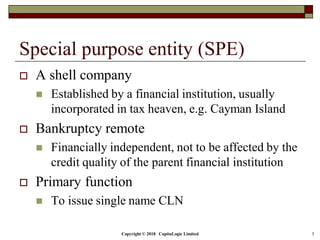

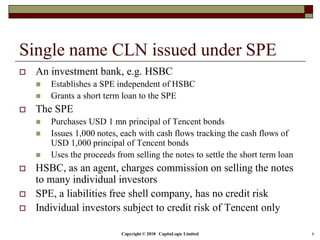

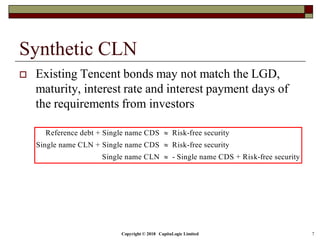

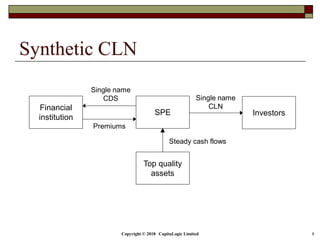

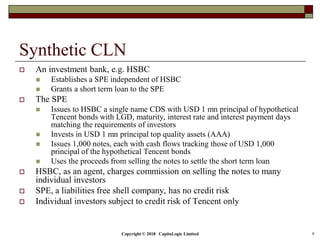

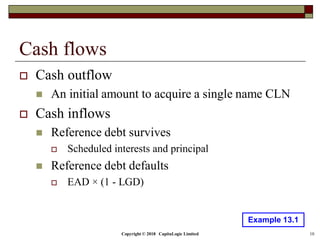

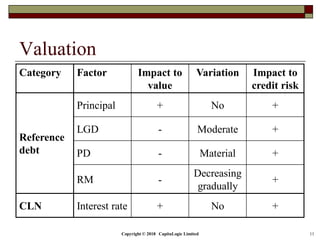

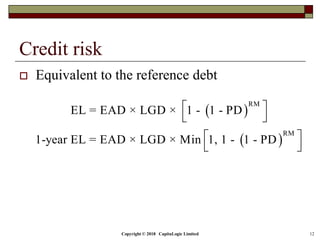

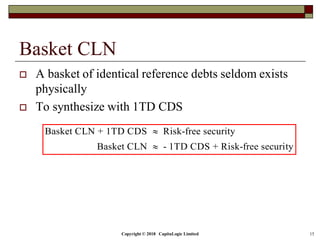

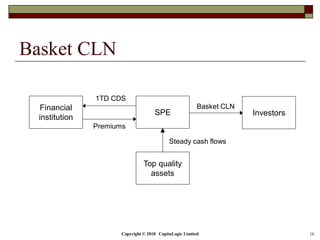

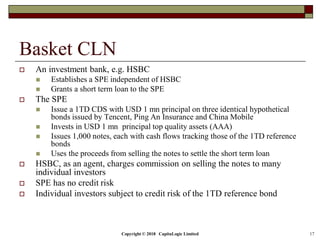

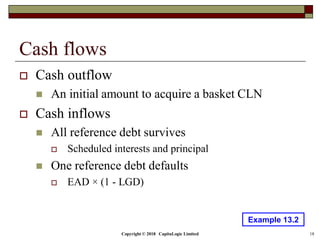

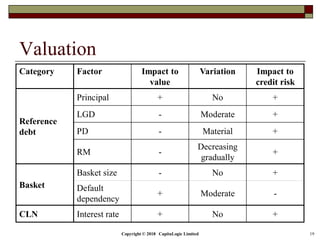

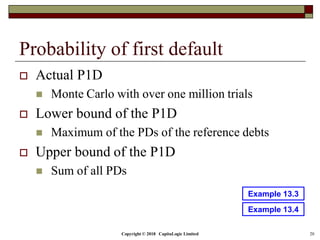

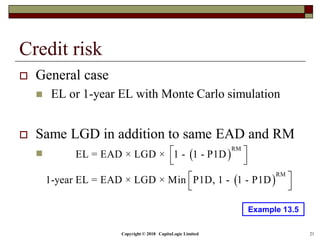

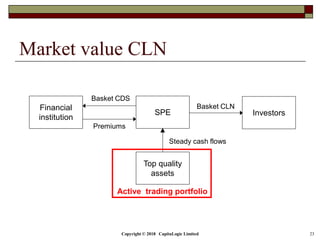

This document discusses different types of credit linked notes (CLNs), including single name CLNs, basket CLNs, and market value CLNs. It describes how each type works, including how they are structured using special purpose entities to isolate credit risk. Key details covered include how the cash flows of each CLN type are linked to underlying debts, how they are priced and valued, and how their credit risks are assessed.