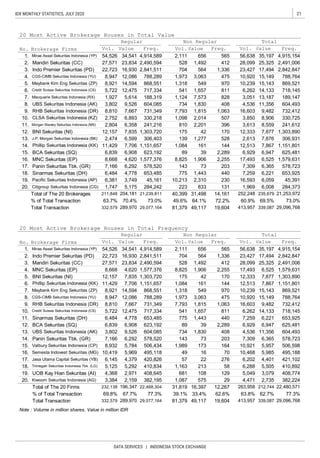

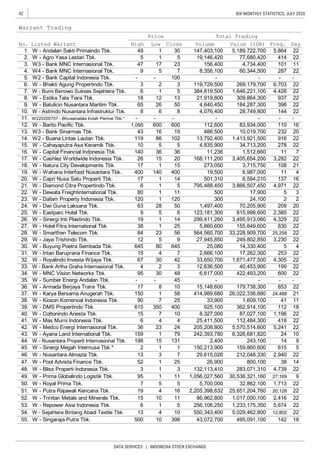

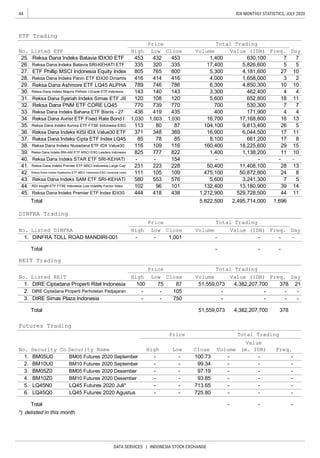

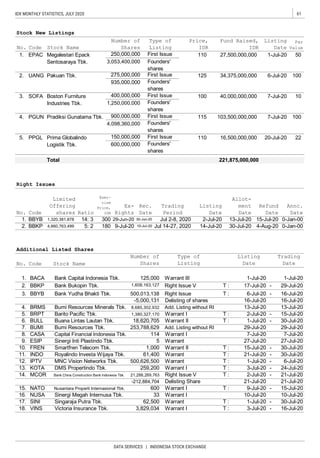

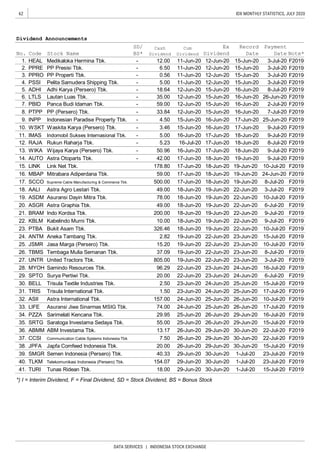

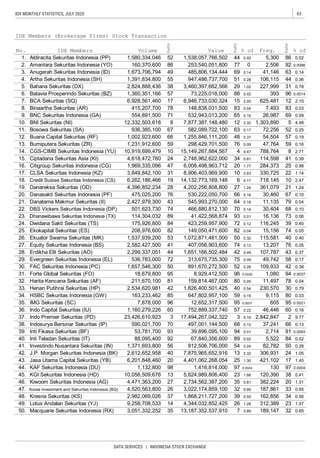

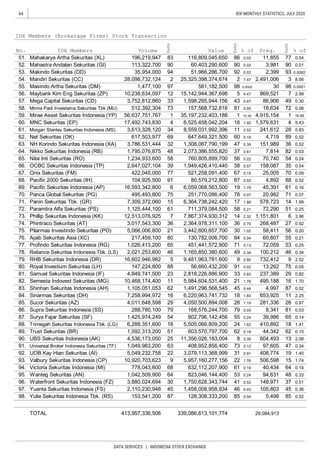

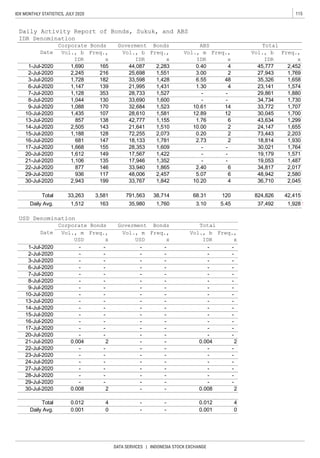

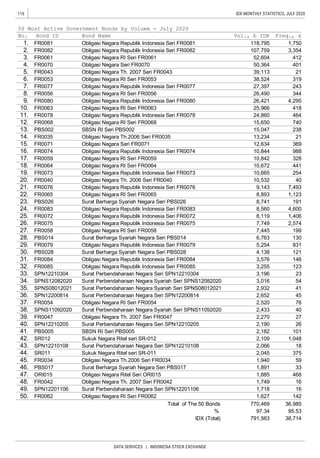

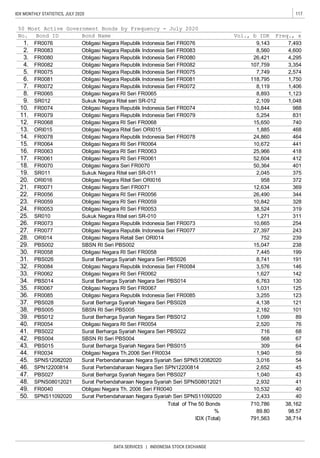

The document is the Indonesia Stock Exchange's (IDX) Monthly Statistics report for July 2020. It provides statistical highlights and indices performance summaries for the month. The IDX Composite Index rose 6.56% in July while trading volume increased 13.26% from the previous month. Most sectoral indices also increased except for the Infrastructure, Utility & Transportation Index which fell 15.26%. The report also includes rankings of the top 20 most active stocks and brokerage houses for the month by various trading metrics.

![20

DATA SERVICES | INDONESIA STOCK EXCHANGE

IDX MONTHLY STATISTICS, JULY 2020

0

Note: the closing price of the last month is an IPO price if the company listed in this month

* Adjusted price if there are any corporate actions

68 68 50 1.00 -18 -26.47

5,125 5,125 3,790 1.00 -1,335 -26.05

19.

20.

Mahaka Radio Integra Tbk. (MARI)

Duta Pertiwi Tbk. [S] (DUTI)

107 107 78 1.00 -29 -27.10

100 100 73 1.00 -27 -27.00

166 166 119 1.00 -47 -28.31

505 505 366 1.00 -139 -27.52

870 870 615 1.00 -255 -29.31

5,900 5,900 4,190 1.00 -1,710 -28.98

155 155 108 1.00 -47 -30.32

5,800 5,800 4,100 1.00 -1,700 -29.31

185 185 124 1.00 -61 -32.97

112 112 77 1.00 -35 -31.25

1,490 1,490 990 1.00 -500 -33.56

430 430 288 1.00 -142 -33.02

160 160 104 1.00 -56 -35.00

368 368 240 1.00 -128 -34.78

1,440 1,440 845 1.00 -595 -41.32

90 90 54 1.00 -36 -40.00

198 198 76 1.00 -122 -61.62

545 545 270 1.00 -275 -50.46

Sitara Propertindo Tbk. [S] (TARA)

Maming Enam Sembilan Mineral Tbk. [S] (AKSI)

Indonesian Tobacco Tbk. (ITIC)

Menteng Heritage Realty Tbk. [S] (HRME)

Ayana Land International Tbk. (NASA)

Andalan Sakti Primaindo Tbk. [S] (ASPI)

Citra Marga Nusaphala Persada Tbk. [S] (CMNP)

Arkha Jayanti Persada Tbk. (ARKA)

Capitol Nusantara Indonesia Tbk. [S] (CANI)

Jasnita Telekomindo Tbk. [S] (JAST)

Kresna Graha Investama Tbk. [S] (KREN)

Maskapai Reasuransi Indonesia Tbk. (MREI)

Anabatic Technologies Tbk. (ATIC)

Pollux Properti Indonesia Tbk. [S] (POLL)

Indosterling Technomedia Tbk. [S] (TECH)

Jaya Bersama Indo Tbk. [S] (DUCK)

Diamond Citra Propertindo Tbk. [S] (DADA)

Boston Furniture Industries Tbk. [S] (SOFA)

10.

11.

12.

13.

14.

15.

16.

17.

18.

1.

2.

3.

4.

5.

6.

7.

8.

9.

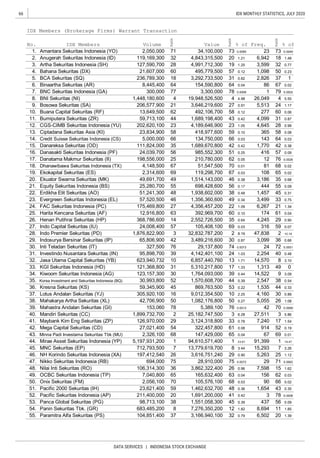

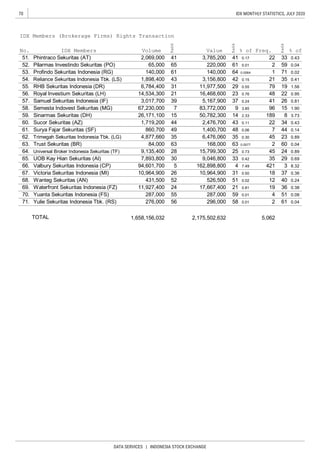

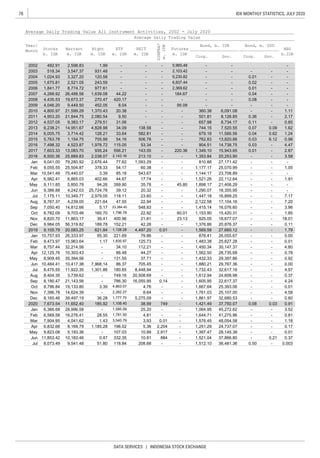

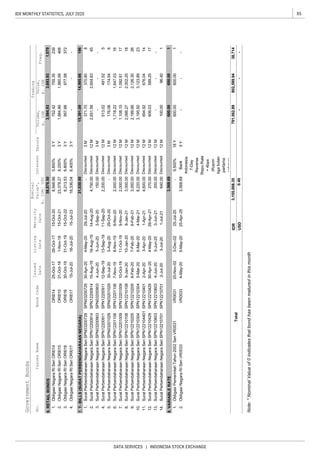

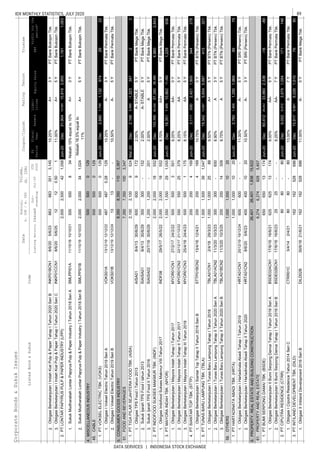

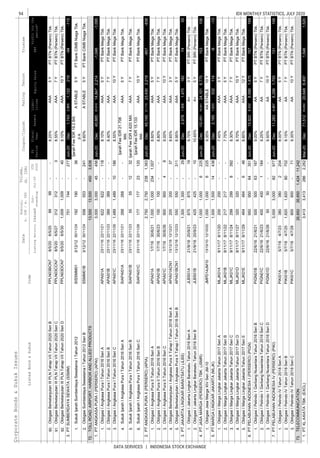

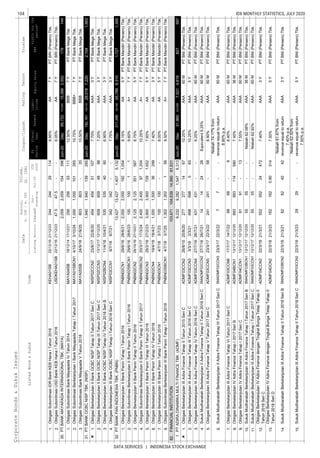

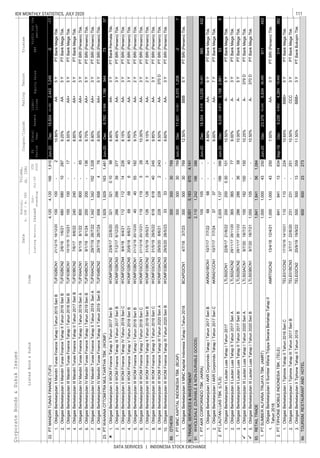

Top 20 Loser Stocks

No. Listed Stocks

Closing Price Dilu-

tion

Factors

Change

Last

Month

Last

Month*

This

Month Price %

80

Listed Stocks

Last

Month

Last

Month*

This

Month

Closing Price Dilu-

tion

Factors

Change

Price %

308

185

79

96

50

366

354

2,280

228

2,250

680

925

414

260

155

470

216

136

122

810

480

110

515

230

232

1,485

865

196

915

406

540

320

130

Bank IBK Indonesia Tbk. (AGRS)

Ginting Jaya Energi Tbk. [S] (WOWS)

115

125

985

110

1,120

344

470

216

136

122

810

480

110

515

230

308

185

79

96

50

Bank Rakyat Indonesia Agroniaga Tbk. (AGRO)

Argo Pantes Tbk. (ARGO)

Pelat Timah Nusantara Tbk. (NIKL)

Prima Globalindo Logistik Tbk. [S] (PPGL)

Pudjiadi & Sons Tbk. [S] (PNSE)

Tifa Finance Tbk. (TIFA)

Bank BRIsyariah Tbk. [S] (BRIS)

Wismilak Inti Makmur Tbk. (WIIM)

Bank Harda Internasional Tbk. (BBHI)

Pradiksi Gunatama Tbk. (PGUN)

Pakuan Tbk. (UANG)

Indofarma Tbk. [S] (INAF)

Megalestari Epack Sentosaraya Tbk. [S] (EPAC)

Kimia Farma Tbk. [S] (KAEF)

Intanwijaya Internasional Tbk. [S] (INCI)

Mark Dynamics Indonesia Tbk. [S] (MARK)

Prima Cakrawala Abadi Tbk. [S] (PCAR)

Delta Dunia Makmur Tbk. (DOID)

6.

