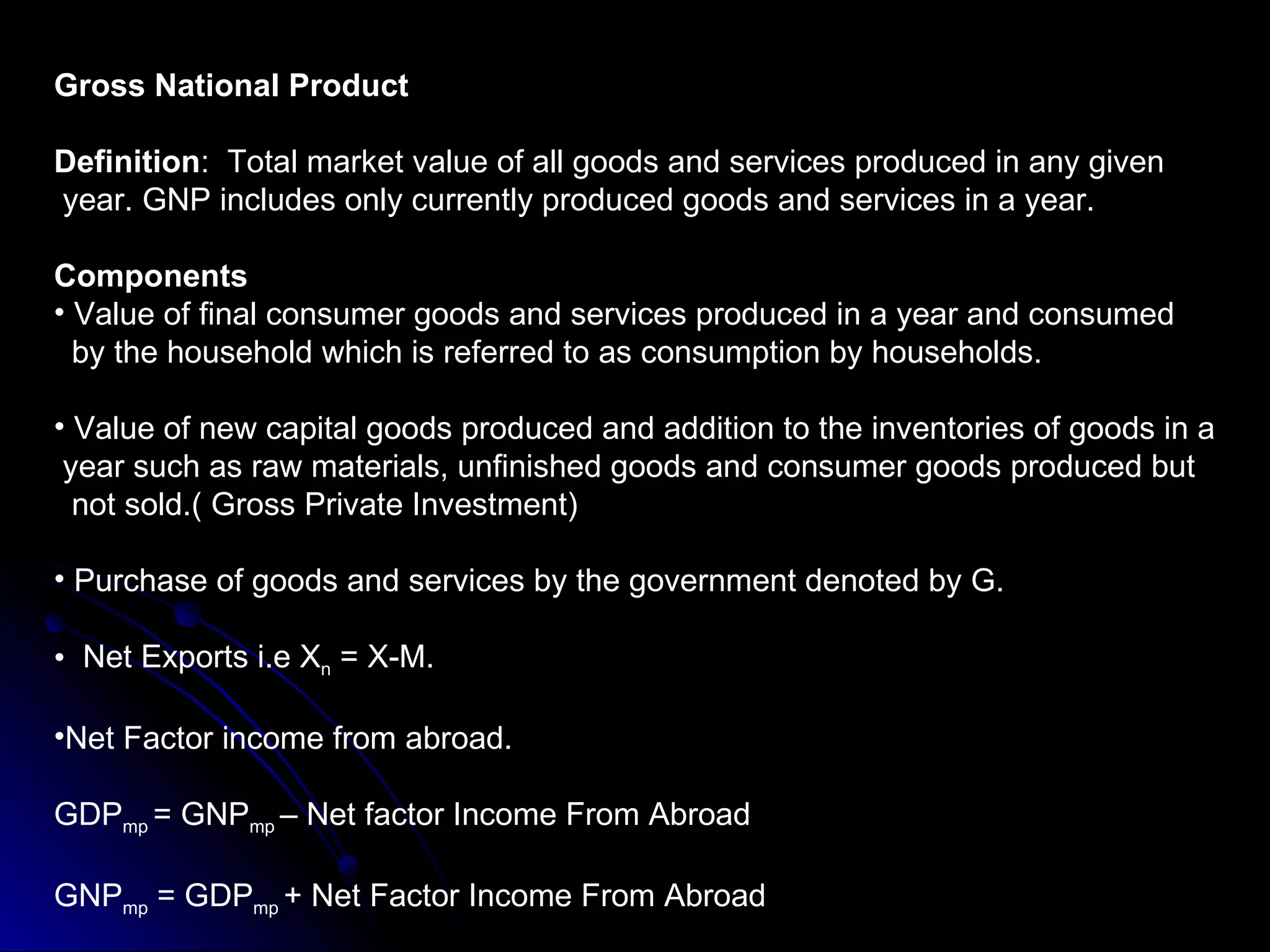

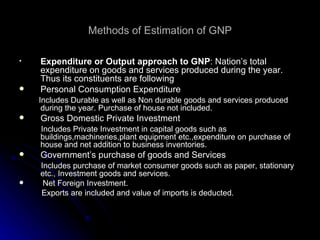

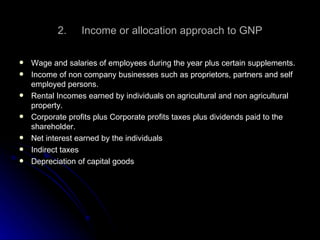

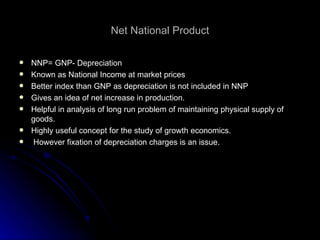

Gross National Product (GNP) is the total market value of all goods and services produced in a given year. It includes the value of final goods and services consumed domestically, gross private investment in new capital, government purchases of goods and services, and net exports. There are two main approaches to estimating GNP: the expenditure approach which looks at total national expenditures, and the income approach which examines total incomes like wages, profits, rents, and taxes. National income is GNP minus depreciation and represents the net increase in production in a year.