Exchange rate behaviour

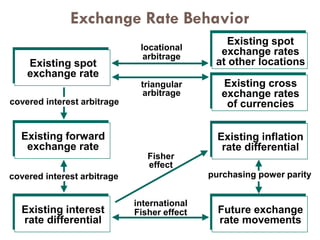

- 1. Exchange Rate Behavior Existing spot exchange rates at other locations Existing cross exchange rates of currencies Existing inflation rate differential Future exchange rate movements Existing spot exchange rate Existing forward exchange rate Existing interest rate differential locational arbitrage triangular arbitrage purchasing power parity international Fisher effect covered interest arbitrage covered interest arbitrage Fisher effect 1

- 2. Exchange Rate Systems Exchange rate systems can be classified according to the degree to which the rates are controlled by the government. Exchange rate systems normally fall into one of the following categories: fixed freely floating managed float pegged 2

- 3. Fixed Exchange Rate System In a fixed exchange rate system, exchange rates are either held constant or allowed to fluctuate only within very narrow bands. The Bretton Woods era (1944-1971) fixed each currency’s value in terms of gold. The 1971 Smithsonian Agreement which followed merely adjusted the exchange rates and expanded the fluctuation boundaries. The system was still fixed. 3

- 4. Fixed Exchange Rate System Pros: Work becomes easier for the MNCs. Cons: Governments may revalue their currencies. In fact, the dollar was devalued more than once after the U.S. experienced balance of trade deficits. Cons: Each country may become more vulnerable to the economic conditions in other countries. 4

- 5. Freely Floating Exchange Rate System In a freely floating exchange rate system, exchange rates are determined solely by market forces. Pros: Each country may become more insulated against the economic problems in other countries. Pros: Central bank interventions that may affect the economy unfavorably are no longer needed. 5

- 6. Freely Floating Exchange Rate System Pros: Governments are not restricted by exchange rate boundaries when setting new policies. Pros: Less capital flow restrictions are needed, thus enhancing the efficiency of the financial market. 6

- 7. Freely Floating Exchange Rate System Cons: MNCs may need to devote substantial resources to managing their exposure to exchange rate fluctuations. Cons: The country that initially experienced economic problems (such as high inflation, increasing unemployment rate) may have its problems compounded. 7

- 8. Managed Float Exchange Rate System In a managed (or “dirty”) float exchange rate system, exchange rates are allowed to move freely on a daily basis and no official boundaries exist. However, governments may intervene to prevent the rates from moving too much in a certain direction. Cons: A government may manipulate its exchange rates such that its own country benefits at the expense of others. 8

- 9. Pegged Exchange Rate System In a pegged exchange rate system, the home currency’s value is pegged to a foreign currency or to some unit of account, and moves in line with that currency or unit against other currencies. The European Economic Community’s snake arrangement (1972-1979) pegged the currencies of member countries within established limits of each other. 9

- 10. Pegged Exchange Rate System The European Monetary System which followed in 1979 held the exchange rates of member countries together within specified limits and also pegged them to a European Currency Unit (ECU) through the exchange rate mechanism (ERM). The ERM experienced severe problems in 1992, as economic conditions and goals varied among member countries. 10

- 11. Pegged Exchange Rate System In 1994, Mexico’s central bank pegged the peso to the U.S. dollar, but allowed a band within which the peso’s value could fluctuate against the dollar. By the end of the year, there was substantial downward pressure on the peso, and the central bank allowed the peso to float freely. The Mexican peso crisis had just began ... 11

- 12. Currency Boards A currency board is a system for maintaining the value of the local currency with respect to some other specified currency. For example, Hong Kong has tied the value of the Hong Kong dollar to the U.S. dollar (HK$7.8 = $1) since 1983, while Argentina has tied the value of its peso to the U.S. dollar (1 peso = $1) since 1991. 12

- 13. Currency Boards For a currency board to be successful, it must have credibility in its promise to maintain the exchange rate. It has to intervene to defend its position against the pressures exerted by economic conditions, as well as by speculators who are betting that the board will not be able to support the specified exchange rate. 13

- 14. Exposure of a Pegged Currency to Interest Rate Movements A country that uses a currency board does not have complete control over its local interest rates, as the rates must be aligned with the interest rates of the currency to which the local currency is tied. Note that the two interest rates may not be exactly the same because of different risks. 14

- 15. Exposure of a Pegged Currency to Exchange Rate Movements A currency that is pegged to another currency will have to move in tandem with that currency against all other currencies. So, the value of a pegged currency does not necessarily reflect the demand and supply conditions in the foreign exchange market, and may result in uneven trade or capital flows. 15