7.

8.

18.

19.

20.

9.

10.

11.

12.

13.

14.

15.

16.

17.

Top 20 Gainer Stocks

115

125

985

110

1,120

No.

1.

2.

3.

4.

5.

218.26

183.20

131.47

107.27

100.89

344

1.00

1.00

1.00

1.00

1.00

1.00

1.00

1.00

1.00

1.00

1.00

1.00

1.00

1.00

1.00

1.00

1.00

1.00

+251

+229

+1,295

+118

+1,130

+336

+455

+198

+124

+110

+675

+385

+86

+400

+176

+232

+135

+51

+59

+30

1.00

1.00

97.67

96.81

91.67

91.18

61.46

60.00

90.16

83.33

80.21

78.18

77.67

76.52

75.32

72.97

64.56](https://image.slidesharecdn.com/7idxmonthlystatisticsjuli2020-201227101938/85/7-idx-monthly-statistics-juli-2020-24-320.jpg)

![23IDX MONTHLY STATISTICS, JULY 2020

DATA SERVICES | INDONESIA STOCK EXCHANGE

1

1

2

1

1

2

1

2

1

1

1

2

1

2

1

2

1

1

2

1

1

2

1

1

2

2

2

2

1

1

1

1

2

1

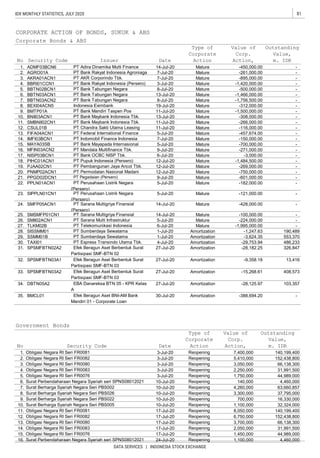

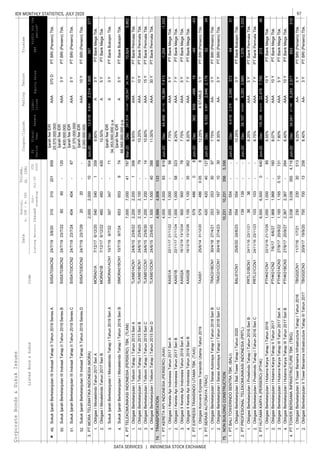

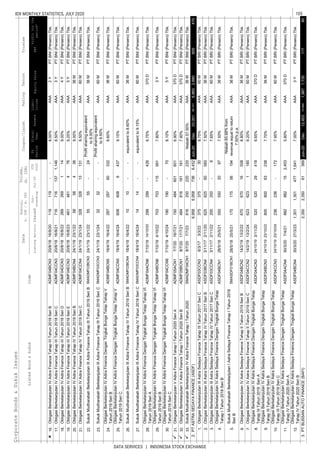

UNSPBakrieSumateraPlantationsTbk.596707/215707/106107/30

ANIMALHUSBANDRY

BEEFEstikaTataTiaraTbk.[S]22224207/0919907/3020007/30

FISHERY

DSFIDharmaSamuderaFishingIndustriesTbk.[S]707507/086207/216607/30

COALMINING

22329,378278,2463,95522

07/30

11.GEMSGoldenEnergyMinesTbk.[S]2,550----2,55003/24102.00015,000--------

10.FIREAlfaEnergiInvestamaTbk.[S]11217107/2410007/0312407/3026.600183284,81339,81034,33222284,81339,81034,33222

9.DSSADianSwastatikaSentosaTbk.[S]19,42522,50007/0318,70007/0120,87507/171,391.66716,085142983771012,337387

8.DOIDDeltaDuniaMakmurTbk.13629607/2813207/0126007/30360.1212,2413,269,752744,221131,667223,342,135758,695131,67222

7.DEWADarmaHenwaTbk.[S]505007/295007/295007/2916.4961,0931,441723615677,70044,9026720

6.BYANBayanResourcesTbk.[S]12,52514,00007/0611,77507/1613,22507/30225.43144,083931,177384223,25641,66338522

5.BUMIBumiResourcesTbk.505007/305007/305007/302.9023,370205,70610,2852,134221,311,58082,9912,26022

4.BSSRBaramultiSuksessaranaTbk.[S]1,4551,44007/091,25007/221,33007/3068.4623,4803774944262137749442621

3.BOSSBorneoOlahSaranaSuksesTbk.[S]829507/097607/228007/3020.000112207,67217,37816,96322217,67218,40516,97222

2.ARIIAtlasResourcesTbk.[S]53059007/0644807/2148207/3033.3331,446470233247222,9701,59624822

1.ADROAdaroEnergyTbk.[S]9951,18007/1599007/011,08507/3098.63634,7051,653,9051,820,206164,403221,695,7311,865,953164,46622

1.61.17637795,37020,67312,4052295,37020,67312,40522

1412320,6321,4213,28020,6321,4213,280

21176,4597,882,5856,805,159736,4979,815,538

1.38.70012320,6321,4213,2802220,6321,4213,28022

2.316,87724,412,71616,763,0121,664,87729,010,26117,659,9261,665,767

7,057,583736,819

76.7093,3834,5488,8231,164224,5488,8231,16422

17.SIMPSalimIvomasPratamaTbk.[S]25433807/27

95,37020,67312,405

18.1,007.7318,6171464692972114646929721

19.124.6277,81124,54319,9323,942

20.2.94415312,5447751,40422302,43422,4111,40722

1337795,37020,67312,405

SMARSMARTTbk.[S]3,1303,40007/152,95007/103,000

SSMS

10,46118

15.PSGOPalmaSerasihTbk.9812007/249507/0311507/3097.1432,1688,576925815228,57692581522

25007/0132207/3029.4555,093323,33698,69925,94822323,33698,69925,94822

14.PGUN*PradiksiGunatamaTbk.11550507/1415507/0736607/30321.7391,82955,57322,02810,4551855,60222,034

16.SGROSampoernaAgroTbk.2,0802,10007/061,78007/271,79007/30

60,3947,55922

13.PALMProvidentAgroTbk.[S]19126807/2718007/1724007/3065.5971,70910,5872,2721,9612212,5872,6421,96222

12.MGROMahkotaGroupTbk.[S]69078507/3066507/0878007/30333.3332,77268,85048,3367,47622102,254

832,14986,06922

11.MAGPMultiAgroGemilangPlantationTbk.[S]505007/295007/295007/2945.4554501095161010951610

10.LSIPPPLondonSumatraIndonesiaTbk.[S]8301,03007/2782007/0199007/30255.4846,755869,774829,87486,05022872,121

1,45743820

9.JAWAJayaAgraWattieTbk.687307/206307/306307/3013.0002381,954131185191,95413118519

8.GZCOGozcoPlantationsTbk.[S]505207/205007/305007/3026.57930017,5028804362029,034

29,2776,51222

7.GOLLGoldenPlantationTbk.50----5002/2717.361183--------

6.DSNGDharmaSatyaNusantaraTbk.36037407/3033207/1436607/3097.2973,88081,92428,7766,5102283,349

435,321129,61022

5.CSRACisadaneSawitRayaTbk.[S]23434407/2122007/0331207/30244.80064089,51625,77814,3102289,52625,78014,31122

4.BWPTEagleHighPlantationsTbk.8912807/278807/0111907/3026.4643,7523,811,664434,674129,607223,817,133

48865007/2747807/0159507/3048.7501,9963642201962136422019621

221,14662213,233221,12454110,811468

1.AALIAstraAgroLestariTbk.[S]8,22510,22507/308,25007/019,70007/30788.00318,66957,155526,39743,7052257,442

22

12PLANTATION70,8635,449,4772,049,535335,6016,103,1262,348,636335,771

125.00007/305007/305007/305050AndiraAgroTbk.[S]ANDI2.

1.BISIBisiInternationalTbk.[S]82587507/3080007/1684007/30407.5002,5204,2803,5121,3642211,266

529,03043,72022

3.ANJTAustindoNusantaraJayaTbk.[S]

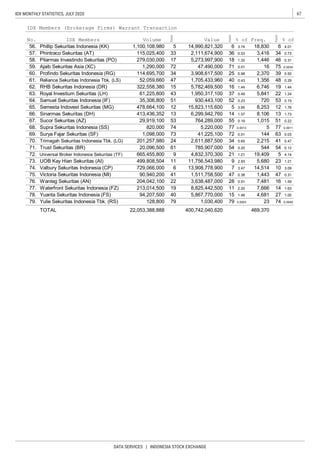

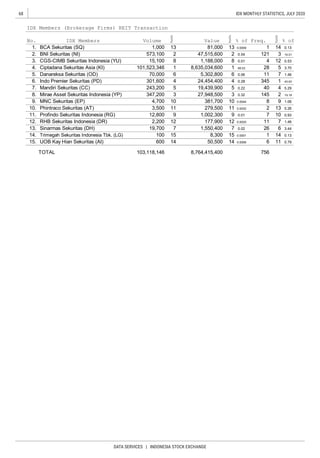

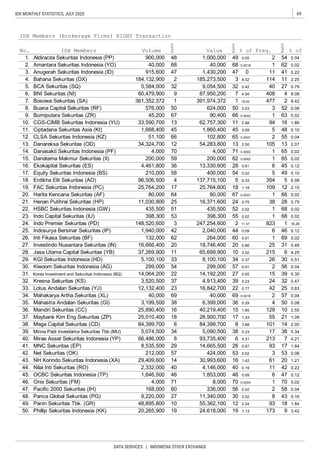

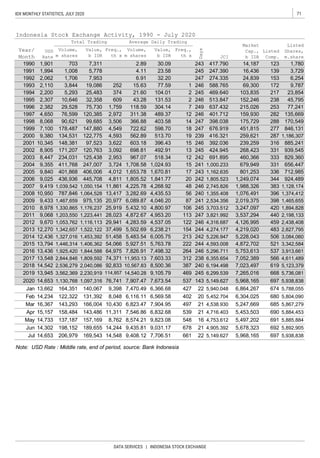

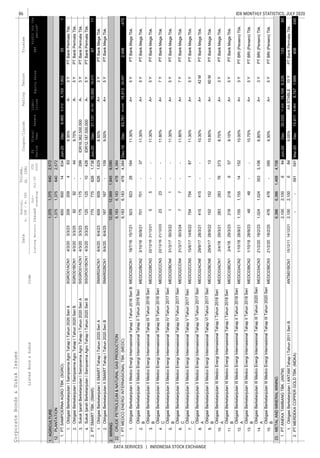

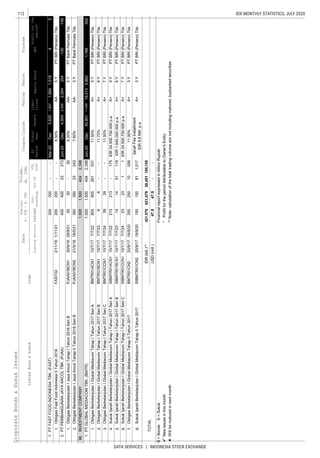

TableTradingbyIndustry

IndustryClassification/StockName

Board

PriceIndivi-

dual

Index

Market

Cap.,

b.IDR

RegularMarketTotalMarket

Prev.

9,2341,368

1.AGRICULTURE73,8825,569,7582,075,141352,6506,230,3942,379,963352,824

11CROPS2,5204,2803,5121,36411,266

Freq.,

xDays

Volume,

th.share

Value,

m.IDR

Freq.,

x

Days

Volume,

th.share

Value,

m.IDRHighDateLowDateCloseDate

9,2341,368

SawitSumbermasSaranaTbk.78086007/2076007/0182007/30

MINING](https://image.slidesharecdn.com/7idxmonthlystatisticsjuli2020-201227101938/85/7-idx-monthly-statistics-juli-2020-27-320.jpg)

![24

DATA SERVICES | INDONESIA STOCK EXCHANGE

IDX MONTHLY STATISTICS, JULY 2020

TableTradingbyIndustry

IndustryClassification/StockName

Board

PriceIndivi-

dual

Index

Market

Cap.,

b.IDR

RegularMarketTotalMarket

Prev.

Freq.,

xDays

Volume,

th.share

Value,

m.IDR

Freq.,

x

Days

Volume,

th.share

Value,

m.IDRHighDateLowDateCloseDate

2

1

1

1

1

2

1

1

1

2

2

1

1

2

1

2

1

2

1

2

2

2

2

2

2

1

2

2

2

2

2

1

2

2

1

2

2

TRAMTradaAlamMineraTbk.[S]50----5003/31

CRUDEPETROLEUM&NATURALGASPRODUCTION

243

16,48122

14918

APEXApexindoPratamaDutaTbk.20223007/0115407/2916507/30

419

TOBATobaBaraSejahtraTbk.[S]35436007/0132407/2934607/3073.0142,785698

156117

10.398.5755,660894,297609,37068,236221,077,652829,14968,33622

3.604,61415,540,57017,584,3851,745,06118,028,50119,706,5121,745,742

1.2.10562309156117309

246230915613091561

11.484.831

TINSTimahTbk.59579507/2958507/0176007/30

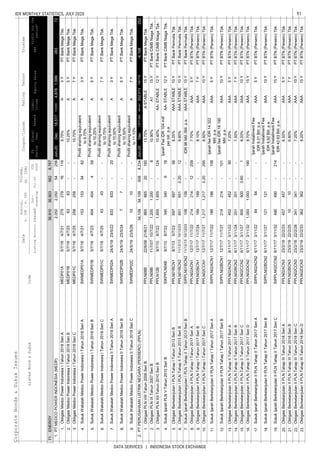

BASICINDUSTRYANDCHEMICALS

3.CITACitaMineralInvestindoTbk.[S]1,8002,00007/301,65007/231,99007/307,257.4217,8811632907118179319

4.CKRACakraMineralTbk.76--7603/31

9.882.4586,8802,657,819662,224119,635222,673,119666,044

MDKAMerdekaCopperGoldTbk.[S]1,3651,96507/281,35007/031,79007/30

33.830388----11811

26,132

6.102.273956101431491810143

7.INCOValeIndonesiaTbk.[S]2,8003,59007/282,77007/01

5.

