1. Econometrics uses statistical methods to estimate economic relationships, test economic theories, and evaluate policies. It builds mathematical and statistical models to represent economic behavior using data.

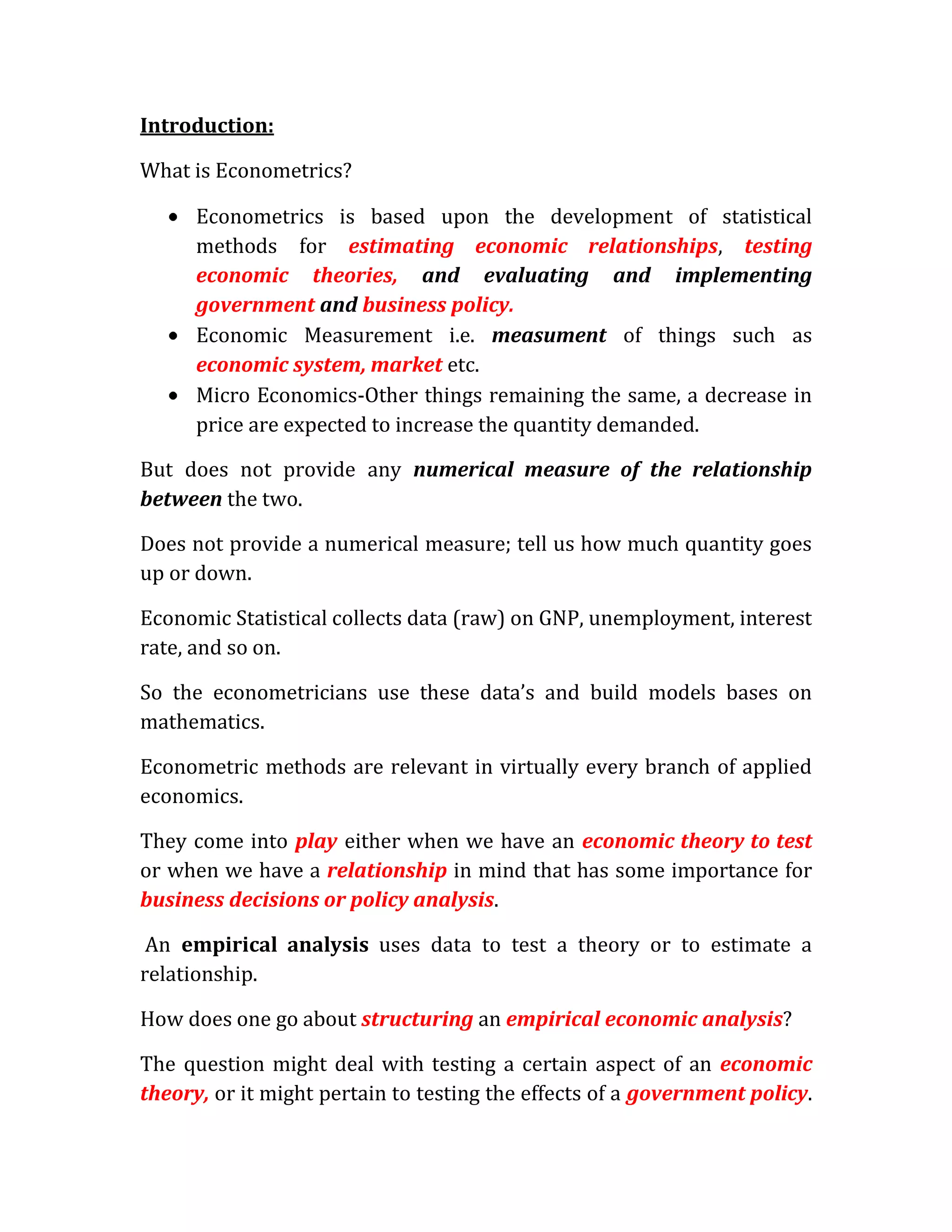

