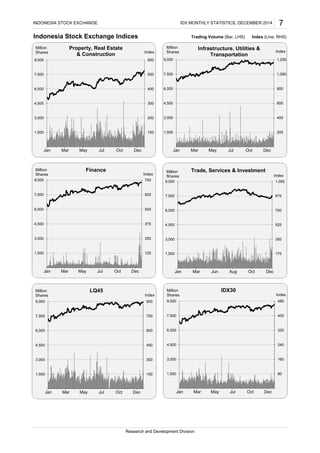

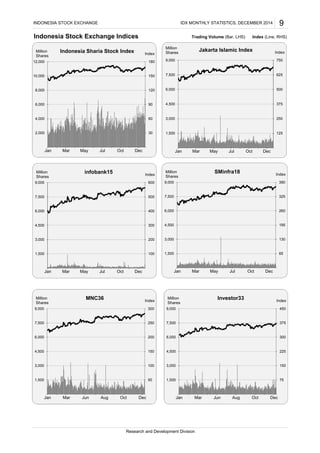

This document provides a summary of trading activity on the Indonesia Stock Exchange (IDX) for the month of December 2014. Some key highlights include:

- The IDX Composite Index closed at 5,226.947, up 1.10% from the previous month.

- Total trading value on the IDX was Rp101.319 trillion, down 1.14% from the previous month. Daily average trading value was Rp4.691 trillion.

- Foreign investors were net sellers on the IDX, with net sales of Rp7.954 billion for the month.

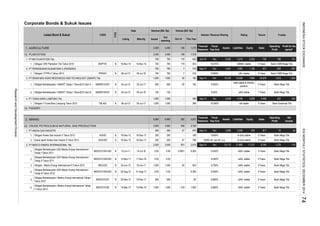

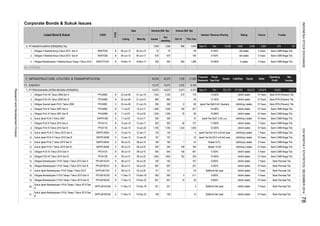

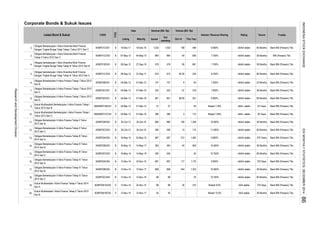

![50 Biggest Market Capitalization

Total of The 50 Stocks

% of IDX (Total)

IDX (Total)

Sumber Alfaria Trijaya Tbk.

Mayora Indah Tbk. [S]

Multi Bintang Indonesia Tbk.

Pakuwon Jati Tbk. [S]

Blue Bird Tbk.

Lippo Karawaci Tbk. [S]

SMART Tbk. [S]

Bank Tabungan Pensiunan Nasional Tbk.

Sinar Mas Multiartha Tbk.

Wijaya Karya (Persero) Tbk. [S]

Bayan Resources Tbk. [S]

Bank CIMB Niaga Tbk.

Astra Otoparts Tbk. [S]

Summarecon Agung Tbk. [S]

Global Mediacom Tbk. [S]

Ciputra Development Tbk. [S]

Bank Permata Tbk.

Sarana Menara Nusantara Tbk.

XL Axiata Tbk.

Astra Agro Lestari Tbk. [S]

Media Nusantara Citra Tbk. [S]

Vale Indonesia Tbk. [S]

Adaro Energy Tbk. [S]

Bumi Serpong Damai Tbk. [S]

Tambang Batubara Bukit Asam (Persero) Tbk. [S]

Bank Pan Indonesia Tbk.

United Tractors Tbk. [S]

Charoen Pokphand Indonesia Tbk. [S]

Indofood Sukses Makmur Tbk. [S]

Surya Citra Media Tbk. [S]

Jasa Marga (Persero) Tbk.

Tower Bersama Infrastructure Tbk.

Elang Mahkota Teknologi Tbk.

Matahari Department Store Tbk.

Bank Danamon Indonesia Tbk.

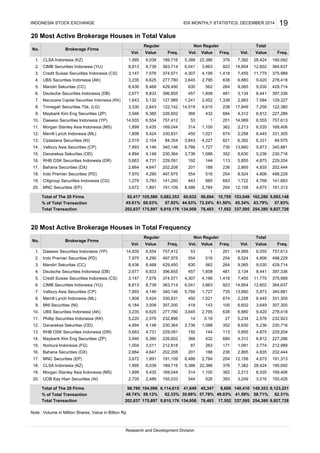

INDONESIA STOCK EXCHANGE IDX MONTHLY STATISTICS, DECEMBER 2014 15

2.498

Total Trading

Total

1.

2.

3,172,3516.13320,361,026

(Million Rp)

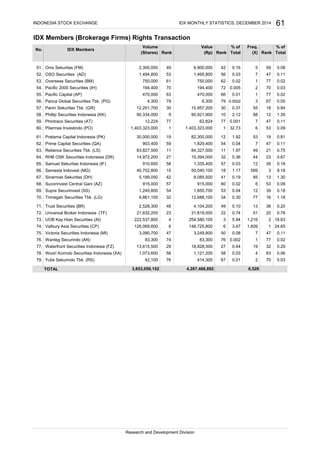

No.

(Million Rp) Total

% of

Market Capitalization

Listed Stocks % of

Number

of Listed

Shares

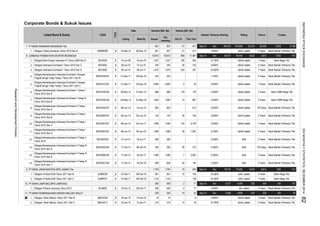

Bank Central Asia Tbk.

HM Sampoerna Tbk.

5 3.31

40,483,553,140 300,590,382 5.75

4,383,000,000 300,892,950 5.76 19,365 229 0.02

24,408,459,120

Value

Rank

3.

24,422,470,380 284,521,780 5.44

4,447,913 3 3.50

100,799,996,400 288,791,990 5.52 4,209,293

6,200,187 2 4.87

Astra International Tbk. [S]

Telekomunikasi Indonesia (Persero) Tbk. [S]

Bank Rakyat Indonesia (Persero) Tbk.

8.

9.

0.84

24,241,508,196 145,449,049 2.78 2,521,726

23,099,999,999 248,902,500 4.76 4,418,807 4 3.47

11 1.98

7,630,000,000 246,449,000 4.71 1,063,175 34

Bank Mandiri (Persero) Tbk.

Unilever Indonesia Tbk. [S]

Perusahaan Gas Negara (Persero) Tbk. [S]

Gudang Garam Tbk.

10.

757,153 46 0.60

18,462,169,893 112,619,236 2.15 2,718,387 10 2.14

1,924,088,000 116,792,142 2.23

Bank Negara Indonesia (Persero) Tbk.

13.

12.

2,004,1241.8411.

14.

1,844,446

14 1.58

3,681,231,699 92,030,792 1.76 1,479,007 22 1.16

5,931,520,000 96,090,624Semen Indonesia (Persero) Tbk. [S]

Indocement Tunggal Prakarsa Tbk. [S]

Kalbe Farma Tbk. [S]

Indofood CBP Sukses Makmur Tbk. [S]

59,267,879 1.13

16 1.45

5,830,954,000 76,385,497 1.46 825,565 45 0.65

20 1.22

46,875,122,110 85,781,473 1.64

17.

16.

1,551,1601.2415.

18.

1,410,046 25 1.11

14,621,601,234 51,175,604 0.98 3,194,315 7 2.51

16,398,000,000 61,984,440 1.19 621,438 56 0.49

3,730,135,136 64,717,845

8,780,426,500

21.

20.

653,7850.9219.

22.

6,984,426

53 0.51

4,796,526,199 46,526,304 0.89 423,075 71 0.33

6,800,000,000 47,940,000

41,520,297 0.79

1 5.49

2,917,918,080 43,768,771 0.84 1,469,530 23 1.16

84 0.25

5,640,032,442 43,992,253 0.84

25.

24.

319,8840.8223.

26.

691,756 49 0.54

1,574,745,000 38,187,566 0.73 634,605 55 0.50

10,202,925,000 42,342,139 0.81 323,127 82 0.25

9,488,796,931 42,936,806

8,534,490,667

29.

28.

746,8150.6927.

30.

1,123,969

47 0.59

9,936,338,720 36,019,228 0.69 828,546 43 0.65

14,276,088,500 36,261,265

25,178,650 0.48

33 0.88

18,371,846,392 33,161,183 0.63 1,026,692 37 0.81

63 0.41

31,985,962,000 33,265,400 0.64

33.

32.

519,5590.5531.

34.

24,613 214 0.02

48,159,602,400 24,802,195 0.47 683,696 51 0.54

23,837,645,998 27,770,858 0.53 58,655 178 0.05

2,304,131,850 28,801,648

2,107,000,000

36.

196,023 11635.

250 385

0.15

23,077,689,619 23,539,243 0.45 2,101,691 12 1.65

2,502,100,000 23,582,293 0.45

0.00022,872,193,366

1.02

6,237,808,717 22,799,191 0.44

23,264,766 0.4437.

115 0.15

0.42

0.42 196,469

109 0.16

27

335 0.001

22,007,431

171 0.05

Indosat Tbk. [S]

44.

3,333,333,500 22,166,668

842,08843.

5,781,884,384 22,838,443 0.44 65,317

14,426,781,680 21,928,708 0.42

39.

38.

41.

40.

209,778

6,149,225,000 22,629,148 0.43 1,292,573

42.

1,463

5,433,933,500

41 0.66

167

0.20

15,165,815,994 18,957,270 0.36 607,496 58 0.48

20,242,879 0.39 56,724 179

24,880,290,775 20,775,043 0.40 74,187 0.06

47.

46. 14,198,613,922 20,233,025 0.39 968,053 39

3,084,060,283,305

24.54%

5,228,043,482

74.33%

50.

0.36

48.

252,582 970.37

128,404 142

293

894,347,989 18,691,87349.

19,307,126

45.

Research and Development Division

4.

5.

6.

7.

