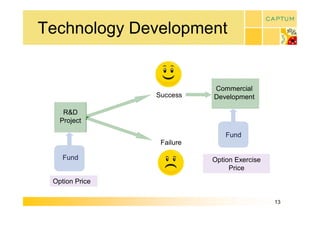

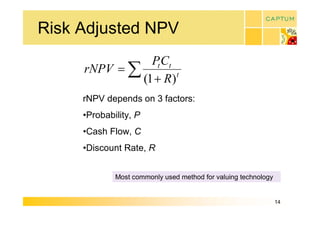

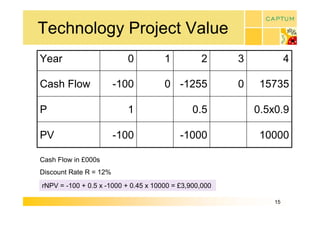

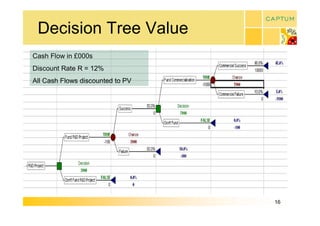

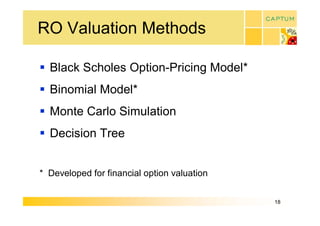

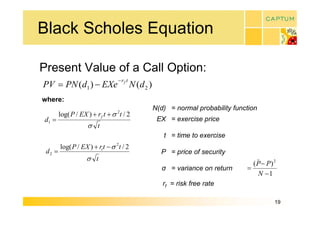

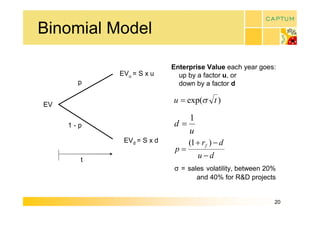

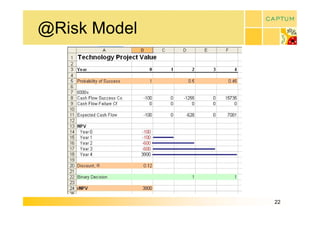

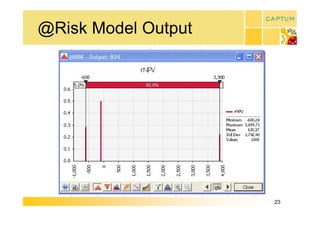

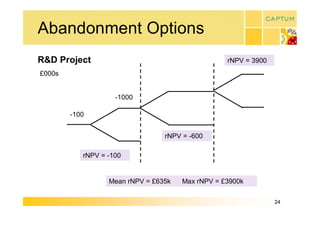

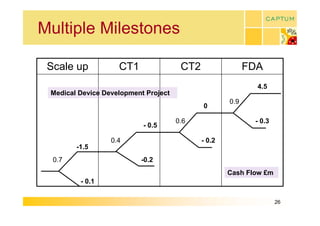

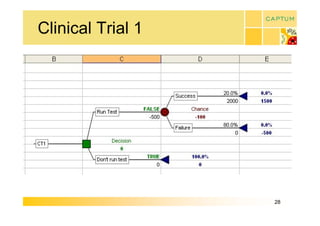

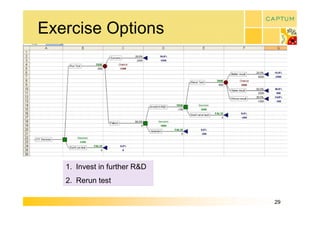

This document discusses real option valuation techniques for technology projects. It begins by providing examples of real options like options to abandon or expand a project. It then covers various valuation models like decision trees, binomial models, and Monte Carlo simulations. These models can value flexibility and account for uncertainty. The document concludes by discussing Captum Capital which provides valuation and consulting services, including upcoming events on their valuation masterclass and workshop on technology evaluation.