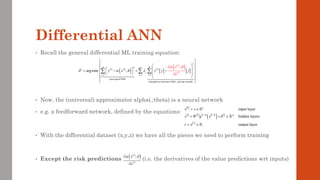

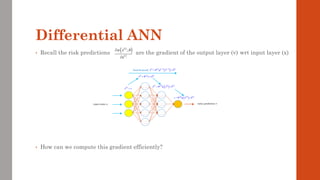

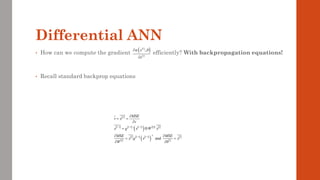

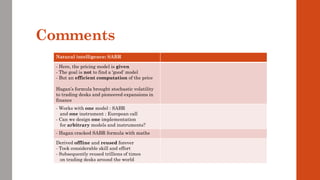

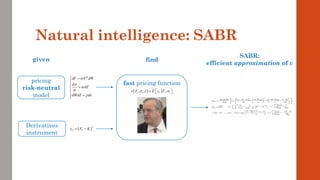

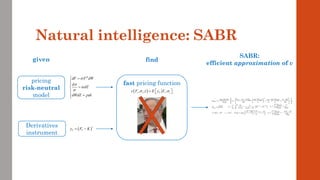

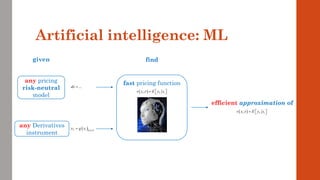

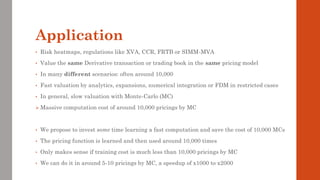

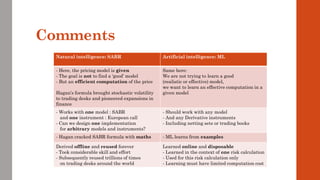

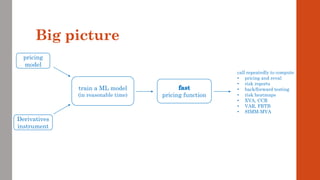

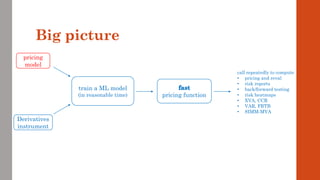

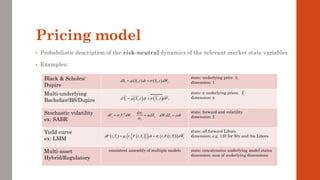

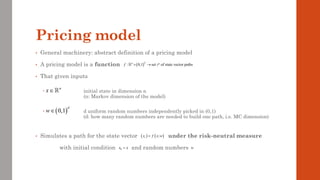

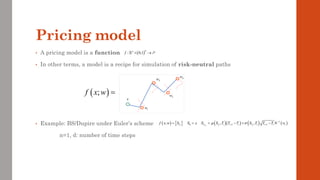

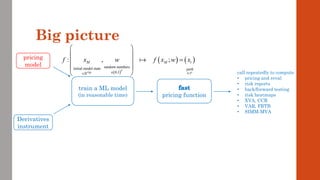

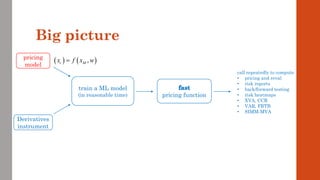

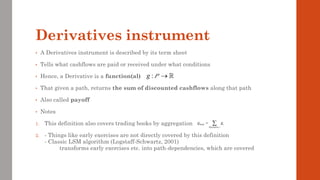

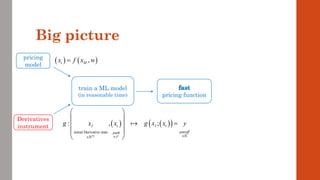

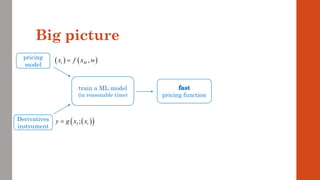

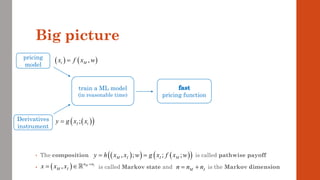

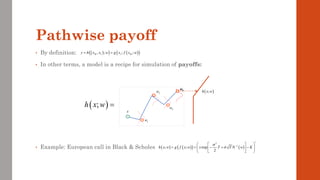

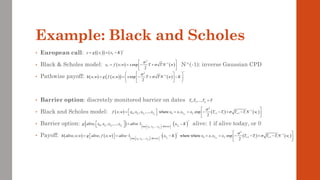

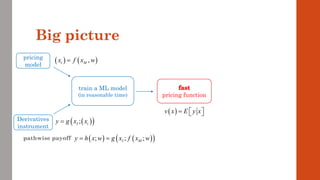

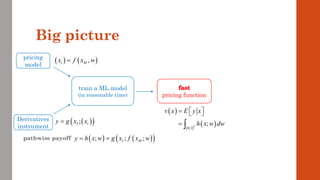

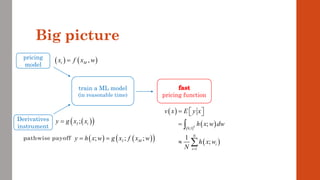

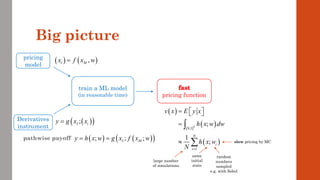

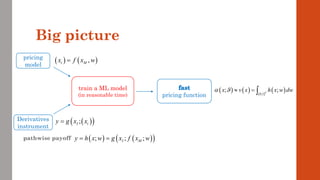

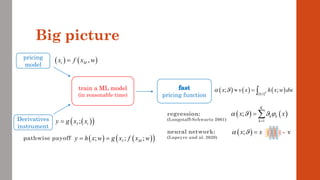