51.87%

127,189,916

0.10

0.04

0.76

0.004

756,791,286,954 3,885,948,200

11,764,996,622

65,969,927

5,63617,706,320 0.34

4,819,733,000

38,614,252,900](https://image.slidesharecdn.com/monthly-dec-2014-170709003957/85/Statistik-Bulanan-BEI-Desember-2014-22-320.jpg)

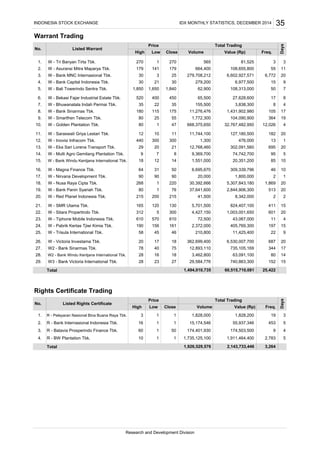

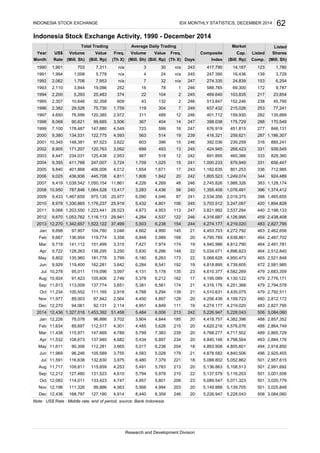

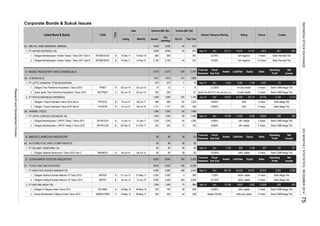

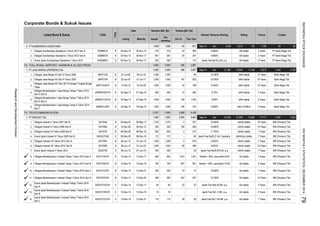

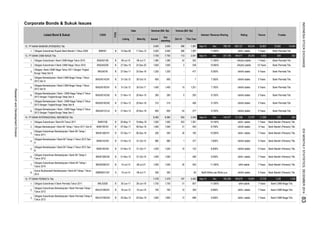

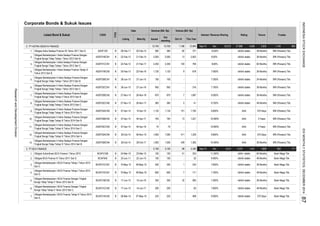

![20 Most Active Stocks by Total Trading Volume

Central Proteina Prima Tbk.

Sekawan Intipratama Tbk. [S]

Capitalinc Investment Tbk.

Bumi Resources Tbk.

Bakrieland Development Tbk. [S]

Arpeni Pratama Ocean Line Tbk.

BW Plantation Tbk.

Bakrie & Brothers Tbk.

Trada Maritime Tbk.

Sugih Energy Tbk. [S]

Energi Mega Persada Tbk. [S]

Alam Sutera Realty Tbk. [S]

Bank MNC Internasional Tbk.

Nirvana Development Tbk. [S]

Sitara Propertindo Tbk. [S]

Sentul City Tbk. [S]

Nusantara Infrastructure Tbk. [S]

Eureka Prima Jakarta Tbk. [S]

Dharma Samudera Fishing Industries Tbk. [S]

Lippo Karawaci Tbk. [S]

Total of The 20 Stocks

% of Total Trading

Total Trading

20 Most Active Stocks by Total Trading Value

Elang Mahkota Teknologi Tbk.

Bank Rakyat Indonesia (Persero) Tbk.

Astra International Tbk. [S]

Bank Mandiri (Persero) Tbk.

Telekomunikasi Indonesia (Persero) Tbk. [S]

Sekawan Intipratama Tbk. [S]

Surya Citra Media Tbk. [S]

Bank Central Asia Tbk.

Adhi Karya (Persero) Tbk. [S]

Bank Negara Indonesia (Persero) Tbk.

Perusahaan Gas Negara (Persero) Tbk. [S]

Lippo Karawaci Tbk. [S]

Trada Maritime Tbk.

BW Plantation Tbk.

Kalbe Farma Tbk. [S]

Alam Sutera Realty Tbk. [S]

Sugih Energy Tbk. [S]

Waskita Karya (Persero) Tbk. [S]

United Tractors Tbk. [S]

Total of The 20 Stocks

% of Total Trading

Total Trading

Semen Indonesia (Persero) Tbk. [S]

INDONESIA STOCK EXCHANGE IDX MONTHLY STATISTICS, DECEMBER 2014

Research and Development Division

5.25 1,365,928,081,800 13,219

16

9,624,340,100 5.70

3.05 231,981,378,000

20

4. 5,900,373,467 3.50 477,002,274,618 78,720 20

3.

186 20

2.

No. Listed Stocks

Total Trading

1. 12,900,256,950

Freq. (X)Value (Rp)

8,868,224,600

6. 4,955,616,759 2.94 408,605,729,235 70,531 20

5. 5,144,546,500

8. 4,673,369,876 2.77 207,835,726,900

7. 4,700,641,305 2.78 1,915,098,422,810 55,878 20

303 20

11. 3,792,814,137 2.25 378,668,244,916 19,903

114,782 20

15,459 20

9. 4,327,443,389

10. 4,109,525,295 2.43 1,708,545,334,526

2.56 2,077,832,480,430

15. 2,971,569,700 1.76 1,290,804,107,100

492,385,296,85017. 2,500,772,757

20

48,903 20

4,963 20

11,820 20

13. 3,062,969,452

14. 3,003,093,781 1.78 490,704,200,250

1.81 342,924,137,380

12. 3,168,955,353

16. 2,793,500,650 1.65 310,870,712,900

18. 2,419,681,516 1.43 1,219,758,778,908

1.48

20. 1,979,358,372 1.17 2,101,690,713,783 49,252 20

19. 2,200,626,100

1.

168,797,436,718 127,189,915,833,986 4,913,864

6,984,426,002,700 5.49 92

No. Listed Stocks

Freq. (X)

1,389,628,124

1.30 386,270,655,200 20

15

5. 1,493,265,688 4,209,293,314,240 3.31 93,946

4,447,913,066,903 3.50

540,204,630 6,200,187,182,895 4.87

65,313

4. 416,710,107 4,418,806,574,076 3.47 57,885

3. 623,730,057

2. 82,491

10. 450,256,166

9. 933,533,060 2,875,052,565,350 2.26 81,342

20

266,596 20

40,549 20

63,765 20

7. 921,781,348

8. 241,068,876 3,172,351,399,589 2.49

3,194,314,998,550 2.51

6. 9,624,340,100

20. 87,212,496 1,551,160,105,244 1.22

19. 1,285,520,789 1,619,692,299,012 1.27

15.

16.

4,700,641,305

1,036,521,626 1,844,446,153,040 1.45

1,915,098,422,810 1.51

3,168,955,353 1,743,856,007,982 1.37

4,109,525,295 1,708,545,334,526 1.34

14.

2,718,386,515,525 2.14

17.

18.

3,829,260,488,900 3.01

13. 114,782

62,239

55,878

79,479

4,327,443,389 2,077,832,480,430 1.63

43,951

56,406

49,252

11. 424,716,121

12. 1,979,358,372 2,101,690,713,783 1.65

Trading

DaysVolume %

93,882 20

Total Trading

3,829,260,488,900 266,596

93,097,680,059 22,144,148,673,638 999,057

76,099

Trading

DaysVolume Value (Rp) %

24,203 20

13,595 20

13,100 20

1.88 1,743,856,007,982

27,663 20

4,913,864

37,878,060,422 61,138,164,466,190 1,395,678

20

7.64 1,164,125,901,150

168,797,436,718 127,189,915,833,986

20

20

20

20

20

20

20

20

2,521,726,387,449 1.98

55.15% 17.41% 20.33%

20

22.44% 48.07% 28.40%

60,018 20

57,332 20

48,903 20

15,459 20

123,647,520 2,004,124,453,186 1.58

20

20](https://image.slidesharecdn.com/monthly-dec-2014-170709003957/85/Statistik-Bulanan-BEI-Desember-2014-23-320.jpg)

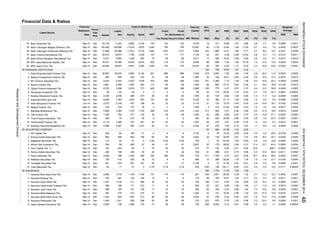

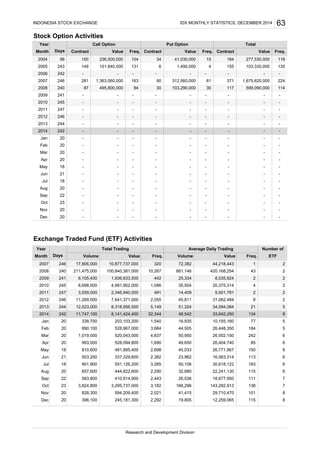

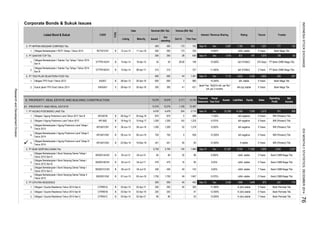

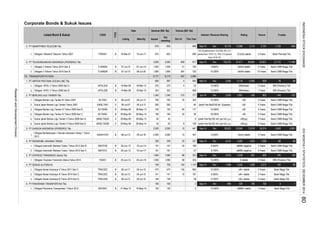

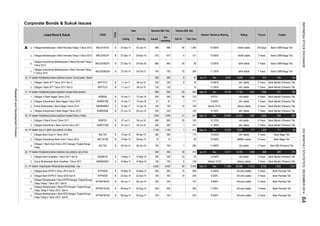

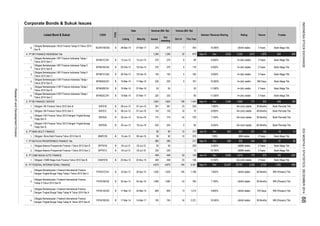

![20 Most Active Stocks by Total Trading Frequency

Sekawan Intipratama Tbk. [S]

Trada Maritime Tbk.

Telekomunikasi Indonesia (Persero) Tbk. [S]

Central Proteina Prima Tbk.

Bank Rakyat Indonesia (Persero) Tbk.

Adhi Karya (Persero) Tbk. [S]

Kalbe Farma Tbk. [S]

Bumi Resources Tbk.

Dharma Samudera Fishing Industries Tbk. [S]

Sawit Sumbermas Sarana Tbk. [S]

Arpeni Pratama Ocean Line Tbk.

Astra International Tbk. [S]

Bank Central Asia Tbk.

Semen Indonesia (Persero) Tbk. [S]

Media Nusantara Citra Tbk. [S]

Waskita Karya (Persero) Tbk. [S]

Bank Mandiri (Persero) Tbk.

United Tractors Tbk. [S]

Perusahaan Gas Negara (Persero) Tbk. [S]

BW Plantation Tbk.