8.469.37139,1972,408,9873,907,013206,677222,518,8534,073,003

IFSHIfishdecoTbk.[S]42045007/2939007/0845007/29

3,42007/301,387.75533,982504,3141,619,662101,69622508,1391,633,275

DKFTCentralOmegaResourcesTbk.[S]9814307/249307/0212607/30331.364710217,70626,10616,48022217,906

12.19.1111981,061,98397,47455,883221,067,21197,73655,88822

BumiResourcesMineralsTbk.[S]505007/305007/305007/307.8743,550149,6797,4841,278221,486,71285,8881,323

1.481.30817,5422,134,3141,451,617146,649222,229,8601,532,653146,75722

2.BRMS22

ANTMAnekaTambangTbk.[S]60575507/2859007/0273007/30

10.RUISRadiantUtamaInterinscoTbk.[S]16617507/1616207/3016207/3066.000125274469920274469920

9,329,219707,898

8.MTFNCapitalincInvestmentTbk.[S]505007/295007/295007/291.2661,59210.07141468,0753652116

9.12.5003147,8322,8193,1912047,8322,819

23120,434

3,19120

12,046,4618,713,179707,42014,174,524

11.1,883.871

7.MITIMitraInvestindoTbk.51----5103/314.30572--------

6.MEDCMedcoEnergiInternasionalTbk.45250007/1644807/0146407/30810.1878,3151,622,013766,44989,754221,630,276

5.ENRGEnergiMegaPersadaTbk.[S]525307/225007/305007/304.169517221,88411,3694,89322370,29025,0264,91722

4.ELSAElnusaTbk.[S]22025207/1321807/0122807/3057.5001,6641,526,113366,00266,225221,526,262

3.BIPIAstrindoNusantaraInfrastrukturTbk.505007/305007/305007/3035.7142,2351,5577811822174,1609,87914122

2.ARTIRatuPrabuEnergiTbk.[S]50--5003/2312.251392----133,80554

21.SMMTGoldenEagleEnergyTbk.[S]8310207/206607/088507/30210.55626816,4921,4442,7812216,4921,4442,78122

22.12.227625------

1.10.5634391,669312692221,669

24.41.3242,482-

2219,9224,483,3621,244,659220,8995,019,8911,273,108220,989

23.

SMRUSMRUtamaTbk.[S]50----5003/31

17722

20.PTROPetroseaTbk.[S]1,3202,01007/301,32007/011,97007/301,528.0001,98743,99975,23015,7332243,99975,23015,73322

19.PTBABukitAsamTbk.[S]2,0202,20007/141,99507/012,03007/301,800.00023,3871,181,6852,486,723187,652221,189,2092,502,231187,69322

18.MYOHSamindoResourcesTbk.[S]1,0151,15007/291,00007/101,13507/30136.3792,5042,7642,949765222,7642,94976622

17.MBAPMitrabaraAdiperdanaTbk.[S]1,6251,95007/171,63007/081,77007/30134.6152,1724,2817,5293,026224,2817,5293,02622

16.KKGIResourceAlamIndonesiaTbk.[S]20422207/2818807/1520807/30722.8071,0401,785364416221,78536441622

15.ITMGIndoTambangrayaMegahTbk.[S]7,1008,35007/287,05007/017,90007/3056.4298,92695,230734,77364,1122296,065742,25064,14222

14.INDYIndikaEnergyTbk.6701,08507/2465007/0198007/3034.4075,106892,088838,646104,97222895,947842,307104,98322

13.HRUMHarumEnergyTbk.[S]1,1901,29007/091,17007/161,18007/3022.6923,19018,99423,0596,1102219,11423,2016,11122

12.GTBOGardaTujuhBuanaTbk.[S]828607/077407/137507/1465.217188326251248326251248

--

-------

9,2213,20917822

PSABJResourcesAsiaPasifikTbk.17630807/2817707/0726007/30

3,6873,079,083429,37146,549223,461,885482,702

CTTHCitatahTbk.[S]505107/305007/305007/30

07/30

LAND/STONEQUARRYING

366,04066,22722

770,35889,77722

31269222

206,78222

7418

4,343371083010371093110SURESuperEnergyTbk.2,9302,95007/212,88007/272,90007/30

PKPKPerdanaKaryaPerkasaTbk.507007/205007/305107/30

WOWSGintingJayaEnergiTbk.[S]5011607/215007/138007/30

METALANDMINERALMINING

ZINCKapuasPrimaCoalTbk.[S]14115007/3013207/0814646,60922

119,63722

11

101,74922](https://image.slidesharecdn.com/7idxmonthlystatisticsjuli2020-201227101938/85/7-idx-monthly-statistics-juli-2020-28-320.jpg)

![25IDX MONTHLY STATISTICS, JULY 2020

DATA SERVICES | INDONESIA STOCK EXCHANGE

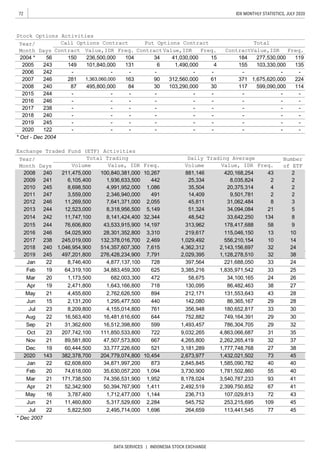

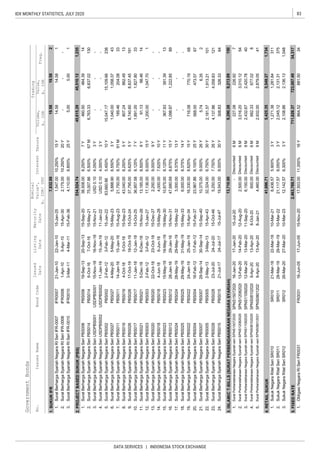

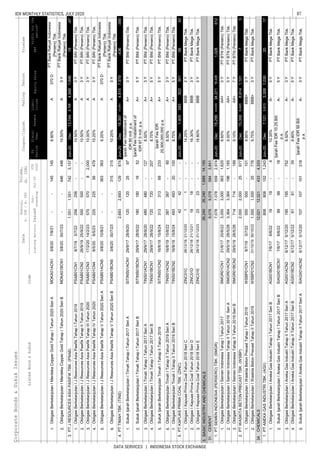

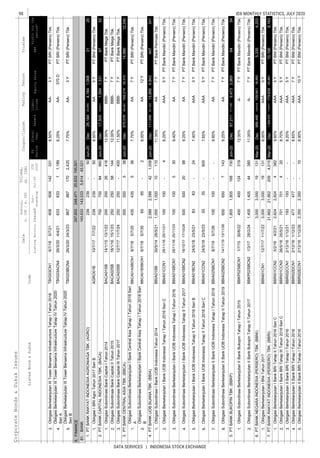

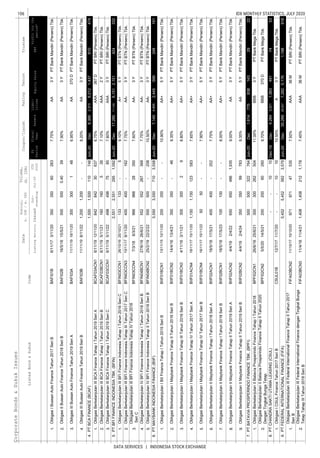

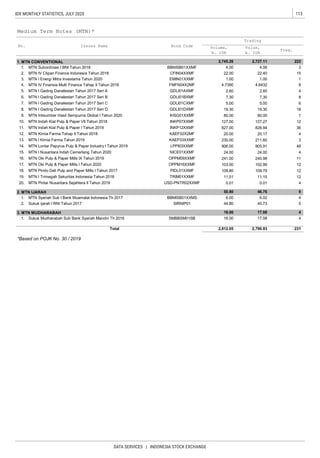

TableTradingbyIndustry

IndustryClassification/StockName

Board

PriceIndivi-

dual

Index

Market

Cap.,

b.IDR

RegularMarketTotalMarket

Prev.

Freq.,

xDays

Volume,

th.share

Value,

m.IDR

Freq.,

x

Days

Volume,

th.share

Value,

m.IDRHighDateLowDateCloseDate

1

1

1

1

1

1

1

1

2

2

1

2

2

2

2

2

2

1

2

2

2

1

2

1

1

2

1

2

1

2

1

1

1

1

1

1

1

07/30

LIONLionMetalWorksTbk.[S]32049807/0629807/0134007/30

22007/30

METALANDALLIEDPRODUCTS

348

378

PelatTimahNusantaraTbk.4801,13007/2447607/0286507/30

7.ETWAEterindoWahanatamaTbk.788007/206707/227207/306.012701,06375134201,0637513420

6.ESSASuryaEsaPerkasaTbk.15417507/2315307/0215507/30299.7522,21754,5728,9374,74622291,57256,6544,75822

5.EKADEkadharmaInternationalTbk.[S]1,0351,38007/211,03007/011,23507/303,135.15486316,71420,74210,5152216,71420,74210,51622

4.DPNSDutaPertiwiNusantaraTbk.[S]24031807/1522807/0824007/3079.9277926270105172627010517

3.BRPTBaritoPacificTbk.[S]1,1601,31007/1588507/3095007/30371.48688,7191,539,4721,740,791141,445221,593,7401,800,720141,52822

2.AGIIAnekaGasIndustriTbk.[S]53061507/0352507/2754507/3049.5451,67114,3138,4432,4162216,3139,6332,41722

1.ADMGPolychemIndonesiaTbk.[S]10113407/2910007/2411507/3010.97944782,6919,7257,5282282,6919,7257,52822

15.30.30810719,5374,1034,6902245,7269,3454,69422

16922620

34231,8862,030,9552,466,628219,1382,859,8992,778,220219,294

17.89.36222227016922620270

PURETrinitanMetalsandMineralsTbk.12312907/0210507/1710907/30

13.LMSHLionmeshPrimaTbk.[S]30232007/1525007/3025007/3034.72224541610219541610219

17,77216,32922

11.KRASKrakatauSteel(Persero)Tbk.27642407/2927207/0338007/3047.9887,3523,540,2631,301,761208,711223,541,7811,302,324208,72122

12.227.97217760122433221601224

16.39.000145152,14517,69416,32422152,650

14.266.1542,183734,236

10.JKSWJakartaKyoeiSteelWorksTbk.60----6003/319.2319--------

9.ISSPSteelPipeIndustryofIndonesiaTbk.12414707/1512107/0112907/3044.746927159,60521,25812,35522160,14821,33012,35822

8.INAIIndalAluminiumIndustryTbk.33438007/2132407/0235807/30129.2442274181472412241814724122

7.GGRPGunungRajaPaksiTbk.[S]27430007/2225207/0827607/3035.0003,3434131122652241311226522

6.GDSTGunawanDianjayaSteelTbk.[S]606507/155407/295807/3037.50053646,2242,8124,6002246,2242,8124,60022

5.CTBNCitraTubindoTbk.[S]2,450----2,45006/122,047.6391,961--------

4.BTONBetonjayaManunggalTbk.[S]19020407/1317407/0618007/30627.8601303,561667838223,56166783822

3.BAJASaranacentralBajatamaTbk.587407/305107/295907/3022.00010616,2861,0071,8042216,2861,0071,80422

3317,7584,674,5961,915,771360,6864,703,3511,921,726360,708

7.700.6842,2701,703378713221,703

2.ALMIAlumindoLightMetalIndustryTbk.22826007/2120007/2120607/3032.9231279682062382196820623821

1.ALKAAlakasaIndustrindoTbk.[S]43043007/0836007/3036007/3063.300183166

71422

634816

TOTOSuryaTotoIndonesiaTbk.[S]220

6.92.693734129,21972,6086,22222129,26972,6366,22322

2.ARNAArwanaCitramuliaTbk.[S]38245007/2036407/1342207/302,881.8053,09836,00514,7273,59122103,54340,0053,60022

3.

4.1.8187461,9489867691,9739867710

5.1,880.0003,515318,257236,57343,21222344,082256,72643,21622

704

KIASKeramikaIndonesiaAssosiasiTbk.[S]505407/235007/295007/29

5.40.6125,2462,486,767510,40368,577212,504,194513,98868,59321

6.