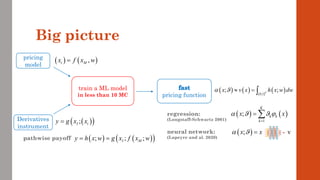

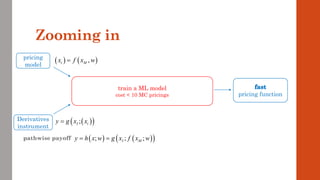

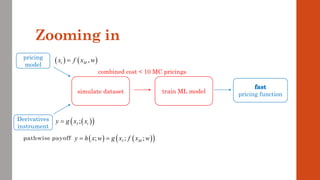

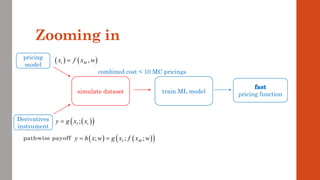

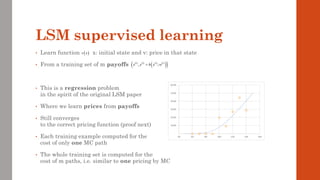

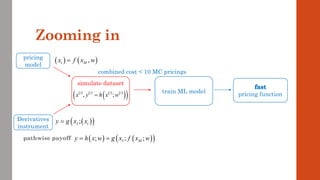

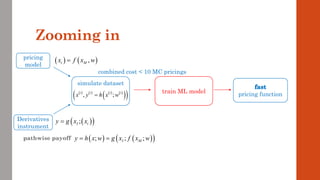

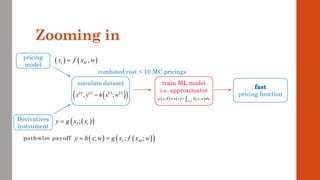

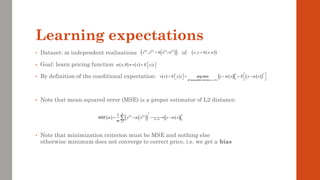

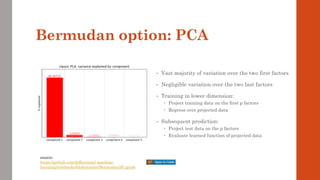

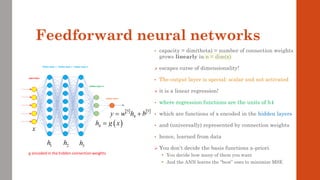

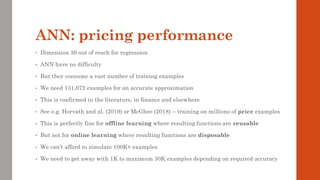

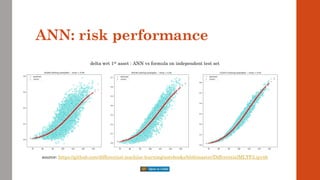

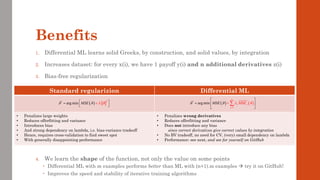

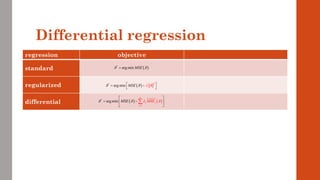

The document reviews the application of machine learning (ML) in derivatives pricing and risk assessment, focusing on both conventional ML methods and differential ML techniques. It emphasizes the importance of efficient computation for pricing models, specifically through the use of exemplary algorithms such as the SABR model, and highlights the potential of ML to significantly reduce computational costs in risk calculations. The document discusses a framework for training ML models to improve speed and efficiency in pricing functions for various derivatives instruments.