Total of The 20 Stocks

% of Total Trading

Total Trading

31.44% 37.21% 33.59%

Research and Development Division

168,797,436,718 127,189,915,833,986 4,913,864

20

19. 424,716,121 1.15

53,078,169,238 47,330,311,210,856 1,650,761

2,521,726,387,449 56,406 20

20. 4,700,641,305 1.141,915,098,422,810 55,878

416,710,107 1.18

18. 87,212,496 1.171,551,160,105,244 57,332

2057,8854,418,806,574,076

20

17.

16. 1,285,520,789 1.221,619,692,299,012 60,018

20

20

60,432 20

20

15. 309,296,672 1.23

14. 123,647,520 1.272,004,124,453,186 62,239

746,814,747,349

11. 4,955,616,759

13. 241,068,876 1.303,172,351,399,589

12. 623,730,057 1.33

63,765

20

20

70,531 20

4,447,913,066,903 65,313

1.44408,605,729,235

20

10. 953,443,526 1.501,460,547,010,180 73,625

76,099

7. 1,036,521,626

9. 2,200,626,100 1.55386,270,655,200

8. 5,900,373,467 1.60

20

20

79,479 20

477,002,274,618 78,720

1.621,844,446,153,040

20

5. 540,204,630 1.686,200,187,182,895 82,491

6. 933,533,060 1.662,875,052,565,350 81,342

20

4. 12,900,256,950 1.911,164,125,901,150 93,882 20

3. 1,493,265,688 1.914,209,293,314,240 93,946

20

2. 4,327,443,389 2.342,077,832,480,430 114,782 20

1.

INDONESIA STOCK EXCHANGE

9,624,340,100 5.433,829,260,488,900 266,596

IDX MONTHLY STATISTICS, DECEMBER 2014

Freq. (X)Value (Rp)

17

No. Listed Stocks

Total Trading Trading

DaysVolume %](https://image.slidesharecdn.com/monthly-dec-2014-170709003957/85/Statistik-Bulanan-BEI-Desember-2014-24-320.jpg)

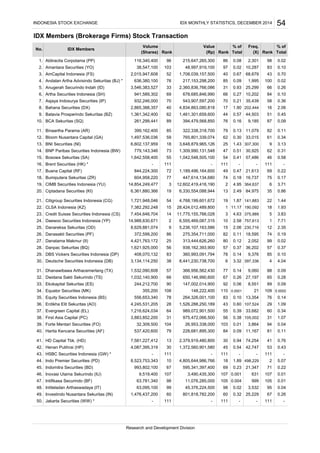

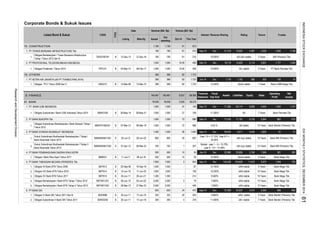

![Top 20 Gainer Stocks

Top 20 Loser Stocks

Sekar Laut Tbk. [S]

Asuransi Jasa Tania Tbk.

Hotel Mandarine Regency Tbk.

Indo-Rama Synthetics Tbk. [S]

Logindo Samudramakmur Tbk.

ICTSI Jasa Prima Tbk.

Wintermar Offshore Marine Tbk. [S]

Benakat Petroleum Energy Tbk.

Berau Coal Energy Tbk.

Resource Alam Indonesia Tbk. [S]

Indo Tambangraya Megah Tbk. [S]

Steel Pipe Industry of Indonesia Tbk. [S]

J Resources Asia Pasifik Tbk. [S]

Maskapai Reasuransi Indonesia Tbk.

JAPFA Comfeed Indonesia Tbk.

Garda Tujuh Buana Tbk. [S]

* Adjusted price if there are any corporate actions

Humpuss Intermoda Transportasi Tbk. [S]

Perdana Karya Perkasa Tbk. [S]

INDONESIA STOCK EXCHANGE IDX MONTHLY STATISTICS, DECEMBER 2014 18

No.

%

Closing Price

Month*

Listed Stocks

Month

1.00

Month Factors

303 303 465 1.00 162 53.47

107

1,050

41.94

Research and Development Division

400 119.40

200 1.00

1.

(Rp)

3.

2.

735

4.

335 335

93 93

525 525

17.

18.

19.

20.

1,045

223 223

16.

5.

6.

7.

8.

9.

10.

148

11.

12.

13.

62

3,800

Central Proteina Prima Tbk.

217

350

334

5814.

15.

2,790

76

148

350

115.05

50.00

790 1.00 265

2,100 2,100

62

1,045

3,800

1,470 1.00 425 40.67

50.48

3,150 1.00

49.33

299

88 1.00 26

60 40.54

333 1.00 110

27 35.53

37.79

103 1.00

208 1.00

82

334 448 1.00

1.00217

58

5,100 1.00

8652,790

76

31.00

1,800 30.00

463 1.00

77 1.00

1,300 34.21

114 34.13

113 32.29

19 32.76

3,655 1.00

6,000 6,000 7,800 1.00

No. Listed Stocks

Closing Price

Month* Month Factors

1,000 1,000

110 110 143 1.00

1,300 1.00

Month

90 90 116 1.00

33 30.00

300 30.00

1. 500 500 169 1.00 -331 -66.20Inovisi Infracom Tbk. [S]

Batavia Prosperindo International Tbk.

Bank Agris Tbk.

(Rp) %

Change

26 28.89

-57.45

3. 600 600 294 1.00 -306 -51.00

2. 705 705 300 1.00 -405

-36.84

5. 330 330 211 1.00 -119 -36.06

4. 380 380 240 1.00 -140

Trada Maritime Tbk.

-35.83

7. 4,000 4,000 2,835 1.00 -1,165 -29.13

6. 1,200 1,200 770 1.00 -430

-26.06

9. 1,100 1,100 825 1.00 -275 -25.00

8. 660 660 488 1.00 -172

-24.38

11. 80 80 63 1.00 -17 -21.25

10. 160 160 121 1.00 -39

-19.28

13. 19,025 19,025 15,375 1.00 -3,650 -19.19

12. 1,245 1,245 1,005 1.00 -240

-19.05

15. 665 665 540 1.00 -125 -18.80

14. 294 294 238 1.00 -56

17. 5,125 5,125 4,240 1.00 -885 -17.27

16. 258 255 208 0.99 -47Bank Internasional Indonesia Tbk. * -18.46

-16.5520. 435 435 363 1.00 -72

-17.06

19. 1,145 1,145 950 1.00 -195 -17.03

18. 25,200 25,200 20,900 1.00 -4,300Mayora Indah Tbk. [S]

Change

Indopoly Swakarsa Industry Tbk. [S]

Last Last This Delusion

DelusionLast Last This

Dharma Samudera Fishing Industries Tbk. [S]

Sekawan Intipratama Tbk. [S]

Bisi International Tbk. [S]

Intermedia Capital Tbk. [S]

Arthavest Tbk. [S]

Waskita Karya (Persero) Tbk. [S]

Capitalinc Investment Tbk.

Perdana Gapuraprima Tbk. [S]

Impack Pratama Industri Tbk. [S]

Atlas Resources Tbk [S]

Arpeni Pratama Ocean Line Tbk.

Pikko Land Development Tbk. [S]

Sinar Mas Multiartha Tbk.

Elang Mahkota Teknologi Tbk.](https://image.slidesharecdn.com/monthly-dec-2014-170709003957/85/Statistik-Bulanan-BEI-Desember-2014-25-320.jpg)

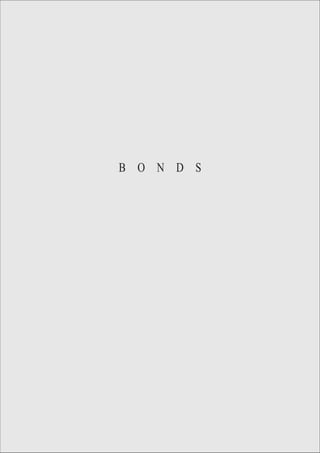

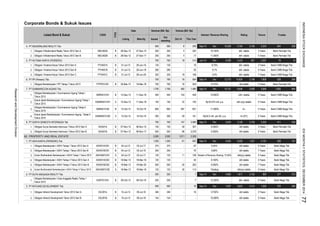

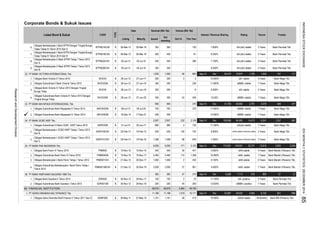

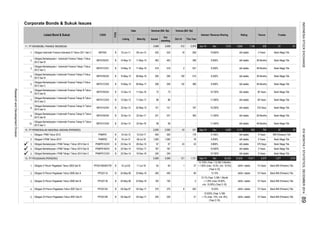

![20 Most Active Stocks by Total Trading Value

January - December 2014

Bank Rakyat Indonesia (Persero) Tbk.

Telekomunikasi Indonesia (Persero) Tbk. [S]

Bank Mandiri (Persero) Tbk.

Astra International Tbk. [S]

Bank Central Asia Tbk.

Bank Negara Indonesia (Persero) Tbk.

Semen Indonesia (Persero) Tbk. [S]

Trada Maritime Tbk.

Perusahaan Gas Negara (Persero) Tbk. [S]

Matahari Putra Prima Tbk. [S]

Matahari Department Store Tbk.

Lippo Karawaci Tbk. [S]

Kalbe Farma Tbk. [S]

Siloam International Hospitals Tbk. [S]

Indocement Tunggal Prakarsa Tbk. [S]

United Tractors Tbk. [S]

Sawit Sumbermas Sarana Tbk. [S]

Adhi Karya (Persero) Tbk. [S]

Indofood Sukses Makmur Tbk. [S]

Total of The 20 Stocks

% of Total Trading

Total Trading

20 Most Active Brokerage Houses in Total Value

January - December 2014

Total of The 20 Firms

% of Total Transaction

Total Transaction

Ciptadana Securities (KI)

UBS Securities Indonesia (AK)

667,438

516,951

4,587,747

242

55,859,074,215 131,227,558,106,002

60,593,959,448 146,274,171,560,013 5.03 3,966,215

111,692,471,339 139,904,081,075,016 4.81 3,880,868

4,458,618

CLSA Indonesia (KZ)

Credit Suisse Securities Indonesia (CS)

CIMB Securities Indonesia (YU)

Total Trading

4,513,951,598 51,770,774,602,660 3.56

227,334

712,183

282,160

Listed Stocks

1,451,645

567,807

526,569

1,087,832

80,464

552,987

671,942

696,189

714,965

6.

5.

12.

11.

10.

9.

