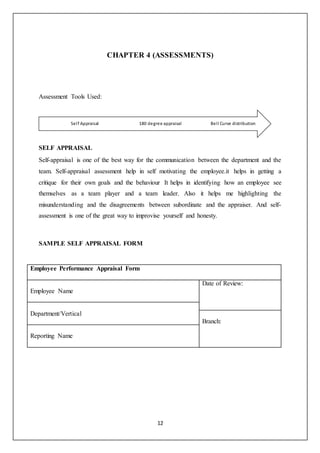

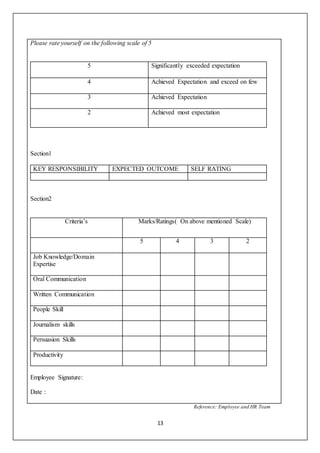

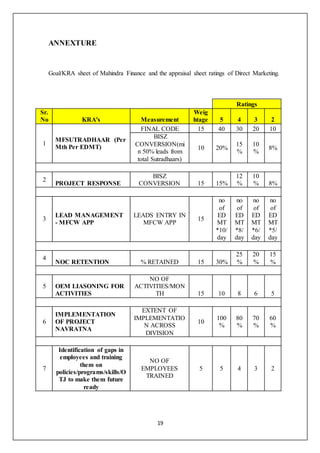

This document provides information on the performance management systems of HDB Financial Services and Mahindra & Mahindra Financial Services. It begins with an introduction to the two NBFC organizations and outlines their product portfolios. It then describes the goal setting process, which involves communicating KRAs, setting targets, mid-term reviews and final performance appraisals. Various assessment tools used are also summarized, including self-appraisals, 180-degree feedback and forced distribution. The document concludes that understanding these NBFCs' PMS procedures provides insight into effectively executing performance management systems.