- 16. Dollarization Dollarization refers to the replacement of a local currency with U.S. dollars. Dollarization goes beyond a currency board, as the country no longer has a local currency. For example, Ecuador implemented dollarization in 2000. 16

- 17. Countries using the U.S.dollar exclusively British Virgin Islands Caribbean Netherlands (from 1 January 2011) East Timor (uses its own coins) Ecuador (uses its own coins in addition to U.S. coins; Ecuador adopted the U.S. dollar as its legal tender in 2000. El Salvador Marshall Islands Federated States of Micronesia (Micronesia used the U.S. dollar since 1944 Palau (Palau adopted the U.S. dollar since 1944 Panama (uses its own coins in addition to U.S. coins. This country has adopted the U.S. dollar as legal tender since 1904) Turks and Caicos Islands 17

- 18. Countries using the U.S.dollar alongside other currencies Bahamas Belize (Belizien Dollar pegged 2/1 but USD is accepted) Uruguay Nicaragua Cambodia (uses Cambodian Riel for many official transactions but most businesses deal exclusively in dollars) Lebanon (along with the Lebanese pound) Liberia (was fully dollarized until 1982 the year the National Bank of Liberia started to issue five dollar coins; U.S. dollar still in common usage alongside Liberian dollar) Zimbabwe Haiti (uses the U.S Dollar alongside its domestic currency called Gourde) Vietnam (along with the Vietnamese Dong) Somalia (along with the Somali Shilling) 18

- 19. € A Single European Currency In 1991, the Maastricht treaty called for a single European currency. On Jan 1, 1999, the euro was adopted by Austria, Belgium, Finland, France, Germany, Ireland, Italy, Luxembourg, Netherlands, Portugal, and Spain. Greece joined the system in 2001. By 2002, the national currencies of the 12 participating countries will be withdrawn and completely replaced with the euro. 19

- 20. A Single European Currency Within the euro-zone, cross-border trade and capital flows will occur without the need to convert to another currency. European monetary policy is also consolidated because of the single money supply. The Frankfurt- based European Central Bank (ECB) is responsible for setting the common monetary policy. € 20

- 21. A Single European Currency The ECB aims to control inflation in the participating countries and to stabilize the euro within reasonable boundaries. The common monetary policy may eventually lead to more political harmony. Note that each participating country may have to rely on its own fiscal policy (tax and government expenditure decisions) to help solve local economic problems. € 21

- 22. A Single European Currency As currency movements among the European countries will be eliminated, there should be an increase in all types of business arrangements, more comparable product pricing, and more trade flows. It will also be easier to compare and conduct valuations of firms across the participating European countries. € 22

- 23. A Single European Currency Stock and bond prices will also be more comparable and there should be more cross-border investing. However, non-European investors may not achieve as much diversification as in the past. Exchange rate risk and foreign exchange transaction costs within the euro-zone will be eliminated, while interest rates will have to be similar. € 23

- 24. A Single European Currency Since its introduction in 1999, the euro has declined against many currencies. This weakness was partially attributed to capital outflows from Europe, which was in turn partially attributed to a lack of confidence in the euro. Some countries had ignored restraint in favor of resolving domestic problems, resulting in a lack of solidarity. € 24

- 25. Government Intervention Each country has a government agency (called the central bank) that may intervene in the foreign exchange market to control the value of the country’s currency. In the United States, the Federal Reserve System (Fed) is the central bank. 25

- 26. Government Intervention Central banks manage exchange rates to smooth exchange rate movements, to establish implicit exchange rate boundaries, and/or to respond to temporary disturbances. Often, intervention is overwhelmed by market forces. However, currency movements may be even more volatile in the absence of intervention. 26

- 27. Government Intervention Direct intervention refers to the exchange of currencies that the central bank holds as reserves for other currencies in the foreign exchange market. Direct intervention is usually most effective when there is a coordinated effort among central banks. 27

- 28. Government Intervention When a central bank intervenes in the foreign exchange market without adjusting for the change in money supply, it is said to engaged in nonsterilized intervention. In a sterilized intervention, Treasury securities are purchased or sold at the same time to maintain the money supply. 28

- 29. Government Intervention Some speculators attempt to determine when the central bank is intervening, and the extent of the intervention, in order to capitalize on the anticipated results of the intervention effort. 29