22

3211,596492,459327,35655,579585,898372,81655,595

1.AMFGAsahimasFlatGlassTbk.3,3003,30007/012,48007/072,70007/30

CAKKCahayaputraAsaKeramikTbk.[S]505107/275007/305007/3029.762604,309215704224,309215

48.1362,388494,913147,114

1,0192,75846121

34,450

116.7351,1721,0192,758

1.INTPIndocementTunggalPrakarsaTbk.[S]11,80012,70007/2811,40007/0112,37507/30496.00045,55592,6351,119,28862,57922128,7861,550,55862,63322

31120,6495,103,0513,453,918364,6265,174,652

4.3,297.02854,71883,601797,24149,1272297,519931,08949,19622

SMBRSemenBaturaja(Persero)Tbk.[S]30863007/2430407/0149207/302.91.0714,8871,943,060877,698148,547221,944,503878,359148,56022

3.SMCB

4,024,329364,793

PICOPelangiIndahCanindoTbk.[S]22825007/0118407/1718807/30

MARKMarkDynamicsIndonesiaTbk.[S]470

CEMENT

46121

WTONWijayaKaryaBetonTbk.[S]28232407/0927407/3027407/30

CERAMICS,GLASS,PORCELAIN

22

SolusiBangunIndonesiaTbk.1,0801,12007/0199507/301,02507/301,219.8077,8542,0772,1741,360222,3772,478

34,43622497,273147,855

1,36122

SMGRSemenIndonesia(Persero)Tbk.9,62510,15007/079,15007/279,22507/30

WSBPWaskitaBetonPrecastTbk.[S]19622007/0919407/0119907/29

MLIAMuliaIndustrindoTbk.[S]53561507/1653007/0155507/30

95007/2946807/01925

23407/0921407/29

33221

565,589109,92622734,236565,589109,92622NIKL

TBMSTembagaMuliaSemananTbk.[S]68570007/0260007/2260507/30

CHEMICALS](https://image.slidesharecdn.com/7idxmonthlystatisticsjuli2020-201227101938/85/7-idx-monthly-statistics-juli-2020-29-320.jpg)

![26

DATA SERVICES | INDONESIA STOCK EXCHANGE

IDX MONTHLY STATISTICS, JULY 2020

TableTradingbyIndustry

IndustryClassification/StockName

Board

PriceIndivi-

dual

Index

Market

Cap.,

b.IDR

RegularMarketTotalMarket

Prev.

Freq.,

xDays

Volume,

th.share

Value,

m.IDR

Freq.,

x

Days

Volume,

th.share

Value,

m.IDRHighDateLowDateCloseDate

1

2

2

1

1

1

2

1

2

1

2

2

2

2

1

2

1

1

1

2

1

2

1

1

1

1

2

1

2

1

1

2

1

1

2

2

2

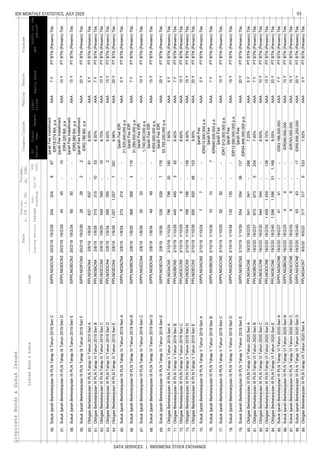

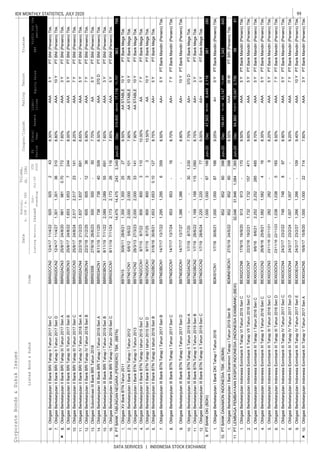

MAINMalindoFeedmillTbk.[S]58570507/2356507/0261007/30

WOODINDUSTRIES

SULISLJGlobalTbk.505007/305007/305007/30

PULP&PAPER

UNICUnggulIndahCahayaTbk.[S]3,3504,13007/303,35007/033,70007/30

PLASTICS&PACKAGING

JPFAJapfaComfeedIndonesiaTbk.[S]1,1851,26007/031,05507/301,06007/30

SINISingarajaPutraTbk.[S]52572007/2750007/0252007/30

INKPIndahKiatPulp&PaperTbk.5,9758,250133,28622395,582

9.615434------

07/225,85007/017,80007/30

507

SRSNIndoAcidatamaTbk.[S]556307/30

34473007/2735607/0168007/30

EPAC*MegalestariEpackSentosarayaTbk.[S]11033607/14148

TIRTTirtaMahakamResourcesTbk.535407/21

TPIAChandraAsriPetrochemicalTbk.[S]6,575

5207/28

37407/07420

07/30177.778264

5407/036007/30

CPROCentralProteinaPrimaTbk.505007/305007/305007/30

MOLI

8,628

IPOLIndopolySwakarsaIndustryTbk.[S]727607/216707/027107/30

07/29

INCIIntanwijayaInternasionalTbk.[S]

07/21

5007/23

460505

5,70722

1,416

2,777,436278,3962,565,6422,918,209278,553

07/0815707/30

21

10,930994

138,241

8742210,930994

483,856146,144

449

4.7.7661,0629476921594769215

5.

6.195.000308634505502225,2813,75851022

-

INRUTobaPulpLestariTbk.[S]83007/2976507/29

KedawungSetiaIndustrialTbk.[S]74095007/0672507/0176007/30

4.23.77153780408515780408515

3884,087968,2966,448,858373,0431,103,8137,410,846373,146

2,928,448133,35322

3.0.7141991,9269630171,9269630

1.291.6974291,08643455191,3595276019

2.1,604.18017,34533240321033FASW

3.404.49942,674300,4772,211,119

371,75798,23613,9769,478102,83116,3899,479

5.1.1561,3934194288819419

2.509.25923516393227224,7582,50522822

1.126.6671,27195,36713,7489,1362213,7489,13622

4288919SIPDSieradProduceTbk.[S]1,0501,10007/0897007/221,04007/30

4.372.1591,366412,437262,61250,37722412,622262,73550,38222

3.302.07812,430813,643944,699119,10822816,596948,158

12.59.74731914333118181433311818

13.232.6411,0951505817459,20725,7186411

14.

2.45.4552,9792871430191,067,668

36120,2451,483,439

1.

6621

108,88722

65,785

28,237.009102,078256,654

61322

22

10.105.8821,6503,9963,4861,7372234,08429,4811,74022

11.99.48263993716621921937166219

1,569,683108,79322268,3381,641,102

9.34.286457

5,5756,600CPINCharoenPokphandIndonesiaTbk.[S]07/075,52507/016,22507/30

TRSTTriasSentosaTbk.[S]38639807/2138007/2139007/23

ANIMALFEED

5.ESIPSinergiIntiPlastindoTbk.[S]16223407/3016007/0223407/30131.288150177,11035,76828,07222177,11035,76828,07222

19,4991,50922

YanaprimaHastapersadaTbk.[S]YPAS8718

226,2096,2094491,416

84007/2488007/30

07/30

TALFTunasAlfinTbk.25629407/0321007/1623607/29

7.

PBIDPancaBudiIdamanTbk.[S]86595507/28

9507/018907/309107/30

3,415911613223,415911

3.BRNABerlinaTbk.[S]1,0151,12507/1493007/3093007/30697.77991154451980145445198014

4.214.545753385,039111,64544,09122518,684

8.331.5796,11415,43419,4991,5092215,434

6.27.906FPNILotteChemicalTitanTbk.[S]93

07/0122807/30

IMPCImpackPratamaIndustriTbk.[S]1,2401,28007/221,24007/021,26507/30

22

87422

IGARChampionPacificIndonesiaTbk.[S]25629607/2125207/02272

2.APLIAsiaplastIndustriesTbk.[S]10513407/218907/0311707/30101.66715921424282212142428221

1.AKPIArghaKaryaPrimaIndustryTbk.[S]31443007/2228007/2929207/3037.726199132439114132911443

14.1,641.941130,63194,040652,51731,4112299,319688,01231,42022

13.40.35194490,1058,3746,2942290,1056,294228,374

3513,499604,277173,60779,206827,068251,85779,258

15.145.9221,41834

7,50007/246,45007/017,32507/30

8.73.54613311,9237,0536,5652211,9347,056

12.11.292361118,4086,9785,70422148,408

10.155.1722,1014664101901622,53122,06319316

11.

6,56622

9.MDKIEmdekiUtamaTbk.[S]13816707/23127

296.6671,8355,5362,1891,458221,50022

-

10

95,367

1207317347317120

ALDOAlkindoNaratamaTbk.[S]36640007/2735807/1739007/30

KBRIKertasBasukiRachmatIndonesiaTbk.50----5003/30

24032FajarSuryaWisesaTbk.[S]7,1507,30007/287,00007/307,00007/30

77.064281261187182611

35.3373971,356203554221,356204

44,093

119,12922

17

87007/16765

22

SAMFSaraswantiAnugerahMakmurTbk.[S]34843007/0234807/01358

MadusariMurniIndahTbk.1,0101,03007/0276007/2990007/30

555

TDPMTridomainPerformanceMaterialsTbk.[S]959907/018807/309007/30

SMKLSatyamitraKemasLestariTbk.18119207/2916207/07188

07/30

IFIIIndonesiaFibreboardIndustryTbk.[S]16315707/0312307/2113507/30

KDSI](https://image.slidesharecdn.com/7idxmonthlystatisticsjuli2020-201227101938/85/7-idx-monthly-statistics-juli-2020-30-320.jpg)

![27IDX MONTHLY STATISTICS, JULY 2020

DATA SERVICES | INDONESIA STOCK EXCHANGE

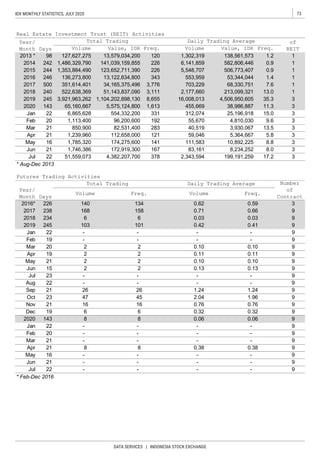

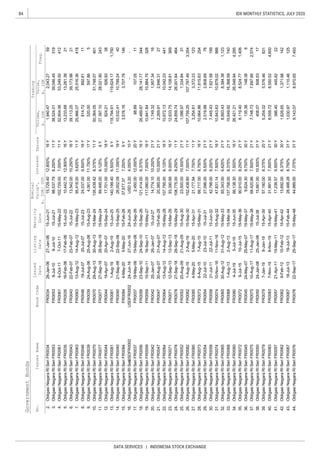

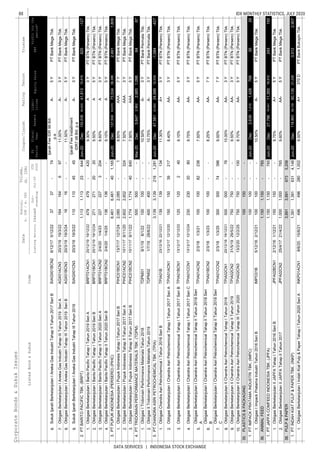

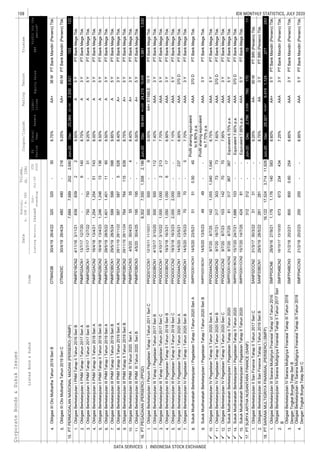

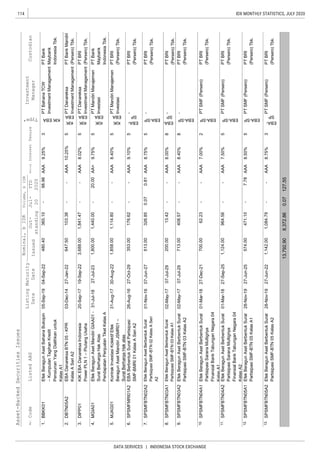

TableTradingbyIndustry

IndustryClassification/StockName

Board

PriceIndivi-

dual

Index

Market

Cap.,

b.IDR

RegularMarketTotalMarket

Prev.

Freq.,

xDays

Volume,

th.share

Value,

m.IDR

Freq.,

x

Days

Volume,

th.share

Value,

m.IDRHighDateLowDateCloseDate

1

2

1

2

2

2

2

2

1

1

2

1

1

2

1

1

1

1

1

2

1

2

1

1

2

2

2

2

2

1

1

1

1

1

2

2

TEXTILE,GARMENT

30029807/0121807/2826007/30

KMTRKiranaMegataraTbk.23832007/3023007/0631607/30

MISCELLANEOUSINDUSTRY

MACHINERYANDHEAVYEQUIPMENT

KPALSteadfastMarineTbk.717707/175907/296207/30

AUTOMOTIVEANDCOMPONENTS

PRASPrimaAlloySteelUniversalTbk.14315107/2110407/1611907/30

SWATSriwahanaAdityakartaTbk.[S]9510207/069207/019507/30

OTHERS

POLUGoldenFlowerTbk[S]8401,13007/03

NIPSNipressTbk.282----28203/31

POLY

GMFIGarudaMaintenanceFacilityAeroAsiaTbk.[S]839407/168107/238407/30

SPMASuparmaTbk.[S]26626807/0324007/2725207/30

490.0001,08817,19912,2894,48822

25007/30

418

73507/0290007/30

129,647

21

22

426.6215,3721,9851,131252

INDRIndo-RamaSyntheticsTbk.[S]2,2002,450

AsiaPacificFibersTbk.505007/305007/305007/30

---25003/27

07/1524807/30

PBRXPanBrothersTbk.

2,054

21

100,85523,498

11.329.861675424011921424011921

12.0.4291251,32966102211,32966

10.442.4781,62010,6132,7781,0672229,4108,1591,08022

8.321.8901,5649992,245429229992,24542922

9.MYTXAsiaPacificInvestamaTbk.505807/215007/285407/307.96670937135227093713522

07/241,98007/022,39007/30

07/2707/03234280286

7.18.924432--------PanasiaIndoResourcesTbk.[S]120----12003/31

4.