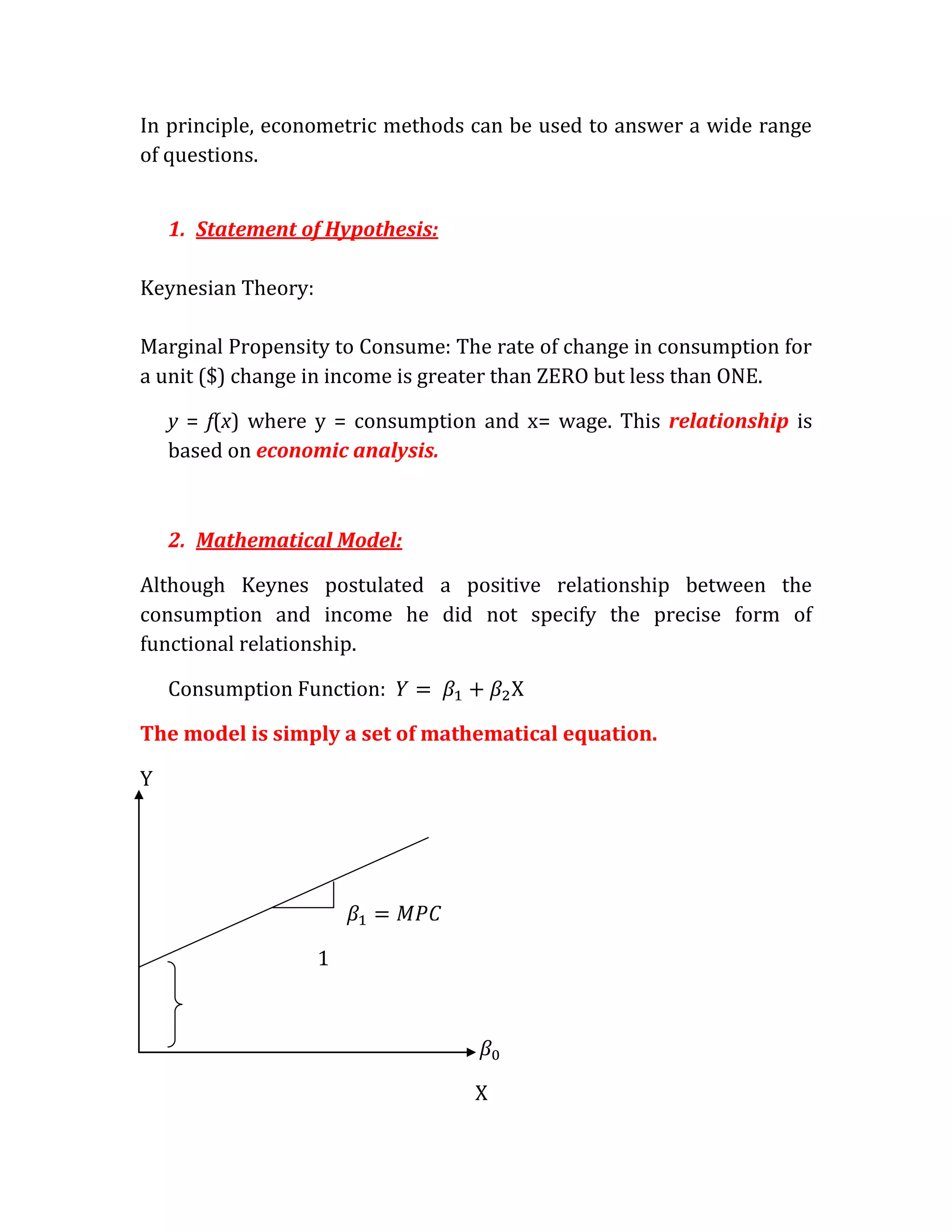

2. A consumption function model relates consumption (C) to income (Y) as C = a + bY, where a and b are parameters estimated using data. The model includes an error term to account for other influences not included.