26,304,965,799 82,126,203,159,686 2.83

43,459,662,289 119,178,407,540,621 4.10

3.92

104,611,251,997 128,988,336,920,424 4.44

Maybank Kim Eng Securities (ZP)

Deutsche Securities Indonesia (DB)

Mandiri Sekuritas (CC)

Macquarie Capital Securities Indonesia (RX)

Morgan Stanley Asia Indonesia (MS)

Merrill Lynch Indonesia (ML)

Bahana Securities (DX)

Citigroup Securities Indonesia (CG)

4,176,099

35,043,635,750 106,298,532,581,504

2.64 2,295,329

2.57 1,847,423

3.66 1,783,315

INDONESIA STOCK EXCHANGE IDX MONTHLY STATISTICS, DECEMBER 2014

Research and Development Division

20

4.

3.

2.

1.

8.

7.

58,976,228

102,915,212

45.54% 63.88% 57.31%

2,654,031,291,812 2,906,784,721,836,380

1,208,653,999,841 1,856,951,494,448,070

2.23 2,091,849

59,968,146,705 59,241,231,951,660 2.04 1,122,520

1.82 4,405,082

55,325,771,488 50,111,982,644,064 1.72 1,103,266

52,879,757,363,793

2.31 1,568,347

99,837,207,242 72,540,548,577,264 2.50 7,082,328

2.28 2,950,410

95,970,533,692 66,113,359,499,184 2.27 1,959,209

19,761,885,746 67,084,981,978,720

2,291,762

32,718,239,696 108,620,534,503,573 3.74 2,046,072

51,238,702,490 114,040,489,386,150

1.

2.

9,095,904,077 91,875,364,270,587

4.51 3,028,054

52,699,283,378 129,718,675,293,780 4.46 2,331,715

6.32

242

72,644,667,072,944 5.00

30,227,293,336 75,840,999,916,140 5.22

242

242

242

6.

3. 7,378,959,224

5.

8. 22,020,412,524 32,524,670,219,812 2.24

33,877,850,564,636 2.33

6,987,340,305 35,597,622,175,914 2.45

7. 2,173,393,616

17. 16,575,863,908 19,203,950,659,841 1.32

1.41

242

242

242

13. 13,943,999,166 22,038,836,625,076 1.52

14. 1,717,892,065 20,750,772,011,721 1.43

242

19. 2,489,955,930 17,299,966,160,929 1.19

182,550,263,989 725,424,347,668,683

18. 6,661,737,902 18,415,235,011,170 1.27

No. Brokerage Firms

Freq. (X)%Value (Rp)Volume

Total Trading

20. 6,956,088,718 16,914,587,833,798 1.16

1,327,015,645,906 1,453,392,360,918,190

606,206 242

13.76% 49.91%

14,072,261

27.35%

51,457,606

Wijaya Karya (Persero) Tbk. [S]

No.

15. 874,145,885

16. 1,004,616,404 1.39

20,506,073,475,431

24,164,217,432,613 1.66

24,571,853,458,993 1.69

12. 23,222,126,894

11. 1,724,445,235

9. 5,365,127,293 29,083,887,602,471 2.00

4. 9,827,844,430 71,069,659,994,337 4.89

10.

Trading

Days

242

242

242

Volume Value (Rp) %

20,167,621,029,786

242

242

242

242

242

129

242

9,789,165,479 27,105,737,549,824 1.86

Freq. (X)

1,070,794

1,187,442

871,953

928,128

651,272

19.

18.

17.

23,325,058,542 74,815,603,172,900

39,409,521,779 76,665,223,366,672

20.

118,074,798,865 64,702,232,367,440

66,379,233,875 66,419,583,399,601

56,380,595,506

16.

15.

14.

13.

JP Morgan Securities Indonesia (BK)

Daewoo Securities Indonesia (YP)

RHB OSK Securities Indonesia (DR)

MNC Securities (EP)

Danareksa Sekuritas (OD)

Trimegah Securities Tbk. (LG)

Indo Premier Securities (PD)](https://image.slidesharecdn.com/monthly-dec-2014-170709003957/85/Statistik-Bulanan-BEI-Desember-2014-27-320.jpg)

![Table Trading by Industry

1. AGRICULTURE

11 CROPS

Bisi International Tbk. [S]

12 PLANTATION

Astra Agro Lestari Tbk. [S]

Austindo Nusantara Jaya Tbk. [S]

BW Plantation Tbk.

Dharma Satya Nusantara Tbk.

Golden Plantation Tbk.

Gozco Plantations Tbk.

Jaya Agra Wattie Tbk. [S]

PP London Sumatra Indonesia Tbk. [S]

Multi Agro Gemilang Plantation Tbk.

Provident Agro Tbk.

Sampoerna Agro Tbk. [S]

Salim Ivomas Pratama Tbk. [S]

SMART Tbk. [S]

Sawit Sumbermas Sarana Tbk. [S]

Tunas Baru Lampung Tbk.

Bakrie Sumatera Plantations Tbk.

13 ANIMAL HUSBANDRY

14 FISHERY

Central Proteina Prima Tbk.

Inti Agri Resources Tbk. [S]

15 FORESTRY

19 OTHERS

Bumi Teknokultura Unggul Tbk.

2. MINING

21 COAL MINING

Adaro Energy Tbk. [S]

Atlas Resources Tbk [S]

ATPK Resources Tbk. [S]

Borneo Lumbung Energi & Metal Tbk.

Berau Coal Energy Tbk.

Baramulti Suksessarana Tbk. [S]

Bumi Resources Tbk.

Bayan Resources Tbk. [S]

Darma Henwa Tbk. [S]

Delta Dunia Makmur Tbk.

Golden Energy Mines Tbk. [S]

Garda Tujuh Buana Tbk. [S]

Harum Energy Tbk. [S]

20

805

3,650,875

20

93 238 12/18

12/24 1,260 12/30 1,008.0001,225

1,008,30512/16

20

12/03 3,850

480

20

55,298

1,460,547 73,625 20

454,494

354

13

13

20385,284 76,081

9,703,417

20

170,335

2,600

42,384

12/30

50

775 12/05

188,911 136,244 15,562 20

20 33,862 12,814

273,36132,697 122,843

9.

3,550

995

SIMP

1.

12.

2.

3.

TBLA

12/30

54

1

12/30 395.000 2,370,000 188,551 135,972

2,000

IIKP

1,500

128,345

2

851

907,500

-

2,930,162

-

12/18

104,6514,488,009 83,1391,660 141,502 20

12/30

1,591,329

0.90

292,164

1,6801

60,376

8,006

11.

224

12/16

2,000

50DEWA

8. 12/021

HRUM 12/3013.

363

1,740

12/30

12/2912/29

12.

12/30

12/16

12/22

12/05

12/30

32

2,000 5

15,510

114.655

10,635

6,880

47,059

170,210

93,8131,094,619

8,636,411

SMAR

1,203,891

5,769,285

12,569

12/30 6,500 12/16 8,100

12/08

2,144

121,445

89.744

11,831,344

12/23

50

38,254

51

93.636

3163,340

GEMS

GTBO

BSSR

5,698,5902

12/306,350

1,60012/19

12/29

CPRO

136,244

6,001

20252,511 30,530 6,926

3,969,000 3,545

250

244,775

20

5

1,049

93,882

20

18

47,125

5,321,266

20

55,878 20

33,746634,605

20

2,269 20

40,505 20

638.416

139,931

1,482,047

1,046

185,405

2

5

8,666

110.417 4,418,743

2,214

3108 142 8 2 108

121,911

19

13

20

201,164,12612,900,257

2,214

2011,802

0.84 7 6

2,72082,377

12/24

887,629 1,361,820

14,027,500

74

2,265

142 12

7

12/30

32

386,271

18,462,834

175

390

205,924416,287

20

9,152

46,556 35,610

384 12/05 360 12/04 378

371,427

1,123,969

92

1,915,098

810,000 246,081 29,499 6,915

20

1,038,839

355,184

755 71,064

689,206

6

88,255

12/30 171.923 4,033,285

23.745 686,024

148,077,001

33,265,400

139,931

12/05

250

2,195,462

6

2064.091

84,348

88,601

185,405

4,000 12/05

Industry Classification / Stock Name

8. LSIP

2. ANJT 1,300 1,400

Volume

1,000

27,072

7,782,025

Date

188,911

12/24 1,325

7. JAWA 1 367

1. BISI 1

10.

1.

3.

AALI

0.84

11.

GZCO

1

9.

1 12/30130 138

4. DSNG

855 12/30

(Thou. Shr)

15,553

4,700,6411,947,281 806,247

24,76838,187,566 581,288

20

40,463

75.600

1

1,890 12/30 487.742 12,895,213 337,216

450,000 69 3 2912/05

22,856

6.

3,895

13.

12/17

12/30 2,676.270

Value Freq.

Board

VolumeIndex

1 460

19,460 3,531

(Million Rp)

Value

245,283

5,420,670 23,386,310 7,648,002 433,394432,612

12,610,116

2,200,626

2 2,770 3,340

12/30

11,222,400 694

74

12/30

76,099

454,690

188,551 135,972

REGULAR MARKETMarket

Cap.

(Million Rp)

12/30

20

161,781,371

33,703

18,436,748

Close Date

1,877.41512/30

142,259,307 4,188,530

87.484

P R I C E

Prev. High

3,758,172

Date Low

400

24,250

15,553

30

34,112 8,718

11,79411,150,499

13,694,431

32,168

21,029

12/29

23,264,766

277,585

1,344,000

255,125,934

12/16 121.389

20

2,074 20

4,168,486

15,859,125

448 12/30

654,449

15. 1

113.824200

12/30

24,550 12/08 22,350 12/16

1

16. 50

2 8,000

1

103

Dharma Samudera Fishing Industries Tbk. [S]

12/08

1

50

BWPT

SGRO

107 12/17 135

12/30

1

14. SSMS 1 1,460 1,700 12/19 1,430 12/01 1,665 12/30

24,000

12/04

515 12/03 790

2,370,000

750

810 70012/01

12/19 50

12/18

12/23 106.667 3,417,379

1,985 2,040 12/05 1,845

DSFI

71.765

12/30

12/05

72

208.108 8,160,845

UNSP

76

55,711

29,516

1,426,831

119

2

2,713 20

500

1 2,275 2,270

2 495 500 12/22 480 12/23

MAGP 2 50 50 50

1

12/17 705 12/30

12/02

248.507

20

45.455

525

12/04

690

PALM

8,100

12/24 2,100

2,005,08615,275,44215,762,313

116

20

6,900

50

73,618 20 953,444

10 174,559

15.750

209

448

219

3

219

20

20

20623,299

1,590 11/28

4.643

1

12,580

1,040 12/30

786,778

11,772

4,566

101,955

277,978

11,772 4,505

12/18

3,226,824

12/30

6

13

-

20

1,050,501

1

78,720

32,168

1

8,738

20

20

127

933

4,505

477,002

21,322

12/19 502

12/04

50

200220

ARII 2 334

1,092,68750

2

18

10. DOID

6.

