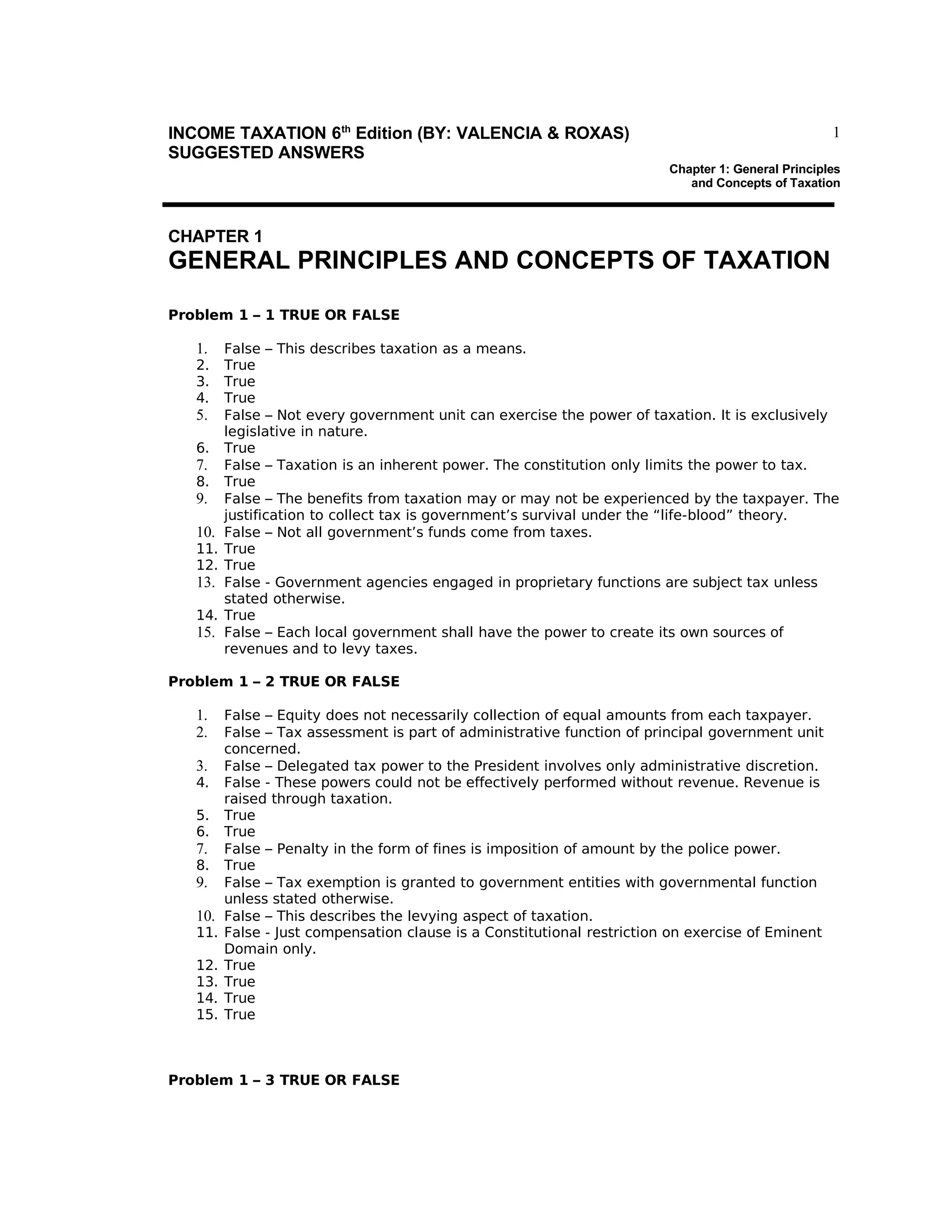

This document contains the suggested answers to problems in Chapter 1 of the book "Income Taxation 6th Edition" by Valencia & Roxas. Chapter 1 covers general principles and concepts of taxation. It includes true/false questions and answers about topics like the definition and justification of taxation, the taxing powers of government, and individual versus corporate taxation. Multiple choice problems cover additional topics like tax exemptions, tax administration, and the relationship between tax laws and the constitution.