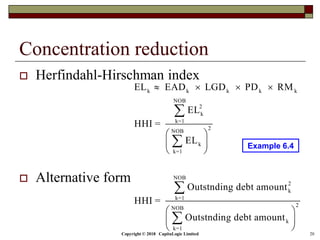

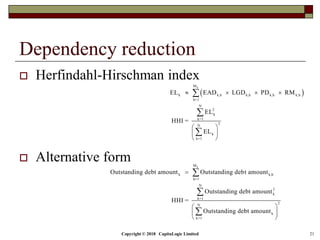

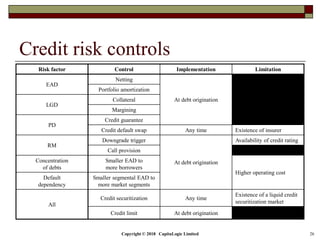

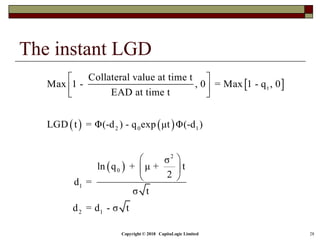

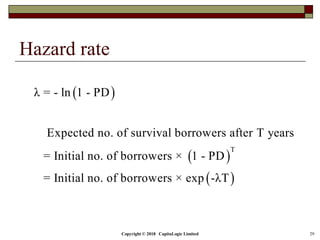

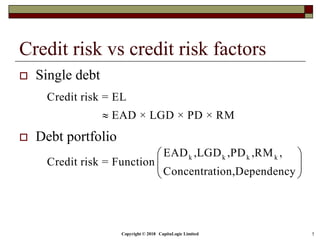

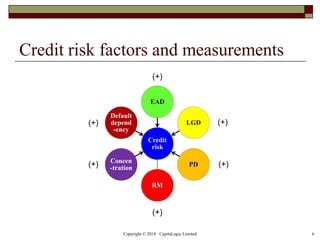

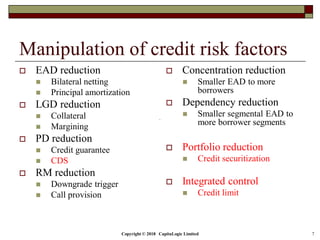

This document provides an outline and overview of credit risk controls under the Basel III framework. It discusses controls for both single debts and debt portfolios. For single debts, it describes controls like bilateral netting, principal amortization, collateral, margining, credit guarantees, credit default swaps, downgrade triggers, and call provisions. For debt portfolios, it discusses reducing concentration and dependency through diversification, as well as credit securitization and credit limits. The appendix provides mathematical formulas for concepts like instant LGD, hazard rate, and average LGD.

![Copyright © 2018 CapitaLogic Limited 9

Bilateral netting

Two banks own each other monies

When one bank defaults

Without bilateral netting agreement

Survival bank must surrender the borrowing EAD

immediately to liquidator

Survival bank then collects the lending EAD from

liquidator

EAD = Principal + Accrued interest

With bilateral netting agreement

Net EAD = Max[Lending EAD - Borrowing EAD, 0]

Example 6.1](https://image.slidesharecdn.com/06-181105045409/85/06-2-credit-risk-controls-9-320.jpg)