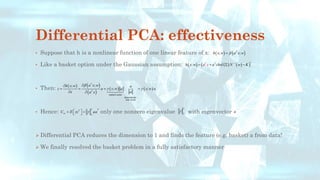

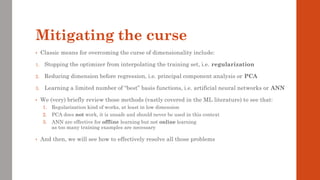

![Example: Gaussian basket

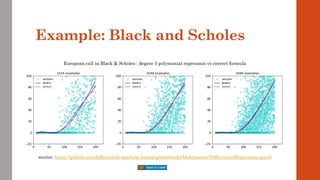

• Black & Scholes is not a representative example

• Because its dimension is 1: x = {spot}

• Most situations in finance are high-dimensional

• e.g. LMM with 3m Libors over 30y: x = {all forward Libors}, dimension = 120

• With netting sets or trading books, dimension generally in the 100s or more

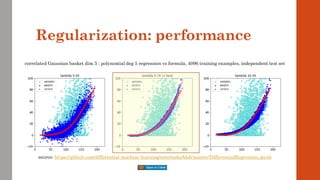

• A more representative example is the basket option in the correlated Bachelier model

Equally simple, with analytic solution

But, crucially, multidimensional x = {spot[1], spot[2], …, spot[n]}

Path generation:

chol: choleski decomp, sigma: covariance matrix and N^(-1) applied elementwise

Cashflow: a: (fixed) weights in the basket and K: strike

Payoff:

Analytic solution: Bach: classic Bachelier formula

( ) ( ) ( )

1

;

T

x f x w x chol N w

−

= = +

( ) ( )

T

T T

g x a x K

+

= −

( ) ( ) ( ) ( )

( )

1

; ; T

h x w g f x w a x chol N w K

+

−

= = + −

( ) ( )

( ) ( )