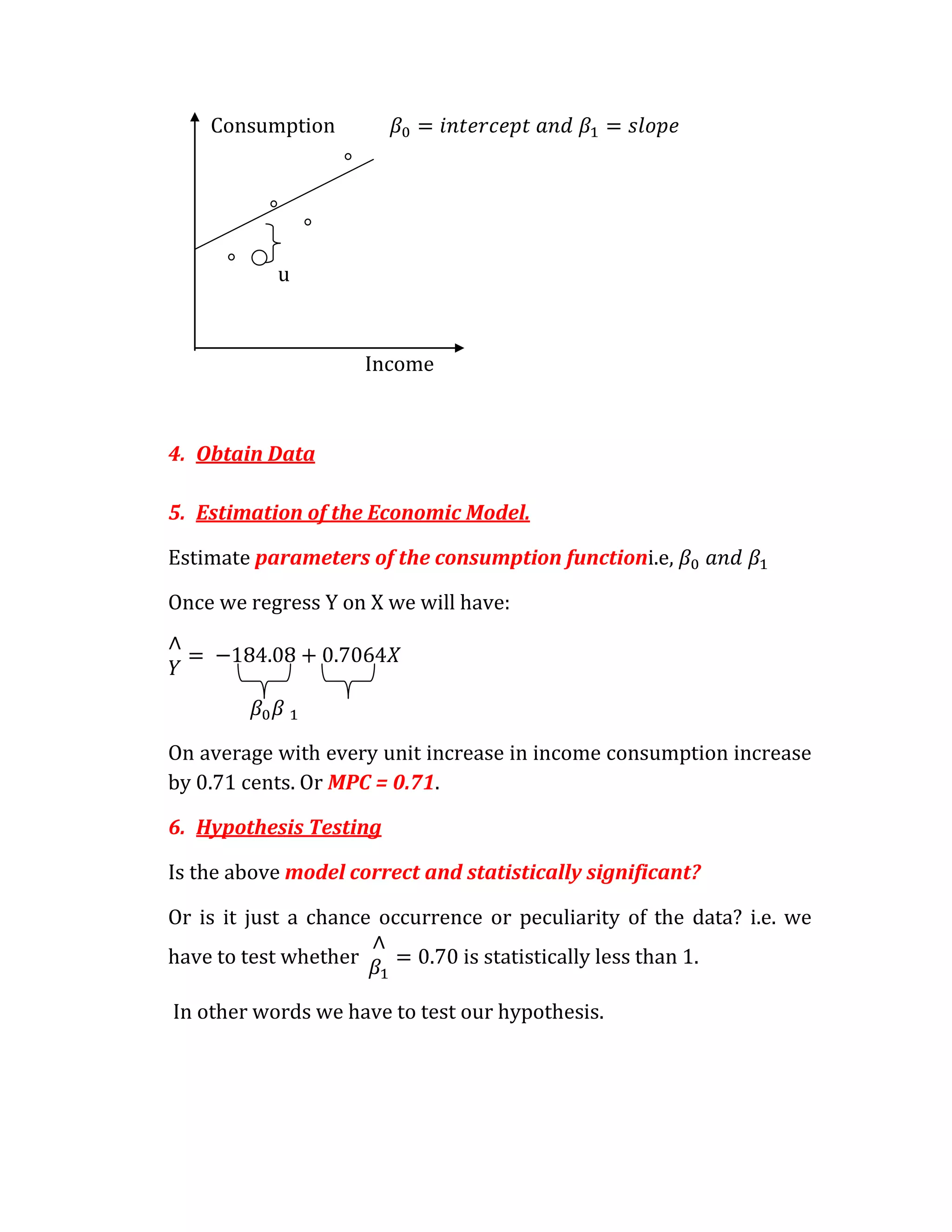

3. Estimating the consumption function parameters using data allows testing hypotheses about marginal propensity to consume and forecasting future consumption based on the model. Government can also use such models for policymaking.