3.

5.

2

1,4502

ADRO 1,145

BTEK

1,080

81

-

428,154 20

2,198,700

- -

1

20

18

80.0001

505435

2,000

2

15,528

2018,039 6,885

BORN

ATPK

64

4,160,235

366,735

21,322

20

175

18

92

6,650

4.

12/02

606,943

BRAU

12/29 1,389,752

81.538

12/30 29.867

12/30

- -

1.

1.

12/08 181

360 315.652

31.923

7. BUMI 12/22 52

1,590

2

80

220

1

2.

63

12/02 193 261.291

127

20

16.496

6,900

80 12/30

94.545

12/30

1,078,710

583,436

185

12/30 50

933

78,651

22,166,668BYAN

6,417

44,479

12/30

8,2282017,578

5,916

4,566

2,0741,389,752

12/03

453,802

624

251,709

88,412

402

7,344,456

50,093

19,161618,776

4,930

11,764,706 2

316 12/04

44,479

4.274 884,650

942

12/24

12/1612/23 1,505

1,463

5,900,373

1,463

87

2010,649

Days

Days

(Thou. Shr) (Million Rp) (X)

Freq.

(X)

TOTAL MARKET

15,562

5. GOLL 2 288 350 12/23 249 12/30 251 12/30 87.153 919,915 96,353 28,609 6,974 4 115,344 34,075 7,094 4

ResearchandDevelopmentDivision

21INDONESIASTOCKEXCHANGEIDXMONTHLYSTATISTICS,DECEMBER2014](https://image.slidesharecdn.com/monthly-dec-2014-170709003957/85/Statistik-Bulanan-BEI-Desember-2014-28-320.jpg)

![Table Trading by Industry

Industry Classification / Stock Name Volume

Date (Thou. Shr)

Value Freq.

Board

VolumeIndex

(Million Rp)

Value

REGULAR MARKETMarket

Cap.

(Million Rp)Close Date

P R I C E

Prev. High Date Low

Days

Days

(Thou. Shr) (Million Rp) (X)

Freq.

(X)

TOTAL MARKET

Indo Tambangraya Megah Tbk. [S]

Resource Alam Indonesia Tbk. [S]

Mitrabara Adiperdana Tbk. [S]

Samindo Resources Tbk. [S]

Perdana Karya Perkasa Tbk. [S]

Petrosea Tbk.

Golden Eagle Energy Tbk.

Permata Prima Sakti Tbk. [S]

Toba Bara Sejahtra Tbk. [S]

22 CRUDE PETROLEUM & NATURAL GAS PRODUCTION

Apexindo Pratama Duta Tbk.

Ratu Prabu Energi Tbk. [S]

Benakat Petroleum Energy Tbk.

Elnusa Tbk. [S]

Energi Mega Persada Tbk. [S]

Surya Esa Perkasa Tbk. [S]

Medco Energi Internasional Tbk. [S]

Radiant Utama Interinsco Tbk.

23 METAL AND MINERAL MINING

Aneka Tambang (Persero) Tbk. [S]

Cita Mineral Investindo Tbk. [S]

Cakra Mineral Tbk. [S]

Central Omega Resources Tbk. [S]

Vale Indonesia Tbk. [S]

J Resources Asia Pasifik Tbk. [S]

SMR Utama Tbk. [S]

Timah (Persero) Tbk. [S]

24 LAND / STONE QUARRYING

Citatah Tbk. [S]

Mitra Investindo Tbk. [S]

29 OTHERS

3. BASIC INDUSTRY AND CHEMICALS

31 CEMENT

Indocement Tunggal Prakarsa Tbk. [S]

Semen Baturaja (Persero) Tbk. [S]

Holcim Indonesia Tbk. [S]

Semen Indonesia (Persero) Tbk. [S]

Wijaya Karya Beton Tbk. [S]

32 CERAMICS, GLASS, PORCELAIN

Asahimas Flat Glass Tbk. [S]

Arwana Citramulia Tbk. [S]

Intikeramik Alamasri Industri Tbk. [S]

72.000

381 12/30 68.036 3,748,156 246,114 96,363 16,368 20 263,070 102,898

3,440 3,525 12/04 2,150 12/11 3,300 12/30 211.268 8,777,505 597 1,956 142 149

1,229

918,673

2,128

22.000

54.551

- 1,821,60010/21 -- - -

109.821

3,623

1,785

2,433183442941,6141,016,098

2

210

22. TKGA - -

12/161,810

-

2,961

1,010,491

421 49,806

1,380,705 45,972

20 11,833

49,873

520

397

940

4,875

16,200

25,000

15.616

17,372,597

252,929

1,948

38,941,993

36,049

46,630

20

20

130,910

SMMT 2

1,800

1,355

4,461

12/30 2.821

52,800 45,486

12/30

5,637.136

19,865

-

2,236

4,595

1,03618,762

12/29 142

104,653

146,340

59,966

1,330,944

1,256

20

12/04

1,010,1481,175

8,087

123 14

120,62820

34,790

93,383 142

32,114

319,863

12/02

12/30

282

1,065

-

97

217

4,588,604

RUIS

7.

19.

12/30

12/30

12/01

1

13,150

160

3,000

19,025

1,1201

PSAB

4,145

DKFT

665

CITA 940

ANTM

-

1,740

ARTI

3.

12/30

720

12/17

12,200

20. PTRO

2

12/163,740 3,800

1,800

71

17812/30200

2 195

SMGR

12/05

6.

920

BIPI

1

102ENRG

12/01

1

2

100 12/12

1.

12/05

6.

108

5.

2.

1.

-

2. 1

1

TOBA

ELSA

1,035 12/05

12/16

1

TINS

CTTH

24,675 25,725 12/02

1

2

23.

381 413 12/04 366 12/16

2.

17.

14.

1

685

ESSA

100

670

MEDC

12/294.

4.

925

12/01

12/30

458

2012

980

PTBA

2

1,005

450 12/19

1,245 990

12/18

1,795

199

02/18

3,000

18.

112

1.

2

12/15

1. APEX

5.

21.

-2

12/16

1

12/16

PKPK

8.

3.

2.

12/30

1 3,1521,005,000

3,495

62

12/042 481 485

91

18,900

12/30

12/021,240KKGI 2015. 20

20

16. MBAP

ITMG

MYOH

1

705.263

15,050

12/29

839

886,877

12/30

12/30

2,995

-

12/16

48.421

4,176.025

27,467 4,240

-

25,498

-3,410.988

55,439

7,922

12,500

149,706

3,495 1,621

6,889,440

12/11

2,700

12/30

24.74812/30 158,368

-

101

311,416 316,845

53,598

1,621

12/05

15,375

12/30

839

1,225

35212/16 920

3,294,500

86.429

932,960

2,173

20

4,999,473

560

22,779

3,350

595

4,680

88

201,576,961

20

20

20

12/09

2,434,286

98,128

4,417,489

1,851,492

86.800

324

35,859

2,4953,541

33,319

1,717

322

12/30

2,175

20

60

3,800 27,629

20

19

28,801,648 30,734

20

9,452

740.000 9,539

30,786

12/30

12/03

13,650

49,907

16

Tambang Batubara Bukit Asam (Persero) Tbk. [S]

121

12/30

10,5105,622,750

171.250

1,501.561

3,626

39,68420

835

12/16 2,173.913

20 11,776

3,792,814

20

905

116 12/30

16

1,080

250

150

1

2,498

895

2 1,300 1,325 12/30 1,290 12/16 1,310 12/30 100.769 1,607,726 21,012 27,467 4,240 20 21,012

11,493

519,559

20

12/17

12/23

12/30

12/30

351

1,038,456

66.698 19,903

197

-

12/11

20

2

346

21,040 20

-

20

9,482

10,543

16 78,581 189,825

-

-

12/16

777,439 1,820,171

1,454,630

1,609490.984

20

66,756

3,134

958,243

4,679

2010,158,460

5,743

4,875

280,180

98,508

5,707

321,526

-

1,359,307

9,594

22,779

-

67,787,077

18

2,034,655

1,293,044

57,179

4,277,499

-

1,182,733

3,168,491

4,464,253

1,326

455

20

828,546

-

16,202

-

12/16

-

12/03

281,383

19

77,421

263,461

48,022 20

17

36,019,228

12,663,316

20

1,678

201,988

77,573

1,870

264

1,230

2,857,680

9,160,737

665 12/01

1,145

1,019.779

350.38312/30

589.538

12/30

3,168,00064.561

10/17/13

945

1,648,225

12/30 88.582

9788

12/15

10,522

1,677 20167,090

238

20

25,530

2033,268

20 28,234

-

378,66894

3,920

20

- -2,238,384

56,839

315,920

20

-

1,479.592

28,234

204,724

12,430,860

1,825

3,081

16,202

9,485,432

32,452

184,174 16,838

288

632,767164,228

20

48,550

62,156

3,129

20

296

16,384

15

16,883

180,610

123,648

1,256

-

47,975

166,348

20

1,384,639

16,856,505

4,899,577

10,701

1,105,248118,853

153,096 200,11320

62,239

15,081 20 125,728 297,078

114,608

15

180,843

19

55,999

1,859,106

191

10,972,719

1,479,007

-

20

15,111 20

20

19

726,049

97

199

20

20

141,355

812,228 41,055

219,943,115

67

1,016,470

65,018

220.339 11,330,107

237,397

20

333

2,004,124

46,054

20

20

1093. 1IKAI

204,615

88

10,613

107,117 242,282

28,508

8,111

468,027

20

41,033

1,038

98,647

4,732

725,402

35,972

123

2,2394,62212/29

41,124

12/30

12/30

INCO

2

381,637,104

628.52312/30

5,913.138

MITI

1

15,350

3,493,700328.571

12/3016,000

2,638.889 16,743,437

12/16 185

12/30

7,150AMFG

120

1,325

3,625

8,050

870

12/16

12/30

198

22,900

73

CKRA

12/05 3,5251 3,985

1 1,220

INTP

WTON

1,225 1,250 12/05

2

1 915 930 12/11

290

-

12/18

1,300

92,030,792

2

397

12/17

8,1751

7.

2. 830

12/30

1,000.000

96,090,624

12/17 12/30

118

12/30171

12/30

12/30

-

82,466

SMRU

540

8.

-

12/30

67

15.733

16,801,393

6,387,045

4.