0,1

, , ; ,

n

T T

v x h x w dw Bach a x a a K T

= =

](https://image.slidesharecdn.com/dlm-masterclass-v2-talk-220319152430/85/Differential-Machine-Learning-Masterclass-49-320.jpg)

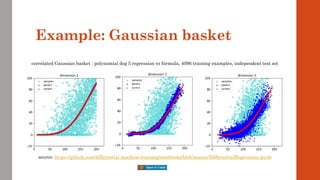

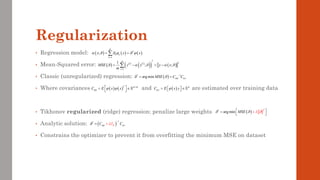

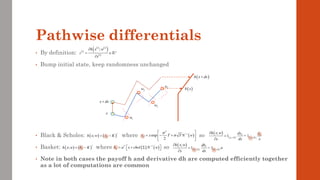

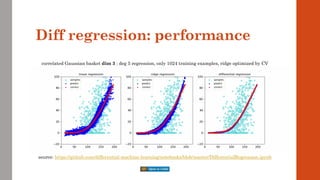

![regression objective solution

standard

regularized

differential

Differential regression

( )

2

*

arg min MSE

=

+

( ) ( )

1

*

arg min

n

j j

j

M E

SE MS

=

=

+

( )

*

arg min MSE

= * 1

y

C C

−

=

( )

1

*

y

K

C I C

−

+

=

1

*

1 1

n n

z

j jj j j

j j

y

C C

C C

−

= =

=

+ +

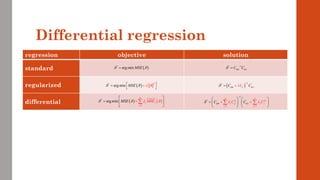

• Where is the covariance matrix of the derivatives of basis functions wrt x_j

• example: cubic regr. dim 2

• and is the vector of covariances of phi_j with z[j], the j-th pathwise derivative

( ) ( )

T K K

jj j j

C E x x

=

( )

( ) ( )

1

,..., K K

j

j j

x x

x

x x

=

( )

( )

( )

2 2 2 2 3 3

1 2 1 2 1 2 1 2 1 2 1 2 1 2

2 2

1 1 2 1 2 1 2 2 1

2 2

2 1 2 2 1 1 1 2

, [ 1 ]

, [ 0 1 0 2 0 2 3 0 ]

, [ 0 0 1 0 2 2 0 3 ]

x x x x x x x x x x x x x x

x x x x x x x x

x x x x x x x x

=

=

=

( )

z K

j j

C E x z j

=

](https://image.slidesharecdn.com/dlm-masterclass-v2-talk-220319152430/85/Differential-Machine-Learning-Masterclass-99-320.jpg)

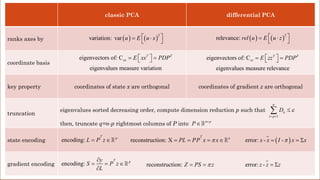

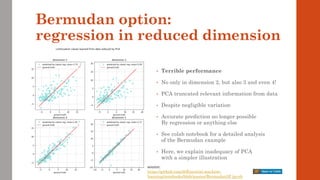

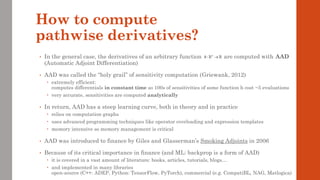

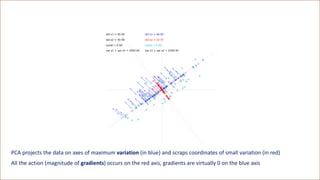

![[Variation = magnitude of data coordinates] is the wrong metric

The correct metric is the magnitude of directional derivatives, called relevance](https://image.slidesharecdn.com/dlm-masterclass-v2-talk-220319152430/85/Differential-Machine-Learning-Masterclass-110-320.jpg)