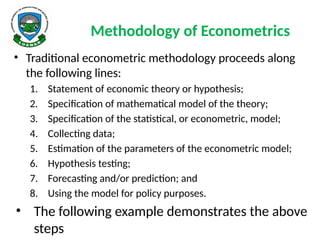

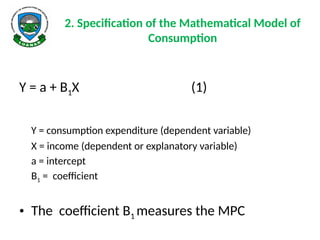

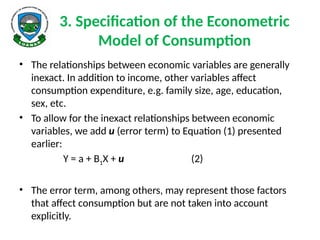

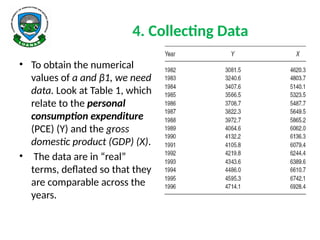

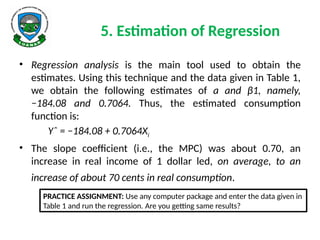

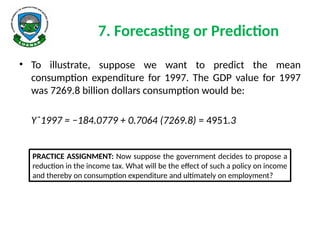

The document introduces econometrics, defining it as the application of statistical methods to economic data to support theories and inform policy decisions. It explains the methodology involved, including hypothesis formulation, mathematical modeling, data collection, and regression analysis. Additionally, it emphasizes the significance of econometrics in quantifying economic relationships and validating economic theories.