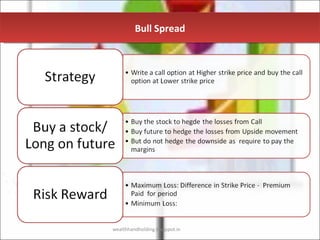

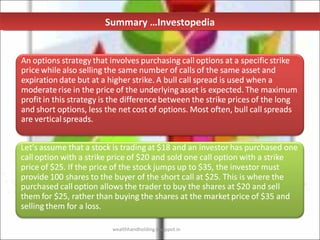

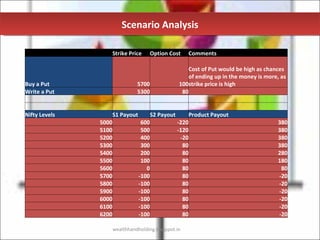

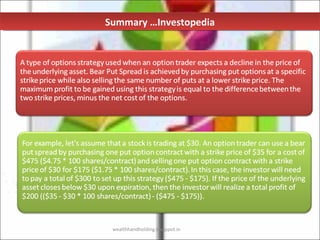

The document discusses various options trading strategies, primarily focusing on bull and bear spreads. In a bull call spread, an investor buys call options at a lower strike and sells at a higher strike to profit from moderate price increases. Conversely, a bear put spread entails buying puts at a higher strike and selling at a lower strike, profiting from expected declines in the asset's price.