1.

3. SMCB 2 2,275 2,355 12/02 2,155 12/16 2,185 12/30

SMBR

12/23

16,800 12/02

12/09

807,105

7,475

100

ARNA

5.

INDONESIASTOCKEXCHANGEIDXMONTHLYSTATISTICS,DECEMBER201422

ResearchandDevelopmentDivision](https://image.slidesharecdn.com/monthly-dec-2014-170709003957/85/Statistik-Bulanan-BEI-Desember-2014-29-320.jpg)

![Table Trading by Industry

Industry Classification / Stock Name Volume

Date (Thou. Shr)

Value Freq.

Board

VolumeIndex

(Million Rp)

Value

REGULAR MARKETMarket

Cap.

(Million Rp)Close Date

P R I C E

Prev. High Date Low

Days

Days

(Thou. Shr) (Million Rp) (X)

Freq.

(X)

TOTAL MARKET

Keramika Indonesia Assosiasi Tbk. [S]

Mulia Industrindo Tbk.

Surya Toto Indonesia Tbk. [S]

33 METAL AND ALLIED PRODUCTS

Alakasa Industrindo Tbk. [S]

Alumindo Light Metal Industry Tbk.

Saranacentral Bajatama Tbk. [S]

Betonjaya Manunggal Tbk. [S]

Citra Tubindo Tbk. [S]

Gunawan Dianjaya Steel Tbk. [S]

Indal Aluminium Industry Tbk. [S]

Steel Pipe Industry of Indonesia Tbk. [S]

Jakarta Kyoei Steel Works Tbk. [S]

Jaya Pari Steel Tbk. [S]

Krakatau Steel (Persero) Tbk. [S]

Lion Metal Works Tbk. [S]

Lionmesh Prima Tbk. [S]

Pelat Timah Nusantara Tbk. [S]

Pelangi Indah Canindo Tbk.

Tembaga Mulia Semanan Tbk.

34 CHEMICALS

Barito Pacific Tbk. [S]

Budi Starch & Sweetener Tbk. [S]

Duta Pertiwi Nusantara Tbk. [S]

Ekadharma International Tbk. [S]

Eterindo Wahanatama Tbk.

Intanwijaya Internasional Tbk. [S]

Sorini Agro Asia Corporindo Tbk.

Indo Acidatama Tbk. [S]

Chandra Asri Petrochemical Tbk. [S]

Unggul Indah Cahaya Tbk. [S]

35 PLASTICS & PACKAGING

Alam Karya Unggul Tbk.

Argha Karya Prima Industry Tbk. [S]

Asiaplast Industries Tbk. [S]

Berlina Tbk.

Lotte Chemical Titan Tbk. [S]

Champion Pacific Indonesia Tbk. [S]

Impack Pratama Industri Tbk.

Indopoly Swakarsa Industry Tbk. [S]

Sekawan Intipratama Tbk. [S]

Siwani Makmur Tbk. [S]

Tunas Alfin Tbk.

Trias Sentosa Tbk. [S]

121,500

3,000

67.376

250,692

90,940

240

-

1,138

449

350

12/11

12/10

12/15

12/10

1,600

705 12/30

59.2581,615

2,500 2,550

12/15

279

338,129

-

220

515

3,25813,039

56,652

465 12/30

564,400

3,078

1,608

771

128

43,086

301,000

337

2,500

12/30

6,788

303

309

80.678 1,710,266 507,570

25,533

-

399

305

10,200

12/29

142

2,500

12/30

12/01 520 12/12

226.676

4

81

16,413,348

12/24

4,241,969

9.107

1,141

5

9,188,442

9,860,888

250

184

12/30

27.603

11

138.636

12/30

-

12/24

12/03

91

-

12/30

18,596,298

-

50

232

61,920

2,313,028

16.303

12/30

40,420

-

8

4,973

6

83,684

24.615

1,240

83

11.865 7,463

3697,200

639

12/23

350 90

9,624,340

-

116

205.882 306,244

114.692

12/24

12/18

24

114

526.367

01/13/11

20

350

9,300

12/30

12/30

4 24

-

12/3068

12/29

5

20

3,829

6

9

20

14,613

12/02

4

450.000 46

12/30

242

12/30

1,529

28

1,610 1,143

175,466

90

12,719

238

19,825

101 12/03

237

215

125

63.810

12/30

55.238

380 1,067,040 1,078352

12/30

77,165

54

19890

490

58

9

485

12/30

12/30

290

17 6

238

315

260

830

SIAP

109.486

88

2

12/16

1,280.965

12/30

12/30353

303 12/30

16

3,975

1

1

2

12/17

2,265 2,265

1,784

7

54

1,251,525

540

12/30 155.128

12/08

438,593 31,530

10.462

107

5

17

65

157

175,942

20

2,054903

1,067

525 12/30

483,749

14,601

1,086

147

12/05

12/30 165,088

7,463

264,646

3,938,112 74

212,899

10,796

12

181,500

12/05

57.991

694,575

4

50

13

-

289,627

2,400

36,075

154

21.412

1,875.047

12,719

131

67.500

534,600

13,126

12/11

75

12/22

12/30

12/18

12/29

5,300

12/10

103 844,600

7

10

31,575

73

24

396

87.683

358,141

78,356

6,389

2,114,908

5.345 147147 1,067

613,33012/22

12/24160

216,412

20

20

20

422

24

20

65

20

19

18,537 20

12,746

74

47,383

-

17

220639

46

19

20

1,183

282,698

-

59

20

103,753

14,578

59

89.583

582.455

2,312,664

-

1,138

6,450

134 12/30

735

04/08/13

695

12/05

12/30

3,090

226

15. 2 160

290

148 12/30142

12/24

2,900

12/18

5,250

12/30

149

12/11

12/29 81

1,600

12/16

9,500

2

50

575 12/10487

12/01

4.

12/17

4.

3,600

12/09

12/03

JPRS

2

ALMI

12/30

135

458

14.

274

12/02

-

12/30

8,100

12/10

740

8,800

CTBN

2

595

7,000

3,991,700

185 11

-

241

3,078 995

29 9

11,143

7

-

20

995

-

36,075

1,307.372

11,160,000

747,432

8,675,736

76,715

20

23.665

251,757 7

28

20

486,450

3,445,637.59

20

19

6174,487

116,889

28

274

31

7

241

11,143

489,307 64,127

266,448

1,783

41

136.364

16,379

289,816

20

-

7,506 3,319

83

3,829,260

14,453 53,610

1,981

266,596

28

1,4666,389

-

40,427

511,066

66

128,423

2,420

41

36

10,798

523

12,745

20

251,252

-

18,477

1,531

9

114

337 19

1,032

64,458

367

3,283

-

485

5

-

20

4,288

12

1,086

491,877

17

4

23

25,53683,793

50

1,783

10

23

1,032

3,536,536

2,304

18

20

12

20

59

485

19,767

22

1,785

20

367

629

6,475

1,466

350

9,789

131,625

3,824

102,094

8

5

8

14,578

18

20

139 11

5

7

6

10

3

195,723

275 19

316

20

7

-

10,162,819

67

5

2,420

-

16

12

6,793

14

-

14

159

20

359,869

19

1,564,066

19

20

-

19

17,921

2,400

-

20

133

20

128,505

903

24,745

184 299

17,914

32

1,078

20

159

29

47,380

20

157

6,475

-

526

399

4,973

12/16

12/30

459.654

12/30

506,544

6

131.646 703,786 2,616 1,356 137 10

12/30

2,054

12/09

12/09

12/18

2

12/19

385

12/04

1

-

471

BRPT1.

AKPI

PICO

SOBI 1

108

IPOL

1 3206.

11.

7,000

12/19

51

163

ETWA

FPNI

UNIC10.

4.

3.

8.

2

103 12/15

-

850 12/29

2

12.

5.

12/23

AKKU

BRNA 2

2

1

9.

700

1,610

8,800

BUDI

IGAR

-

291

-

TRST 390

460

9.

16. 2

SRSN

10.

TALF 2

MLIA

12/12

12/04

297

12/16

12/30

11/06

12/17

KIAS

253

2

550

268

900--

16,787,782

255 3982 12/12

2

12/30

-

118.800

41.231

30.303

2,194,578

12/30

96 12/11

2 540

TOTO

5.

50

7. 349 302 12/12

2.

4.

12/23

2

1 6,000 12/18 4,429.586

91,380

57.059

41.231

9,500

2 93

2

5,400

DPNS

EKAD

5,200

1

4,000

12/30

8.

505

-

293

7,650,875

110,880

3. BAJA

1. 2 900

2

1

12/11

BTON

140

2

800

101

400

1

1

6.

296 12/01 222

53

12/16

133

KRAS

12/03

TBMS

5.

1

50

8.

SIMA 128

3,900

500 530 12/09

3.

1.

7.

162

307 12/09

12/01

3,000

535

473

413

2

APLI

TPIA

INCI

320

12/18

64.37587

12.

10.

ISSP 1

299

12/29

294

515

337 12/15

238 12/29

12/05

LION

LMSH

9.

INAI

242

90

1

2

NIKL

ALKA

13.

6.

7. IMPC 2 3,800 7,000 12/19 4,300 12/17 5,100 12/30 134.211 2,465,085 3,428 21,641 1,891 8 21,621 90,876 1,921 8

JKSW

11.

9,300

84

5.

305

12/10

1 10,100

350

2.

2.

6. GDST

INDONESIASTOCKEXCHANGEIDXMONTHLYSTATISTICS,DECEMBER201423

ResearchandDevelopmentDivision](https://image.slidesharecdn.com/monthly-dec-2014-170709003957/85/Statistik-Bulanan-BEI-Desember-2014-30-320.jpg)

![Table Trading by Industry

Industry Classification / Stock Name Volume

Date (Thou. Shr)

Value Freq.

Board

VolumeIndex

(Million Rp)

Value

REGULAR MARKETMarket

Cap.

(Million Rp)Close Date

P R I C E

Prev. High Date Low

Days

Days

(Thou. Shr) (Million Rp) (X)

Freq.

(X)

TOTAL MARKET

Yanaprima Hastapersada Tbk. [S]

36 ANIMAL FEED

Charoen Pokphand Indonesia Tbk. [S]

JAPFA Comfeed Indonesia Tbk.

Malindo Feedmill Tbk. [S]

Sierad Produce Tbk. [S]

37 WOOD INDUSTRIES

SLJ Global Tbk.

Tirta Mahakam Resources Tbk.

38 PULP & PAPER

Alkindo Naratama Tbk [S]

Dwi Aneka Jaya Kemasindo Tbk. [S]

Fajar Surya Wisesa Tbk.

