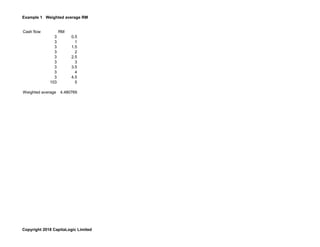

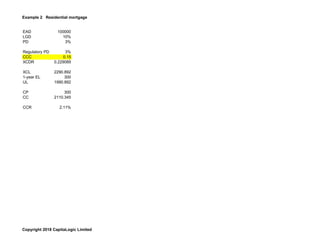

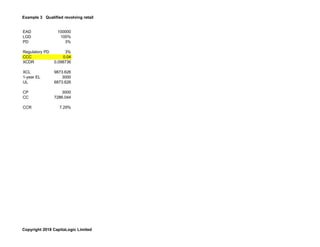

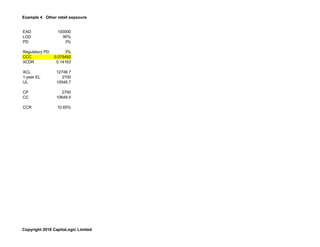

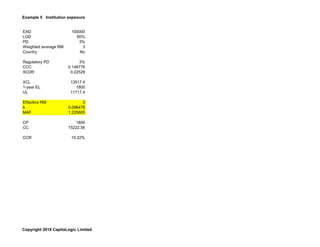

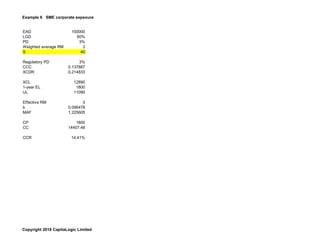

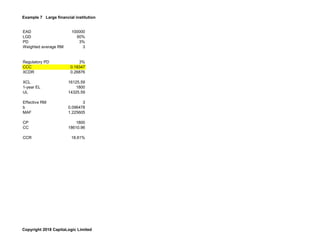

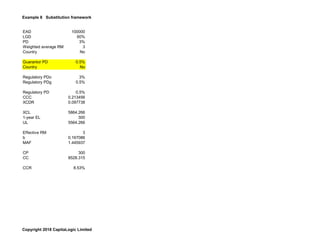

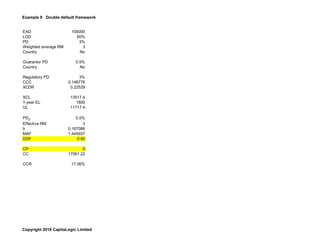

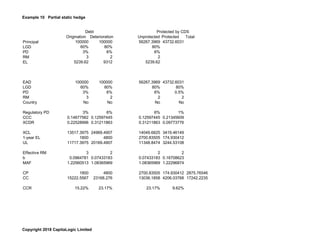

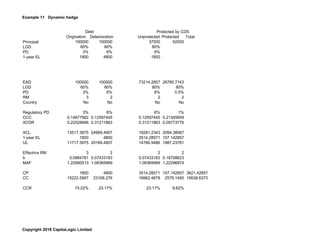

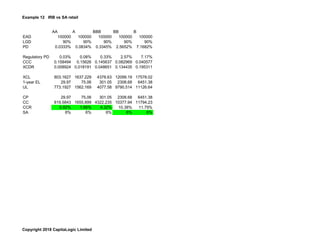

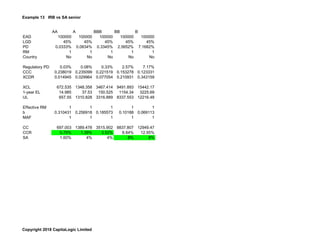

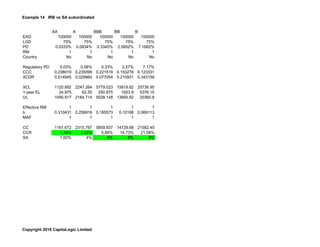

This Excel workbook contains 14 examples calculating credit risk metrics such as expected loss, unexpected loss, and capital charge ratio under the internal ratings-based approach and standardized approach. The examples cover topics like weighted average risk measurement, residential mortgages, corporate exposures, and the substitution framework. The workbook is prepared according to a credit risk management textbook and aims to explain credit risk concepts discussed in the textbook.