5.47.96014753663270225366327022

6.ESTIEverShineTexTbk.51

CNTXCenturyTextileIndustry(PS)Tbk.26026207/15226

22

HDTX

17112274216112450.909

ERTXEratexDjajaTbk.14214007/0210407/1611407/30

6607/155007/3050

43

4216

1.ARGOArgoPantesTbk.8101,49507/2980007/071,48507/3037.437498893113893113

2.BELLTrisulaTextileIndustriesTbk.[S]69576007/2768507/1075007/30

3.CNTBCenturyTextileIndustry(SeriB)Tbk.250-

27

17,19912,2894,48822

100.00033--------

21,5321,070,750228,660124,8751,538,818292,572124,943

13.SMSMSelamatSempurnaTbk.[S]1,0501,34507/301,04007/061,28507/303,485.6707,40095,492110,06637,6492296,965111,61337,650

10.

11.205.234461-------

211,9851,131252

831,282150298211,28215029812.69.808

MASAMultistradaArahSaranaTbk.[S]58062007/2053007/0858507/30

8.203.4371,4047401,637681217401,63768121

7.IMASIndomobilSuksesInternasionalTbk.65574007/2261007/0165007/3089.2771,797149,604100,78723,49422149,704

9.LPINMultiPrimaSejahteraTbk.[S]23827007/1022007/0623607/30108.5611004461052082144610520821

INDSIndospringTbk.[S]1,9852,42007/031,94007/032,14007/30

22

6.

247,061

3.157.2732,0046755772712675

1,525,97642

96007/2383507/01870

GJTLGajahTunggalTbk.[S]38463007/2937007/02540

5,15007/30

113.8681,882262,457129,15025,69122263,65707/30

07/214,77007/08ASIIAstraInternationalTbk.[S]4,8005,450

07/30

2.

5.172.36446020939

122.03457626188

3.

34,939

39

31,7518,9788,97822

178,244

4,7855,337

5.1,160.00059547867613317478

342984.BRAMIndoKordsaTbk.[S]6,1506,15007/015,32507/175,32507/17207.2432,3966342986

67613317

22

12209

07/1428807/14

5,3362269,185

12

22

3.68.1222,5961,155334383191,155334383

4.

41

47010,6802,6488282230,7667,935835

3,764247,84320,30414,896247,843

07/30782.3104,19334,93931,751

21.2502,372178,24415,3879,171

1.3,629.225208,490741,7403,761,643149,621

2.AUTOAstraOtopartsTbk.[S]885

236,1791,289,8444,137,706

4.

1.AMINAteliersMecaniquesD'IndonesieTbk.[S]26432007/1424007/16268

9.431.25221,014636,6814,233,477230,82922672,1704,474,789230,85122

39

1.42.2767273,4283,8523,69817

3,13885,2636,8344,909105,34812,1214,916

3,69817

2.98.40022

INCFIndoKomoditiKorporaTbk.505907/205007/305007/30

TKIMPabrikKertasTjiwiKimiaTbk.5,1507,42507/095,10007/016,75007/30

INOVInocycleTechnologyGroupTbk.

8.59.37528728,0162,6877,9262228,0162,6877,92622

7.32132222321110.2745331,274320

73,4283,852

22

19

9,17122

1569261881569

22

25,69822

-

21

22

35194

55.6526669,1854,785

GDYRGoodyearIndonesiaTbk.[S]1,4001,70007/241,36007/131,45007/30

279,9513,268,7224,527,535447,3124,426,4996,052,012447,616

195.3132891333519407/30

KRAHGrandKartechTbk.50052507/0140007/21

07/30855

47407/23

20,30414,897

149,799

15,387

22

5772712BOLTGarudaMetalindoTbk.[S]97093507/02

1,278

4,928,735

22133

5,306,912247,251

22975,099

ARKAArkhaJayantiPersadaTbk.43046007/01288

810

102

07/3020.08010116,3479962,0542216,347996](https://image.slidesharecdn.com/7idxmonthlystatisticsjuli2020-201227101938/85/7-idx-monthly-statistics-juli-2020-31-320.jpg)

![28

DATA SERVICES | INDONESIA STOCK EXCHANGE

IDX MONTHLY STATISTICS, JULY 2020

TableTradingbyIndustry

IndustryClassification/StockName

Board

PriceIndivi-

dual

Index

Market

Cap.,

b.IDR

RegularMarketTotalMarket

Prev.

Freq.,

xDays

Volume,

th.share

Value,

m.IDR

Freq.,

x

Days

Volume,

th.share

Value,

m.IDRHighDateLowDateCloseDate

1

2

1

2

1

2

2

1

2

2

1

2

2

2

2

1

2

1

1

1

1

2

2

1

1

2

1

1

1

1

2

1

1

2

1

1

FOODANDBEVERAGES

UNITNusantaraIntiCorporaTbk.[S]15116607/1313907/1715907/30

FOOTWEAR

BATASepatuBataTbk.[S]55560007/3053007/1560007/30

CABLE

SCCOSupremeCableManufacturing&CommerceTbk.[S]9,1009,95007/289,00007/019,80007/30

JSKYSkyEnergyIndonesiaTbk.[S]888807/097507/297807/30

20807/16

07/10

22

07/3019707/30

DLTADeltaDjakartaTbk.5,1005,00007/144,74007/304,74007/30

ELECTRONICS

TRISTrisulaInternationalTbk.[S]21223207/0719207/0622007/30

ZONEMegaPerintisTbk.[S]41842207/0840807/2141607/30

KBLIKMIWireandCableTbk.[S]39447007/0737007/30

UCID

KBLMKabelindoMurniTbk.[S]224234

2,518

394,645

2,9362218,0614,5292,93622

14348

RICYRickyPutraGlobalindoTbk.[S]949707/029007/309207/30

BIMAPrimarindoAsiaInfrastructureTbk.505007/3050

113

3303122062,5188,01031620

31007/30

66,95322

07/2051507/302,282.6096,180293,145144,81334,87722

07/2392507/27

07/10117

74507/09

DMNDDiamondFoodIndonesiaTbk.[S]940965

86.66776105,93613,0057,26222105,93613,0057,26322

13.GOODGarudafoodPutraPutriJayaTbk.[S]1,3001,36507/301,27507/081,34007/30103.1139,8894,9456,4343,34322

14.209.6771,623258,257171,69619,24322278,527184,87119,24522

154,945126,434

07/3064007/2868007/30

FOODSentraFoodIndonesiaTbk.[S]140145

11.103.8258,8064654416232246544162322

12.

49.3204059,274820

7.CEKAWilmarCahayaIndonesiaTbk.[S]1,9952,10007/021,77507/301,80007/30392.5621,0714,0457,891

192,01034,881

2,581224,0507,9002,582

22

9.409.0914541,206955479209,9978,95548220

10.28,692.6893,7952111,021488222111,02148822

COCOWahanaInterfoodNusantaraTbk.[S]840860

8.CLEO

1.ADESAkashaWiraInternationalTbk.[S]8651,05007/2984007/0899007/3051.9485842,4532,2661,777222,4532,266

22

3.ALTOTriBanyanTirtaTbk.38640007/2030407/2734007/30170.8677455318591753185917

4.BTEKBumiTeknokulturaUnggulTbk.[S]505007/29

941229,27482094122

6.61.8181,1598,3411,7002,163228,3411,7002,16322

5.BUDI

2.AISATigaPilarSejahteraFoodTbk.168----16801/3020.448804--------

5007/295007/29383.0832,314693321511,3294543616

869507/228407/149007/30

51321,7751,637,2984,279,118388,4262,990,5696,292,354388,886

5.1,082,0139,372,43116,926,8691,547,75311,516,80319,916,2441,548,600CONSUMERGOODSINDUSTRY

1.39.500159347,84028,65322,53322369,04032,22222,54422

4611,525563,616105,30846,597584,818108,87646,609

3.4,456.52210,2506,25232,3601,483226,25232,3601,48322

2.112.7591,116209,52344,29422,58122209,52544,29522,58222PTSNSatNusapersadaTbk.[S]18524407/2817607/1521007/30

SLISGayaAbadiSempurnaTbk.

7.85.8168234,360871597224,36087159722

6.6,322.5812,0151371,296205211,65520821

VOKSVokselElectricTbk.[S]19121007/2418907/3019807/30

300,1548,10622

15,608

38007/30

07/0121407/3022007/305.7.3332468,7321,9731,709228,7321,9731,70922

4.48.1171,52364,75426,6768,07622495,612

2301974816223019

20.102.6676,40125,56638,2167,5532230,92846,3337,560

JECCJemboCableCompanyTbk.[S]6,9506,90007/096,32507/216,80007/21

20521

07/3050

Uni-CharmIndonesiaTbk[S]1,3951,55007/141,39007/011,54007/30

21807/30

22

07/02

3.515.3661,028852124852124

2.19.58926751211320521512

2.12.2863022114112211411

1.7,392.99678083471292283

323,30013,773

1.98.40024018,0614,529

456,14296,56335,51013,740528,939

4712922

07/30

127.451672

6236311062363110

4481010548143105

21.3.8231217226131201722613120

22.139.5973621,727719487221,72771948722

18.69.7971,4954110841108

19.73.333691748162

TFCOTificoFiberIndonesiaTbk.[S]

SBATSejahteraBintangAbadiTextileTbk.10115807/309407/1015807/30143.810336298,37233,21366,91122682,27575,945

17.

13.14.9295960657220226065722022

14.

15.82.5004,009693,083137,35040,25322693,087137,35140,25522

16.143.529779

SRILSriRejekiIsmanTbk.

07/30

IKBISumiIndoKabelTbk.[S]226240

SSTMSunsonTextileManufacturerTbk.[S]50072007/0257007/3066507/30

StarPetrochemTbk.[S]14014407/0311807/2914007/30

38035807/0630807/24

STAR

197CAMPCampinaIceCreamIndustryTbk.[S]20621207/13

07/0211107/30

5,0755,50007/025,02507/215,12507/30

1,77722

81007/30

BudiStarch&SweetenerTbk.[S]

46656507/29444

HOKIBuyungPoetraSembadaTbk.[S]660715

93007/30

SarigunaPrimatirtaTbk.[S]

3,355

18820807/1618607/0119607/30

CCSICommunicationCableSystemsIndonesiaTbk[S]24828407/2724007/30240](https://image.slidesharecdn.com/7idxmonthlystatisticsjuli2020-201227101938/85/7-idx-monthly-statistics-juli-2020-32-320.jpg)

![29IDX MONTHLY STATISTICS, JULY 2020

DATA SERVICES | INDONESIA STOCK EXCHANGE

TableTradingbyIndustry

IndustryClassification/StockName

Board

PriceIndivi-

dual

Index

Market

Cap.,

b.IDR

RegularMarketTotalMarket

Prev.

Freq.,

xDays

Volume,

th.share

Value,

m.IDR

Freq.,

x

Days

Volume,

th.share

Value,

m.IDRHighDateLowDateCloseDate

1

2

2

1

2

1

1

2

2

2

1

2

2

2

1

1

1

1

2

1

1

1

1

1

1

2

1

2

2

1

1

1

2

1

1

1

1

ULTJUltraJayaMilkIndustry&TradingCompanyTbk.[S]1,6501,67507/011,59507/301,62507/30

TOBACCOMANUFACTURERS

WIIMWismilakIntiMakmurTbk.18532807/3017807/0732007/30

PHARMACEUTICALS

TSPCTempoScanPacificTbk.[S]1,3901,70507/231,35507/281,38007/30

TCIDMandomIndonesiaTbk.[S]7,5007,50007/086,72507/306,72507/30

1,455

SCPIMerckSharpDohmePharmaTbk.[S]29,000----29,00003/31

07/3023,953

6007/017207/30

MERKMerckTbk.[S]2,7504,45007/17

07/012,28007/30

638607/14

COSMETICSANDHOUSEHOLD

UNVRUnileverIndonesiaTbk.[S]7,9008,40007/307,75007/018,40007/30

RMBABentoelInternasionalInvestamaTbk.24026807/1622007/2823607/30

SIDOIndustriJamudanFarmasiSidoMunculTbk.[S]1,2151,31507/301,18007/071,30007/30

SKLTSekarLautTbk.[S]1,6101,610

890

--

ICBPIndofoodCBPSuksesMakmurTbk.[S]9,3509,65007/17

STTPSiantarTopTbk.[S]8,0009,00007/077,45007/017,95007/29

ITICIndonesianTobaccoTbk.1,4401,50007/0161007/27

HMSPH.M.SampoernaTbk.1,6451,90007/171,62007/011,70507/30

PYFAPyridamFarmaTbk.[S]6101,57507/2458007/01

MRATMustikaRatuTbk.[S]12817807/2212507/0214507/30

-

15,3277,4832222,163

304,5362,678,8733,891,976343,7052,704,810

3810

18719

9,55622

343,832

15,41422

5003/31

ROTINipponIndosariCorpindoTbk.[S]1,1901,26507/131,180

736011871973

IIKPIntiAgriResourcesTbk.[S]50----

07/221,610

6.211,213.518320,460272,9362,198,534122,69322300,0282,414,785122,80822

5.686.5981,3522071,492328212071,49232821

553,219967,144368,21866,096984,431372,62366,101HOUSEWARE

4.23.077626,4641,0291,635226,4641,0291,63522

3.9.595773,904279384223,90427938422

2.30.9523831,6741,7203,2632231,6741,7203,26422

MBTOMartinaBertoTbk.[S]

KPASCottonindoAriestaTbk.[S]506407/155007/305007/30

1.87.6324,74319,88967,6326,3432220,30169,0206,34722

9.218.96619,500154,506192,27944,35522166,306206,79444,36922

8.227.451104-----

54326,733335,0752,270,687134,646362,5792,488,326134,766

10.246.1826,21015,29022,1117,48222

---

KINOKinoIndonesiaTbk.[S]3,4503,660

4.14,873.69673,3602,083,4503,269,049244,099222,178,8743,415,485244,18722

5.9,781.9501,6406,18823,2578,685226,20823,3118,68622

50,81211,32722

7.935.907476114,397124,57923,94622725,642597,700

6.119.7831,22229,52050,76211,3192229,559

KLBFKalbeFarmaTbk.[S]1,4601,695

22

07/211,45007/171,56507/30

2,74007/013,66007/30

07/30PEHAPhaprosTbk.[S]1,3102,38007/241,06507/08

5.43.6926721,333,143349,80276,831221,333,218349,82176,83222

53124,6733,743,0256,114,266612,2134,463,3986,751,527612,348

3.2,220.00012,497971,3621,825,738178,18722973,1001,828,624178,200

4.1,877.9348,59157313427422573134274

1.853.9712,5981,9654,4512,144221,9654,4512,144

2.