Indah Kiat Pulp & Paper Tbk.

Toba Pulp Lestari Tbk. [S]

Kedawung Setia Industrial Tbk. [S]

Suparma Tbk.

Pabrik Kertas Tjiwi Kimia Tbk.

39 OTHERS

4. MISCELLANEOUS INDUSTRY

41 MACHINERY AND HEAVY EQUIPMENT

Grand Kartech Tbk. [S]

42 AUTOMOTIVE AND COMPONENTS

Astra International Tbk. [S]

Astra Otoparts Tbk. [S]

Indo Kordsa Tbk. [S]

Goodyear Indonesia Tbk. [S]

Gajah Tunggal Tbk. [S]

Indomobil Sukses Internasional Tbk.

Indospring Tbk. [S]

Multi Prima Sejahtera Tbk. [S]

Multistrada Arah Sarana Tbk. [S]

Nipress Tbk.

Prima Alloy Steel Universal Tbk. [S]

Selamat Sempurna Tbk. [S]

43 TEXTILE, GARMENT

Polychem Indonesia Tbk. [S]

Argo Pantes Tbk.

Century Textile Industry (Seri B) Tbk.

Century Textile Industry (PS) Tbk.

Eratex Djaja Tbk.

Ever Shine Textile Industry Tbk. [S]

1,650 1,730

8,102

- 17,500 10/21

288

530 605 12/15 520

- -

12/04 575 12/30 122.340 1,437,500 46,819 26,416 3,617 20 344,105

12/17 735

-

4,648

105,157

700

12/12 200

1,650

379 380

410 12/05

-

12/18 10,127,497

12/30

79

17

2,525

3.

ESTI

-

12/05107

KDSI

115,859

65,095 4,447,913

4,151,523

-

61

172,847

294

395

10.

4,525

12/05

2 17,500

CNTB

12/30

1

-

9817147,420

293,933 1,611

1

- -

-

332,216

2032,453 1,681

20

20

361

9.

-

-

ADMG

6. 0.020.10 0.02193 1 112/05

690

630

CNTX

534101,315

1,590.909

12/01

-

193 12/05

12/30 33.377ERTX

15,403

4,006 1,513 20

288

12/19 364

61,250

2

77.507 388,9351

534

12/23 4,750

21,577

5,050

-1,150 -

197 12/16

12/18 12/301 4,625

-

81,929

6,838,427

1 201

2,555,908

165 12,646

4,628 11,208

-

158 12/04

2,688 12,780

66,866 11,456

123,753

165

-

19

12/30

2,356

53.847

188 197

850

3,780 12/30

17,742950 137,275

153,219

12/30

12/30

76,424,496

19,370

337,488

2,130 119,68253,310

56,112279,919

86

1,210.227

11/19

404,250

2

146,869

5,717,177

3,814,830

0.886

725

12/19

- 53-

12/04

378.128

87,01379

259.705

12/16

326.667

39.314

12/30

1,150

16,090

497,729

84,529

935

12/24 61,984,440

12/30500

144,390

12/29

500

2,250,000

32,115

3,856,838298.635

1

20

2012/30

12/11

12/24 204 12/30 114.845 143,013 21,577

20

412

7,175

3,798.499 20,242,879 1,589 6,266

19

246,702

1,040

467

850

12/29

12/30

12/24

2,270,694

17,332

0.20

20,800

3,700

194.594

1,032,215

3,375

1,420

537.002

5,200

4,088,516

12/30

11.675

17,945

62

16,390,753

4,200

656,000

91.000

50

19

20

2,418

12/01 810

12/01

12/30

5012/30

3,037,191

1,596,863

12/30

59 12/24

1,045

61 65

4,600,266

83

12/12

12/30

6,200 12/29 141.650

192,907

786,664 24,379

12/30

12/03

12/30 9.615

12/02

12/02

12/30

88.309

420

12/30

131,750

7,475

30,668

14,303

1,625

5,000 12/30

7,425

1,280.000

11,061,114 9,436

1,600

-28.894

12/22/00

294

1,150

47,017

12/24

0.10

-

-

1,173,693

19

-

4,824

4

352324

12/30

52.554

02/19

13,028

24,379

32,500

354.429 724,007 331,004

4,923,148

623,730

56,724

20

1,397

14,782

5

6

424

42,851

2,554 4,006

17,689

11

9,541

20

116,133

65,313

20 123,169

19

5

5,503,539

91.743

357,144

9

3,625

91,486

20

- -

3,461

20

56,262

47,461

17,757

7

20

7,179

92,052

20

2

20

434,400

352

20

30,668

573

4,350

577

2,187,421 452,789

6,540

20

17,947

20

19

41,10322,00820

3,864 20

3,958

19,283

4,351

595,531

84,588

6,538

20

20 13,406

77,064

3,456 3,624

138,355

19,356

1,192 2,915

839,042

0.20

4,824

9 145

11

3,745,094

12,649

548,939 123,803

-

25,656

-

20

20

776

-

1

1,611

-

372,499,764

786,664

19,183

46,994

165,997

-385,891

641,715

20

20

20

20

20

894

-

19,571

352,510,248

300,590,382

20

3,239

172,247 15,583 20

0.22

36,929

13,405

44,461

0.22

20,853

4,660

-

1,199

169,712 3,636

24,379

769

4,965,840 119,493

324

14,678,618 1,939,169 418,341

54

3,800,793

19

20

-

-

12 96

1983

171,196

8

36,979

8

30,668 24,379 4,824

201,515

54

15,592

45

3,882

57,073

30,867

20

20

20

20

2,914

47,431

889,872

-

5

20

1,713,143

30,668

159,444

-

12/29

12/15

3,050

334,000

0.589

17,215.467

5,309.753

247,038

621,438

148,752

524,269

15

- -

20

4,824

15

12145

18,024

4,628 11,208

12/15

-

14.728

3,171.953

12/30 279.763

-

61

4,000

0.0005,000

1,676

1,393

18,007

887

12/30 150.000 1,050,000 2,554

1,425

12/24

4,110

4.

2

1

12/08

1,305 1,490

AUTO

197

2.

2.

6. Kertas Basuki Rachmat Indonesia Tbk.

700 855 12/08

1,645

YPAS

12/29

86

1

12.

ARGO

1. 1

SMSM

4.

5.

190

LPIN

-

590

1

7.

3.

207

50

11. PRAS

16,000

3,900

1. KRAH 2

950

1.

4,200

2

NIPS

2

12/12

-

BRAM

7,125

12/02

1.

770

1

5,000

-

7.

2.

9.

8.

53

3.

1.

FASW

4,230

KBRI

INRU

4.

GJTL

585

5.

2

12/19

487

MASA 1 425 428 12/01

2

6,700

INKP

940

DAJK 1

2

223

2

12/30

12/02

12/04

1,150

1,1551

SPMA

8. 2

12/01

5.

2

1,175

2.

3.

1,145

ALDO

1

2

TIRT

1

1

1,040

730

12/02

13.

-

1,655

2,540

CPIN

JPFA

3,700

2,045

12/29

1,015

52 12/04

INDS

12/30

1,245

16,000

2

1

14.

2.

SIPD

SULI

4,560 12/17

ASII

6.

6,850

1.

510

1,180

2

1

MAIN

12/04

IMAS

667 245 98 667 245

12/29

1 3,420 4,000 12/30

17,350

12/301

-

760

193

12/30

16,000 12/30

12/02 487 12/30

12/30 12/30

1

5,850 6,200

GDYR

TKIM

12/30 294.545

-

12/23

INDONESIASTOCKEXCHANGEIDXMONTHLYSTATISTICS,DECEMBER201424

ResearchandDevelopmentDivision](https://image.slidesharecdn.com/monthly-dec-2014-170709003957/85/Statistik-Bulanan-BEI-Desember-2014-31-320.jpg)

![Table Trading by Industry

Industry Classification / Stock Name Volume

Date (Thou. Shr)

Value Freq.

Board

VolumeIndex

(Million Rp)

Value

REGULAR MARKETMarket

Cap.

(Million Rp)Close Date

P R I C E

Prev. High Date Low

Days

Days

(Thou. Shr) (Million Rp) (X)

Freq.

(X)

TOTAL MARKET

Panasia Indo Resources Tbk.

Indo-Rama Synthetics Tbk. [S]

Apac Citra Centertex Tbk.

Pan Brothers Tbk. [S]

Asia Pacific Fibers Tbk.

Ricky Putra Globalindo Tbk. [S]

Sri Rejeki Isman Tbk. [S]

Sunson Textile Manufacturer Tbk. [S]

Star Petrochem Tbk. [S]

Tifico Fiber Indonesia Tbk. [S]

Trisula International Tbk. [S]

Nusantara Inti Corpora Tbk.

Unitex Tbk. [S]

44 FOOTWEAR

Sepatu Bata Tbk. [S]

Primarindo Asia Infrastructure Tbk.

45 CABLE

Sumi Indo Kabel Tbk.

Jembo Cable Company Tbk.

KMI Wire and Cable Tbk. [S]

Kabelindo Murni Tbk. [S]

Voksel Electric Tbk. [S]

46 ELECTRONICS

Sat Nusapersada Tbk. [S]

49 OTHERS

5. CONSUMER GOODS INDUSTRY

51 FOOD AND BEVERAGES

Tiga Pilar Sejahtera Food Tbk. [S]

Tri Banyan Tirta Tbk.

Wilmar Cahaya Indonesia Tbk. [S]

Davomas Abadi Tbk. [S]

Delta Djakarta Tbk.

Indofood CBP Sukses Makmur Tbk. [S]

Indofood Sukses Makmur Tbk. [S]

Multi Bintang Indonesia Tbk.

Mayora Indah Tbk. [S]

Prasidha Aneka Niaga Tbk. [S]

Nippon Indosari Corpindo Tbk. [S]

Sekar Bumi Tbk. [S]

Sekar Laut Tbk. [S]

Siantar Top Tbk. [S]

12/30 67.917

266

13

180

49.0

46

12/30

207,222

1,701.826

12/10

1,210

69,230

2,492,752

12/19

34

1,509

187,733

329,730

122,525

482

-1,040

2,350

50

2,876,961

59,267,879

79 46

12/19

2,432

356

12/17

11

20

-

24,483 20

18,367155,586

12/23

-

6,325

-

1,500

12/30

132

-

11,150 242.817

46,625.620

12/19

17,885 20

5

278

97

98,372

110

2,332,236

12/01460

-

16

20

186

236

2,858,514

20

11

122,737

13 7

20

20

8

19

-

109,927

175

-

109

676

41,362

19,266

79

1,710

172

233,959

0.01

266

18

15

-

37,837

14

19,228

-

1,837

20

47

364

16

516

516

43

--

38,332

-

671

159,503

392

20

330,403

7

121

1,710

194

1

79

-

338

180

16

1,59220

155

11,950

2

BATA

BIMA

KBLM

PSDN

ROTI

SKBM

25,300 20,4501

3,765

12/30

12/16

12/08 970

1

2,890

2

970

16

IKBI

JECC

KBLI

5.