- 30. Government Intervention Central banks can also engage in indirect intervention by influencing the factors that determine the value of a currency. For example, the Fed may attempt to increase interest rates (and hence boost the dollar’s value) by reducing the U.S. money supply. Note that high interest rates adversely affects local borrowers. 30

- 31. Government Intervention Governments may also use foreign exchange controls (such as restrictions on currency exchange) as a form of indirect intervention. 31

- 32. Exchange Rate Target Zones Many economists have criticized the present exchange rate system because of the wide swings in the exchange rates of major currencies. Some have suggested that target zones be used, whereby an initial exchange rate will be established with specific boundaries (that are wider than the bands used in fixed exchange rate systems). 32

- 33. Exchange Rate Target Zones The ideal target zone should allow rates to adjust to economic factors without causing wide swings in international trade and fear in the financial markets. However, the actual result may be a system no different from what exists today. 33

- 34. Intervention as a Policy Tool Like tax laws and money supply, the exchange rate is a tool which a government can use to achieve its desired economic objectives. A weak home currency can stimulate foreign demand for products, and hence local jobs. However, it may also lead to higher inflation. 34

- 35. Intervention as a Policy Tool A strong currency may cure high inflation, since the intensified foreign competition should cause domestic producers to refrain from increasing prices. However, it may also lead to higher unemployment. 35

- 36. Impact of Central Bank Intervention on an MNC’s Value n t t m j tjtj k1= 1 ,, 1 ERECFE =Value E (CFj,t ) = expected cash flows in currency j to be received by the U.S. parent at the end of period t E (ERj,t ) = expected exchange rate at which currency j can be converted to dollars at the end of period t k = weighted average cost of capital of the parent Direct Intervention Indirect Intervention 36

- 37. International Arbitrage Arbitrage can be loosely defined as capitalizing on a discrepancy in quoted prices. Often, the funds invested are not tied up and no risk is involved. In response to the imbalance in demand and supply resulting from arbitrage activity, prices will realign very quickly, such that no further risk-free profits can be made. 37

- 38. International Arbitrage Locational arbitrage is possible when a bank’s buying price (bid price) is higher than another bank’s selling price (ask price) for the same currency. Example: Bank C Bid Ask Bank D Bid Ask NZ$ $.635 $.640 NZ$ $.645 $.650 Buy NZ$ from Bank C @ $.640, and sell it to Bank D @ $.645. Profit = $.005/NZ$. 38

- 39. International Arbitrage Triangular arbitrage is possible when a cross exchange rate quote differs from the rate calculated from spot rates. Example: Bid Ask British pound (£) $1.60 $1.61 Malaysian ringgit (MYR) $.200 $.202 £ MYR8.1 MYR8.2 Buy £ @ $1.61, convert @ MYR8.1/£, then sell MYR @ $.200. Profit = $.01/£. (8.1.2=1.62) 39

- 40. International Arbitrage When the exchange rates of the currencies are not in equilibrium, triangular arbitrage will force them back into equilibrium. 40

- 41. International Arbitrage Triangular arbitrage (sometimes called triangle arbitrage) refers to taking advantage of a state of imbalance between three foreign exchange markets: a combination of matching deals are struck that exploit the imbalance, the profit being the difference between the market prices. Triangular arbitrage offers a risk-free profit (in theory), so opportunities for triangular arbitrage usually disappear quickly, as many people are looking for them, or simply never occur as everybody knows the pricing relation. 41

- 42. International Arbitrage Consider the three foreign exchange rates among the Canadian dollar, the U.S. dollar, and the Australian dollar. Triangular arbitrage will produce a profit whenever the following relation does not hold: CD$/US$ * AU$/CD$ = AU$/US$. For example if you can trade at these exchange rates the Canadian Dollar (CD$) against the US dollar (US$) is CD$1.13/US$1.00 (1 US$ gets you CD$1.13) the Australian Dollar (AU$) against the US dollar (US$) is AU$1.33/US$1.00 (1 US$ gets you AU$1.33) the Australian Dollar (AU$) against the Canadian Dollar (CD$) is AU$1.18/CD$1.00 (1 CD$ gets you AU$1.18) 1.13 * 1.18 = 1.3334 > 1.3300, thus mispricing has occurred. To take advantage of the mispricing, starting with US$10,000 to invest: 1st buy Canadian Dollars with his US Dollars: US$10,000 * (CD$1.13/US$1) = CD$11,300 2nd buy Australian Dollars with his Canadian Dollars: CD$11,300 * (AU$1.18/CD$1.00) = AU$13,334 3rd buy US Dollars with his Australian Dollars: AU$13,334 / (AU$1.33/US$1.0000) = US$10,025 Net risk free profit: US$25.00 42