DVLADarya-VariaLaboratoriaTbk.[S]2,1802,45007/222,15007/202,32007/30

IndofarmaTbk.[S]985

3.411.36479551,60851,86429,1262256,98257,88329,127

1.1,937.56196,15626,6301,287,44463,0482228,2971,365,99563,10922

2.8,611.222198,3221,266,9202,202,732174,426221,285,7412,234,977174,49022

22

GGRMGudangGaramTbk.

84507/30

47,17550,60007/1646,50007/0749,97507/30

29.161.6763,900118,21579,57915,41322118,23579,593

30.3,111.91318,774135,443217,0519,285221,120,4451,793,529

4,008,810

26.194.783483441138104411

601

52

74507/2755007/0173007/30

07/221,61007/22

TBLATunasBaruLampungTbk.555

24.10.00014455642105564210

25.480.3927,64010,78013,1553,9792223,24128,420

28.4,697.749

27.134.7911,1121222

PSDNPrasidhaAnekaNiagaTbk.13213607/019907/1710007/21

10,415

SKBMSekarBumiTbk.[S]32232207/0121007/3028007/30

22

22

12

3,981

22.53.704241,41084541221,4108454122

23.241.33348359221040413592210

21.MYORMayoraIndahTbk.[S]2,2602,37007/302,18007/142,35007/3011,755.87852,54363,963143,93527,1422291,248

PANIPratamaAbadiNusaIndustriTbk.[S]597407/075507/025807/30

40413

206,05027,17622

PCARPrimaCakrawalaAbadiTbk.[S]21644007/2818607/1541407/30

17.595.833562174,939109,94934,11822174,939109,94934,11822

18.

MLBIMultiBintangIndonesiaTbk.10,02510,05007/029,50007/279,80007/3062,420.38220,6499849,751953221,11611,068

19.138.0001,5388,9649,5263,6152226,82229,1683,62622

20.

1,095.53456,634254,3871,675,060112,81522262,8971,730,795112,87022

95522

INDFIndofoodSuksesMakmurTbk.[S]6,5256,80007/226,35007/296,45007/30

IKANEraMandiriCemerlangTbk.

16.95.9731,680-----

15.338.276107,290179,0501,669,135106,02422189,226

07/24980

1,23507/30

49875507/2946207/08

9,20007/30

INAF

67507/30

22

KEJUMuliaBogaRayaTbk.[S]8801,13007/2187507/011,02507/30

3,33007/241,09507/012,25007/30KAEFKimiaFarmaTbk.[S]1,120

9,00007/28

07/06

07/023,25007/243,32007/30

2,930

1,762,972106,081

22

844.0007,066366,347602,04091,99622366,417602,18891,999

22

22

22](https://image.slidesharecdn.com/7idxmonthlystatisticsjuli2020-201227101938/85/7-idx-monthly-statistics-juli-2020-33-320.jpg)

![30

DATA SERVICES | INDONESIA STOCK EXCHANGE

IDX MONTHLY STATISTICS, JULY 2020

TableTradingbyIndustry

IndustryClassification/StockName

Board

PriceIndivi-

dual

Index

Market

Cap.,

b.IDR

RegularMarketTotalMarket

Prev.

Freq.,

xDays

Volume,

th.share

Value,

m.IDR

Freq.,

x

Days

Volume,

th.share

Value,

m.IDRHighDateLowDateCloseDate

2

2

1

2

3

1

1

1

1

2

2

1

1

2

2

2

1

2

2

2

1

1

1

2

2

1

2

1

1

1

2

1

2

2

1

1

2

1

SOFA*BostonFurnitureIndustriesTbk.10012107/087107/287307/30

HRTAHartadinataAbadiTbk.[S]21227407/2719807/0123407/30

PROPERTY,REALESTATEANDBUILDINGCONSTRUCTION

PROPERTYANDREALESTATE

16

LMPILanggengMakmurIndustriTbk.[S]828407/227507/208207/29

07/3025427007/24

KICIKedaungIndahCanTbk.[S]18727607/2318607/0225007/29

WOODIntegraIndocabinetTbk.[S]39244807/15

GPRAPerdanaGapuraprimaTbk.[S]5156

20.701352

CINTChitoseInternasionalTbk.[S]

07/24

5007/3021.99921489,5374,596

GowaMakassarTourismDevelopmentTbk.[S]16,97517,97507/2417,97507/2417,97550.7013

2,4542289,5414,5962,45522

30.GMTD3,126.0871,825

31.07/205007/30

29.47.61950180.3914111,411,19269,4602816GAMAGadingDevelopmentTbk.[S]505007/305007/305007/30

28.FORZForzaLandIndonesiaTbk.505007/305007/305007/3022.7279935235217473621

27.FMIIFortuneMateIndonesiaTbk.[S]80074507/2374507/2374507/23745.0002,02710.822110.8221

26.EMDEMegapolitanDevelopmentsTbk.20220207/2918807/2920207/2980.8006771092235953,689

25.ELTYBakrielandDevelopmentTbk.[S]505007/305007/305007/3010.3082,17658629351845,9311,1287320

24.DUTIDutaPertiwiTbk.[S]5,1256,47507/163,79007/303,79007/30388.2137,0121,3977,7352,108203,46717,9912,116

23.DMASPuradeltaLestariTbk.[S]17224207/2916407/0822007/30111.42910,6043,074,534611,28687,642223,146,492625,95887,65522

22.DILDIntilandDevelopmentTbk.[S]18819507/0317607/2417907/3031.0181,85565,24611,8343,83022185,14440,4563,88122

21.DARTDutaAnggadaRealtyTbk.28027007/0120007/2221607/3041.779679159346913159346913

20.DADADiamondCitraPropertindoTbk.[S]10711007/157707/307807/3080.3925601,970,229187,61678,692221,970,22922187,61678,692

19.CTRACiputraDevelopmentTbk.[S]61068507/0960007/0165507/30146.65112,157967,734626,77773,031221,038,278671,08873,08322

18.CPRICapriNusaSatuPropertiTbk.505007/305007/305007/3040.0001221397441713974517

17.COWLCowellDevelopmentTbk.505007/135007/135007/1338.462244100.512251132

16.CITYNaturaCityDevelopmentsTbk.[S]525507/305007/215307/3045.8332861,62684347191,6438534819

15.BSDEBumiSerpongDamaiTbk.[S]74079507/0967007/2169007/30140.05714,6081,061,729784,73863,300221,085,961802,59963,34722

14.BKSLSentulCityTbk.[S]505007/305007/305007/303.4553,354115,9385,79786622143,2266,94388822

13.BKDPBukitDarmoPropertyTbk.[S]596407/215007/305007/3041.6673761,942102401201,94210240120

12.BIPPBhuwanatalaIndahPermaiTbk.[S]508007/305007/017107/3025.4383577,8974511,120227,8974511,12022

11.BIKABinakaryaJayaAbadiTbk.18719807/1616007/1319007/3018.90011310318234211031823421

10.BESTBekasiFajarIndustrialEstateTbk.[S]11413607/1611107/0212307/3073.5291,1871,048,127131,09035,098221,055,227132,01935,10522

9.BCIPBumiCitraPermaiTbk.[S]506107/175007/305007/3045.4557190,7534,9164,2502290,7534,9164,25022

8.BBSSBumiBenowoSuksesSejahteraTbk.[S]14715107/0712207/2912807/30107.500614169,26124,07425,24622208,88629,48225,26422

7.BAPIBhaktiAgungPropertindoTbk.[S]505007/305007/305007/3033.33328068134106229,66934913822

6.BAPABekasiAsriPemulaTbk.[S]505107/305007/305007/3033.33333145723914672410

5.ASRIAlamSuteraRealtyTbk.[S]12914107/1612207/3012307/30120.0002,4171,470,766193,04442,335221,471,767193,18942,33922

4.ASPIAndalanSaktiPrimaindoTbk.[S]36838007/0322607/2824007/30243.810163271,41079,87027,80222333,967100,00727,81222

3.ARMYArmidianKaryatamaTbk.[S]50----5003/2616.667450--------

2.APLNAgungPodomoroLandTbk.[S]11412407/1611007/0611707/3032.3292,656648,16976,11426,11722660,99877,56426,11922

1.AMANMakmurBerkahAmandaTbk.[S]19619707/0219507/3019607/30177.2737595,4351,063216225,6991,11521722

61241,46921,553,1285,541,773972,24028,240,4226,998,947973,171

6.285,04127,916,39210,018,5931,476,66635,181,03711,555,5601,477,804

1.80.6671,07811,0162,6052,6672211,0162,6052,66722

591,07811,0162,6052,66711,0162,6052,667

6.148.4622,396853,547345,22556,23122857,547346,84156,23222

3.53.0776917943148191794314819

37807/2938007/30

OTHERS

2.78.1822586951752432269517524322

5.73.000120152,59215,50524,58618152,92315,53824,60418

4.11.9658319315136191931513619

24007/17258

1.125.000413112,53022,7609,33822125,81825,5499,34222CBMFCahayaBintangMedanTbk.[S]20622807/0818607/1622007/30

20

10,7674212](https://image.slidesharecdn.com/7idxmonthlystatisticsjuli2020-201227101938/85/7-idx-monthly-statistics-juli-2020-34-320.jpg)

![31IDX MONTHLY STATISTICS, JULY 2020

DATA SERVICES | INDONESIA STOCK EXCHANGE

TableTradingbyIndustry

IndustryClassification/StockName

Board

PriceIndivi-

dual

Index

Market

Cap.,

b.IDR

RegularMarketTotalMarket

Prev.

Freq.,

xDays

Volume,

th.share

Value,

m.IDR

Freq.,

x

Days

Volume,

th.share

Value,

m.IDRHighDateLowDateCloseDate

1

2

2

1

2

1

1

2

2

1

1

2

1

2

2

2

1

2

2

2

2

1

2

1

1

2

1

2

1

1

1

1

1

2

2

2

2

2

2

1

1

SMRASummareconAgungTbk.[S]58566007/0356507/2060007/30

TARASitaraPropertindoTbk.[S]19819207/137607/307607/30

1,29570,080

07/30

07/27

CityRetailDevelopmentsTbk.15014807/30131

424

3,297

60422

07/2441207/30

KBAGKaryaBersamaAnugerahTbk.[S]39243007/1734207/2237407/30

2,85007/01

RODAPikkoLandDevelopmentTbk.[S]515207/175007/305007/30

JRPT

29207/07

33.333

RIMORimoInternationalLestariTbk.[S]50----5003/31

07/01

07/15

43,25618,1396,5642243,25618,1406,56522

INPPIndonesianParadisePropertyTbk.[S]650705

65115107/30INDORoyalindoInvestaWijayaTbk.[S]109214

6868911707/03907,257686604

10207/07

07/0210222

4,129871856

JayaRealPropertyTbk.[S]40845407/03404

07/305007/30

76,64022

205222220522

30,17122

2,254--------

73

07/30

26135007/295007/29

20,379

75

5003/31

22

22

LPKRLippoKarawaciTbk.[S]171172

2,84522

-

16,37314,988

07/30668.29334,8561,0615,2303,296221,0615,230

22

---

62,77829,508222,368,455569,73629,51822

105.427768----

230

22

50

22007/2823407/28

22

15

18421

251051717,749

423

07/0739007/29

-

12

19,17015,9585,54222

MPROMahaPropertiIndonesiaTbk.880

22

15,9585,54322

1,352,53677,66223,230121,354,93677,831

423,221

19,170

51520

7912,30007/282,70007/30

50

789907/177407/297707/30

POSA

07/3032.308

21,5201,025

224,912

---642------

226,208

822,50676,626221,376,302837,392

50

14

65.50.0003321,811,90892,545

70.

8,09622815

47723022

96

RISEJayaSuksesMakmurSentosaTbk.[S]46049007/1539007/30

68.79.8346806,208311444

62.1,634.604PWONPakuwonJatiTbk.[S]416438

64.65

22396,768132,7813,86222

REALRepowerAsiaIndonesiaTbk.[S]525807/075007/305007/3030,168221,904,413

3,059,3251,287,652130,797

63.15.9941335732613573

6514813

22

8

97,319

311444

07/1640407/13

60.108.1083,0841,313,02068,11520,312221,526,61076,811

61.29.1867711827751511827

07/3059.

39007/3067.240.4913,8818,8864,0043,860

PUDPPudjiadiPrestigeTbk.[S]248

07/23

69.42.73563492741,08724

PPROPPPropertiTbk.[S]5055

20,4202,491,8181,051,320130,76222

50

07/29

RDTXRodaVivatexTbk.4,9505,35007/304,95007/105,35007/30266.0431,43813

BlissPropertiIndonesiaTbk.505007/30

22760143

419131773211317

58.POLLPolluxPropertiIndonesiaTbk.[S]5,9006,12507/034,00007/304,190

55.79.000241183,66415,45214,98622197,312

28151520250281POLIPolluxInvestasiInternasionalTbk.1,2151,20007/151,06507/271,14007/30

51.40.00056-------

PLINPlazaIndonesiaRealtyTbk.[S]2,330

-

52.12016

50.