15.

1,200

197

12/29 11,575

1

25.116

12/18

13.

12/12

12/02

-

1.

139

1

3.

UNTX

163

705

146

970 12/12 610

1

11,250

12/01

12/02

- -

Supreme Cable Manufacturing & Commerce Tbk. [S]

1,400 12/09

12/02

-

11,850

700-

800 615

1,040

975

76,114.650

12/30

446,250

2

12/30

1

2

387,500

695

3,597

254.994

48.97

300

343

14,332.036

ULTJ

6. VOKS

2 250705

-

03/08/12

12/30

16.89012/30

14.300

23.593

12/30 12/30

15

523,401 245,244

309

516 171

18,305

37,759

1

6,377

- - -

- -

1,014,800,996

-

620,186

6,245,141 2 778

2

171 20

20,900

5,311

710

2

3 1

1,412

2

DAVO

1,976

2

150,573

1,105

355,320

104,678

19

1

12/24

14.

15.

3,000

13,883

12 110

12,726

2,548.387

2

6,742,967

5

33,948

-

1,830

33,526

-

265

-

710

12/16 173,600

143

12/30

154.959

50

12/16 3,950

1,807

79

795

483,281

76,385,497

7,010,593

205,920

217,197,851

14.655

175.863

12/12 318 172

3,700

12/30 7.894

85

12/29

12/08

-

4

20

20

769,658

2,186 20 5,709

2,106

211,312

5,099

12/30

12/24

12/178112/04

1,385

1,436,500 482

268

10/21/11

12/01

5,570,944

664,470

12/02 2,050

12/16

1,496,700

0.00

-

09/19/13 85.999 60,200

12/15123

-

12/02

-

12/24

812,054

318,240

70.334

12/22

11/21

12/16

-

104

337 12/03

11.

369

1,190

12/08

137

12.

8. 1

9.

SRIL

-

2,270

12/19

12/03

351

97

2,290

12/30

1.

3,700

2.

158

165 135

12/12

5. 1

-

1

2

3,875

1

390

PBRX

2

INDR

995

2

3,950

-

-

12/01 151

12/22

143

STTP

340

12/19 390,000

1

5,939

-

23,341

38 32

146.542

41

557,006

11/14

--

660,741

63

1,305

265

5555 12

-

120

3,108

919 8

175

-

-

516

2

1,590

-

12/30

48,001

13

4

20

20

12

105,058

-

5

11

1,410,046

7

20

214,262

908,435

24,568

2,212

6

919

3941,512

20

1,842

49,119

215,252

128,404

20

3,772,8002,880

24,613

3

120,604

979,420 158,637

16

9

482

122,525 43,774

9723,984

6,986,820

1,799.536 10,744,7813,720

5,444

12

-

20

12/30

25,178,650

1

825,565

289494 32

19. 2

347

TFCO

13.

2.

4. 155

SCCO

128

1. 1 1,000

STAR

1.

125

50

390390

MYOR

4,000

ICBP

ALTO

3,670 12/29

12,000

387,500

12/02

19

3

40,537

3

20

5

53,725

3,108

12/30

-

14

3,271,539

1,721

22 1

352,370

103.705

28

12/30 1,155.4466,750

40,316

5

17.084

20

17,895

20

12/30

12/30Ultrajaya Milk Industry & Trading Co. Tbk. [S]

MYTX

10,201

16. 950 12/10 900

14,579

336,867

20

250.847 29,853

1

12/17 900

174 12/30

37,759

1

124,693102 131 12/10 99

111,659

12/23

12/09

18,372

20

20

20

964,270 156,181

12/30

-

1,963,826

1,719

61.502

13,100

31,592

321,205

12/18

804

50 12/23

12/01 14,579

366,54650

172 172

103 12/30

12/23

11

38

63

178.105

0.816 237,097

893.805

9

1.20 1.09 3

20505

543.137

12/30

32

49.020

20

24.235

240,000

20

3,030,641

212726

1

32

197,128 1,297,023 41,305

166,418

1,511

77012/29

13

1

0.72

12/30

95

730

461 530 12/09

12/24

2 127 12/16 76 12/01

390,000

13,400

12/30

2,350

140

50

118.667

12/24 7

12/17

390

12/30

2,095

583,884

522

5.167

18,691,873

12/30

43,774

726 125 212 19

1 3

364

12/30 4,184.578

371,580

27.635

503,851 654 716 15

31,612

124,693

125

35,442

71

4,340,769

294 15 62

203.952

482

522

5,693

13,937

12/30

13

1

12/05

-

2,880

12/30

597,703

128

12/30

150,573

12/12 843.478

SSTM

700

368

RICY

1,455

-

12.

2.

8.

SKLT

1,700

HDTX

1

1,140

2

1,540

1

1

14.

188180

POLY 78

89

CEKA

1

25,200

6,700 6,775INDF 1

9.

10.

4.

6.

7.

MLBI

3.

11.

PTSN

AISA

10. 2

17. TRIS

364 12/29

-

18.

7.

352

3,700

DLTA

1,225

165

2

UNIT

ResearchandDevelopmentDivision

INDONESIASTOCKEXCHANGEIDXMONTHLYSTATISTICS,DECEMBER201425](https://image.slidesharecdn.com/monthly-dec-2014-170709003957/85/Statistik-Bulanan-BEI-Desember-2014-32-320.jpg)

![Table Trading by Industry

Industry Classification / Stock Name Volume

Date (Thou. Shr)

Value Freq.

Board

VolumeIndex

(Million Rp)

Value

REGULAR MARKETMarket

Cap.

(Million Rp)Close Date

P R I C E

Prev. High Date Low

Days

Days

(Thou. Shr) (Million Rp) (X)

Freq.

(X)

TOTAL MARKET

52 TOBACCO MANUFACTURERS

Gudang Garam Tbk.

HM Sampoerna Tbk.

Bentoel Internasional Investama Tbk.

Wismilak Inti Makmur Tbk.

53 PHARMACEUTICALS

Darya-Varia Laboratoria Tbk. [S]

Indofarma (Persero) Tbk. [S]

Kimia Farma (Persero) Tbk. [S]

Kalbe Farma Tbk. [S]

Merck Tbk. [S]

Pyridam Farma Tbk. [S]

Merck Sharp Dohme Pharma Tbk.

Industri Jamu dan Farmasi Sido Muncul Tbk. [S]

Tempo Scan Pacific Tbk. [S]

54 COSMETICS AND HOUSEHOLD

Akasha Wira International Tbk. [S]

Mustika Ratu Tbk. [S]

Martina Berto Tbk. [S]

Mandom Indonesia Tbk. [S]

Unilever Indonesia Tbk. [S]

55 HOUSEWARE

Chitose Internasional Tbk. [S]

Kedaung Indah Can Tbk. [S]

Langgeng Makmur Industri Tbk. [S]

59 OTHERS

6. PROPERTY, REAL ESTATE AND BUILDING CONSTRUCTION

61 PROPERTY AND REAL ESTATE

Agung Podomoro Land Tbk. [S]

Alam Sutera Realty Tbk. [S]

Bekasi Asri Pemula Tbk. [S]

Bekasi Fajar Industrial Estate Tbk. [S]

Bumi Citra Permai Tbk. [S]

Bhuwanatala Indah Permai Tbk. [S]

Bukit Darmo Property Tbk. [S]

Sentul City Tbk. [S]

Bumi Serpong Damai Tbk. [S]

Cowell Development Tbk. [S]

Ciputra Development Tbk. [S]

Ciputra Property Tbk. [S]

Ciputra Surya Tbk. [S]

150,000

1,690

2,430 3,330

20

20

687

1,028

43,737

11

20

19

23,105

203,750

6.70

1,080,472 35,931

1,458

20

414

14

13,898

20

20

26,440

607,496480,618

5477,799

31,339

18,104 10,998

12/12

CTRS

1,750

MBTO

2 685

1

285

1

3.

13.

COWL

BAPA

368

770

12/01

12/02

12/08

790

12/02

12/30

8,136,610

12/30

SCPI

560

1 115

TSPC

CTRA

12.

1

1,250

12/02

12/05

12/03

1,770 1,895

175

49,620

77,291

MRAT

7.

9.

1

12/09

57,100

1

BKDP

811,108

422,762,315

ADES

1,150

315,000

BIPP

BCIP

3,100

1,375

12/03

2,645

12/16

895

2 333,000

2

361

2

1 497

260

1

53

12/18

600 12/16

2

1,345

7,041,187

640 12/23 575

49

1,830

12/04

12/16

2

429.412

169,900

1

2.

97,314

12/12

52

165

11,003,671

12/12

-

2

12/02

12/16

2,43520

11/27/12

12/10

12/15

4.

1.

21,855

101,204.70 63,895

61,525

85,781,4731,715

1 595

730

169

285

12/16

93 99

50 12/30

6. 2

99 12/09

3.

1

645 12/04

3.

1,550

GGRM

1

RMBA

2

9.

12/16

12/02

770

BEST

12/08

12/16

80

-

12/02

CTRP

12/30 30,525 12/15

17,500

1

1.

1,370

10. 640

11.

5,912 20

9,886

374

20

20

93,869

17,973,719

1,718.946

UNVR 32,300

7,799

27,882

165,386.585 246,449,000 29,806

469

25

8,621 124 14 684 12,222 12617,525

36,790,333

81.66712/30 27,641

1,184.000

20

2038,562

65,491 6,311 2012/30

443,838

1,101,035

6,3275,196,750

17,2095,857,440

9,889267,013

20

20

33,161,183

2048,9033,168,955

547392

398,25612/30

12/30

16,201

19,831

360,004,139

20

71.42912/30 1,029

33,089

04/02/01

12/30

533.333

6,867,802

13,621.032

227.451

374

32,667,156

25

420 420

25

12/30

20

1,562,561

40,332

12/30

127,952

760

787,679

12/30

68,650

520

204

12/12 498 144,068.858 311

107,377

62.207

1,681,432 140,731

8

7,153

0.20

15 88

25,931

176,491 8,282

64,55212,892,500 14,414

21,888

20

418

8,301

20

20

20

22,076

0.20

756,967

49,118

365,216

272

77

2

79,479

2,232,247

163

53