- 43. International Arbitrage Covered interest arbitrage is the process of capitalizing on the interest rate differential between two countries, while covering for exchange rate risk. Covered interest arbitrage tends to force a relationship between forward rate premiums and interest rate differentials. 43

- 44. International Arbitrage Example: £ spot rate = $1.50 90-day forward rate = $1.60 U.S. 90-day interest rate = 2% U.K. 90-day interest rate = 2% Borrow $ at 3%, or use existing funds which are earning interest at 2%. Convert $ to £ at $1.60/£ and engage in a 90-day forward contract to sell £ at $1.60/£. Lend £ at 4%. 44

- 45. International Arbitrage Locational arbitrage ensures that quoted exchange rates are similar across banks in different locations. Triangular arbitrage ensures that cross exchange rates are set properly. Covered interest arbitrage ensures that forward exchange rates are set properly. 45

- 46. International Arbitrage Any discrepancy will trigger arbitrage, which will then eliminate the discrepancy. Arbitrage thus makes the foreign exchange market more orderly. 46

- 47. Interest Rate Parity (IRP) Market forces cause the forward rate to differ from the spot rate by an amount that is sufficient to offset the interest rate differential between the two currencies. Then, covered interest arbitrage is no longer feasible, and the equilibrium state achieved is referred to as interest rate parity (IRP). 47

- 48. Derivation of IRP When IRP exists, the rate of return achieved from covered interest arbitrage should equal the rate of return available in the home country. End-value of a $1 investment in covered interest arbitrage = (1/S)(1+iF)F = (1/S)(1+iF)[S(1+p)] = (1+iF)(1+p) where p is the forward premium. 48

- 49. Derivation of IRP End-value of a $1 investment in the home country = 1 + iH Equating the two and rearranging terms: p = (1+iH) – 1 (1+iF) i.e. forward = (1 + home interest rate) – 1 premium (1 + foreign interest rate) 49

- 50. Determining the Forward Premium Example: Suppose 6-month ipeso = 6%, i$ = 5%. From the U.S. investor’s perspective, forward premium = 1.05/1.06 – 1 -.0094 If S = $.10/peso, then 6-month forward rate = S (1 + p) .10 (1 _ .0094) $.09906/peso 50

- 51. Determining the Forward Premium Note that the IRP relationship can be rewritten as follows: F – S = S(1+p) – S = p = (1+iH) – 1 = (iH–iF) S S (1+iF) (1+iF) The approximated form, p iH–iF, provides a reasonable estimate when the interest rate differential is small. 51

- 52. Test for the Existence of IRP To test whether IRP exists, collect the actual interest rate differentials and forward premiums for various currencies. Pair up data that occur at the same point in time and that involve the same currencies, and plot the points on a graph. IRP holds when covered interest arbitrage is not worthwhile. 52

- 53. Interpretation of IRP When IRP exists, it does not mean that both local and foreign investors will earn the same returns. What it means is that investors cannot use covered interest arbitrage to achieve higher returns than those achievable in their respective home countries. 53

- 54. Does IRP Hold? Various empirical studies indicate that IRP generally holds. While there are deviations from IRP, they are often not large enough to make covered interest arbitrage worthwhile. This is due to the characteristics of foreign investments, including transaction costs, political risk, and differential tax laws. 54

- 55. Considerations When Assessing IRP Transaction Costs IRP may not be feasible after taking into consideration transaction costs. 55

- 56. Considerations When Assessing IRP Political Risk A crisis in the foreign country could cause its government to restrict any exchange of the local currency for other currencies. Investors may also perceive a higher default risk on foreign investments. Differential Tax Laws If tax laws vary, after-tax returns should be considered instead of before-tax returns. 56

- 57. Explaining Changes in Forward Premiums During the 1997-98 Asian crisis, the forward rates offered to U.S. firms on some Asian currencies were substantially reduced for two reasons. The spot rates of these currencies declined substantially during the crisis. Their interest rates had increased as their governments attempted to discourage investors from pulling out their funds. 57

- 58. Impact of Arbitrage on an MNC’s Value n t t m j tjtj k1= 1 ,, 1 ERECFE =Value E (CFj,t ) = expected cash flows in currency j to be received by the U.S. parent at the end of period t E (ERj,t ) = expected exchange rate at which currency j can be converted to dollars at the end of period t k = weighted average cost of capital of the parent Forces of Arbitrage 58