07/0619207/1419907/3051.249466113882161

54.15.132551---

53.80.455435760143423

----

07/2314807/30

270

56.1,004.1919,58533279118421332

NZIANusantaraAlmaziaTbk.[S]212240

PAMGBimaSaktiPertiwiTbk.[S]

90007/2783007/301071831

--

NIRO

57.66.0552,292250

55

44.

138821

45.MKPIMetropolitanKentjanaTbk.[S]15,80014,70007/2214,70007/2214,70007/22700.00013,93822883841,332125

46.MMLPMegaManunggalPropertyTbk.[S]18819607/2417807/14188

23,233

48.163.9682,985147567918148,35871,050370

49.MTSMMetroRealtyTbk.[S]220

47.677.2738,252

OMREIndonesiaPrimaPropertyTbk.[S]316----31606/26

MTLAMetropolitanLandTbk.[S]40440007/17340

41.LPCKLippoCikarangTbk.[S]85589007/0778007/2981507/3093.5802,184

42.

MDLNModernlandRealtyTbk.[S]626607/215007/065207/3015.432652

44.8859,784

MYRXHansonInternationalTbk.50--

07/0916507/2319807/30

43.MABAMargaAbhinayaAbadiTbk.50--5002/26

40.LCGP

7,064224,007143,08310,88322292,607186,24110,8882207/30

13807/30

36.378.0002,674

-

37.KIJAKawasanIndustriJababekaTbk.[S]14415907/3013607/0115907/304.8923,31130,8104,4362,94422947,774134,060

38.325.000

EurekaPrimaJakartaTbk.[S]-

3,07022

11403/3191.200

659,440262,58793,45622725,500288,08393,46022

86022

114-

1,032

KOTA

39.LANDTrimitraPropertindoTbk.21425807/0218607/2820407/3048.462570

DMSPropertindoTbk.[S]65067507/3061007/20670

35.396.1545,665

07/0757007/0370007/30

32,1545,2737,3522232,1545,2737,35222

34.666.6677,8273572372802035723728020

32.GWSAGreenwoodSejahteraTbk.[S]07/3043.6007967,257

33.130.000

139.0483,28523,0573,28411414154,15721,385

14,554

13,2252,84322130,36724,559

-34.0994,335---

66.27.451

5007/29

72.76.4157651,6412022231446,650

12.543

71.1,002.3008,6561,352,046

10507/088307/1410007/30

SATUKotaSatuPropertiTbk.505007/295007/2950

SMDMSuryamasDutamakmurTbk.

RBMSRistiaBintangMahkotasejatiTbk.[S]

680

13507/21

MYRXPHansonInternational(SeriB)Tbk.50----5003/31

90

21](https://image.slidesharecdn.com/7idxmonthlystatisticsjuli2020-201227101938/85/7-idx-monthly-statistics-juli-2020-35-320.jpg)

![32

DATA SERVICES | INDONESIA STOCK EXCHANGE

IDX MONTHLY STATISTICS, JULY 2020

TableTradingbyIndustry

IndustryClassification/StockName

Board

PriceIndivi-

dual

Index

Market

Cap.,

b.IDR

RegularMarketTotalMarket

Prev.

Freq.,

xDays

Volume,

th.share

Value,

m.IDR

Freq.,

x

Days

Volume,

th.share

Value,

m.IDRHighDateLowDateCloseDate

2

2

1

1

2

1

1

1

2

1

1

1

2

1

2

1

1

1

1

1

1

2

2

2

1

2

1

1

2

1

1

1

2

1

2

1

ENERGY

PGASPerusahaanGasNegaraTbk.[S]1,1351,28007/301,11007/031,26507/30

TOLLROAD,AIRPORT,HARBORANDALLIEDPRODUCTS

JSMRJasaMarga(Persero)Tbk.[S]4,4004,57007/033,90007/303,93007/30

TELECOMMUNICATION

BUILDINGCONSTRUCTION

WIKAWijayaKarya(Persero)Tbk.[S]1,2001,30007/151,15007/011,19007/30

POWRCikarangListrindoTbk.[S]58573007/2957007/2865507/30

07/30

07/295007/295007/29

URBNUrbanJakartaPropertindoTbk.[S]1,6051,60507/061,36507/301,36507/30

KOPIMitraEnergiPersadaTbk.[S]51052507/1349007/0850507/30

CASSCardigAeroServicesTbk.[S]18826007/3017907/2022007/30

504,6336,940,6154,556,613

METANusantaraInfrastructureTbk.[S]10511507/3010207/0111207/30

SSIASuryaSemestaInternusaTbk.[S]39040007/0336007/1737607/30

TAMA

PTPPPP(Persero)Tbk.[S]8701,07507/2485507/0197507/30

SKRNSuperkraneMitraUtamaTbk.[S]55067507/2852007/0162007/30

07/0164

RAJARukunRaharjaTbk.[S]10913107/2310707/0111907/30

KARWICTSIJasaPrimaTbk.[S]505907/2950

4,476,820504,426

71507/2965507/0671007/30

60,19327,234

3,72810,51522

44,04821,08922101,704

92,84631,16422

190,629

374,47612,344,90410,142,153705,46212,787,49411,254,621

07/305007/30

LancartamaSejatiTbk.16020007/2215007/2216407/30

07/066807/30

25.976786101,704

44,89022

8,242908908228,60094390922

1.BTELBakrieTelecomTbk.50----5003/3146.9131,841--------

7.127.8541,7999101,2805912

3.

13355018

6.33.6291,984

5.

73

4.235.28728,523151,030644,90857,43422165,406707,87357,49422

TEBEDanaBrataLuhurTbk.[S]1,5651,83007/081,29507/091,40007/27

705,823

44,04821,08922

124,287136,5016312

8.464292,531133549182,531

IPCCIndonesiaKendaraanTerminalTbk.[S]45045207/1441607/1443207/30

7237,165526,424753,381108,090664,535951,603108,156

8.34.50018784,2565,9638,32622100,166

22

2.CMNPCitraMargaNusaphalaPersadaTbk.[S]1,4901,50007/0798007/3099007/30100.4733,5851,5741,912817221,5741,91281722

1.54.000459260,43360,19327,234

7,0508,32822

22260,433

TGRATerregraAsiaEnergyTbk.[S]7979

5.410.00030,6662,659,4113,154,312197,805222,736,8603,240,688197,89822

4.26.000422,0731117362263,347738223,175

39,58822

7.415.636503350,85641,55223,71322350,85641,55223,71322

6.43.66710,537485,273302,33239,58022567,772351,565

1.87.8791,41548,16316,3402,4852248,36316,4022,48622

7143,9003,630,6643,520,930273,1193,868,0013,660,753273,226

3.LAPDLeyandInternationalTbk.[S]50----5006/2692.782198--------

2.127.8483526323194742263832247522

348398

7.632,72929,675,32122,351,4132,781,94033,058,26024,334,9602,782,826

18.178.1388,4841,374,133965,68991,733221,381,370970,95791,76422

17.309.72610,674789,576970,87393,91422796,749979,63593,94722

WSKTWaskitaKarya(Persero)Tbk.71075507/0362007/30625

INFRASTRUCTURE,UTILITIESANDTRANSPORTATION

16.68.6211,857937,369190,06644,88522939,869

15.108.5451,037273,12392,83831,16322273,141

14.TOPSTotalindoEkaPersadaTbk.[S]505007/305007/305007/3080.4751,6671,0725425120465,240

TOTLTotalBangunPersadaTbk.[S]32837807/1429607/3030407/30

WEGEWijayaKaryaBangunanGedungTbk.[S]19121807/0918707/0119407/30

13.93.71416451780613225178061322

12.155.8971,769601,133227,82633,44922601,623228,01733,45122

22,46428521

9.59.1671,06570487587048758PBSAParamitaBangunSaranaTbk.[S]

8.36.94177920,0197,1193,4182220,019

1,646,520134,46322

11.90.00093030,51118,6131,5772230,55118,6411,58022

10.188.9106,045

NRCANusaRayaCiptaTbk.[S]34838007/1430607/2731207/303,41822

655

7.131.892188--------

6.279.7625,8716,2332,1325672019,977

5.15.00037731,2405,8631,9642231,2405,8631,96422

JKONJayaKonstruksiManggalaPratamaTbk.[S]40041007/0831807/2336007/306,88257320

--24403/31

20222007/1615407/06188IDPRIndonesiaPondasiRayaTbk.[S]07/30

MTRAMitraPemudaTbk.[S]244--

1.11.84218651,13114,5768,3302295,46326,3698,33222

356,69047,56622

ACSTAcsetIndonusaTbk.[S]25631207/2225407/0226607/30

1243318

3.17.0006764,6303,72710,5142264,659

ADHIAdhiKarya(Persero)Tbk.[S]61069007/0360007/3060007/302.494.7662,137534,765342,36747,55522557,181

CSISCahayasaktiInvestindoSuksesTbk.[S]506807/165007/305107/30

DGIKNusaKonstruksiEnjiniringTbk.[S]5050

6243,5726,363,264

26607/30

4.22.22227729127174,789

73.134.0001,163423,548114,97829,63322423,548114,97829,63322

74.117.9174,4123,9696,074493227,63211,46649722

TRINPerintisTrinitiPropertiTbk.[S]27028807/2126207/30

07/30

7,119

1,647,7131,634,946134,391221,658,158

MPOWMegapowerMakmurTbk.556107/095107/305107/30

07/3030007/13386KEENKencanaEnergiLestariTbk.[S]](https://image.slidesharecdn.com/7idxmonthlystatisticsjuli2020-201227101938/85/7-idx-monthly-statistics-juli-2020-36-320.jpg)

![33IDX MONTHLY STATISTICS, JULY 2020

DATA SERVICES | INDONESIA STOCK EXCHANGE

TableTradingbyIndustry

IndustryClassification/StockName

Board

PriceIndivi-

dual

Index

Market

Cap.,

b.IDR

RegularMarketTotalMarket

Prev.

Freq.,

xDays

Volume,

th.share

Value,

m.IDR

Freq.,

x

Days

Volume,

th.share

Value,

m.IDRHighDateLowDateCloseDate

1

1

1

2

1

2

1

1

2

1

1

1

1

2

2

2

1

2

1

2

2

2

2

1

2

1

2

2

2

3

1

1

2

2

2

2

2

2

1

1

TRANSPORTATION

FRENSmartfrenTelecomTbk.[S]9716807/279407/0114307/30

ISATIndosatTbk.[S]2,3502,64007/142,21007/302,30007/30

BBRMPelayaranNasionalBinaBuanaRayaTbk.

1,15507/2491507/211,115

18

29

23007/21

22

22

3,105,589

550

50

52063507/14

146

27.083

SOCISoechiLinesTbk.12314807/2712007/0112107/30

CANI

1,4073417761934

1,052,052

53,56212,2122251,45454,11712,21522

16,54522250,586119,63116,54822

---

07/30100.000

--

1,09007/30

07/30

544.554

260284

184

07/0219007/30

IPCM

HITS

CapitolNusantaraIndonesiaTbk.[S]

2819

9,565

121

BlueBirdTbk.[S]

HELIJayaTrishindoTbk.[S]

HumpussIntermodaTransportasiTbk.

KJEN

07/30

12,86412,91022

1,1001,10007/231,10007/231,10007/23

7

--5006/26

1,139,664

69,29622

07/09

07/30

18523007/08

6907/277807/30

17

21.739268

958,256100,316

275,043

--184

1481793

33.3386,3161,051,648

--

3,00007/303,05007/30

5007/30

07/17124

19502130,714

--

02/25

-

6,1664,435

846,16281,78122

7807/30

200

24007/0124407/30

22

21,183

3,3764,759

28

07/20

8292210,7281,80682922

9147187,37533,7749,5659187,375

41007/01500

KridaJaringanNusantaraTbk.[S]

66,60025,77522

07/2419307/30

1,539

31607/0141607/30

07/3016.000511,482170140

JasaArmadaIndonesiaTbk.[S]202

6718757

318

1,85322

72

179172204,164

21281

07/295007/29MIRAMitraInternationalResourcesTbk.[S]505007/2950

28151,297,344

142258

557

1776

33,774

0.20

221,482

MBSSMitrabahteraSegaraSejatiTbk.[S]

17421

76,37635

07/1616407/30

JAYAArmadaBerjayaTransTbk.[S]

18

18.

24.PORTNusantaraPelabuhanHandalTbk.[S]44069519

11321132

22.22.06219840.2028194

55,22421,1839,8082255,224

7.806202139

76.78628928137211

11.58.66797128,48111,90312,90822139,5208607/30

43407/28

23.

9,80822

1447

17014007/2811207/0220.LRNAEkaSariLorenaTransportTbk.[S]122150

21.

07/305007/305007/30

26.125728

3721121

19.

PSSIPelitaSamuderaShippingTbk.[S]16918207/0916007/1717007/3026.127.40792110,7281,806

25.PPGL*PrimaGlobalindoLogistikTbk.11019807/3012107/2019607/30178.200

9.62.0001039313

17.

16.56.8421,1107,1581,5391,853227,158

38.462535955

39,7453,3764,7592239,745

AirAsiaIndonesiaTbk.[S]

GIAAGarudaIndonesia(Persero)Tbk.24628407/1612.

13.181.8181642,854663324222,854

CMPP

DEALDewataFreightinternationalTbk.[S]9210507/278107/22

14.

15.

19607/0321007/30

--

274,94169,29122

49607/2351507/293,657308792.308

3.

