This document summarizes a study on Nepal's microfinance policy and regulatory framework. The study aimed to review existing frameworks, identify stakeholder issues, and suggest measures to enhance sustainability and growth. Key findings include: 1) microfinance has expanded but penetration remains low, 2) regulations exist but reforms are needed, 3) a national seminar provided feedback before finalizing recommendations. The study resulted in the model Microfinance Act of 2009 to establish a level playing field and support sector growth.

![Policy and regulatory environment

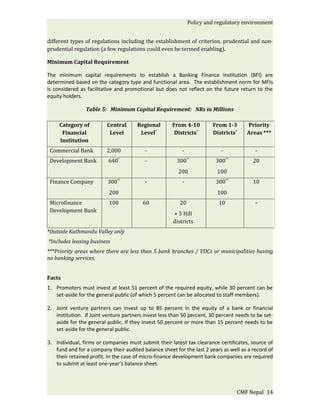

2. Permissible Activities

• Lending as per NRB directives

• Micro-credit provision in accordance with NRB directives

• Borrowing from local and/or foreign institutions for micro lending or strengthening micro-

finance systems

• Providing services to promote microfinance i.e., training and conducting seminars.

• Taking deposits (with or without interest) from the public as per the conditions stated by

the NRB.

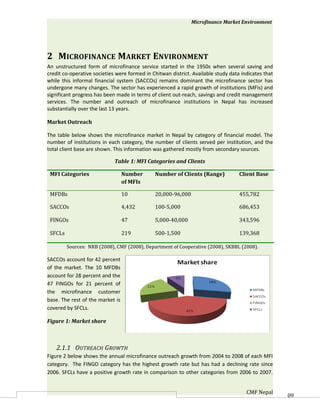

3. Capital Adequacy Ratio (CAR)

The CAR is set at a lower rate for MFDBs than other BFIs. CAR - primary capital 4% and total

capital fund 8 percent of risk weighted asset. [For commercial banks, development banks, and

finance companies the CAR is 5.5 and 11 percent. Recent changes for type A, B and C BFIs

require a minimum CAR of 8 percent and additional capital provision as per BASEL II regulations]

Risk Weights applicable to Micro Finance Development Banks (MFDBs) %

Cash 0

Balance held at Nepal Rastra Bank 0

Nepal Government/Nepal Rastra Bank securities

Balance with other Banks and FIs 20

Loans against govt. securities 0

Accrued interest to be received (Government securities) 0

Loans against other Bank and Finance institutions FDs 20

Balance held with Foreign Banks 20

Money at call 20

Investment in shares/debenture 100

Loans 100

Fixed assets 100

Other assets 100

4. Loan Loss Provision

Categories LLP %

Pass - Principle not overdue or due up to 3 months 1%

Sub-standard - Principle overdue from 3 to 6 months 25%

Doubtful - Principle overdue from 6 to 12 months 50%

Loss - Principle overdue from more than a year 100%

A term loan (more than one year) installment due is counted as the total due and provision

need to be made accordingly. A loan to a missing borrower and a miss-utilized loan are

counted in the loss category whether overdue or not .

CMF Nepal 17](https://image.slidesharecdn.com/finalstudyreportforpublication-december172009-120930233542-phpapp02/85/Final-study-report-for-publication-december-17-2009-25-320.jpg)