8.BULLBuanaLintasLautanTbk.[S]30835607/1029807/0332407/3031.2933,8382,883,353908,380100,269

10.34.8061,966--------

22

22

22

22

7.75.0001213812829422381

6.0.6581,2973765007/30

BataviaProsperindoTransTbk.788507/137007/28

62BLTABerlianLajuTankerTbk.50

BPTR

13148

501,004

223,055,733

28294

1.108.0001943,5321,0201,378226,9002,5271,38222

7459,8488,043,8562,908,1761,139,5339,817,959

BIRD

4.BESSBatulicinNusantaraMaritimTbk.23029007/1421807/1725207/30243.81085710,0282,4524,4342227,385

1,818242,432115,9642.ASSAAdiSaranaArmadaTbk.40257007/2339807/0653507/30133.333

5.17.3082,79050,955

6.1,576.582302,1402,536,2627,819,489335,852222,872,2368,861,285336,12722

3.8.50031,1698,605,7671,172,563205,910228,611,8621,173,300205,92422

4.167.14312,498115,174285,95144,35822115,972287,90844,36822

JASTJasnitaTelekomindoTbk.[S]11211507/017607/307707/30

TLKMTelekomunikasiIndonesia(Persero)Tbk.[S]3,0503,190

2.EXCLXLAxiataTbk.[S]2,7703,07007/062,41007/302,50007/30128.90726,765288,400785,90081,72422309,773

5.32.52063799,30178,24937,61822877,65185,96737,62322

AKSIMamingEnamSembilanMineralTbk.[S]54555007/0116107/29270

07/30

07/305007/305007/30

NELYPelayaranNellyDwiPutriTbk.[S]13914007/0211907/23123

889407/09

28.PURAPutraRajawaliKencanaTbk.[S]9514507/089107/0613007/30121.9056892,298,499274,482615,216222,403,672287,461615,24522

27.17.263908014471580

30.19.3301195,7671,083811215,7671,08381121

29.RIGSRigTendersIndonesiaTbk.[S]20224007/1620007/0322607/3092.60413864414225821644

SAFE

15

21

SteadySafeTbk.19120007/17170

32.27.53657379195116379195116

31.900.0001,875571212810257

34.1,043.422832119,47429,12215,92822119,47529,12215,92922

33.421.4291,60511,8877,0152,7212211,887

2910

7,0152,72122SHIPSilloMaritimePerdanaTbk.55560507/2255007/0159007/30

SMDRSamuderaIndonesiaTbk.[S]19028807/2919307/0125407/30

07/3007/3050

35.23.636854498,67266,60025,77522498,672

07/30

IATAIndonesiaTransport&InfrastructureTbk.[S]5050

LEADLogindoSamudramakmurTbk.5050

PTISIndoStraitsTbk.17518907/07159

324

2,049

SDMUSidomulyoSelarasTbk.[S]505007/3050

SAPXSatriaAntaranPrimaTbk.[S]1,8502,34007/101,80007/072,25007/30

663](https://image.slidesharecdn.com/7idxmonthlystatisticsjuli2020-201227101938/85/7-idx-monthly-statistics-juli-2020-37-320.jpg)

![34

DATA SERVICES | INDONESIA STOCK EXCHANGE

IDX MONTHLY STATISTICS, JULY 2020

TableTradingbyIndustry

IndustryClassification/StockName

Board

PriceIndivi-

dual

Index

Market

Cap.,

b.IDR

RegularMarketTotalMarket

Prev.

Freq.,

xDays

Volume,

th.share

Value,

m.IDR

Freq.,

x

Days

Volume,

th.share

Value,

m.IDRHighDateLowDateCloseDate

2

1

2

1

2

2

2

1

1

2

2

2

1

2

1

2

2

2

1

2

2

1

1

1

2

2

2

2

2

1

2

1

1

1

1

1

1

2

TNCATrimudaNuansaCitraTbk.[S]17525007/0314507/1520407/30

NONBUILDINGCONSTRUCTION

PPREPPPresisiTbk.[S]19021407/1617407/3017407/30

PTPWPratamaWidyaTbk.[S]1,0601,60007/211,05007/061,58507/30

FINANCE

SUPRSolusiTunasPratamaTbk.4,8504,65007/154,65007/154,65007/15

MTPSMetaEpsiTbk.[S]13814707/2813007/2114007/30

OASAProtechMitraPerkasaTbk.[S]38839007/2235007/2935007/29

19707/30

IBSTIntiBangunSejahteraTbk.[S]8,200

GOLDVisiTelekomunikasiInfrastrukturTbk.[S]21023607/0216907/23

TRUKGunaTimurRayaTbk.[S]11213907/0910907/0711507/30

TBIGTowerBersamaInfrastructureTbk.1,1051,35007/291,06007/021,29007/30

8,20004/17

GHONGihonTelekomunikasiIndonesiaTbk.[S]1,9751,95007/021,45007/301,55007/30

5,5544,41922

1,88722

13,12721

767

66,906

TCPI

BBYBBankYudhaBhaktiTbk.23831007/3023407/01300

20019

370,121

BBNIBankNegaraIndonesia(Persero)Tbk.4,5804,86007/094,510

20,120,24137,425,2062,047,488

5,864

3,610,832

07/28

32607/1337207/30178.846372500179171

07/20

44.06329291712727522917

320.98829,2281,091,2711,283,56659,718221,235,2201,457,28159,78922

448,89596,97122

3,625,083421,51522

47,454,7942,449,827

2,1961710

7,8356,28322

13848122

415,087

131,80319,89122

17917118

1,750225

18,812

3,661

11,256,875

1

71222

100,125

07/14

4,60007/30

AGRSBankIBKIndonesiaTbk.9618807/2893

22

15507/30

36.TAMUPelayaranTamarinSamudraTbk.[S]646907/015207/305507/30502.5132,063172,02310,51012,86122180,64810,97612,86222

39.TMASTemasTbk.[S]12513207/0210007/2011107/30271.40263366,2357,8356,2832266,235

38.2,862.31919,550281,4771,102,250212,09922296,2971,143,964212,10122

37.8.9293071055138TAXI

42.50.4355077,1259,6556,7222277,1259,6556,72222

41.142.60990642613848122426

40.136.000867411243192274112432022

TPMATransPowerMarineTbk.[S]28036007/2728007/0134407/30

44.WINSWintermarOffshoreMarineTbk.[S]9110207/308507/069907/3027.0434208,553786254218,55378625521

43.WEHAWEHATransportasiIndonesiaTbk.[S]999907/017307/237607/3033.6136712,3821,0073,8392212,3821,0073,83922

2.112.7121,8481,2949101,071221,294

5,362,394555,957

1.1,062.5003,502107901271821417112818

75117,3415,129,4735,026,774555,7365,920,270

9101,07122

BALIBaliTowerindoSentraTbk.[S]79589507/0179507/2189007/30

BUKKBukakaTeknikUtamaTbk.[S]76080007/0363507/2770007/30

5.104.7342521,708307456221,70830745622

4.132.4798531081741481710817414817

3.CENTCentratamaTelekomunikasiIndonesiaTbk.[S]8112107/297907/0211007/30729.6003,430422,17541,97611,46922958,79492,45511,47222

6.881.91011,077-----

13.

9.184.2111264,8041,7502254,804

8.

10.41.8601,779256,90650,17540,93222266,327

7.LCKMLCKGlobalKedatonTbk.[S]36637207/30

----

18500

14.TOWRSaranaMenaraNusantaraTbk.

AGROBankRakyatIndonesiaAgroniagaTbk.122268

11.234.6151,39292,914131,80319,8912292,914

3.AMARBankAmarIndonesiaTbk.29258007/0729207/0237407/30216.0922,97513,1935,5544,41922

12.142.8145,2900.100.47110.10

2.146.3641,7295,8647671,88622

31,914,705

1,904,783BANK

6.249.1982,9545,2192,0567082249,819

5.BABPBankMNCInternasionalTbk.505007/305007/305007/3057.3881,25311869322270,601

12107/0323207/30

BACABankCapitalIndonesiaTbk.41442207/3027007/2842207/30

2,231,795

7.BBCABankCentralAsiaTbk.28,47531,32507/0828,37507/0131,20007/3017,528.571761,544300,6059,166,768

5,192.20757,9023,256,772

4.ARTOBankJagoTbk.1,7703,40007/031,79007/012,80007/3013,960.28630,09424,24666,45413,11821

1,0201,15007/301,00507/011,13507/30

1.392.1064,9022,231,795448,89596,96922

8.2,137,92724,690,40139,314,1092,446,804

81

9.BBKPBankBukopinTbk.18519207/2717607/2217807/3053.6762,3401,115,083205,40640,790221,792,548326,49840,88822

8.BBHIBankHardaInternasionalTbk.7919507/077507/0113007/30106.40053920,4033,0284,0612220,4034,061223,028

11.22.07684,9261,042,7624,870,230228,054221,093,6145,108,631228,14822

10.BBMDBankMestikaDharmaTbk.1,2601,65007/091,26007/011,45507/30105.7975,89281118197192,581

13.BBTNBankTabunganNegara(Persero)Tbk.1,2451,36507/091,22007/061,26507/30167.60913,2621,713,2742,218,632137,678221,724,1382,232,651137,72022

12.BBRIBankRakyatIndonesia(Persero)Tbk.3,0303,25007/143,03007/203,16007/303,565.714385,8753,111,2909,710,945369,80922

14.305.4371,9799,1612,594829219,16107/30

BCICBankJTrustIndonesiaTbk.45070007/2956007/2870007/29

2,59482921

15.52.4876,9380.400.24320.400.2443

43,903,2842,049,976

12727522

---

3,515,717421,45522

12,663,275204,90222

24,420

52,15441,01822

17,5749822

13,193

203,46522

3,357,471

22,297,106

0.471

07/305007/305007/30

TranscoalPacificTbk.[S]4,6504,66007/013,02007/153,91007/30

ExpressTransindoUtamaTbk.5050](https://image.slidesharecdn.com/7idxmonthlystatisticsjuli2020-201227101938/85/7-idx-monthly-statistics-juli-2020-38-320.jpg)

![35IDX MONTHLY STATISTICS, JULY 2020

DATA SERVICES | INDONESIA STOCK EXCHANGE

TableTradingbyIndustry

IndustryClassification/StockName

Board

PriceIndivi-

dual

Index

Market

Cap.,

b.IDR

RegularMarketTotalMarket

Prev.

Freq.,

xDays

Volume,

th.share

Value,

m.IDR

Freq.,

x

Days

Volume,

th.share

Value,

m.IDRHighDateLowDateCloseDate

1

2

2

1

1

1

2

2

1

1

1

1

1

1

1

2

1

1

1

1

1

1

1

1

1

1

1

1

1

1

2

1

2

1

2

2

2

1

2

1

NISPBankOCBCNISPTbk.73575007/1670007/3070007/30

FINANCIALINSTITUTION

PNBNBankPanIndonesiaTbk.81590007/1377507/1080507/30

07/1631407/30

MCORBankChinaConstructionBankIndonesiaTbk.13815707/1313207/2913707/30

07/3088007/30

262198

BankQNBIndonesiaTbk.

DNARBankOkeIndonesiaTbk.16932007/0721007/0224007/30

FUJIFujiFinanceIndonesiaTbk.10611907/2410207/3010407/30

BVICBankVictoriaInternationalTbk.687607/065707/235907/30

FINNFirstIndoAmericanLeasingTbk.50----5003/31

115216

2160,574

36,405

154,737

1,161

115,3341,777

07/305007/30

22

5,492,780

82421

1,26622

10,567

740,106679,49086,17522

1,029,965153,84422

437,067

73007/30

BDMNBankDanamonIndonesiaTbk.2,690

07/30

129.0708,176787,589436,57979,12022788,468

670

82,55442,774

-----

60,5746,265210

22

07/30

BINABankInaPerdanaTbk.94594507/01820

22

BPDBantenTbk.50

206

7,289

33,660

18.49.51555393,0065,0574,9642293,0665,0604,96522

16.1.54726,51228,91280,83312,4712233,73994,96112,48422

07/30217.3063,1739,06345338822

2,90007/082,70007/202,740

505007/305044422

19.477.4124,92617,10214,6931,2652240,702

17.BEKS

BGTGBankGaneshaTbk.506407/075007/305007/30

190.0006957,0792,09157622

23.83.750BMASBankMaspionIndonesiaTbk.24437007/1025007/30

21.

264

20.BJBRBPDJawaBaratdanBantenTbk.7601,04007/2875507/0393507/30160.8339,107726,421664,63486,15022

BKSW

27.BNIIBankMaybankIndonesiaTbk.16107/302.52614,921154,73733,66010,56522

24.1,717.556267,960901,2954,813,823153,66122

79,13522

22.174.3921,5582,041152871222,04115287122

2,15257822

26.BNGABankCIMBNiagaTbk.72093507/1072007/0177007/305.75919,158299,780248,19038,63522398,443324,49338,701

BMRIBankMandiri(Persero)Tbk.4,9506,00007/284,90007/035,80007/30

25.

07/30

29.107.8435,1946,334,9333,026,976416,546226,335,194

28.BNLIBankPermataTbk.1,2701,28507/221,24507/291,27007/3013.77335,258195,716248,9366,47522196,393249,7986,49022

30.BSIMBankSinarmasTbk.54553507/0348607/0251507/30351.2518,89128714724622

BRISBankBRIsyariahTbk.[S]30861507/2930407/0254007/303,027,107416,553

40.854.29715,9012,1481,554856222,5481,85286822

94,34043

38.120.1885,143374,19454,75514,48722375,76454,97214,48822

-

32.441.38018,4712,4255,3791,704222,4255,3791,70422

31.1,306.6532,406--

34.59.57352318,2511,1662,6332218,2511,1662,63322

33.351.795

BTPNBankBTPNTbk.2,1602,45007/302,12007/012,29007/30

39.

37.MAYABankMayapadaInternasionalTbk.6,5006,50007/136,50007/136,50007/132,955.392

36.INPCBankArthaGrahaInternasionalTbk.505407/065007/305007/300.2917823,765191770223,82519477122